|

Vocapedia >

Economy

Cycles, sales, business, markets,

prices, taxes, budgets, jobs

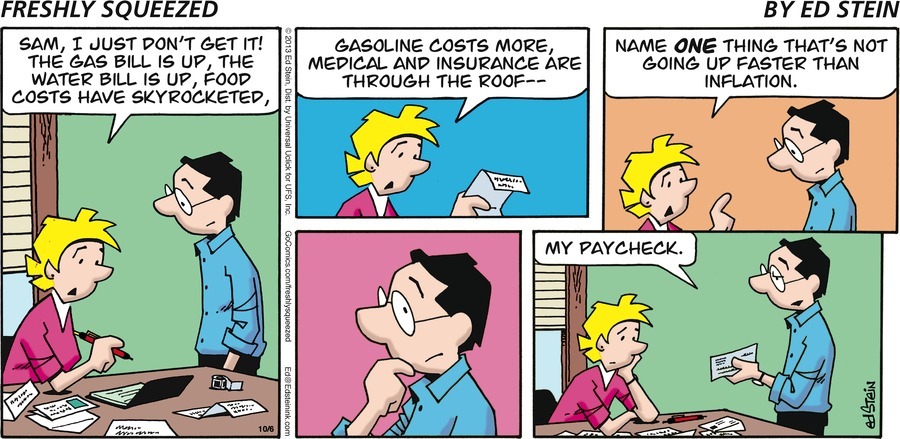

Up

Freshly Squeezed

Ed Stein

GoComics

October 06, 2013

http://www.gocomics.com/freshlysqueezed/2013/10/06#.UrasBfTuKAk

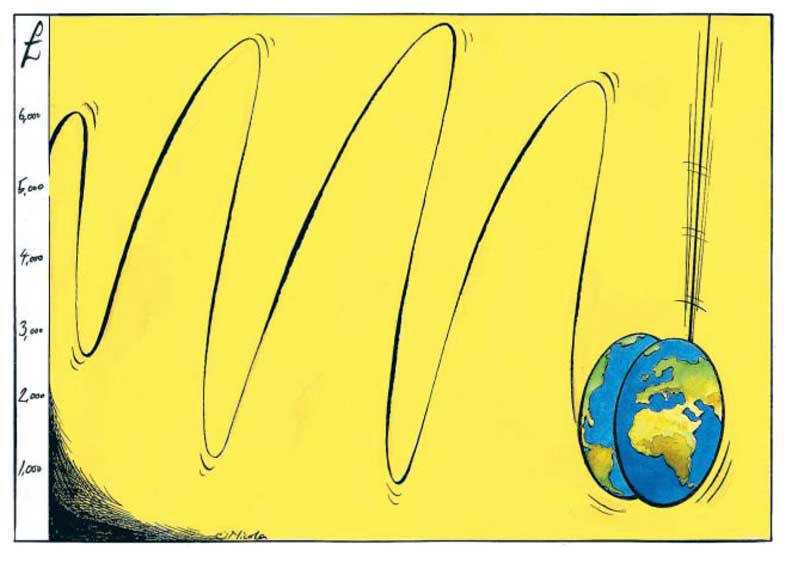

Nicola

comment cartoon

The Guardian

p. 32

9 October 2004

the ebbs and flows of our economy

USA

http://www.nytimes.com/2013/12/16/nyregion/

one-brother-reaches-out-to-another-across-the-economic-divide.html

Vince O'Farrell

cartoon

The Illawarra Mercury, The Melbourne Express

Wallongong, Australia

Cagle

16 October 2008

up UK / USA

https://www.npr.org/2021/12/31/

1069539022/energy-got-a-lot-more-expensive-in-2021

http://www.npr.org/2016/01/19/

463620235/gun-stocks-up-but-activists-move-to-expand-anti-investment-push

http://www.nytimes.com/2015/07/22/technology/apple-earnings-q3.html

https://www.theguardian.com/business/2007/may/09/interestrates.interestrates

https://www.theguardian.com/business/2006/aug/04/

royalbankofscotlandgroup

jack up prices

USA

https://www.npr.org/2023/07/27/

1189665392/fees-inflation-white-house-service-hidden

high prices USA

https://www.npr.org/2024/04/06/

1242873226/parents-inflation-election-2024

higher USA

https://www.npr.org/2023/06/13/

1181686474/cheaper-eggs-gas-lead-inflation-lower-in-may-

but-higher-prices-pop-up-elsewhere

drive up

https://www.npr.org/2020/07/14/

890841587/stay-at-home-improvement-diy-builders-help-drive-up-lumber-prices

go up

shoot up

/ shoot up

to N

https://www.theguardian.com/business/2016/sep/30/

rude-awakening-as-price-of-coffee-and-orange-juice-shoots-up-20

http://www.theguardian.com/business/2015/mar/20/

ftse-100-rises-above-7000-for-the-for-the-first-time

https://www.theguardian.com/business/2009/jul/15/

unemployment-figures-britain-jobless

edge up

http://www.nytimes.com/2008/01/16/business/16cnd-econ.html

creep up

http://www.nytimes.com/2008/01/16/

business/16cnd-econ.html

pick up

https://www.npr.org/2020/02/07/

803449712/hiring-picks-up-as-employers-add-225-000-jobs-in-january

http://www.theguardian.com/money/2014/aug/29/

house-prices-august-nationwide

inch up

tick up

http://www.npr.org/sections/thetwo-way/2017/01/06/

508509327/u-s-added-156-000-jobs-in-december-hourly-wages-rose-10-cents

perk up

balloon

USA

https://www.npr.org/2023/07/13/

1187540763/budget-federal-deficit-nationa-debt-ceiling

https://www.npr.org/sections/coronavirus-live-updates/2020/07/13/

890564669/red-ink-overflowing-in-june-u-s-borrows-a-typical-years-worth

climb

climb USA

http://www.nytimes.com/2013/06/30/business/an-unstoppable-climb-in-ceo-pay.html

high UK

https://www.theguardian.com/business/2006/jul/13/

marketforces.money

record high

UK

https://www.theguardian.com/business/2006/aug/08/

oilandpetrol.frontpagenews

price > hit

all-time record UK

https://www.theguardian.com/business/2023/feb/20/

why-the-price-of-milk-has-soared-in-the-uk

peak

UK

https://www.theguardian.com/business/2004/oct/23/

money.interestrates

in the black

https://www.ft.com/content/ecbde9a4-62b3-11dc-b3ad-0000779fd2ac

regain

UK

https://www.theguardian.com/business/2006/aug/12/

terrorism

gain

rally

UK

https://www.npr.org/2024/04/16/

1244173751/bitcoin-halving-rally-crypto

https://www.theguardian.com/business/2006/aug/11/

terrorism.money

https://www.theguardian.com/business/2006/jul/20/

interestrates.usnews

rally

USA

https://www.npr.org/2024/04/16/

1244173751/bitcoin-halving-rally-crypto

top

estimates

soar

UK / USA

https://www.reuters.com/markets/

global-markets-wrapup-1pix-2024-08-06/

https://www.theguardian.com/technology/2024/feb/01/

meta-earnings-q4-zuckerberg

https://www.npr.org/2024/01/25/

1226811891/economy-gdp-recession-growth-interest-rates-inflation-federal-reserve

https://www.npr.org/2022/08/23/

1119107417/as-inflation-eases-food-prices-soar

https://www.theguardian.com/business/2022/aug/01/

food-prices-soar-across-world-amid-ukraine-crisis-world-bank-finds

https://www.npr.org/2022/06/10/

1103995329/inflation-americans-spending-consumer-behavior-prices

https://www.npr.org/2021/11/10/

1054229643/the-electric-startup-rivian-soared-in-its-stock-debut-

why-theres-so-much-buzz

https://www.nytimes.com/2021/03/05/

realestate/nyc-suburbs-housing-demand.html

https://www.npr.org/sections/coronavirus-live-updates/2020/05/19/

858558844/walmart-hires-almost-a-quarter-million-workers-

as-sales-soar

https://www.npr.org/2020/03/13/

815344533/dow-expected-to-open-up-more-than-1-100-points

https://www.npr.org/2018/08/03/

635071790/despite-strong-economy-federal-deficit-soars

https://www.npr.org/sections/health-shots/2017/03/15/

520110742/as-drug-costs-soar-

people-delay-or-skip-cancer-treatments

https://www.theguardian.com/technology/2014/jul/23/

facebook-earnings-beat-expectations-ad-revenues

https://www.nytimes.com/2013/10/25/

technology/amazons-revenue-soars-but-no-profit-in-sight.html

http://www.nytimes.com/2011/02/23/business/global/23oil.html

http://www.guardian.co.uk/business/2010/jul/14/unemployment-part-time-working-record-high

http://www.guardian.co.uk/business/2010/feb/16/inflation-soars-vat-petrol

http://www.guardian.co.uk/business/2008/oct/28/oil-oilandgascompanies

http://www.guardian.co.uk/business/2008/oct/14/record-inflation

http://www.guardian.co.uk/business/2008/sep/03/unemploymentdata.economics1

https://www.theguardian.com/uk/2007/jun/23/art.artnews

https://www.theguardian.com/business/2007/may/04/citynews.usnews

https://www.theguardian.com/business/2007/apr/25/supermarkets.money

https://www.theguardian.com/business/2006/sep/20/

money

https://www.theguardian.com/money/2006/aug/08/

houseprices.business

https://www.theguardian.com/business/2006/jul/31/money

http://www.theguardian.com/business/2004/oct/23/money.interestrates

https://www.reuters.com/article/us-financial3/

governments-to-buy-bank-stakes-stocks-soar-idUSTRE49A36O

20081013

soaring UK

/ USA

http://www.npr.org/2017/03/03/

518347917/the-soaring-stock-market-and-your-nest-egg

https://www.theguardian.com/society/2013/aug/10/

housing-bubble-families-london-help-to-buy

skyrocket

https://www.npr.org/2021/12/31/

1069539022/energy-got-a-lot-more-expensive-in-2021

http://www.nytimes.com/2012/01/05/

business/oil-price-would-skyrocket-if-iran-closed-the-strait.html

http://www.nytimes.com/2008/06/07/business/07oil.html

sky-high bills

USA

https://www.npr.org/2021/02/22/

970074424/why-some-texas-residents-now-face-huge-electricity-bills

sky-high concert ticket prices

https://www.reuters.com/lifestyle/

taylor-swift-act-other-efforts-target-sky-high-concert-ticket-prices-2024-04-25/

leap

rise

UK / USA

https://www.nytimes.com/2012/04/25/

technology/apple-profits-up-as-iphone-sales-grow-88.html

http://www.guardian.co.uk/business/2011/apr/26/city-bonuses-shrink-pay-rise

https://www.theguardian.com/money/2006/oct/24/creditanddebt.business

https://www.theguardian.com/media/2006/aug/01/pearson.pressandpublishing

https://www.theguardian.com/business/2006/jun/27/water.environment

rise UK / USA

http://www.nytimes.com/2013/04/19/technology/after-apples-rise-a-bruising-fall.html

http://www.guardian.co.uk/business/2008/nov/13/inflation-deflation-interest-rates-recession

https://www.theguardian.com/business/2006/sep/28/interestrates.interestrates

https://www.theguardian.com/business/2006/aug/04/interestrates.marketforces

USA > rise and fall

UK

https://www.theguardian.com/business/2010/aug/25/

rise-fall-american-apparel

raise

UK / USA

https://www.theguardian.com/business/2007/jan/11/interestrates.interestrates1

https://www.theguardian.com/business/2006/aug/03/interestrates.interestrates

increase

UK

http://www.theguardian.com/business/2006/dec/29/housingmarket.houseprices

http://www.theguardian.com/money/2006/sep/29/utilities.utilities

http://www.theguardian.com/money/2006/aug/02/interestrates.houseprices

increase

USA

http://www.nytimes.com/2013/01/23/

technology/ibm-continues-its-profit-growth.html

bear

the brunt of the increases

turbocharge

USA

https://www.npr.org/2024/04/16/

1244173751/bitcoin-halving-rally-crypto

triple

USA

https://www.npr.org/2024/04/17/

1245184430/biden-wants-to-hike-tariffs-on-imports-of-chinese-steel-and-aluminum

http://www.nytimes.com/2009/10/21/

technology/companies/21yahoo.html

lift

UK / USA

http://www.nytimes.com/2011/01/19/technology/19apple.html

https://www.theguardian.com/business/2006/aug/31/

highstreetretailers.consumerspending

surge

UK / USA

https://www.reuters.com/markets/us/

us-inflation-increases-moderately-

february-consumer-spending-surges-2024-03-29/

https://www.npr.org/2023/12/13/

1216457187/wall-street-magnificent-seven-

apple-amazon-nvidia-tesla-microsoft-meta-alphabet

https://www.npr.org/2023/07/13/

1187540763/budget-federal-deficit-nationa-debt-ceiling

https://www.npr.org/2022/02/04/

1077642688/employers-economy-jobs-labor-market-january-omicron

https://www.npr.org/2021/11/10/

1054019175/inflation-surges-to-its-highest-since-1990

https://www.npr.org/2021/10/07/

1044132419/why-energy-prices-are-surging-in-europe

https://www.npr.org/2021/07/29/

1021671595/the-economy-is-surging-

these-4-things-will-determine-what-happens-next

https://www.npr.org/2020/11/24/

935506414/dow-surges-past-30-000-for-first-time-in-historic-milestone

https://www.npr.org/2019/12/06/

785334356/job-market-surges-as-employers-add-266-000-jobs-in-november

https://www.npr.org/2018/07/27/

632640711/u-s-could-see-blockbuster-economic-growth-number-today

http://www.theguardian.com/business/2006/aug/02/interestrates

surge USA

http://www.nytimes.com/2008/05/21/business/21econ.html

jump UK / USA

https://www.theguardian.com/business/2021/nov/17/

uk-inflation-jumps-to-highest-level-in-10-years-as-energy-bills-soar

https://www.npr.org/2020/03/17/

817073479/u-s-stock-markets-tick-up-after-steepest-drop-since-1987

http://www.nytimes.com/2015/07/22/technology/apple-earnings-q3.htm

http://www.theguardian.com/money/2013/oct/21/london-house-price-50000-month

https://www.reuters.com/article/newsOne/idUSREE064781

20080606

https://www.ft.com/content/

13eeaa62-66c0-11dc-a218-0000779fd2ac - September

19, 2007

https://www.theguardian.com/business/2006/aug/01/

money

jump

ease

http://www.theguardian.com/business/2006/oct/18/politics.money

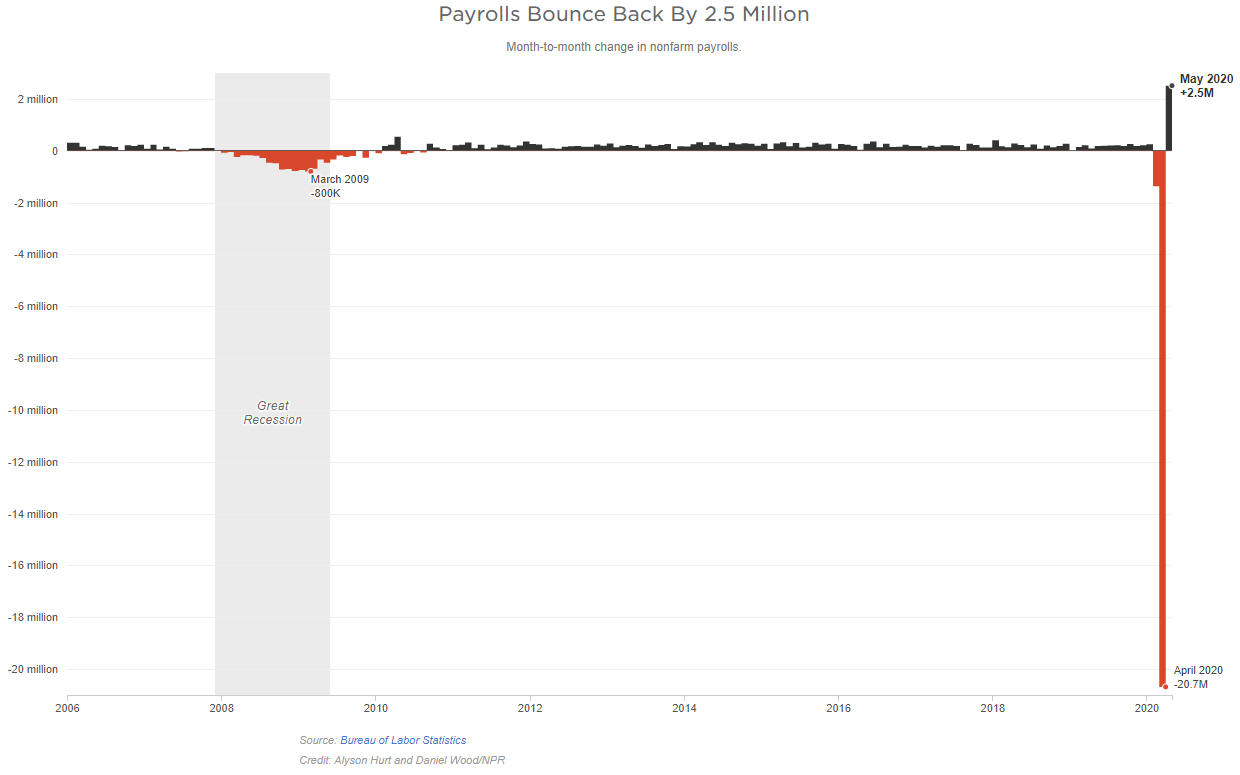

https://www.npr.org/sections/coronavirus-live-updates/2020/06/05/

869821293/as-america-struggles-to-return-to-work-staggering-unemployment-numbers-loom

bounce

https://www.reuters.com/markets/

global-markets-wrapup-1pix-2024-08-06/

bounce

UK

http://www.theguardian.com/business/2006/aug/31/

highstreetretailers.consumerspending

an

unexpected bounce in retail sales

bounce

https://www.reuters.com/article/topNews/idUSTRE49N5VU

20081028

bounce back

UK / USA

https://www.npr.org/sections/coronavirus-live-updates/2020/06/05/

869821293/as-america-struggles-to-return-to-work-staggering-unemployment-numbers-loom

http://www.nytimes.com/2014/01/31/

business/international/daily-stock-market-activity.html

http://www.theguardian.com/business/2004/feb/25/globalrecession

rebound

UK / USA

https://www.npr.org/2019/07/05/

738624184/rebound-in-job-growth-expected-in-june

http://www.nytimes.com/2010/05/07/business/07markets.html

https://www.reuters.com/article/hotStocksNews/idUSL2356064

20071128

http://www.theguardian.com/business/2007/sep/18/money.northernrock

rebound

USA

https://www.nytimes.com/2023/05/02/

business/economy/manufacturing-recession-economy.html

https://www.npr.org/2020/03/13/

815344533/dow-expected-to-open-up-more-than-1-100-points

climb back

USA

http://www.nytimes.com/2008/11/22/business/22markets.html

buffer

boost

UK / USA

https://www.theguardian.com/business/2006/sep/28/retail.money

https://www.theguardian.com/business/2006/aug/04/

housingmarket.interestrates

https://www.theguardian.com/money/2001/oct/16/

ethicalmoney.business

roar back

USA

https://www.nytimes.com/2016/07/09/

business/economy/jobs-report-unemployment-wages.html

https://www.reuters.com/article/topNews/idUSTRE49N5VU

20081028

roaring trade

UK

https://www.theguardian.com/business/2022/jul/28/

shell-posts-10bn-quarterly-profits-as-households-struggle-with-bills

thrive

USA

http://www.npr.org/2016/12/27/

503052538/when-residents-take-ownership-a-mobile-home-community-thrives

boom UK / USA

https://www.gocomics.com/danasummers/2022/06/16

https://www.npr.org/2021/04/15/

987597284/signs-of-economic-boom-emerge-

as-retail-sales-surge-jobless-claims-hit-pandemic

https://www.npr.org/sections/coronavirus-live-updates/2020/10/22/

926657942/housing-boom-sales-of-million-dollar-homes-double

https://www.npr.org/2019/10/23/

772760183/it-s-time-to-get-something-back-

union-workers-voices-are-getting-louder

https://www.npr.org/2017/12/05/

567264841/south-florida-real-estate-boom-

not-dampened-by-sea-level-rise

http://www.theguardian.com/money/2014/apr/28/negative-equity-house-price-boom

http://www.theguardian.com/business/2013/oct/06/what-1973-today-economic-crisis

http://www.nytimes.com/2010/05/22/opinion/22sat1.html

http://www.nytimes.com/2008/12/07/business/07leon.html

http://www.guardian.co.uk/business/interactive/2008/oct/22/creditcrunch-recession

http://www.guardian.co.uk/business/interactive/2008/jul/11/ftse100

https://www.theguardian.com/business/2006/jul/27/ukeconomy

boom / boom

UK

http://www.theguardian.com/commentisfree/2007/nov/15/comment.business

dotcom boom

enjoy a record-long economic boom

USA

https://www.npr.org/2019/10/23/

772760183/it-s-time-to-get-something-back-

union-workers-voices-are-getting-louder

booming USA

https://www.npr.org/2018/09/12/

646708799/fact-check-who-gets-credit-for-the-booming-u-s-economy

bubble USA

http://www.nytimes.com/2015/08/17/opinion/the-problem-with-house-prices.html

boom and bust

UK / USA

http://www.nytimes.com/2010/05/22/opinion/22sat1.html

http://www.nytimes.com/2008/12/07/business/07leon.html

rom boom to gloom UK

http://www.theguardian.com/commentisfree/2007/nov/15/comment.business

go bust

UK

https://www.theguardian.com/business/2009/jan/25/

recession-uk

in the bust USA

http://www.nytimes.com/2015/08/17/opinion/the-problem-with-house-prices.html

get a boost from

N

inflate

UK

http://www.theguardian.com/business/2006/oct/12/housingmarket.houseprices

bull market UK

https://www.theguardian.com/business/2003/apr/13/

globalrecession.globalisation

bull market

USA

https://www.npr.org/2022/06/30/

1109062324/where-bull-market-and-bear-market-come-from

bull run UK

https://www.theguardian.com/business/2006/mar/18/

ftse.frontpagenews

buoyant UK

http://www.theguardian.com/theobserver/cartoon/2014/may/04/

davidcameron-georgeosborne

buoyant USA

http://dealbook.nytimes.com/2014/09/25/

buoyant-dollar-underlines-resurgence-in-u-s-economy/

buoyed by N

barrel ahead

growth UK / USA

https://www.npr.org/2018/07/26/

632653239/facebooks-big-growth-is-slowing-sending-its-stock-tumbling

https://www.npr.org/sections/thetwo-way/2018/01/26/

580964131/as-2017-wound-down-u-s-growth-was-good-but-not-as-strong-as-expected

http://www.nytimes.com/2016/01/31/

books/review/the-powers-that-were.html

http://www.nytimes.com/2012/10/29/

opinion/want-to-boost-the-economy-invest-in-science.html

http://www.guardian.co.uk/business/2010/oct/26/uk-

economy-grew-in-third-quarter

http://www.guardian.co.uk/business/2010/aug/27/uk-

economy-fastest-growth-in-nine-years

https://www.theguardian.com/business/2006/sep/28/

interestrates.interestrates

https://www.theguardian.com/business/2006/aug/04/

housingmarket.interestrates

growth pace USA

https://www.npr.org/2018/07/27/

632640711/u-s-could-see-blockbuster-economic-growth-number-today

grow

USA

https://www.npr.org/2018/07/26/

632297326/how-fast-did-the-economy-grow-forecasts-are-all-over-the-place

http://www.nytimes.com/2014/07/31/

business/economy/us-economy-grew-4-in-second-quarter.html

https://www.theguardian.com/business/2010/oct/26/

uk-economy-grew-in-third-quarter

grow at a 3.9 percent annual pace

in the

July-September quarter

economic growth

slowing economic growth

slow growth

UK

https://www.theguardian.com/business/2010/jul/12/

economic-growth-recession-uk

sluggish wage growth

growth rate

USA

http://www.nytimes.com/2012/10/27/

business/economy/us-economy-grew-at-2-rate-in-3rd-quarter.html

hike

USA

https://www.npr.org/2024/05/14/

1251096758/biden-china-tariffs-ev-electric-vehicles-5-things

https://www.npr.org/2024/05/14/

1251096758/biden-china-tariffs-ev-electric-vehicles-5-things

https://www.npr.org/2024/04/17/

1245184430/biden-wants-to-hike-tariffs-on-imports-of-chinese-steel-and-aluminum

hike

UK

http://www.guardian.co.uk/commentisfree/2010/jul/13/

george-osborne-hold-hike-double-dip

http://www.guardian.co.uk/money/2009/jun/11/

mortgages-rates-inflation-nationwide

https://www.theguardian.com/society/2006/sep/29/

socialexclusion.business

hike

USA

https://www.npr.org/2022/06/15/

1105026915/federal-reserve-interest-rates-inflation

https://www.npr.org/2022/01/07/

1071181227/what-do-minimum-wage-hikes-mean-for-businesses-and-customers

http://www.npr.org/sections/health-shots/2017/10/04/

551013546/california-bill-would-compel-drugmakers-to-justify-price-hikes

spike USA

https://www.npr.org/sections/coronavirus-live-updates/2020/07/30/

897271729/amazon-doubles-profit-to-5-8-billion-

as-online-shopping-spikes

https://www.npr.org/sections/coronavirus-live-updates/2020/04/30/

848021681/a-staggering-toll-

30-million-have-filed-for-unemployment

https://www.npr.org/sections/coronavirus-live-updates/2020/04/02/

825383525/6-6-million-file-for-unemployment-

another-dismal-record

spike

UK / USA

https://www.nytimes.com/roomfordebate/2011/03/08/

whats-behind-the-spike-in-oil-prices

http://www.theguardian.com/business/2006/jul/19/oilandpetrol.news

gazump

UK

http://www.theguardian.com/money/2007/nov/07/1

gazumping

UK

http://www.theguardian.com/business/2006/oct/12/

housingmarket.houseprices

recovery

greenshoots of recovery

UK

https://www.theguardian.com/politics/2009/jan/15/

vadera-green-shoots-recovery

killing

Bubblenomics NYT

21 September 2008

https://www.nytimes.com/2008/09/21/

weekinreview/21leonhardt.html

Corpus of news articles

Economy >

Cycles, business, markets,

prices, taxes, budgets, jobs >

Up

Whiplash Ends

a Roller Coaster Week

October 11, 2008

The New York Times

By VIKAS BAJAJ

For three straight days, the stock market collapsed in the

last hour of trading. On Friday, it merely swooned.

Until 3 p.m., things looked awful as investors drove the Dow Jones industrial

average down nearly 700 points at one point, to below 8,000 for the first time

in five years. Then the market made a U-turn, surging higher with the Dow

climbing nearly 900 points in less than 40 minutes. The rally fizzled in the

last 20 minutes of trading and the Dow closed down 1.5 percent — but it was a

far cry from its 8 percent decline at the start of the trading day just six and

a half hours earlier.

“We just don’t see turnarounds like this,” Howard Silverblatt, chief index

analyst for Standard & Poor’s, said about the late afternoon rally. “These

swings are enormous.”

It was one of the wildest moves in stock market history, and perhaps a fitting

conclusion to the worst week in at least 75 years. The Dow and the broader

Standard & Poor’s 500-stock index both closed down 18 percent for the week. The

Dow has never had a week that bad in its 133-year history. The S.& P. has fallen

slightly more only twice before — in 1929 and 1933. This month was the first

time that the S.& P. had fallen by more than 1 percent for seven days in a row.

In the credit markets, conditions went from bad to worse. Borrowing costs for

banks and companies jumped once again as investors sought safety in Treasury

bills despite earlier signs that the government might take equity stakes in

troubled companies to try to halt the credit crisis. It was the worst single day

for junk bonds ever, and the cost of borrowing shot up for even blue-chip

companies: I.B.M. agreed to pay 8 percent interest on $4 billion of 30-year

bonds, about twice the rate at which the federal government borrows money.

On Friday evening, after a meeting of finance ministers and central bankers from

the Group of 7 countries, the Treasury secretary, Henry M. Paulson Jr.,

confirmed that the government would move quickly to buy stakes in financial

institutions. But the details he provided fell far short of what investors were

seeking.

Indeed, while policy makers have taken a stab at many extraordinary efforts to

restore confidence, none have alleviated panic in global markets so far. Because

the $700 billion financial stabilization plan will take several weeks to have an

impact, investors say officials must present significant details on the more

fast-track effort to recapitalize banks to get them to lend money to each other

and other businesses again.

“We have to do something,” said Robert C. Doll, vice chairman of BlackRock, the

big investment firm. “At the end of the weekend, before the markets open up on

Monday, these guys have to have something to say. And it can’t be, ‘Everything

is O.K., just calm down.’ ”

Investors will be watching for any new developments in Washington this weekend

after Mr. Paulson signaled that countries stopped short of agreeing to a

globally coordinated approach to stem the crisis. In addition to the G-7

meetings, which go through Sunday, the International Monetary Fund and the World

Bank are also holding annual meetings.

Politicians were busy in Washington, and on Wall Street, things were anything

but calm. Friday in New York began with a now-familiar feeling: dire

expectations of what the opening bell would bring after stocks in Asia and

Europe plummeted by as much as 10 percent.

Scott Black, president of Delphi Management in Boston, said he had taken to

waking up at 3 a.m. to check on foreign markets. When he arose before dawn on

Friday, he was distressed. “I am worried,” he said. “I have a fiduciary

responsibility to my clients.”

At the open, the Dow Jones industrial average quickly sank nearly 700 points.

But suddenly, shares of struggling financial companies surged, the Dow regained

all of its losses in less than half an hour, and a cheer went up on the trading

floor of the New York Stock Exchange.

By about 10:20, stocks had started to slide again, and President Bush tried to

soothe frayed nerves with an appearance at the White House. “This is an anxious

time,” he said. “But the American people can be confident in our economic

future. We know what the problems are. We have the tools to fix them. And we’re

working swiftly to do so.”

If traders were paying attention to the president, it did not show. Over the

course of several hours, stocks ground down, with the Dow losing more than 600

points and again falling below the 8,000 mark.

In the afternoon, an investor walked into a Kansas office of the mutual fund

company American Century Investments. The woman, who is two years from

retirement, was worried about her small business account. She brought her

unopened statement to John Leis, a director of personal financial solutions at

the company.

“She didn’t have the guts to open it even though she had conservative

investments,” Mr. Leis said. “She asked me, ‘How bad is it going to be?’ ” The

client was fortunate: her investments, in mostly government-backed bonds, were

up 6 percent for the year. But Mr. Leis said the concern about her investments

symbolized the fear among many everyday Americans who are watching the financial

markets with trepidation.

Back in New York, stocks were about to stage one of their most impressive

rallies ever. Shortly after 3 p.m., the Dow surged by nearly 900 points, with

companies like Exxon Mobil, Chevron and Boeing leading the way. While those

companies have posted decent results this year, their shares have fallen

significantly in recent months.

Why stocks surged late in the day is the subject of much discussion and

speculation among analysts and investors. Many said it was only a matter of time

before stocks bounced back from the unrelenting decline of recent days. Many

investors have been waiting on the sidelines either because they feared what

would come next or because they expected prices to fall further.

Barry Ritholtz, chief executive of Fusion IQ and author of a popular financial

blog, The Big Picture, pointed out that investors were holding more cash than at

any time since 2002, when the last bear market ended. Some of that cash appears

to have come into the market later in the day when it looked like stock prices

would not fall much further.

Some analysts said the late-hour surge reflected bargain hunting by money

managers who have watched stocks of premier companies like General Electric,

Google and Exxon Mobil fall to their cheapest levels in years or decades.

Google, for instance, opened trading at about $315 a share, about $100 below

where it was just a week and a half ago. Shares of the company closed up

modestly, at $332.

“What I saw was people starting to buy at the really distressed prices and, when

the market got better, they kept buying,” said Laszlo Birinyi Jr., president of

Birinyi Associates, an investment firm in New York.

Still, many investors said that although they were excited about buying beaten

up stocks and bonds, they were worried that the sell-off was far from over. The

recent spate of forced selling of stocks by hedge funds and other investors who

had used lots of borrowed money to make big bets during the recent credit boom

may not yet be over, they fear.

“The problem is that in order to invest in this you have to make sure your base

of capital is stable,” said Whitney Tilson, founder and managing director of T2

Partners, a hedge fund firm in New York. “Who knows when the dumping is going to

end. Who knows how many hedge funds are going to go under.”

Still, Mr. Tilson, describing current prices as “prosperously cheap,” said he

recently allowed his investors to put more money into his funds — and a handful

took him up on the offer.

The benchmark 10-year Treasury bill fell 22/38, to 101 1/32, and the yield,

which moves in the opposite direction from the price, was at 3.87 percent, up

from 3.79 percent late Thursday.

Ian Austen, Vikas Bajaj, David Stout

and Bettina Wassener contributed reporting.

Whiplash Ends a

Roller Coaster Week,

NYT,

11.10.2008,

https://www.nytimes.com/2008/10/11/

business/11markets.html

Oil

Prices Skyrocket,

Taking Biggest Jump Ever

June 7,

2008

The New York Times

By JAD MOUAWAD

Oil prices

had their biggest gains ever on Friday, jumping nearly $11 to a new record above

$138 a barrel, after a senior Israeli politician raised the specter of an attack

on Iran and the dollar fell sharply against the euro.

The unprecedented gains on Friday capped a second day of strong gains on energy

markets, and fueled suspicions that commodities might be caught in a speculative

bubble.

Oil futures surged $10.75, or 8 percent, to $138.54 a barrel on the New York

Mercantile Exchange. The record gain followed a jump of 5.5 percent on Thursday,

bringing total two-day gains to $16 a barrel.

Stocks fell sharply. The Dow Jones industrials fell 323.97 points, or 2.53

percent, in midday trading. Chevron Corp. was the only stock that rose on the

blue-chip index.

“This market is going to shoot itself in the foot,” said Adam Robinson, an

analyst at Lehman Brothers. “It is searching for a price that will build a

safety cushion in the system — either as inventories or as spare capacity. But

this takes time. The market has gotten extremely impatient and is not willing to

wait.”

Even as uncertainties abound about the fundamentals of the market, geopolitical

tensions in the Middle East regained center stage after Israel’s transportation

minister, Shaul Mofaz, said Friday that an attack on Iran’s nuclear sites looked

“unavoidable.” Iran is the second-largest oil producer within the OPEC cartel

and any interruptions in its exports could push prices higher levels.

“The return of the Iranian risk premium calls for a careful assessment of the

potential oil supply impact of military strikes on Iran,” said Antoine Halff, an

analyst at Newedge, an energy broker.

The strong volatility in energy markets in recent weeks have continued to puzzle

investors and traders. Prices keep rising despite a lack of shortages in the

market, and strong evidence of lower consumption in industrialized countries.

But investors seem to be caught in a bullish mood, focusing instead on perceived

risks to future oil supplies and continued growth in oil demand from emerging

economies that subsidize fuels.

The latest jump in oil prices also came as the dollar lost almost 1 percent

against the euro amid bleak economic news that fanned recession fears on Friday.

The unemployment rate surged to 5.5 percent last month, the government said, the

biggest increase in more than two decades.

Investors reacted to the latest forecast by a large Wall Street bank that oil

prices would spike to $150 a barrel in the next month because of strong demand

from Asian economies. Morgan Stanley said “an unprecedented share” of Middle

East oil exports are headed to Asia.

Some analysts also said that the threat of a strike by Chevron’s workers in

Nigeria could lead to “considerable” shutdowns of Nigerian production. A similar

strike by Exxon Mobil workers last April, which lasted a week, reduced Nigerian

output by 800,000 barrels a day, or nearly a third of the country’s daily

exports.

A strike might delay the start of Chevron’s 250,000 barrels-a-day Agbami

project, the country’s largest offshore venture, which is slated for June 15.

One view that has been gaining ground in recent months is that the commodity

market is caught in a speculative bubble akin to the housing or technology

bubble of the late 1990s. The notion is buffered by the fact the oil prices have

doubled in 12 months despite a slowing economy.

That theory was raised by politicians in Washington and a slew of OPEC

producers, who blame speculators for the staggering rally in oil prices.

Speaking before Congress recently, George Soros, a prominent hedge fund

investor, said the current oil markets presented some characteristics of a

bubble.

“I find commodity index buying eerily reminiscent of a similar craze for

portfolio insurance, which led to the stock market crash of 1987,” Mr. Soros

said earlier this week. But he cautioned that an oil market crash was not

imminent. “The danger currently comes from the other direction. The rise in oil

prices aggravates the prospects for a recession.”

Jeffrey Harris, the chief economist at the Commodity Futures Trading Commission,

who was speaking before another Senate committee last month, said he saw no

evidence of a speculative bubble in the commodity market. Instead, Mr. Harris

pointed out to a confluence of trends that have contributed to the oil price

rally, including a weak dollar, strong energy demand from emerging-market

economies, and political tensions in oil-producing countries.

“Simply put, the economic data shows that overall commodity price levels,

including agricultural commodity and energy futures prices, are being driven by

powerful fundamental economic forces and the laws of supply and demand,” Mr.

Harris said. “Together these fundamental economic factors have formed a ‘perfect

storm’ that is causing significant upward pressures on futures prices across the

board.”

Oil prices had been weakening in recent days but reversed dramatically after the

president of the European Central Bank, Jean-Claude Trichet, suggested on

Thursday that the bank might raise interest rates. That pushed up the euro

against the dollar and prompted investors to buy into commodities to hedge

against the weaker American currency.

Gasoline prices have also been rising steadily. American drivers are now paying

an average of $3.99 for a gallon of gasoline nationwide, according to AAA, the

automobile group. In many parts of the country, like California, Connecticut and

New York, consumers are already paying well over $4. Diesel costs $4.76 a gallon

on average.

“I don’t know how else to say it, this is not a bubble,” Jan Stuart, global oil

economist at UBS, said. “I think this is real. There is a whole bunch of

commercial buyers out there who are spooked and are buying. You are an airline,

right now, you’re scared. But I don’t see who would buy at these prices unless

they need to.”

Oil Prices Skyrocket, Taking Biggest Jump Ever, NYT,

7.6.2008,

https://www.nytimes.com/2008/06/07/

business/07oil.html

Foreclosures skyrocket 65%

in April

14 May 2008

USA Today

By Stephanie Armour

In a sign that the mortgage collapse is getting worse, not better,

foreclosure filings surged 65% in April from April 2007, leading some analysts

to warn that the crisis might not end before 2010.

One in every 519 households received a foreclosure filing — the highest such

figure since RealtyTrac began issuing foreclosure reports in January 2005.

Nationally, 243,353 homes were facing foreclosure last month, RealtyTrac said.

That amounts to roughly 2% of all homes.

Signs that the crisis is accelerating include sinking home values, rising

foreclosures, swelling supplies of homes for sale and tighter lending rules that

have shut out some who want to buy homes or refinance their mortgages.

"For the foreclosures to stop, inventories have to stop rising, and home sales

have to rise," says Mark Zandi, chief economist of Moody's Economy.com, who

thinks foreclosures will continue rising well into 2009 and possibly till 2010.

"We need prices to come down some more."

Congress is working on a bill that would let many borrowers facing foreclosure

refinance with federally insured mortgages. The bill's prospects, though, are

uncertain.

"Policy is essential," Zandi says. "If they don't do anything, this crisis will

continue."

Foreclosure filings in April rose from a year earlier in all but eight states,

according to RealtyTrac. Those hardest hit by the tsunami of foreclosures

included Arizona, California, Florida and Nevada — states where runaway subprime

lending and escalating home prices symbolized the real estate boom that fizzled

in 2006.

"It will almost certainly get worse," Rick Sharga of RealtyTrac says of the

foreclosure filings. "Unless the government does something, we'll probably see

this go on. We would expect a spike (in filings) in the third and fourth

quarter" of 2008.

Joel Naroff of Naroff Economic Advisors says he thinks foreclosures could

persist at a high rate into 2010. "Prices are dropping and will continue to fall

throughout the year," Naroff says. "People want to buy, but they can't get

financing."

As the downturn intensifies, credit counselors are reporting a wave of calls

from anxious homeowners. Diane Gray, director of Novadebt, a non-profit

counseling group, says its largest surge in demand from clients involves

housing-related counseling services.

"Homeowners are calling about mortgage payments, including those with ARMs and

interest-only loans," Gray says. "A lot of times, they've gotten into a home,

and it's hard for them to understand they may not be able to afford it."

Foreclosures skyrocket

65% in April, UT, 14.5.2008,

http://www.usatoday.com/money/economy/housing/

2008-05-14-foreclosures-mortgage-apps_N.htm - broken link

What Plunge?

Stocks Back Near Highs Hit

in July

September

29, 2007

The New York Times

By VIKAS BAJAJ

After a

tumultuous and brutal August, the stock market has regained its footing and is

within striking distance of the record highs it set in July.

The surge began building before the Federal Reserve cut interest rates last week

and has come at a time when news from the housing market remains bleak.

Conditions in the debt markets have eased somewhat, but specialists say they

remain much tighter than they were earlier this year.

Since Aug. 15, when the stock market hit its lowest point in five months, the

Standard & Poor’s 500-stock index is up 8.5 percent and the Dow Jones industrial

average 8 percent. The increase has erased much of the decline from late July

and early August and left the indexes up modestly for the third quarter, which

ended yesterday.

“It’s kind of amazing how well equities have held up,” said Douglas M. Peta,

chief market strategist at J. W. Seligman & Company, an investment firm in New

York.

“If you went away sometime in July and came back about now, you might say,

‘Nothing happened while I was gone,’” he said.

In yesterday’s trading, the main indexes fell slightly, with the S.& P. 500 down

4.63 points, or 0.3 percent, to 1,526.75. The Dow slipped 17.31 points, or 0.12

percent, to 13,895.63, and the Nasdaq fell 8.09 points, or 0.30 percent, to

2,701.50.

That still left the Dow and the Nasdaq with gains of more than 11 percent this

year, and the S.&P. up 7.7 percent for the year.

The market appears to be buoyed by a belief that the problems in the housing and

credit markets will not pull the broader economy into a recession and that

growth in Asia and Europe will help offset those ill effects. The optimism is

most vividly manifest in the performance of foreign markets, particularly in the

fast-developing countries like China and India.

A widely followed Morgan Stanley index that tracks emerging markets is up 26

percent since Aug. 16, when it hit a low. Markets in developed countries

excluding the United States are up nearly 12 percent in the same period.

Even in the United States, the market’s return has been led by sectors like

energy, industrials, materials and technology, which investors believe are best

positioned to take advantage of the growth abroad.

The financial and consumer discretionary sectors have lagged; they are seen as

having the most to lose from a declining housing market and slowing consumer

spending domestically.

Indeed, investors in September poured $1.1 billion into mutual funds that

specialize in emerging markets, while they withdrew about $3.2 billion from

domestic equity funds, according to AMG Data Services, a research firm.

Expectations that the rest of the world will outperform the United States are

also reflected in the depreciating dollar, which dropped yesterday to $1.4265

against the euro, a new low. The dollar has fallen 2.8 percent against the euro

since Sept. 14, when the Fed cut rates and is down 8 percent for the year. Gold

prices rose 1.4 percent, to $742.80 a troy ounce, the highest since 1980.

Currency traders, and others in the financial markets, are operating under the

assumption that central bankers in Washington have taken a more activist and

accommodating stance.

That view started to take hold in mid-August when the Fed cut the discount rate

— what it charges banks to borrow directly from it. Investors became even more

convinced last week when the Fed cut its benchmark rate by half a point, to 4.75

percent, rather than the expected quarter point.

The futures market is now predicting that the Fed will cut rates at least once

more, to 4.5 percent, at its meeting on Oct. 30 and 31.

But one Fed official, William Poole, said yesterday that “it would be a mistake

for markets to bake into the cake the assumption of ongoing rate cuts,”

according to Bloomberg News.

Mr. Poole, president of the Federal Reserve Bank of St. Louis, responding to a

question after a speech in New York, said he was expressing his own views and

not speaking for the Fed.

In the credit market, the Fed’s rate cutting and its lending at the discount

rate and through open market operations have eased the logjam somewhat.

This week, banks raising money for the private equity buyout of the First Data

Corporation, a credit card processor, were able to sell more debt than they had

planned.

Still some of the roughly $300 billion debt backlog that needs to be sold may

never be worked off. The private equity acquisitions that are falling apart or

being withdrawn include the purchases of the student loan provider Sallie Mae

and Harman International Industries, a maker of high-end audio speakers.

“You still have a big overhang of supply out there,” said Eric G. Takaha,

director of corporate and high-yield debt at Franklin Templeton, the investment

company. “But the path has become a little clearer.”

One mortgage company, Thornburg Mortgage, said the market for “jumbo” home loans

— those with a face value of more than $417,000 — appeared to be improving. In

recent weeks, investors have been more willing to buy bonds backed by pools of

the mortgages, but are demanding higher returns and more safeguards against

default.

Home buyers searching for jumbo loans will notice a slight drop in interest

rates but will have to shop around, said Larry A. Goldstone, president and chief

operating officer at Thornburg, based in Santa Fe, N.M.

“The market has improved modestly and it is certainly not deteriorating,” Mr.

Goldstone said. “I think it has a ways to go before it’s back to functioning in

a completely normal way.”

What Plunge? Stocks Back Near Highs Hit in July,

NYT,

29.9.2007,

https://www.nytimes.com/2007/09/29/

business/29markets.html

Explore more on these topics

Anglonautes > Vocapedia

economy, cycles, business, markets, prices, taxes >

down

inflation

deflation, stagflation

science, numbers, figures,

data, statistics

stock markets

stock markets > traders

economy, money, taxes,

housing market, shopping,

jobs, unemployment,

unions, retirement,

debt,

poverty, hunger,

homelessness

industry, energy, commodities

Related > Anglonautes >

Grammaire anglaise

explicative - niveau avancé

verbes à particule adverbiale

liste / classement par particule

|