|

Vocapedia >

Economy

Cycles, sales, business, markets,

prices, taxes, budgets, jobs

Down

Nate Beeler

Editorial cartoon

The Washington Examiner

Washington, D.C.

Cagle

18 August 2011

R: U.S. President Barack Obama

Martin Kozlowski

cartoon

inxart.com

Cagle

18

September 2008

Paul Conrad

cartoon

The Los Angeles Times Syndicate

California

Cagle

14

October 2008

volatile UK / USA

http://www.nytimes.com/2010/05/08/

business/08markets.html

http://www.guardian.co.uk/money/2008/apr/08/

houseprices.property2

the ebbs and flows of our economy

USA

http://www.nytimes.com/2013/12/16/nyregion/

one-brother-reaches-out-to-another-across-the-economic-divide.html

fluctuate

wobble

flounder

https://www.reuters.com/article/newsOne/idUSN11166760

20080414

ebb from N

http://www.nytimes.com/reuters/business/business-markets-oil.html

sour

http://www.nytimes.com/2008/10/11/business/11auto.html

on double whammy UK

https://www.theguardian.com/business/2008/jun/26/

fooddrinks.profitwarnings

take a double whammy

demise

UK

https://www.theguardian.com/lifeandstyle/2018/jul/24/

their-jobs-are-disappearing-

how-the-demise-of-the-high-street-is-killing-womens-jobs

rout

UK / USA

https://www.npr.org/2018/10/11/

656436335/us-stock-markets-regain-footing-after-plunge

https://www.reuters.com/article/

us-markets-stocks/dow-dives-below-10000-on-credit-recession-fears-idUSTRE4952D2

20081006 - October 6, 2008

https://www.reuters.com/article/

us-bearstearns-fed/bear-fire-sale-sparks-rout-on-eve-of-fed-rate-cut-idUSN16505641

20080317-

March 17, 2008

https://www.theguardian.com/business/2008/jan/22/

businessqandas.marketturmoil

down UK / USA

https://www.nytimes.com/2020/04/10/

opinion/coronavirus-unemployment-small-business.html

https://www.npr.org/2018/10/11/

656436335/us-stock-markets-regain-footing-after-plunge

https://www.npr.org/sections/thetwo-way/2018/03/28/

597598628/facebook-down-80-billion-in-market-value-playboy-spacex-tesla-exit

https://www.theguardian.com/money/2008/oct/27/

house-prices-decline

https://www.independent.co.uk/

property/house-and-home/houses-prices-down-1-5-in-three-months-801865.html

bring down drug prices

USA

https://www.npr.org/sections/health-shots/2023/11/17/

1213612489/sen-sanders-pushes-nih-to-rein-in-drug-prices

nudge down

USA

http://www.npr.org/sections/thetwo-way/2017/03/10/

519614370/u-s-employers-added-a-robust-235-000-jobs-in-february

end down

downward

downfall USA

https://www.npr.org/2023/11/06/

1209917988/wework-bankruptcy

https://www.nytimes.com/2008/07/29/

business/29indymac.html

downturn UK / USA

http://www.guardian.co.uk/commentisfree/2008/nov/06/bankofenglandgovernor-interestrates

http://www.guardian.co.uk/business/2008/oct/30/bank-of-england-economy

http://www.guardian.co.uk/business/2008/oct/25/globalrecession-globaleconomy

https://economix.blogs.nytimes.com/2008/10/20/long-and-shallow/

http://www.guardian.co.uk/money/2008/jan/06/foreigncurrency.globaleconomy

https://www.theguardian.com/business/2006/jul/19/oilandpetrol.news

recession UK / USA

http://www.guardian.co.uk/business/2012/apr/26/britain-long-depression-100-years

https://www.reuters.com/article/politicsNews/idUSTRE48O0PT

20080925

https://www.reuters.com/article/ousiv/idUSN08398566

20080409

https://www.reuters.com/article/domesticNews/idUSN08389014

20080409

http://www.guardian.co.uk/business/2008/apr/09/useconomy.subprimecrisis

https://www.reuters.com/article/topNews/idUSWAT009233

20080402

https://www.reuters.com/article/ousiv/idUSN26351185

20080227

https://www.reuters.com/article/newsOne/idUSL3180310

20080105

slip

http://www.nytimes.com/2013/04/24/technology/

as-profit-slips-apple-increases-efforts-to-reward-shareholders.html

slip

into recession

suffer

recession

crisis

USA 2008

https://www.reuters.com/article/us-financial/

crisis-hammers-stocks-u-s-urges-unified-response-idUSTRE49542Y20081006

global financial crisis

2008

https://www.ft.com/content/3e3dc394-07be-11dd-a922-0000779fd2ac

bailout

USA 2008

https://www.reuters.com/article/us-financial-quotes/

factbox-bush-appeals-for-backing-of-bailout-

idUKTRE48O0UE20080925?virtualBrandChannel=10112

tapper off

http://www.nytimes.com/2013/04/06/

business/economy/us-adds-only-88000-jobs-jobless-rate-falls-to-7-6.html

slowdown UK / USA

https://www.npr.org/sections/coronavirus-live-updates/2020/03/20/

818906241/the-economy-is-getting-hit-hard-and-the-forecasts-are-scary

https://www.reuters.com/article/ousiv/idUSTRE4965NQ

20081007

http://www.guardian.co.uk/business/2008/sep/03/unemploymentdata.economics1

http://www.theguardian.com/business/2007/feb/28/businesscomment.internationalnews

suffer a sharp slowdown

in activity and employment

meltdown UK / USA

http://www.nytimes.com/2013/07/28/

opinion/sunday/the-psychology-of-an-irish-meltdown.html

http://www.theguardian.com/business/2006/may/14/

globaleconomy.observerbusiness

writedown

stock market wipeout

USA

https://www.npr.org/2018/07/26/

632771946/facebook-loses-more-than-100-billion-in-value-

in-worst-stock-market-wipeout-in-h

wipe off

bust UK / USA

http://www.theguardian.com/business/2013/oct/06/

what-1973-today-economic-crisis

http://www.nytimes.com/2013/01/19/

business/economy/fed-transcripts-open-a-window-on-2007-crisis.html

http://www.nytimes.com/2010/05/22/opinion/22sat1.html

http://www.nytimes.com/2008/12/07/business/07leon.html

http://www.guardian.co.uk/business/interactive/2008/oct/22/creditcrunch-recession

http://www.guardian.co.uk/business/interactive/2008/jul/11/ftse100

http://www.guardian.co.uk/business/2008/may/29/housingmarket.houseprices1

bump UK

http://www.guardian.co.uk/politics/2008/nov/01/

osborne-brown-public-spending-recession

to the wall

low

https://www.reuters.com/article/us-property-southerncalifornia/

southern-california-home-prices-at-2-1-2-year-low-idUSN1420423220071114

lower

https://www.npr.org/2023/06/13/

1181686474/cheaper-eggs-gas-lead-inflation-lower-in-may-

but-higher-prices-pop-up-elsewhere

record low

https://www.theguardian.com/business/2008/oct/20/

recession-economy-slump-crunch

https://www.reuters.com/article/us-usa-economy-housing/

existing-home-sales-fall-to-record-low-in-oct-idUSN1950763920071128

under

underwater

http://www.nytimes.com/interactive/2008/11/10/business/20081111_MORTGAGES.html

http://www.nytimes.com/2008/11/11/business/11home.html

https://www.reuters.com/article/us-usa-housing-economycom/

one-in-10-home-loans-is-under-water-economy-com-

idUSN2259847620080222

doldrums

USA

http://www.nytimes.com/2010/11/17/business/17shop.html

economic doldrums

USA

http://www.nytimes.com/2010/09/22/business/22dollar.html

remain in doldrums

UK

https://www.theguardian.com/business/2006/apr/03/politics.money

lose steam

slow

UK

https://www.theguardian.com/business/2006/sep/28/

interestrates.interestrates

slow

https://www.npr.org/2021/05/07/

994217612/spring-slump-employers-add-just-266-000-jobs-in-april

https://www.npr.org/2021/01/28/

961372699/us-economy-slows-sharply-as-pandemic-resurges

https://www.npr.org/2019/10/30/

774485430/as-growth-slows-the-economy-is-falling-short-of-trumps-target

https://www.npr.org/sections/thetwo-way/2018/01/26/

580964131/as-2017-wound-down-u-s-growth-was-good-but-not-as-strong-as-expected

http://www.nytimes.com/2012/04/28/

business/economy/us-economic-growth-slows-to-2-2-rate-report-says.html

https://www.reuters.com/article/lifestyleMolt/idUSN17444805

20080417

slow to a crawl

USA

http://www.nytimes.com/2010/08/28/business/economy/28fed.html

slacken

decline

USA

http://www.npr.org/sections/thetwo-way/2017/10/06/

556071100/u-s-jobs-dropped-by-33-000-in-september-likely-due-to-storms

http://www.nytimes.com/2011/09/23/

business/global/daily-stock-market-activity.html

contract

UK / USA

http://www.nytimes.com/2013/01/31/

business/economy/us-economy-unexpectedly-contracted-in-fourth-quarter.html

http://www.guardian.co.uk/business/2013/jan/04/uk-

service-sector-contracts-pmi#start-of-comments

shed

http://www.npr.org/sections/thetwo-way/2017/10/06/

556071100/u-s-jobs-dropped-by-33-000-in-september-likely-due-to-storms

http://www.independent.co.uk/news/business/news/

bae-to-shed-nearly-600-jobs-in-wake-of-failed-bid-for-jet-contract-804612.html

retreat

in the red

USA

https://www.npr.org/2021/05/01/

991992812/roughly-40-of-post-offices-operate-in-the-red-

could-banking-offer-them-a-way-out

http://www.npr.org/sections/thetwo-way/2015/05/29/

410557869/first-quarter-revision-puts-gdp-in-the-red

cool USA

https://www.npr.org/2023/12/16/

1219574403/economy-inflation-prices-wages-disinflation-deflation-interest-rates

https://www.npr.org/2023/11/14/

1212857267/cpi-october-us-inflation-gas-prices-consumer

cooling

weak UK

https://www.theguardian.com/business/2006/jul/27/

ukeconomy

https://www.theguardian.com/business/2006/jul/29/

usnews

weaken

https://www.npr.org/2019/08/14/

751129610/dow-tumbles-over-600-points-as-bond-markets-signal-recession

http://www.nytimes.com/2010/03/25/business/economy/25econ.html

https://www.reuters.com/article/newsOne/idUSREE064781

20080606

stall

UK / USA

https://www.nytimes.com/2023/05/02/

business/economy/manufacturing-recession-economy.html

https://www.nytimes.com/2014/09/06/

opinion/jobs-stall-and-so-does-the-economy.html

http://www.guardian.co.uk/business/2013/jan/30/us-economy-surprise-shrink

https://www.nytimes.com/2008/11/12/

business/economy/12leonhardt.html

https://www.theguardian.com/business/2006/jul/29/

usnews

slip USA

https://www.nytimes.com/2009/10/31/

business/economy/31econ.html

https://www.nytimes.com/2008/04/16/

business/worldbusiness/16cnd-euro.html

slide UK

/ USA

https://www.nytimes.com/live/2025/04/04/business/jobs-report-march-tariffs-economy

http://www.guardian.co.uk/business/2008/oct/15/creditcrunch-globaleconomy

http://www.guardian.co.uk/business/2008/jun/26/fooddrinks.profitwarnings

http://www.nytimes.com/2008/03/21/business/21commodity.html

https://www.theguardian.com/business/2006/sep/25/oilandpetrol.news1

slide

into N

http://www.guardian.co.uk/business/2011/dec/15/

imf-world-risks-1930s-style-slump

slide UK / USA

http://www.nytimes.com/2011/11/02/

business/daily-stock-market-activity.html

http://www.theguardian.com/business/2007/mar/01/

ftse.moneyinvestments

burst

turmoil UK

http://www.theguardian.com/business/2007/sep/18/money.northernrock

http://www.theguardian.com/money/2006/jan/19/business.politics

slacken

stall

sluggish

http://www.nytimes.com/2012/06/14/

business/economy/weak-economys-mixed-blessing-falling-commodity-prices.html

lacklustre global economy

falter

https://www.npr.org/2019/08/14/

751129610/dow-tumbles-over-600-points-as-bond-markets-signal-recession

fall UK /

USA

https://www.npr.org/2025/02/03/

nx-s1-5284820/global-stocks-slide-trump-imposes-tariffs

https://www.nytimes.com/2011/08/06/

business/daily-stock-market-activity.html

https://www.theguardian.com/business/2010/jul/14/

unemployment-part-time-working-record-high

https://www.independent.co.uk/news/business/news/

manufacturing-output-falls-again-1058577.html - 9 December 2008

http://www.guardian.co.uk/money/2008/oct/09/house.prices.property

https://www.theguardian.com/money/2007/sep/20/northernrock

https://www.theguardian.com/media/2005/jun/29/citynews.business

fall UK /

USA

https://www.npr.org/2018/07/27/

633090205/twitter-shares-fall-ending-a-hard-week-for-social-media-stock

http://www.nytimes.com/2012/01/08/

business/sean-quinn-and-irelands-boom-and-bust.html

http://www.guardian.co.uk/business/2008/jan/21/marketturmoil.equities

https://www.theguardian.com/business/2007/feb/28/china.frontpagenews

https://www.theguardian.com/business/2006/jul/13/ukeconomy

bruising fall

USA

https://www.nytimes.com/2013/04/19/

technology/after-apples-rise-a-bruising-fall.html

heavy falls

fall sharply

USA

http://www.nytimes.com/2010/11/24/

business/economy/24foreclosure.html

rise and fall

UK

http://www.guardian.co.uk/business/2010/aug/25/

rise-fall-american-apparel

freefall

UK

http://www.guardian.co.uk/business/2009/jan/19/

bank-shares-plummet

http://www.guardian.co.uk/business/2008/dec/05/

usemployment-useconomy1

droop USA

https://www.nytimes.com/2023/05/02/

business/economy/manufacturing-recession-economy.html

drop UK /

USA

https://www.npr.org/2023/03/15/

1163640413/credit-suiss-banks-silicon-valley-bank-signature-bank

https://www.theguardian.com/technology/2022/oct/26/

meta-earnings-report-facebook-stocks

https://www.npr.org/2022/09/23/

1124713385/stock-markets-drop-

as-wall-street-takes-a-gloomy-view-of-the-economy

https://www.npr.org/2020/03/12/

814853898/stocks-in-meltdown-over-trumps-coronavirus-plan

https://www.npr.org/2020/02/25/

809390207/dow-drops-1900-points-in-2-days-

as-markets-sell-off-on-fears-of-coronavirus-spre

https://www.npr.org/2019/05/03/

719507647/solid-job-gains-expected-

latest-sign-the-u-s-economy-remains-strong

http://www.npr.org/sections/thetwo-way/2016/02/05/

465686010/u-s-added-151-000-jobs-in-january-unemployment-dropped-to-4-9-percent

http://www.nytimes.com/2011/12/03/

business/economy/us-adds-120000-jobs-unemployment-drops-to-8-6.html

https://www.reuters.com/article/hotStocksNews/idUSTRE49B3Y6

20081125

http://www.guardian.co.uk/business/2008/nov/18/inflation-cpi-falls

drop UK / USA

https://www.npr.org/2022/01/18/

1073797789/inflation-omicron-big-plunge-markets-stocks-bonds

https://www.theguardian.com/business/2020/apr/20/

over-a-barrel-how-oil-prices-dropped-below-zero

https://www.nytimes.com/2020/04/08/

business/europe-economy-france-germany.html

https://www.npr.org/sections/thetwo-way/2018/06/01/

615917917/unemployment-rate-drops-to-3-8-percent-lowest-since-2000

http://www.npr.org/sections/thetwo-way/2017/10/06/

556071100/u-s-jobs-dropped-by-33-000-in-september-likely-due-to-storms

http://www.nytimes.com/2013/01/25/

technology/microsoft-reports-drop-in-profits.html

http://www.nytimes.com/2010/11/24/business/24markets.html

https://www.reuters.com/article/hotStocksNews/idUSN27328979

20090227

steep drop

record drop

shrink

UK / USA

https://www.theguardian.com/technology/2022/oct/26/

meta-earnings-report-facebook-stocks

https://www.npr.org/2019/08/14/

751129610/dow-tumbles-over-600-points-as-bond-markets-signal-recession

http://www.nytimes.com/2013/05/15/business/cbo-cuts-2013-deficit-estimate-by-24-percent.html

http://www.guardian.co.uk/business/2011/apr/26/city-bonuses-shrink-pay-rise

turn negative

dip

UK / USA

https://www.npr.org/2025/02/07/

nx-s1-5288979/jobs-labor-market-workers

https://www.theguardian.com/technology/2022/oct/26/

youtube-battle-with-tiktok-takes-its-toll-as-revenues-dip-alphabet

https://www.npr.org/sections/coronavirus-live-updates/2020/06/05/

869821293/as-america-struggles-to-return-to-work-

staggering-unemployment-numbers-loom

https://www.npr.org/2018/08/03/

634939540/jobs-outlook-steady-gains-low-unemployment-

what-about-wages

https://www.npr.org/sections/thetwo-way/2015/03/06/

391164116/nearly-300k-new-jobs-in-february-

unemployment-dips-to-5-5-percent

dip below N

USA

https://www.npr.org/sections/coronavirus-live-updates/2020/08/13/

902102168/new-jobless-claims-dip-below-1-million-for-first-time-since-march

dip

sink

UK / USA

https://www.npr.org/2025/04/04/

nx-s1-5352362/markets-selloff-dow-trump-tariffs

https://www.nytimes.com/2025/01/27/

business/us-stock-market-deepseek-ai-sp500-nvidia.html

https://www.npr.org/2022/10/07/

1127215494/september-jobs-report-employment-unemployment-inflation

http://www.guardian.co.uk/business/2011/dec/29/

euro-sinks-italian-bond-auction

https://www.reuters.com/article/newsOne/idUSTRE48S24L

20080929

sink into N

UK

http://www.guardian.co.uk/business/2012/apr/26/

britain-long-depression-100-years

sink deeper into recession

slump

https://www.reuters.com/markets/europe/

europe-prepares-response-trump-tariffs-global-markets-plunge-2025-04-04/

slump USA

https://www.nytimes.com/2016/04/20/

technology/intel-earnings-job-cuts.html

https://www.theguardian.com/business/2014/sep/11/

morrisons-profits-slump-2014-supermarkets-dividend

http://dealbook.nytimes.com/2012/05/21/facebook-shares-slump-on-second-day/

http://www.nytimes.com/2011/01/26/business/economy/26econ.html

http://www.guardian.co.uk/money/2008/nov/25/mortgages-property

http://www.guardian.co.uk/money/2008/oct/30/house-prices-property

http://www.guardian.co.uk/business/2008/sep/29/marketturmoil.bradfordbingley

http://www.nytimes.com/2008/01/31/business/31cnd-stox.htm

slump by 71%

UK

https://www.theguardian.com/business/2021/dec/29/

air-travel-in-and-out-of-uk-slumps-in-2021-amid-pandemic

slump

UK / USA

https://www.nytimes.com/2020/04/02/

opinion/coronavirus-economy-stimulus.html

https://www.npr.org/sections/coronavirus-live-updates/2020/04/01/

825215754/factories-feel-the-coronavirus-slump

http://www.nytimes.com/2014/08/15/

opinion/paul-krugman-the-forever-slump.html

http://www.guardian.co.uk/world/2013/jan/19/

snow-triple-dip-recession

http://www.nytimes.com/2011/09/27/us/

unrelenting-downturn-is-redrawing-americas-economic-map.html

http://www.nytimes.com/2010/01/20/

business/20market.html

http://www.guardian.co.uk/business/2008/oct/22/

recession-retail

http://www.guardian.co.uk/business/2008/oct/16/

market-turmoil-recession

http://www.guardian.co.uk/money/2008/jan/16/

houseprices.interestrates

slump / slowdown

slow sharply

hit a pothole

warn of

profits slump

world slump

slump in sales

Doonesbury

Garry Trudeau

October 22, 2023

GoComics

https://www.gocomics.com/doonesbury/2023/10/22

sales >

tank USA

https://www.gocomics.com/doonesbury/2023/10/22

sluggish

a 29 per cent slump in full-year

profits

hiring slump / employment decline

squeeze

UK

https://www.ft.com/content/630f47e4-66ae-11dc-a218-0000779fd2ac

crunch

UK

http://news.bbc.co.uk/1/hi/business/6999821.stm

crumble

http://www.theguardian.com/business/2007/sep/19/

money.northernrock

skid

http://www.nytimes.com/2010/05/26/business/26markets.html

https://www.reuters.com/article/newsOne/idUSL3180310

20080105

stumble

stumble

UK

https://www.theguardian.com/business/2007/feb/28/

ftse.marketforces

profits >

halve UK

https://www.theguardian.com/technology/2022/oct/26/

meta-earnings-report-facebook-stocks

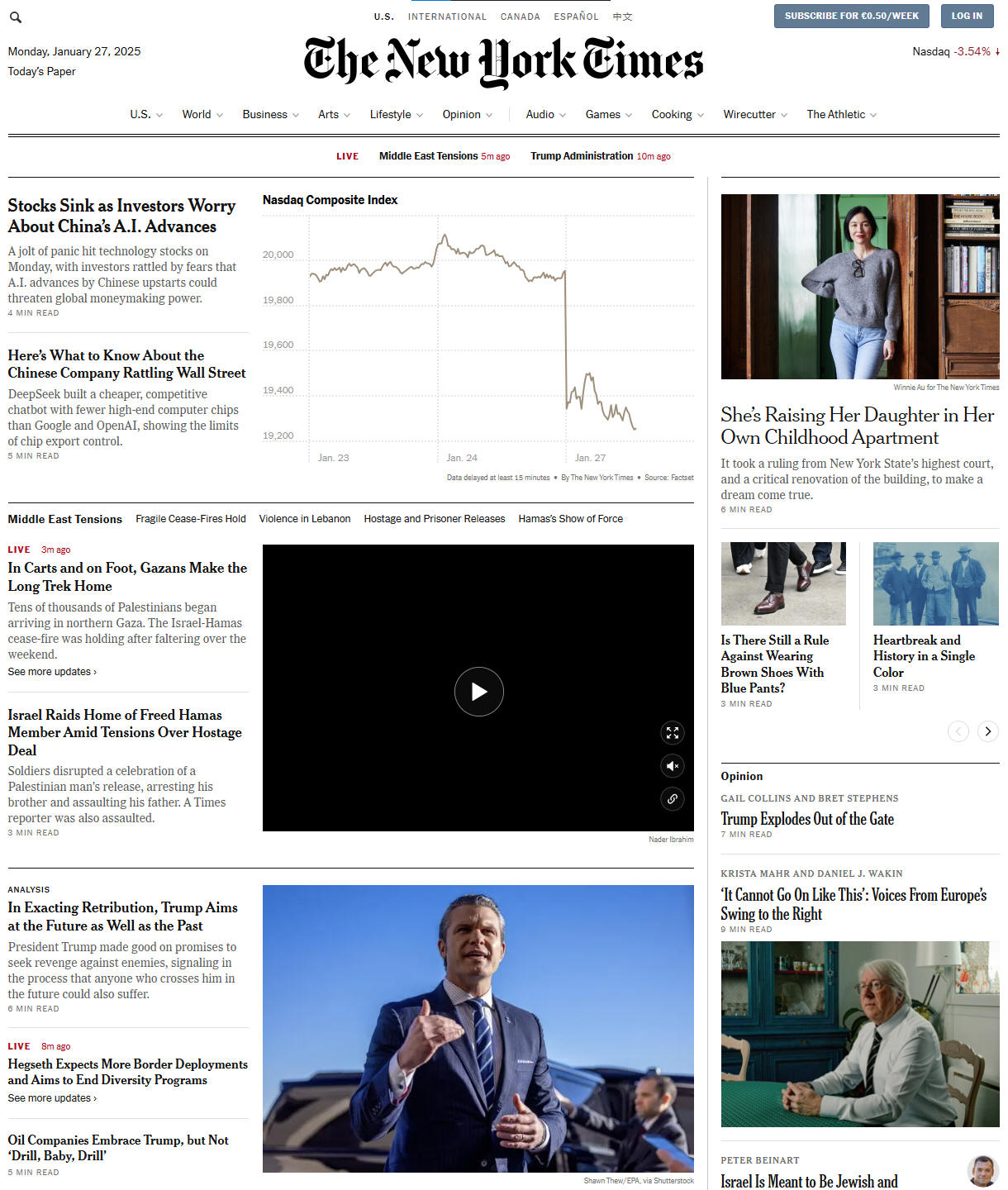

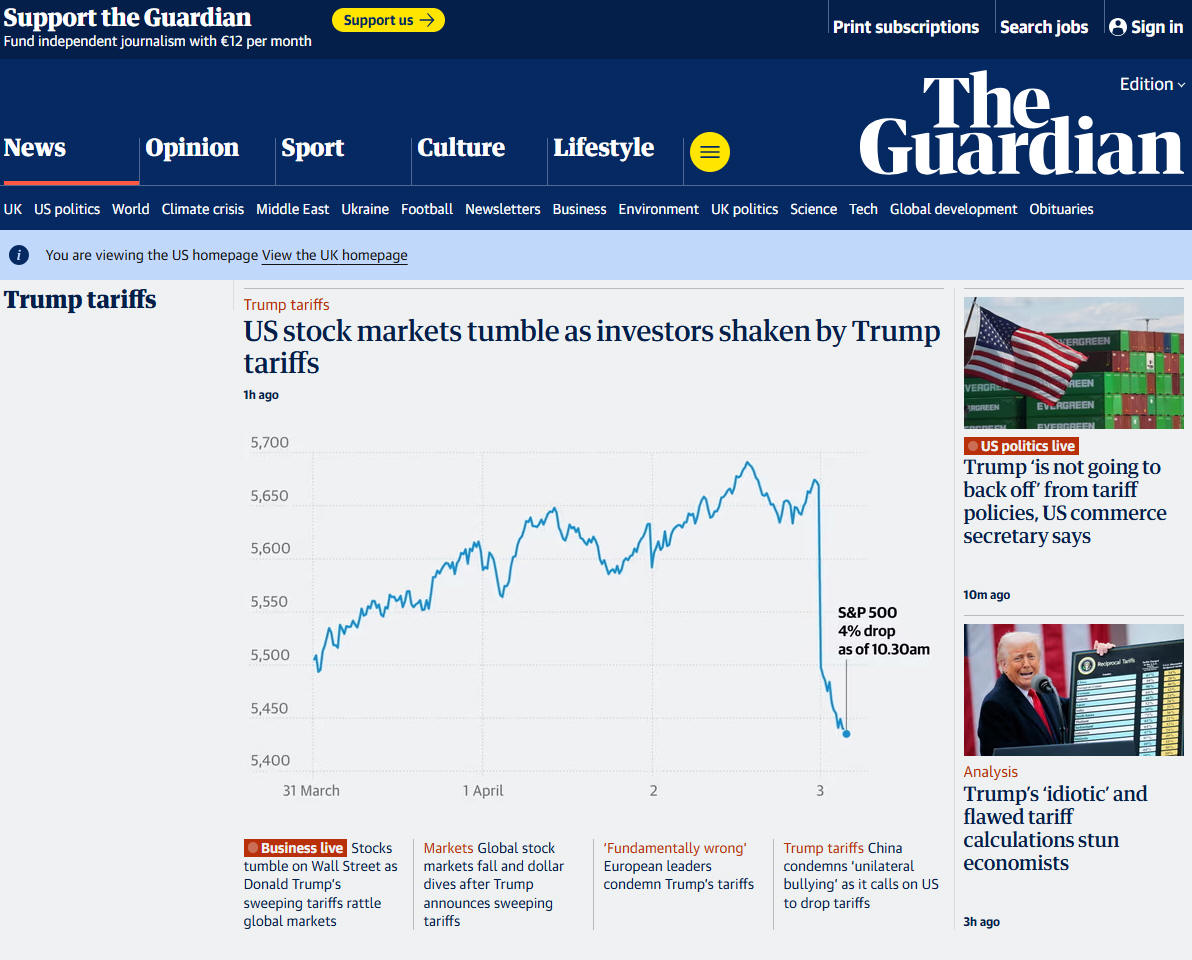

Guardian frontpage

3 March 2025

tumble UK

/ USA

https://www.theguardian.com/us-news/2025/apr/03/

trump-tariffs-stock-market

https://www.npr.org/2025/01/27/

nx-s1-5276097/wall-street-stock-markets-tumble-deepseek-ai-tech-stock

https://www.nytimes.com/2024/06/25/

business/dealbook/nvidia-stock-wipeout.html

https://www.npr.org/2024/04/01/

1242085620/trump-social-media-stock-djt-truth-social

https://www.nytimes.com/2023/03/15/

business/stocks-today.html

https://www.npr.org/2020/02/28/

810295350/financial-markets-shudder-around-the-world-

as-coronavirus-tightens-its-grip

https://www.npr.org/2020/02/24/

808811280/stocks-fall-sharply-on-coronavirus-fears

https://www.npr.org/2019/08/14/

751129610/dow-tumbles-over-600-points-

as-bond-markets-signal-recession

http://www.theguardian.com/world/2015/jun/28/

greece-crisis-deepens-banks-close-a-week-weekend-shook-euro

https://www.theguardian.com/business/2012/oct/05/

september-jobs-report-obama-unemployment

http://www.guardian.co.uk/business/2008/dec/04/interest-rates-bank-of-england

http://www.nytimes.com/2008/10/29/business/economy/29econ.html

http://www.guardian.co.uk/business/2008/oct/22/pound-recession-interest-rates

http://www.guardian.co.uk/business/2008/mar/13/currencies.marketturmoil

https://www.reuters.com/article/newsOne/idUSL3180310

20080105

https://www.theguardian.com/business/2007/feb/28/

ftse.internationalnews

tumble

19% tumble in Meta’s share price UK

https://www.theguardian.com/technology/2022/oct/26/

meta-earnings-report-facebook-stocks

take a

tumble UK

http://www.guardian.co.uk/money/2012/may/04/house-prices-april-halifax

tumble /

plunge into the red

tumble into insolvency

USA

https://www.nytimes.com/2013/07/19/

us/detroit-files-for-bankruptcy.html

skittish

USA

https://www.nytimes.com/2011/10/05/

business/daily-stock-market-activity.html

plunge

UK / USA

https://www.npr.org/2025/04/22/

nx-s1-5371552/tesla-earnings-april-2025-elon-musk-doge

https://www.reuters.com/world/us/

trump-tariff-live-updates-stocks-extend-global-selloff-investors-fear-us-2025-04-04/

https://www.nytimes.com/live/2025/04/03/

business/trump-tariffs

https://www.npr.org/2024/04/08/

1243498311/truth-social-shares-trump-media-legal-troubles

https://www.npr.org/2021/05/20/

998539706/bitcoin-is-plunging-

what-to-know-about-the-wild-ride-in-cryptocurrencies

https://www.nytimes.com/2020/05/15/

business/economy/retail-sales.html

https://www.npr.org/2020/03/16/

816382835/stocks-shudder-despite-emergency-measures

https://www.npr.org/2020/03/12/

814853898/stocks-in-meltdown-over-trumps-coronavirus-plan

https://www.theguardian.com/business/2016/jun/24/

ftse-100-and-sterling-plunge-on-brexit-panic

https://www.theguardian.com/business/2012/jun/01/

world-markets-global-crisis-deepens

http://www.nytimes.com/2011/08/05/business/markets.html

http://www.nytimes.com/2010/05/07/business/07markets.html

http://www.nytimes.com/2008/11/25/business/economy/25econ.html

http://www.guardian.co.uk/business/2008/sep/29/bradfordbingley.banking5

http://www.guardian.co.uk/business/2008/jul/30/lloydstsbgroup.creditcrunch

http://www.guardian.co.uk/business/2008/jul/28/ryanair.theairlineindustry1

https://www.reuters.com/article/ousiv/idUSNAT003747

20080226/

https://www.theguardian.com/business/2007/sep/14/

money.northernrock

https://www.theguardian.com/business/2006/jul/29/

usnews

plunge

into N UK

https://www.theguardian.com/business/2005/apr/20/

usnews.internationalnews1

record plunge

USA

https://www.npr.org/sections/coronavirus-live-updates/2020/05/15/

856253115/retail-wipeout-sales-plunge-a-record-16-4-in-april

plunge UK

https://www.theguardian.com/business/2007/oct/22/

money.graemewearden

plunging

sell-off

https://www.reuters.com/technology/

chinas-deepseek-sets-off-ai-market-rout-2025-01-27/

https://www.reuters.com/markets/

global-markets-wrapup-1pix-2024-08-06/

dive USA

https://www.npr.org/2022/05/05/

1096880050/dow-jones-stocks-inflation-economy-recession

dive

UK / USA

https://www.npr.org/sections/coronavirus-live-updates/2020/05/15/

856253115/retail-wipeout-sales-plunge-a-record-16-4-in-april

https://www.npr.org/sections/coronavirus-live-updates/2020/05/15/

856253115/retail-wipeout-sales-plunge-a-record-16-4-in-april

https://www.npr.org/sections/coronavirus-live-updates/2020/03/20/

818854894/can-stocks-stay-higher-2-days-in-a-row

https://www.npr.org/2020/03/18/

817650272/another-day-another-direction-for-stocks-this-time-its-down

https://www.npr.org/2020/03/11/

814412314/here-we-go-again-dow-drops-700-points-as-stock-market-turmoil-continues

https://www.npr.org/2020/03/09/

813619387/dow-dives-1-900-points-nyse-halts-trading-as-stock-indexes-plummet

https://www.theguardian.com/business/2006/may/18/

ftse.interestrates

take a dive

USA

https://www.nytimes.com/2008/05/21/

business/21econ.html

nosedive

UK

https://www.independent.co.uk/news/business/news/

rbs-shares-collapse-after-record-losses-1419467.html - 19 January 2009

https://www.theguardian.com/business/2006/sep/01/

britishidentityandsociety.uknews

plummet

UK / USA

https://www.npr.org/2023/04/26/

1172178067/first-republic-bank-silicon-valley-bank-signature-bank-collapse

https://www.theguardian.com/technology/2022/oct/26/

meta-earnings-report-facebook-stocks

https://www.nytimes.com/2020/05/06/

business/media/new-york-times-earnings-subscriptions-coronavirus.html

https://www.npr.org/2020/03/15/

816175414/fed-cuts-interest-rates-to-near-zero

https://www.npr.org/2016/02/23/

467768203/cheap-gas-contributes-to-record-u-s-traffic-volumes

https://www.npr.org/2016/01/20/

463724352/as-oil-plummets-cheap-jet-fuel-means-better-travel-deals

https://www.youtube.com/watch?v=9rMJyf3NS1w

https://www.nytimes.com/2012/07/27/

technology/facebook-reports-a-loss-but-its-revenue-beats-expectations.html

https://www.nytimes.com/2011/09/22/us/

greenwood-sc-had-steepest-economic-decline-in-us.html

https://www.nytimes.com/2010/05/07/

business/07markets.html

https://edition.cnn.com/2008/BUSINESS/10/27/

world.markets/index.html

https://www.reuters.com/article/hotStocksNews/idUSTRE4952D2

20081006

https://www.reuters.com/article/politicsNews/idUSTRE48S6OH

20080929

http://www.guardian.co.uk/business/2008/mar/26/

useconomy.houseprices

https://www.theguardian.com/media/2005/nov/25/

newmedia.games

worsen

UK

https://www.theguardian.com/business/2008/apr/10/

interestrates.interestrates

turmoil UK / USA

https://www.nytimes.com/interactive/2008/09/27/

business/economy/20080927_WEEKS_TIMELINE.html

http://www.guardian.co.uk/money/2008/jan/22/shares.moneyinvestments

turbulence USA

https://www.nytimes.com/2016/06/25/

business/international/brexit-financial-economic-impact-leave.html

https://archive.nytimes.com/www.nytimes.com/interactive/2008/09/30/

business/20080930_economy_voices.html

http://www.nytimes.com/2008/01/23/business/23crisis.html

jitters

collapse

UK / USA

https://www.npr.org/2023/03/14/

1163301477/after-2-banks-failed-sen-warren-blames-the-loosening-of-restrictions

https://www.npr.org/2020/09/15/

913052498/oil-demand-has-collapsed-and-it-wont-come-back-any-time-soon

https://www.nytimes.com/2015/08/20/

business/oil-drillers-sit-on-hands-at-auction-for-leases.html

https://www.ft.com/content/f09ec422-6294-11dc-b3ad-0000779fd2ac

collapse UK / USA

https://www.nytimes.com/2023/05/02/

business/economy/federal-reserve-interest-rates.html

https://www.npr.org/2023/03/14/

1163135286/silicon-valley-bank-collapse-fallout-whats-next

https://www.nytimes.com/2020/12/25/

realestate/nyc-real-estate-market.html

http://www.nytimes.com/2013/01/20/

opinion/sunday/financial-collapse-a-10-step-recovery-plan.html

http://www.guardian.co.uk/business/2011/dec/02/

angela-merkel-action-euro-collapse

http://www.nytimes.com/2008/11/07/

business/07retail.html

swoon

https://www.reuters.com/article/politicsNews/idUSTRE48S6BD

20080929

crash

https://www.reuters.com/article/newsOne/idUSTRE4A23QU

20081103

crash

UK/ USA

https://www.theguardian.com/news/audio/2022/jul/05/

understanding-the-cryptocurrency-crash-podcast

https://www.nytimes.com/2013/12/19/

opinion/gordon-brown-stumbling-toward-the-next-crash.html

http://www.guardian.co.uk/business/2008/oct/28/economics-credit-crunch-bank-england

http://www.guardian.co.uk/business/interactive/2008/oct/14/creditcrunch-marketturmoil

http://www.guardian.co.uk/business/2008/jan/22/marketturmoil.equities

http://www.pbs.org/fmc/timeline/estockmktcrash.htm

https://www.theguardian.com/technology/2005/mar/10/

newmedia.media

http://news.bbc.co.uk/2/hi/business/2131739.stm - 12 February 2003

drag down

UK

https://www.theguardian.com/business/2006/aug/01/

ftse.marketforces

bear market

UK / USA

A bear market is defined as a period

in which the major stock indexes

drop by 20% or more from a recent high point

and remain that low for at least a few months.

The two worst bear markets in history

— during the Great Depression and the Great Recession —

produced cumulative losses of 83% and 51%, respectively.

Analysts like to say

that the stock market is not the economy.

But a bear market reflects

concerns and anxieties about the economy,

and at times a bear market is accompanied

by a recession.

A recession is when the economy experiences

two or more consecutive quarters of decline.

https://www.npr.org/2020/03/12/

815090982/stocks-enter-bear-market-what-does-it-mean

This is one of those

terms

for which the

internet offers

various competing

“folk etymologies”,

which is the

linguist’s polite term for nonsense.

Bear markets are

named because bears attack

by swiping their paws downwards?

No.

The origin in fact

lies in the old proverb warning

that you shouldn’t

sell a bear’s skin

before you have

caught the bear.

In the 18th century,

speculators who did

sell borrowed commodities

before they had paid

for them

– in anticipation of

profiting from a fall in price –

were therefore called

“bearskin jobbers”,

later shortened to

“bears”.

So bears expect

the

value of investments to go down.

By contrast,

those who expected

prices to go up

came to be called “bulls”,

perhaps because that

beast is famously

headstrong and incautious.

In times such as

these,

we might prefer after

all to be led

by bears rather than bulls.

https://www.theguardian.com/books/2020/mar/12/

bear-markets-word-of-the-week

https://www.npr.org/2022/06/30/

1109062324/where-bull-market-and-bear-market-come-from

https://www.nytimes.com/interactive/2020/03/18/

business/coronavirus-stock-market-recessions.html

https://www.npr.org/2020/03/12/

815090982/stocks-enter-bear-market-what-does-it-mean

https://www.theguardian.com/books/2020/mar/12/

bear-markets-word-of-the-week

https://www.npr.org/2020/03/11/

814412314/here-we-go-again-dow-drops-700-points-as-stock-market-turmoil-continues

https://www.npr.org/2016/01/22/

463833909/what-do-bears-and-bulls-have-to-do-with-our-investments

http://news.bbc.co.uk/1/hi/business/1238320.stm - 23 March 2001

loss

UK

https://www.theguardian.com/business/2006/aug/11/

terrorism.money

cut

https://www.theguardian.com/business/2006/sep/28/

retail.money

slice

slash

UK / USA

https://www.npr.org/2024/08/23/

g-s1-18860/smart-ways-to-save-money-at-the-grocery-store-inflation

https://www.npr.org/2023/02/02/

1152586942/tesla-price-cuts-ford-mach-e-gm-electric-cars-tax-credit

https://www.theguardian.com/business/2020/may/14/

cruise-firm-carnival-slashes-jobs-and-pay-in-face-of-covid-19-crisis

https://www.npr.org/2020/03/15/

816175414/fed-cuts-interest-rates-to-near-zero

http://www.npr.org/sections/thetwo-way/2017/03/16/

520399205/trumps-budget-slashes-climate-change-funding

http://www.npr.org/2016/11/21/

502918106/president-elect-trump-proposes-to-slash-taxes-on-businesses

http://takingnote.blogs.nytimes.com/2013/11/01/

eviscerating-the-food-stamps-program/

http://www.npr.org/blogs/thetwo-way/2013/09/20/

224512240/blackberry-to-slash-workforce-amid-1-billion-loss

https://www.independent.co.uk/news/uk/

politics/brown-and-darling-slash-vat-in-163-18bn-tax-gamble-

1031213.html - 23 November 2008

https://www.independent.co.uk/news/business/news/

bank-warns-mortgage-lending-will-be-slashed-further-

804614.html - 4 April 2008

http://www.guardian.co.uk/business/2008/jan/22/us

economy.marketturmoil1

go bust

http://www.independent.co.uk/travel/news-and-advice/

warning-30-airlines-will-go-bust-this-year-928774.html

file for bankruptcy -

go into

administration / insolvency (UK)

file for chapter 11 (USA)

http://www.nytimes.com/2008/09/15/business/15lehman.html

http://news.bbc.co.uk/2/hi/business/7615712.stm

go down

go to the wall

going out of business

USA 2008

https://www.reuters.com/article/ousiv/idUSTRE49542Y

20081006

struggling

financial

ruin

hit the buffers

move

back into the

black UK

https://www.theguardian.com/business/2011/aug/19/

government-borrowing-surplus

wind up

UK

https://www.theguardian.com/money/2005/apr/29/

business.travelinsurance

be forced

into provisional liquidation UK

https://www.theguardian.com/money/2005/apr/29/

business.travelinsurance

white knight

pessimism

https://www.reuters.com/article/domesticNews/idUSN17643160

20080318

fear

UK

http://www.independent.co.uk/news/business/news/

the-day-fear-hit-the-markets-953498.html

anxiety

https://www.reuters.com/article/hotStocksNews/idUSTRE49A06V

20081011

panic

UK / USA

http://norris.blogs.nytimes.com/2008/10/06/live-blogging-amid-panic/

http://www.guardian.co.uk/business/2008/sep/29/marketturmoil.bradfordbingley

mayhem

UK

http://www.guardian.co.uk/business/video/2008/dec/23/credit-crunch-recession

abyss

UK

http://www.guardian.co.uk/business/2008/oct/08/creditcrunch.marketturmoil1

the worst

is yet to come

R.J. Matson

Comment cartoon

The New York Observer and Roll Call

NY

Cagle

25 August 2010

Corpus of news articles

Economy >

Cycles, sales, business, markets,

prices, taxes, budgets, jobs >

Down

Stumbling Toward the Next Crash

December 18, 2013

The New York Times

By GORDON BROWN

LONDON — In early October 2008, three weeks after the Lehman

Brothers collapse, I met in Paris with leaders of the countries in the euro

zone. Oblivious to the global dimension of the financial crisis, they took the

view that if there was fallout for Europe, America would be to blame — so it

would be for America to fix. I was unable to convince them that half of the

bundled subprime-mortgage securities that were about to blow up had landed in

Europe and that euro-area banks were, in fact, more highly leveraged than

America’s.

Despite the subsequent decision of the Group of 20 in 2009 on the need for rules

to supervise what is now a globally integrated financial system, world leaders

have spent the last five years in retreat, resorting to unilateral actions that

have made a mockery of global coordination. Already, we have forgotten the basic

lesson of the crash: Global problems need global solutions. And because we

failed to learn from the last crisis, the world’s bankers are carrying us toward

the next one.

The economist David Miles, who sits on the monetary policy committee of the Bank

of England, may exaggerate when he forecasts financial crises every seven years,

but most of the problems that caused the 2008 crisis — excessive borrowing,

shadow banking and reckless lending — have not gone away. Too-big-to-fail banks

have not shrunk; they’ve grown bigger. Huge bonuses that encourage reckless

risk-taking by bankers remain the norm. Meanwhile, shadow banking — investment

and lending services by financial institutions that act like banks, but with

less supervision — has expanded in value to $71 trillion, from $59 trillion in

2008.

Europe’s leaders aren’t the only ones with these blind spots. Emerging-market

economies in Asia and Latin America have seen a 20 percent growth in their

shadow-banking sectors. After 2009, Asian banks expanded their balance sheets

three times faster than the largest global financial institutions, while adding

only half as much capital.

In the patterns of borrowing today, we can already detect parallels with the

pre-crisis credit boom. We’re seeing the same over-reliance on short-term

capital markets that ultimately brought down Northern Rock, Iceland’s banks and

Lehman Brothers.

While the internationalization of the renminbi is opening up new opportunities

for global investment in China, it is also increasing the exposure of the global

economy to any vulnerability in its banking sector. China’s total domestic

credit has more than doubled to $23 trillion, from $9 trillion in 2008 — as big

an increase as if it had added the entire United States commercial banking

sector. Borrowing has risen as a share of China’s national income to more than

200 percent, from 135 percent in 2008. China’s growth of credit is now faster

than Japan’s before 1990 and America’s before 2008, with half that growth in the

shadow-banking sector. According to Morgan Stanley, corporate debt in China is

now equal to the country’s annual income.

Although sizable foreign reserves make today’s Asia different from the Asia that

experienced the 1997 crash in Indonesia, Thailand and South Korea, we are all

implicated. If China’s economy were to slow, Asian countries would be doubly hit

from the loss of exports and by higher prices. They would face downturns that

would feel like depressions.

And China’s banking system may not be Asia’s most vulnerable. Thailand’s

financial institutions, for example, appear overdependent on short-term foreign

loans; and in India, where 10 percent of bank loans have gone bad or need

restructuring, banks will need $19 billion in new capital by 2018.

If the emerging markets of Asia and Latin America are hit by financial turmoil

in coming years, will we not turn to one another and ask why we did not act

after the last crisis? Instead of retreating into our national silos, we should

have seized the opportunity to fix global standards for how much capital banks

must hold, how much they can lend against their equity, and how open they are

about their liabilities.

The Volcker Rule, now approved by American regulators, illustrates the initial

boldness and ultimate weakness of our post-2008 response. This element of the

Dodd-Frank financial reform law of 2010 forbids deposit-taking banks in the

United States from engaging in short-term, proprietary trading. But these

practices are still allowed in Europe. Controls are even weaker in Latin America

and Asia.

International rules are needed for international banks. Without them, as the

International Monetary Fund has warned, global banks will evade regulation “by

moving operations, changing corporate structures, and redesigning products.”

When I was chairman of the G-20 summit meeting here in April 2009, our first

principle was that future financial crises that started in one continent would

affect all continents. That was why we charged the new Global Financial

Stability Board with setting global standards and rules.

Nearly five years on, its chairman, the Bank of England governor Mark Carney,

has spoken of “uneven progress” in recapitalizing banks and making them disclose

their risks. The G-20 plan for oversight of shadow banking is, as yet, only a

plan. While the world’s $600 trillion derivatives market is being regulated with

new minimum capital and reporting requirements, global financial regulators must

“find a way to collaborate across borders,” Mr. Carney says.

In short, precisely what world leaders sought to avoid — a global financial

free-for-all, enabled by ad hoc, unilateral actions — is what has happened.

Political expediency, a failure to think and act globally, and a lack of courage

to take on vested interests are pushing us inexorably toward the next crash.

Gordon Brown,

a Labour member of the British Parliament,

is a former chancellor of the Exchequer

and prime minister.

Stumbling Toward the Next Crash,

NYT,

18.12.2013,

https://www.nytimes.com/2013/12/19/

opinion/gordon-brown-stumbling-toward-the-next-crash.html

Data Show

County’s Pain

as Economy Plummeted

September 22,

2011

The New York Times

By SABRINA TAVERNISE

GREENWOOD,

S.C. — The Greenwood Mills Matthews Plant once employed three generations of

Frances Flaherty’s family. Her grandmother, father and brother made textiles

there — denim for jeans and khaki for military uniforms.

But it all but closed in 2007 when the economy soured, pitching dozens of

workers into the ranks of the unemployed, and the plant now functions mainly as

a bleak backdrop to Ms. Flaherty’s restaurant, the Southside Cafe, where diners

gaze out at its red brick walls.

“It’s what held this town together, all the mills,” Ms. Flaherty said, watching

another thinly attended lunch hour go by. “They just slowly but surely dwindled

out.”

The falloff of the economy of Greenwood County, a district of almost 70,000

people that once pulsed with busy factories and mills, was the steepest in the

country by two counts.

According to an analysis of Census Bureau figures made public on Thursday, its

poverty rate more than doubled to 24 percent from 2007 to 2010, the largest

increase for any county in the nation.

The decline also engulfed the middle class. Median household income plunged by

28 percent over the same period, shaving nearly $12,000 off the annual earnings

of families here during the recession, according to the analysis, by Andrew A.

Beveridge, a demographer at Queens College.

The numbers tell the story of a painful decade in Greenwood, which began with

poverty levels that were close to the nation’s, and ended far above — after

layoffs in textile mills, a foundry, restaurants and construction companies

pummeled the county’s residents.

The number of workers in manufacturing alone fell by a quarter in the county

from 2005 to 2009, according to a census survey of employers.

Those new facts are just sharp reminders to people here about what they have

lived through.

“There just aren’t any jobs in Greenwood anymore,” said James Freeman, 58, a

former textile mill worker. “My son can’t even get a job flipping burgers.”

Mr. Freeman worked for years in the textile mills, including the Matthews plant.

He lost his last mill job in 2007 and was unable to find another. The work at

one of the mills that employed him went to Argentina, he said, because the

fabric was cheaper to produce there. Those workers were paid less, he was told,

and got no benefits.

“That made me feel kind of bad,” said Mr. Freeman, who now collects disability.

The mill’s closing “hurt a lot of people here in Greenwood.”

Disappointment like Mr. Freeman’s has welled up in areas of deep economic

decline, infusing this election season with a blend of exhaustion and

bitterness.

“Until we bring the companies back from overseas and stop protecting the world,

we’re not going to be anything,” said Sam Stevenson, a retired construction

worker, who could summon only expletives when asked about President Obama’s job

plan.

In many ways, Greenwood is a typical American county. More than a quarter of its

residents had at least some college education in 2009, roughly the same as the

27 percent nationally. It has a public university, which grants four-year

degrees, a museum and a shopping mall.

But education has not seemed to ease the economic pain in an area whose fortunes

were tied so closely to the textile industry that is now in such steep decline.

Signs with the words “space available” are posted outside vacant factories on

the road between here and Columbia, 80 miles to the east.

A red brick Baptist church on the outskirts of town commanded on its marquee,

“Have your tools ready, and God will find you work.”

Apache Pawn and Gun, a pawn shop in town, is packed with items sold by people

trying to make ends meet. Televisions, chain saws, bicycles and guitars are

stacked from floor to ceiling. Chris Harris, the owner, said more middle-class

people had come in to buy since the recession began.

“They’re saying, ‘Why should I buy a new chain saw when I could buy a used one?’

” Mr. Harris said.

Ms. Flaherty said her cafe —its walls adorned with black-and-white photographs

of mill workers and residents from happier times —is barely making it. When she

opened in 2007, lunch used to bring lines out the door from workers at the plant

and other businesses. Now it draws only a few diners. On Wednesday around 1:30

p.m., there were two.

And while housing prices have picked up — now a median of about $120,000 for the

current listings compared with $109,000 in 2009 — the economy this year does not

seem to be getting any better.

“It’s been bad this year,” said Kathy Green, owner of the Garden Grill, who said

business was down significantly since the start of the recession. People order

less, she said, and come in for the specials — $6 for a hamburger, fries and a

drink.

Ms. Green said, “People just don’t have the money anymore.”

Barclay Walsh

contributed reporting from Washington,

and Anne McQuary

from Greenwood.

Data Show County’s Pain as Economy Plummeted,

NYT,

22.9.2011,

http://www.nytimes.com/2011/09/22/us/

greenwood-sc-had-steepest-economic-decline-in-us.html

Stocks

Plunge

on Fears of Global Turmoil

August 4,

2011

The New York Times

By GRAHAM BOWLEY

What began as

a weak day in the stock markets ended in the worst rout in more than two years,

as investors dumped stocks amid anxiety that both Europe and the United States

were failing to fix deepening economic problems.

With a steep decline of around 5 percent in the United States on Thursday,

stocks have now fallen nearly 11 percent in two weeks. Markets have been

plunging as investors sought safer havens for their money — including Treasury

bonds, which some had been avoiding during the debate over extending the

nation’s debt ceiling.

Sparking the drop was an unsuccessful effort by the European Central Bank to

reassure the markets, which instead ended up spooking investors. The bank

intervened with a show of support to buy bonds of some smaller countries, but

not Italy and Spain, whose mounting troubles have come into the spotlight. This

was taken as a sign that the recent rescue packages by Europe could soon be

overwhelmed by the huge debt burdens in those two countries.

Investors were further unnerved by a candid remark by José Manuel Barroso, the

European Commission president, who seemed to confirm fears about the sense of

political paralysis. Rather than play down the problems, as European officials

have done since the debt crisis began last year, he said, “Markets remain to be

convinced that we are taking the appropriate steps to resolve the crisis.”

With investors in the United States already focusing anew on fragile economic

growth and high unemployment, waves of selling of stocks began in Europe and

continued throughout the day in the United States. Analysts said the market

still might have further to fall, as investors reassess the dimming economic

prospects. In the short run, attention will be focused on critical unemployment

numbers for July to be released on Friday morning. And some in the markets are

already questioning whether the Federal Reserve has done enough to mend the

economy and whether it could soon take further steps to stimulate growth.

On Thursday, more than 14 billion shares changed hands, the heaviest selling in

more than a year. In addition to being unnerved by weaker economic data reported

in recent days, investors appeared to lose their optimism about the strength of

corporate profits that had driven increases in the stock market in the first

half of this year.

At the close, the Standard & Poor’s 500-stock index was down 60.27 points, or

4.78 percent, to 1,200.07. The Dow Jones industrial average was off 512.76

points, or 4.31 percent, to 11,383.68, and the Nasdaq was down 136.68, or 5.08

percent, to 2,556.39.

The S.& P. 500 has now fallen 10.7 percent from 1,345 on July 22, underlining

the new negative investment sentiment about the economy and about Europe.

“We are now in correction mode,” said Sam Stovall, chief investment strategist

at Standard & Poor’s. “We could have another couple of weeks to go before it

bottoms.”

The last time the market was in a correction was last summer, when it fell 16

percent before recovering.

Analysts said credit markets were still healthy and the United States was now

stronger than just a few years ago so that a repeat of the financial crisis was

unlikely.

“There is a huge difference — during the financial crisis the banking sector

broke down. Right now it’s a crisis of confidence based on weak economies but

the banking sector is not broken,” said Reena Aggarwal, professor of finance at

Georgetown University.

The Vix, which measures the implied volatility of options on the S.& P. 500

index, and is called the fear index by traders, spiked on Thursday, though it is

still much lower than during the depths of the financial crisis in 2008.

Washington’s reaction to the market’s tumble was muted. The Treasury Department

said it did not plan to issue any statements or provide officials to comment.

“Markets go up and down,” said the White House spokesman, Jay Carney. “We

obviously are monitoring the situation in Europe closely.”

As the prospects for economic growth dimmed, several commodities, including oil,

silver and palladium, fell by more than 5 percent, perhaps producing some good

news for consumers.

With oil prices dropping below $87 a barrel, wiping out the rise caused by

unrest in the Middle East and North Africa earlier in the year, drivers can

expect sharply lower gasoline prices just in time for the Labor Day weekend and

back-to-school shopping.

Agricultural crops and most industrial metals fell somewhat less drastically,

with copper falling 1.9 percent, aluminum by 1.7 percent, corn by 1.9 percent,

wheat by 3.4 percent and soybeans by 1.8 percent.

Taken together, the drops should mean lower input costs for manufacturers and

give the Federal Reserve more policy options should the economy continue to

slow.

A closely-watched survey of American investor attitudes provided by the American

Association of Individual investors on Thursday showed the biggest increase in

bearish sentiment for five years in the latest week. As investors fled assets

like stocks, they piled into the perceived safety of United States Treasuries

where 10-year interest rates fell to 2.41 percent, recording the biggest one day

fall since March 2009.

Yields on one-month United States notes actually fell into negative territory

before closing at zero.

Besides piling into Treasuries, institutional investors are also seeking out the

safety of cold, hard cash, pouring billions into commercial bank accounts backed

up by the Federal Deposit Insurance Corporation. Investors had also been buying

Swiss francs and Japanese yen. But earlier this week, Switzerland unexpectedly

cut interest rates in an effort to weaken the franc. Japan on Thursday also

intervened to weaken its currency, raising the specter that more nations could

take similar steps to try to protect their economies.

Around the world, markets from Brazil to Turkey were battered.

In Britain, stocks closed down 3.43 percent. In Germany, the DAX index dropped

3.4 percent. In France, the CAC 40 closed down 3.9 percent.

“It really is Europe today,” said Barry Knapp, head of United States equity

strategy at Barclays Capital. “The market feels that European leaders are one

step behind, and they are.”

Asian markets quickly followed suit in trading lower. In midday trading on

Friday, the Nikkei 225 in Japan was down 3.47 percent to 9,312.22 while the S.&

P./ASX 200 index in Australia fell 3.98 percent to 4,106.40. The Hang Seng index

in Hong Kong opened sharply lower as well, and was down 4.6 percent to 20,865.95

by midday.

With some warning signs that weaker European banks are struggling to fund

themselves, the central bank moved to help weaker banks by expanding its lending

to institutions in the euro zone. Bank stocks nevertheless fell sharply in

Europe.

In the United States, as the stock market fell, it broke through critical

support levels, leading to more selling as traders rushed to reduce exposure to

plummeting prices. That included computerized program traders, one analyst said.

Reporting was

contributed

by Nelson D. Schwartz, Clifford Krauss,

Mark Landler,

Motoko Rich and Bettina Wassener.

Stocks Plunge on Fears of Global Turmoil, NYT, 4.8.2011,

http://www.nytimes.com/2011/08/05/business/markets.html

U.S. Markets Plunge,

Then Stage a Rebound

May 6, 2010

The New York Times

By GRAHAM BOWLEY

A bad day in the stock market turned into one of the most terrifying moments

in Wall Street history on Thursday with a brief 1,000-point plunge that recalled

the panic of 2008.

It lasted just 16 minutes but left Wall Street experts and ordinary investors

alike struggling to come to grips with what had happened — and fearful of where

the markets might go from here.

At least part of the sell-off appeared to be linked to trader error, perhaps an

incorrect order routed through one of the nation’s exchanges. Many of those

trades may be reversed so investors do not lose money on questionable

transactions.

But the speed and scale of the plunge — the largest intraday decline on record —

seemed to feed fears that the financial troubles gripping Europe were at last

reaching across the Atlantic. Amid the rout, new signs of stress emerged in the

credit markets. European banks seemed to be growing wary of lending to each

other, suggesting the debt crisis was entering a more dangerous phase.

Traders and Washington policy makers struggled to keep up as the Dow Jones

industrial average fell 1,000 points shortly after 2:30 p.m. and then mostly

rebounded in a matter of minutes. For a moment, the sell-off seemed to overwhelm

computer and human systems alike, and some traders began referring grimly to the

day as “Black Thursday.”

But in the end, Thursday was not as black as it had seemed. After briefly

sinking below 10,000, the Dow ended down 347.80, or 3.2 percent, at 10,520.32.

The Standard & Poor’s 500-stock index dropped 37.75 points, or 3.24 percent, to

close at 1,128.15, and the Nasdaq was down 82.65 points, or 3.44 percent, at

2,319.64.

But up and down Wall Street, and across the nation, many investors were

dumbstruck. Experts groped for explanations as blue-chip stocks like Procter &

Gamble, Philip Morris and Accenture plunged. At one point, Accenture fell more

than 90 percent to a penny. P.& G. plunged to $39.37 from more than $60 within

minutes.

The crisis in Greece, high-speed computer program trading, the debate over

regulatory reform in Washington, talk of errant trades — all were pointed to as

possible catalysts. But most agreed the plunge would not have been as bad had

the markets not already been on edge over the debt crisis in Europe.

“There is a recognition that the Greek crisis has morphed into not only a

European crisis but is going global,” said Mohamed A. El-Erian, chief executive

of Pimco, the money manager.

On the trading floor of the New York Stock Exchange, traders shouted or watched

open-mouthed as the screens lighted up with plummeting prices and as phones rang

off the hook. “It was almost like ‘The Twilight Zone.’ ” said Theodore R.

Aronson of Aronson, Johnson & Ortiz, a money management firm in Philadelphia.

Wall Street managers wandered their trading floors, trying to calm their people

and figure out what was going on. They began to notice wild movements in stocks

like P.& G. and Philip Morris. Many traders said computer program trades

accelerated the slide as market indexes fell through crucial levels.

In Washington, Treasury officials began combing market tapes for answers. By the

evening they still had not gotten to the bottom of it, but they discovered some

aberrations — market blips — in trading coming out of Chicago.

The Treasury secretary, Timothy F. Geithner, was returning to the Treasury about

2 p.m. from the Capitol when he saw on his BlackBerry that the market was down 3

percent. He called the Treasury’s market room, which constantly monitors

financial exchanges; officials there theorized that the cause was Greece’s and

Europe’s financial woes.

Minutes later in the Treasury hallway, Mr. Geithner looked again at his

BlackBerry and saw that the market was down nearly 9 percent. He told colleagues

it had to be a mistake.

Mr. Geithner immediately called the market room and then the Federal Reserve. He

held a conference call with Fed officials and Mary L. Schapiro, the chairwoman

of the Securities and Exchange Commission. About 3:15, Mr. Geithner walked to

the Oval Office to brief President Obama.

Next Mr. Geithner spoke with European central bankers. After the markets closed,

at 4:15 and again at 5:45, he joined conference calls with the heads of the Fed,

the New York Fed, the S.E.C. and the Commodity Futures Trading Commission; the

calls were expected to continue into the evening.

The Group of 7 industrial nations’ ministers and governors, including Mr.

Geithner, plan a conference call at 7:30 a.m. Friday Eastern time.

As of about 6 p.m., all the officials knew was that there had been what one

called “a huge, anomalous, unexplained surge in selling, it looks like in

Chicago, at about 2:45.” The source remained unknown, but it had apparently set

off algorithmic trading strategies, which in turn rippled across everything,

pushing trading out of whack and feeding on itself — until it started to

reverse.

Federal officials fielded rumors that the culprit was a single stock, a single

institution or execution system, a $16 billion trade that should have been $16

million. But they did not know the truth.

What happens to the day’s market losers will depend on the nature of the cause

and whether it can be identified. That is a question for the S.E.C. The Nasdaq

market said in the evening that it would cancel all trades in hundreds of stocks

whose prices had swung wildly between 2:40 p.m. and 3 p.m.

As Wall Street reeled, anchors on CNBC, Bloomberg and the Fox Business Network

turned their attention to the Dow.

When the Dow was down more than 900 points and the CNBC anchor Erin Burnett

observed that the P.& G. stock had dropped 25 percent, Jim Cramer, the former

hedge fund trader and the host of “Mad Money,” seemed to calm the conversation a

bit by basically saying, “Buy, buy, buy.”

“If that stock is there, you just go and buy it,” he said of P.& G. “That is not

a real price. Just go buy Procter & Gamble.”

The day’s uncertainty pushed the euro to its lowest level against the dollar in

14 months. It slipped to $1.2529 at one point before closing at $1.2602. The

dollar’s rise, and the mounting fear of a slowdown in global growth, sent

commodities prices lower. Crude oil fell $2.86 to settle at $77.16 a barrel.

By the close, when calm was restored, the focus was on working out what had

happened.

The S.E.C. and the Commodity Futures Trading Commission said they were reviewing

“unusual trading activity.” But already markets were turning attention back to

Europe — whether German lawmakers would approve the Greek bailout on Friday,

whether warning signals would flash brighter, whether the euro zone would stay

together, or whether this was a precursor of more gyrations to come.

Eric Dash, Christine Hauser, Nelson D. Schwartz,

Jackie Calmes

and Binyamin

Appelbaum

contributed reporting.

U.S. Markets Plunge,

Then Stage a Rebound, NYT, 6.5.2010,

http://www.nytimes.com/2010/05/07/business/07markets.html

Cost of crash:

$2,800,000,000,000

• Bank of England calls for reform

• Markets jittery after Asian losses

• Brown defends borrowing

Tuesday October 28 2008

The Guardian

Larry Elliott, Phillip Inman and Nicholas Watt

This article appeared in the Guardian

on Tuesday October 28 2008

on p1 of the

Top stories section.

It was last updated at 08.17 on October 28 2008.

Autumn's market mayhem has left the world's financial institutions nursing

losses of $2.8tn, the Bank of England said today, as it called for fundamental

reform of the global banking system to prevent a repeat of turmoil "arguably"

unprecedented since the outbreak of the first world war.

In its half-yearly health check of the City, the Bank said tougher regulation

and constraints on lending would be needed as policymakers sought to learn

lessons from the mistakes that have led to a systemic crisis unfolding over the

past 15 months.

The Bank's Financial Stability Report, which will be sent to every bank director

in Britain, more than doubled the previous estimate of the potential losses

faced by all financial institutions since the spring, but said that given time

the actual losses could be pared by between a third and a half.

The £50bn pledged by the government had helped underpin the system, the Bank

said, and would provide a breathing space for UK banks so that they did not have

to sell assets at cut-price values immediately. The report also expressed

cautious optimism about the effectiveness of the recent global bail-out plan.

The Bank's estimate exceeds that made by the International Monetary Fund

recently. The IMF concentrated on US institutions and did not include losses

from the turmoil of recent weeks. Estimated paper losses from UK banks on

mortgage-backed securities and corporate bonds are currently £122.6bn, the Bank

report said.

Gordon Brown insisted yesterday that it was right for the government to increase

borrowing in order to fund investment to help the economy through tough times.

But he moved to reassure markets that he would not preside over a reckless

increase in borrowing during the recession and said he would reduce it as a

proportion of GDP once the economy picks up.

Paving the way for an expected abandonment of the tight fiscal rules he

established as chancellor, Brown said: "The responsible course of government is

to invest at this time to speed up the economic activity. As economic activity

rises, as tax revenues recover, then you would want borrowing to be a lower

share of your national income. But the responsible course at the moment is to

use the investments that are necessary, and to continue them, and to help people

through very difficult times.

"I think that's a very fundamental part of what we are doing."

In another turbulent day yesterday on global markets, there were hefty falls in

Asian stockmarkets and a fresh fall in the pound. Japan's Nikkei index closed

down more than 6% at a 26-year-low of 7162.9. London's FTSE 100 recovered from

an early fall of more than 200 points to close 30 points lower at 3852.6, while

the Dow Jones closed down 2.42% at 8,175.77.

Brown and Peter Mandelson, the business secretary, served notice that Britain

should brace itself for a downturn when they both warned about rising

unemployment. Brown said: "I can't promise people that we will keep them in

their last job if it becomes economically redundant. But we can promise people

that we will help them into their next job."

Mandelson was more blunt as he warned of the impact of the recession. "We are

facing an unparalleled financial crisis," he said during a visit to Moscow. "I

don't think yet people have realised what the impact is going to be on our real

economy."

The Tories intensified their attacks on the government by depicting Brown as not

a man with a plan but a man with an overdraft.

Responding to Brown's remarks, George Osborne, shadow chancellor, said: "What

they are talking about is borrowing out of necessity, not out of virtue. Gordon

Brown is a man with an overdraft, not a man with a plan. He is being forced into

this borrowing. He presents it as a strategy but it is actually a consequence of

his great failure that borrowing is already out of control before we even get

into the worst of the economic circumstances that we are in."

Brown was speaking as the Treasury finalised plans to rewrite the fiscal rules

which have governed his approach to the economy over the past decade. Alistair

Darling will use his pre-budget report next month to say that it is time for a

more flexible approach in the new economic cycle, which started in 2006-07.

The previous FSR in April envisaged a gradual recovery in global markets and the

Bank was careful today not to sound the all-clear despite the coordinated action

in Britain, the US and the eurozone this month to recapitalise banks and provide

extra liquidity to markets. "In recent weeks, the global banking system has

arguably undergone its biggest episode of instability since the start of the

first world war," it said.

Sir John Gieve, the Bank's deputy governor for financial stability, added: "With

a global economic downturn under way, the financial system remains under strain.

But it is better placed as a result of the exceptional package of capital,

guaranteed funding and liquidity support. That is helping to underpin the

banking system both directly and by demonstrating the authorities' determination

to do whatever is needed to restore confidence.

"Looking further ahead, we need a fundamental rethink of how to manage systemic

risk internationally. We need to establish stronger restraints on the build-up

of risks in the financial system over the cycle with the dangers they bring to

the wider economy.

"That means not just increasing capital and liquidity requirements for

individual institutions but relating them to the cyclical growth of risk in the

system more broadly. Counter-cyclical policy of that sort should complement

regulation of companies and broader macroeconomic policy."

The Bank believes that the capital injection from the taxpayer will also prevent

banks from slashing their lending too aggressively over the coming months,

relieving the recessionary pressure on the economy.

Figures released yesterday, however, from financial data provider Moneyfacts

showed banks were failing to pass on interest rate cuts to mortgage borrowers

despite making severe cuts in savings rates. It said most institutions had

already passed on the last half-point base rate cut to savers while holding back

on cuts in home loan interest rates.

"Some providers are using the base rate cut as a way of increasing their margin

for risk, by not passing on the full cut to mortgage customers but passing the

cut on in full to savings customers," it said.

A separate study last week marked a new low in the number of mortgage products

available.

Concerns at widespread job losses across the finance sector prompted unions to

demand a "social contract" to protect jobs. Derek Simpson, Unite's joint general

secretary, said: "Workers in the financial services are facing insecurity as the

world is gripped by economic turmoil. The Unite 'social contract' sets out the

principles which employees expect the government and finance companies to now

sign up to.

"Unite is calling for the protection of jobs, pensions, the end to short-term

remuneration policies and an overhaul of the regulatory structures in the

financial services sector. There must be a recognition of the importance of

employment in the financial services sector, as many communities now depend on

the sector since being decimated by the collapse of the manufacturing industry.

"Workers in the financial services industry are not the culprits of the credit

crunch and we are not prepared to allow them to become the victims. The taxpayer

must now get firm assurances that the financial lifeline extended to these large

organisations will be used to protect jobs and the public. It is not acceptable

for the government to socialise the risk without allowing the wider society to

capitalise on the rewards in the finance industry."

How much is that?

The Bank of England may have put the paper cost of the global

crisis at a staggering $2.8 trillion, but how does one come to grips with such a

sum? Think of it like this: it could pay for 46 bail-outs of the kind the

Treasury handed to the banks RBS, HBOS group and Lloyds TSB; or pay off the last

quarter's public debt 45 times. It is more than three times the sum of UK annual

public spending, and also equivalent to the wealth of 100 Oleg Deripaskas -

before the credit crunch anyway. It's equal to 138m bottles of 1947 Petrus

Pomerol, the bankers' favourite vintage; or, if it's your turn in the coffee

round, 773bn lattes - nearly 13,000 each for every UK citizen.

Cost of crash:

$2,800,000,000,000,

G, 28.10.2008,

https://www.theguardian.com/business/2008/oct/28/

economics-credit-crunch-bank-england

Oil falls below $63 to 17-month low

as investors eye

falling demand

27 October 2008

USA Today

SINGAPORE (AP) — Growing evidence of a severe global economic

slowdown drove oil prices to 17-month lows below $63 a barrel Monday, as

investors brushed off a sizable OPEC output cut.

Traders were taking their cues from world markets, which

slumped again Monday with the Nikkei index in Japan closing at its lowest in 26

years, down 6.4%. Hong Kong, and European markets followed suit, closing or

trading substantially lower. The Dow Jones industrial average fell 3.6% Friday.

Light, sweet crude for December delivery declined $1.57 to $62.58 a barrel in

electronic trading on the New York Mercantile Exchange by noon in Europe, the

lowest since May 2007.

On Friday — even after the Organization of Petroleum Exporting Countries

announced a 1.5 million barrel-a-day cut — oil fell $3.69 to settle at $64.15.

Prices have plunged 57% from a record $147.27 on July 11.

"The mood is fairly negative reflecting worry about the international economic

outlook," said David Moore, a commodity strategist at Commonwealth Bank of

Australia in Sydney. "If there is further weak economic data in the U.S. or

Europe, prices could come under more downward pressure."

Iran's OPEC governor Mohammad Ali Khatibi said Sunday a reduction in production

"will be considered" at the group's next meeting in Algiers in December — a

meeting that might even be held early if necessary.

"I thought the OPEC cut was a fairly decisive act, but concerns of recession in

the major economies remain dominant," Moore said. "OPEC's cut does take a step

toward tightening the market."

Vienna's JBC Energy said prices were out of OPEC's control — for now.

"Oil is currently being driven by the present financial crisis and not by OPEC

cuts," said its research report. "As oil prices are being pressured by the

credit squeeze and a lack of liquidity, they may stay largely detached from

supply factors for several weeks to come. As a result, OPEC is currently

struggling with factors beyond its control."

Investors have been paying close attention to signs that a slowing economy and

higher gasoline prices earlier this year have hurt crude demand in the U.S., the

world's largest oil consumer.

The U.S. Department of Transportation said Friday that Americans drove 5.6%

less, or 15 billion fewer miles (24 billion fewer kilometers), in August

compared with same month a year ago — the biggest single monthly decline since

the data was first collected regularly in 1942.

"If we're looking a severe economic downturn, it's hard to say what the bottom

of any commodity price will be," Moore said.

In other Nymex trading, gasoline futures fell more than 3 cents to $1.44 a

gallon, while heating oil slipped by more than 4 cents to $1.91 a gallon.

Natural gas for November delivery fell nearly 21 cents to $6.03 per 1,000 cubic

feet.

In London, November Brent crude was down $1.75 to $60.30 a barrel on the ICE

Futures exchange.

Oil falls below $63

to 17-month low

as investors eye falling demand,

UT, 27.10.2008,

http://www.usatoday.com/money/industries/energy/2008-10-27-oil-monday_N.htm

- broken link

High-Flying Hedge Fund

Falls Back to Earth

October 14, 2008

The New York Times

By LOUISE STORY

Only 10 months ago, Remy Trafelet was so flush that he treated

about 100 employees at his hedge fund to a getaway in Venice. He and his crew

spent a long, luxurious weekend at the five-star Hotel Bauer, which has Murano

glass chandeliers, private gondoliers and a splendid view of a 17th-century

basilica.

But now, a bit like Venice, Mr. Trafelet’s hedge fund seems to be sinking. His

flagship fund has fallen about 26 percent this year, and Mr. Trafelet is

struggling to hold on to anxious employees, as well as some investors.

Perhaps the most remarkable thing about Mr. Trafelet is that he is not so

remarkable at all. Thousands of hedge fund managers like him — mostly young,

mostly male and virtually all unknown outside financial circles — confront a

sober reality: for now, the days of easy money are over.

The economics of the hedge fund industry, so lucrative on the way up, are trying

even the most seasoned managers on the way down. Hotshots who amassed millions