|

Vocapedia >

Economy > Inflation

Illustration by

Ben Jennings

G

17 August 2023

https://www.theguardian.com/commentisfree/picture/2023/oct/01/

nicola-jennings-on-the-conservative-party-conference-cartoon#img-40

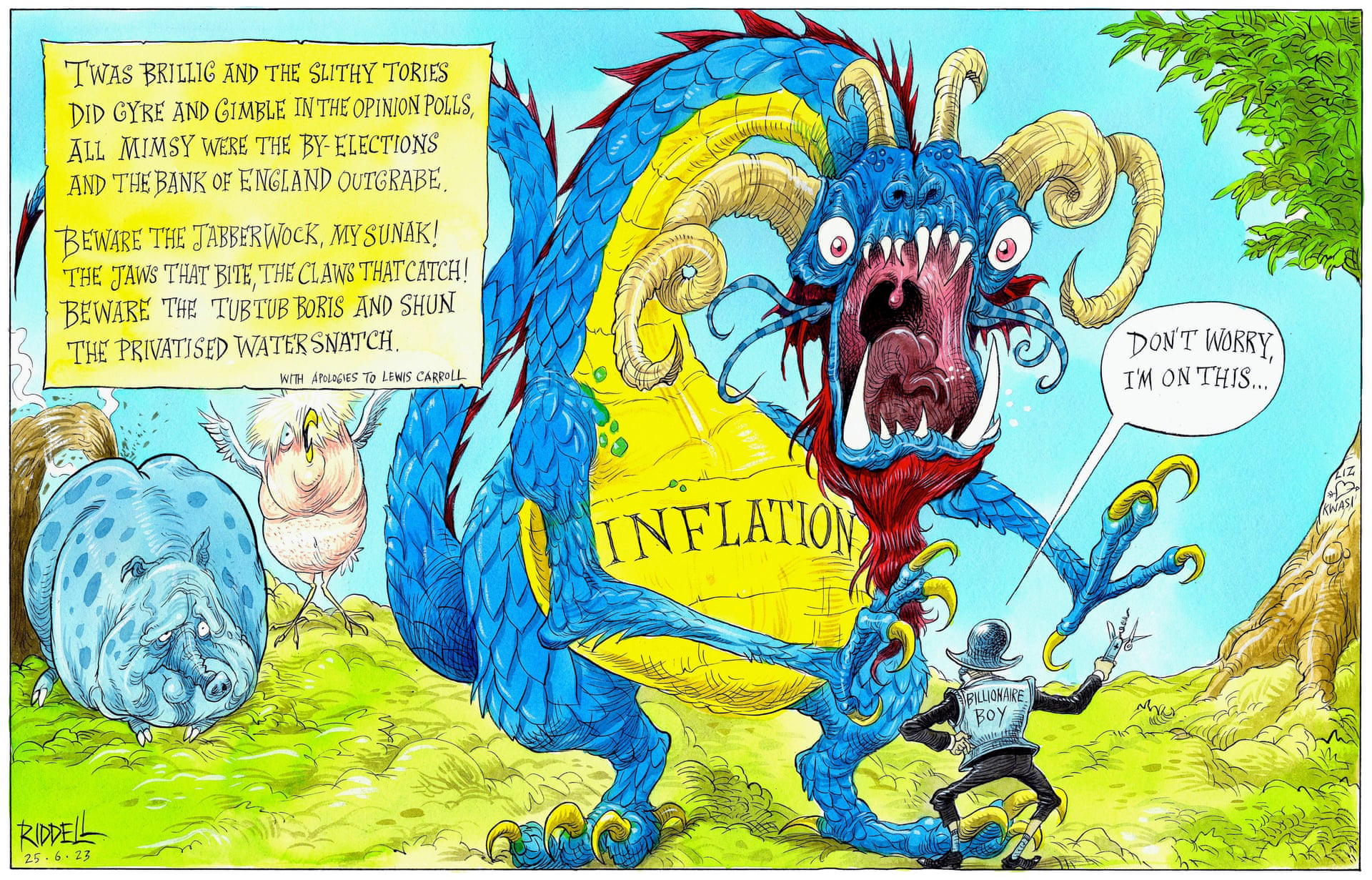

Illustration by

Chris Riddell.

Rishi Sunak attempts to slay the inflation

Jabberwock – cartoon

Beware the jaws that bite, prime minister!

G

Sat 24 Jun 2023 18.00 BST

Last modified on Sun 25 Jun 2023

11.16 BST

https://www.theguardian.com/commentisfree/picture/2023/jun/24/

rishi-sunak-attempts-to-slay-the-inflation-jabberwocky-cartoon

Illustration by

Chris Riddell.

Rishi Sunak sleeps on as his demons gather

around – cartoon

The Covid inquiry, immigration, interest

rates and inflation

are all conspiring against him

G

Sat 27 May 2023 18.00 BST

Last modified on Tue 13 Jun 2023

16.55 BST

https://www.theguardian.com/commentisfree/picture/2023/may/27/

rishi-sunak-sleeps-on-as-his-demons-gather-around-cartoon

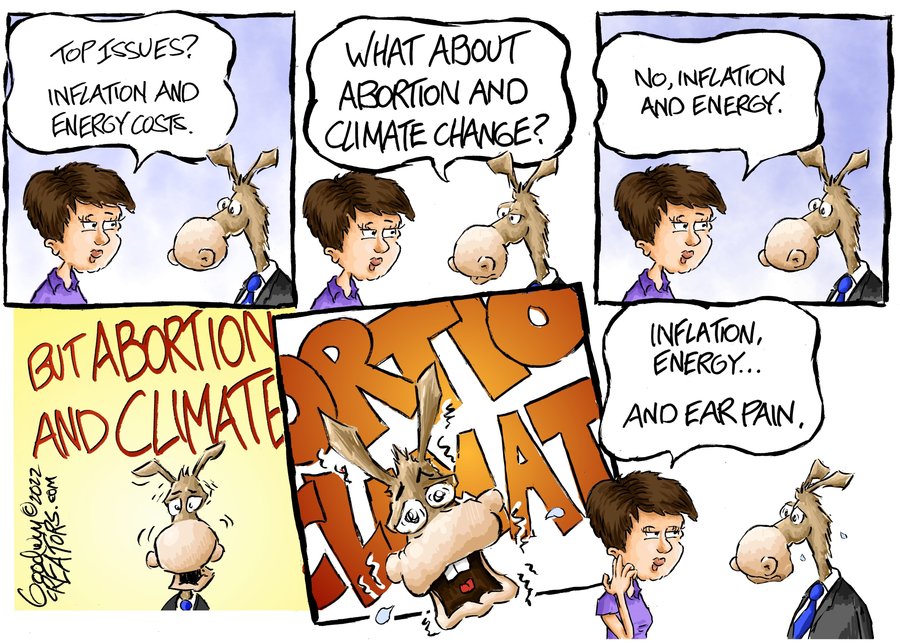

Al Goodwyn

political cartoon

GoComics

July 11, 2022

https://www.gocomics.com/algoodwyn/2022/07/11

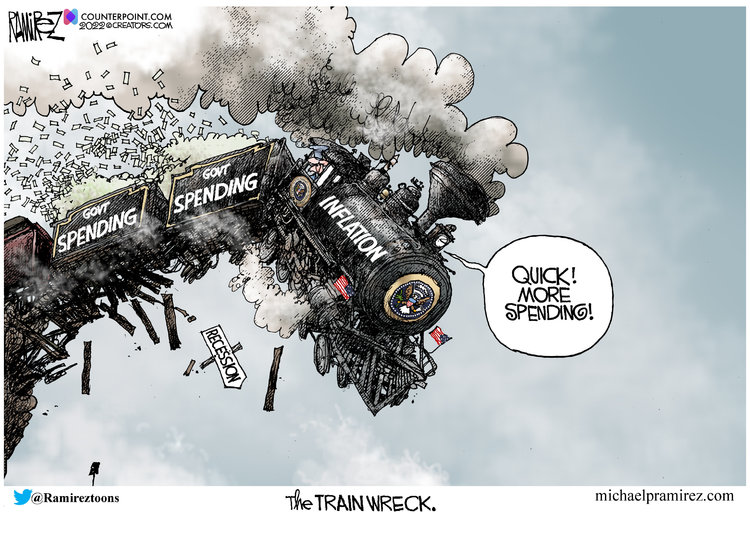

Michael Ramirez

political cartoon

GoComics

June 20, 2022

https://www.gocomics.com/michaelramirez/2022/06/20

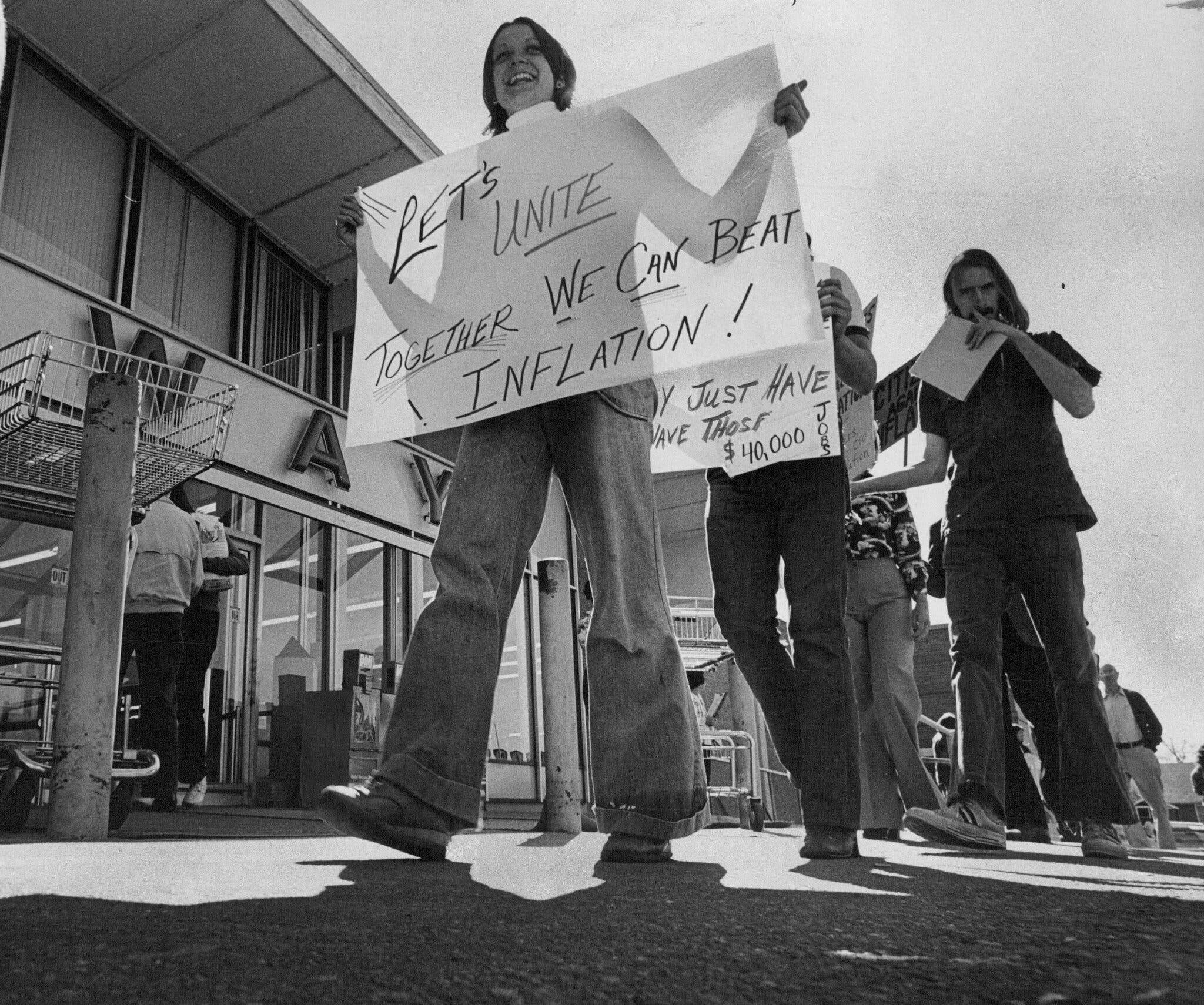

Illustration: Jack Richardson

A Great Inflation Redux?

Economists Point to

Big Differences.

Prices climbed for years

before the runaway

inflation of the 1970s.

Economists see parallels today,

but the

differences are just as important.

NYT

Published July 8, 2021

Updated Oct. 11, 2021

https://www.nytimes.com/2021/07/08/

business/economy/inflation-redux.html

Shoppers protested high prices

outside a grocery store in Denver in 1974.

The Arab oil embargo of 1973-74 set the

stage

for the oil shortage that later sent gas

prices soaring.

Photograph: Denver Post,

via Getty Images

Veterans of Carter-Era Inflation Warn

That

Biden Has Few Tools to Tame Prices

President Biden and Democrats face political

peril

as costs keep rising and midterm elections

loom.

NYT

July 5, 2022 5:00 a.m. ET

https://www.nytimes.com/2022/07/05/

business/economy/carter-era-inflation-biden.html

2025

podcasts > before 2024

inflation

UK

https://www.theguardian.com/business/2007/apr/12/

businessglossary55

https://www.theguardian.com/business/

inflation

2023

https://www.theguardian.com/commentisfree/picture/2023/jun/24

/rishi-sunak-attempts-to-slay-the-inflation-jabberwocky-cartoon

https://www.theguardian.com/commentisfree/picture/2023/may/27/

rishi-sunak-sleeps-on-as-his-demons-gather-around-cartoon

2022

https://www.theguardian.com/commentisfree/picture/2022/sep/17/

what-lurks-beneath-the-emergency-budget-

cartoon - Guardian cartoon

https://www.theguardian.com/business/nils-pratley-on-finance/2022/may/30/

as-food-and-fuel-costs-rise-there-is-no-doubt-the-poorest-are-hardest-hit

2021

https://www.theguardian.com/news/audio/2021/nov/29/

inflations-back-but-is-it-here-to-stay-podcast

2019

https://www.theguardian.com/business/2019/sep/18/

inflation-falls-lowest-three-years-brexit-prices-economists

2015

http://www.theguardian.com/business/2015/may/19/uk-inflation-turns-negative

http://www.theguardian.com/business/2015/apr/14/uk-inflation-holds-at-record-low-of-00

http://www.theguardian.com/business/2015/feb/17/uk-inflation-new-low-petrol-price-record

2012

https://www.theguardian.com/business/2012/may/22/

uk-inflation-drops-mervyn-king

2011

http://www.guardian.co.uk/business/2011/apr/12/inflation-falls-to-four-per-cent

http://www.guardian.co.uk/money/2011/apr/12/savers-struggling-despite-inflation-drop

http://www.reuters.com/article/2011/04/07/us-usa-economy-inflation-idUSTRE7367BZ20110407

http://www.guardian.co.uk/business/2011/feb/15/inflation-hit-four-per-cent-in-january

http://www.guardian.co.uk/business/2011/jan/18/inflation-december-2010-record-monthly-increase

http://www.guardian.co.uk/business/2011/jan/18/inflation-worse-than-expected

http://www.guardian.co.uk/business/2011/jan/18/inflation-what-the-experts-say

http://www.guardian.co.uk/business/2010/may/18/inflation-george-osborne-mervyn-king

http://www.guardian.co.uk/business/2010/feb/16/inflation-soars-vat-petrol

http://www.guardian.co.uk/business/2010/jan/19/inflation-surges-in-december

2009

http://www.guardian.co.uk/business/2009/jun/16/inflation-remains-above-target

http://image.guardian.co.uk/sys-files/Business/pdf/2009/03/24/qkingtodarling.pdf

http://image.guardian.co.uk/sys-files/Business/pdf/2009/03/24/qdarlingtoking.pdf

http://www.guardian.co.uk/news/blog/2009/mar/24/inflation-deflation

http://www.guardian.co.uk/business/2009/mar/24/rpi-inflation-zero

http://www.guardian.co.uk/business/2009/feb/18/inflation-global-recession

2008

http://www.guardian.co.uk/business/2008/nov/18/inflation-cpi-falls

http://www.guardian.co.uk/business/2008/nov/13/inflation-deflation-interest-rates-recession

http://www.guardian.co.uk/business/cartoon/2008/nov/13/inflation-bankofenglandgovernor

https://www.reuters.com/article/domesticNews/idUSWBT008460

20080227

2006

https://www.theguardian.com/business/2006/oct/18/politics.money

https://www.theguardian.com/business/2006/apr/21/oilandpetrol.money

2005

https://www.theguardian.com/business/2005/aug/17/

interestrates.oilandpetrol

inflation USA

https://www.npr.org/tags/129904130/

inflation

2025

https://www.gocomics.com/michaelramirez/2025/01/27

https://www.npr.org/2025/01/15/

nx-s1-5259869/inflation-consumer-prices-eggs-trump

2024

https://www.reuters.com/graphics/

USA-ELECTION/INFLATION/jnpwjxkdavw/ - Nov. 4, 2024

https://www.npr.org/2024/08/16/

nx-s1-5043678/questions-inflation-interest-rates-prices

https://www.npr.org/2024/07/10/

nx-s1-5033145/inflation-food-grocery-prices-economy

https://www.npr.org/sections/planet-money/2024/07/09/

g-s1-8534/shrinkflation-inflation-price-consumers-law

https://www.npr.org/2024/05/01/

1248454950/federal-reserve-inflation-interest-rates

https://www.npr.org/2024/04/25/

1247177492/why-experts-say-inflation-is-relatively-low-

but-voters-feel-differently

https://www.npr.org/2024/04/10/

1243833081/inflation-consumer-prices-gas-groceries-rent-insurance-economy

https://www.npr.org/2024/04/06/

1242873226/parents-inflation-election-2024

https://www.npr.org/2024/03/03/

1233963377/auto-home-insurance-premiums-costs-natural-disasters-inflation

2023

https://www.npr.org/2023/12/16/

1219574403/economy-inflation-prices-wages-disinflation-deflation-interest-rates

https://www.npr.org/2023/12/16/

1219574403/economy-inflation-prices-wages-disinflation-deflation-interest-rates

https://www.npr.org/2023/12/12/

1218660706/economy-inflation-consumer-prices-interest-rates-

federal-reserve-recession

https://www.gocomics.com/garyvarvel/2023/10/17

https://www.npr.org/2023/09/20/

1200327332/federal-reserve-inflation-economy-interest-rates

https://www.npr.org/2023/08/10/

1193189937/inflation-consumer-prices-cpi-economy-soft-landing-interest-rates-fed

https://www.npr.org/2023/07/01/

1184614833/how-to-save-money-on-meat-july-4

https://www.npr.org/2023/06/13/

1181686474/cheaper-eggs-gas-lead-inflation-lower-in-may-

but-higher-prices-pop-up-elsewhere

https://www.npr.org/2023/05/03/

1173371788/the-fed-raises-interest-rates-again-

in-what-could-be-its-final-attack-on-inflati

2022

https://www.npr.org/2022/12/14/

1142757646/fed-federal-reserve-interest-rates-december-inflation-benchmark

https://www.npr.org/2022/10/31/

1131903418/holiday-flights-pricey-packed-book-now-fares-rise

https://www.npr.org/2022/10/29/

1131086240/inflation-biden-economy

https://www.npr.org/2022/10/18/

1129431951/inflation-you-can-run-but-you-cant-hide

https://www.npr.org/2022/10/13/

1128415198/inflation-social-security-income-benefits-raise-september-cola

https://www.gocomics.com/garyvarvel/2022/08/23

https://www.npr.org/2022/08/20/

1117689118/poll-69-of-native-americans-say-

inflation-is-severely-affecting-their-lives

https://www.npr.org/2022/08/18/

1117699640/inflation-makes-recovery-from-california-fires-and-other-disasters-

more-difficul

https://www.gocomics.com/lisabenson/2022/08/11

https://www.gocomics.com/stevebreen/2022/07/30

https://www.npr.org/2022/07/25/

1112915507/inflation-rural-america-gas-prices-economy

https://www.npr.org/2022/07/24/

1112770581/inflation-recession-soft-landing-rates-jobs-fed

https://www.gocomics.com/henrypayne/2022/07/13

https://www.npr.org/2022/07/13/

1111070073/no-retreat-in-the-summer-heat-

prices-likely-topped-40-year-high-last-month

https://www.gocomics.com/algoodwyn/2022/07/11

https://www.npr.org/2022/07/06/

1107732282/inflation-personal-finance-recession

https://www.nytimes.com/2022/07/05/

business/economy/carter-era-inflation-biden.html

https://www.gocomics.com/michaelramirez/2022/06/20

https://www.gocomics.com/nickanderson/2022/06/17

https://www.gocomics.com/clayjones/2022/06/17

https://www.gocomics.com/chipbok/2022/06/17

https://www.npr.org/2022/06/11/

1104214753/inflation-price-gas-groceries-cost-of-living

https://www.npr.org/2022/06/10/

1103995329/inflation-americans-spending-consumer-behavior-prices

https://www.npr.org/2022/05/17/

1099487306/for-businesses-in-manhattans-chinatown-

inflation-is-a-tough-economic-hurdle

https://www.npr.org/2022/04/13/

1091883946/inflation-michigan-7th-congressional-district

https://www.npr.org/2022/03/31/

1090086246/grocery-store-food-prices-increase-2022-usda-report

https://www.npr.org/sections/health-shots/2022/03/10/1

085792118/americans-stress-is-spiking-over-inflation-war-in-ukraine-survey-finds

https://www.npr.org/2022/03/10/

1085448058/inflation-40-year-high-gas-prices-energy-russia-ukraine

https://www.npr.org/2022/02/19/

1081875948/inflation-has-many-retirees-worried-about-outliving-their-savings

https://www.npr.org/2022/02/10/

1079260860/january-inflation-consumer-prices-cpi-economy-federal-reserve

https://www.npr.org/sections/money/2022/02/08/

1078035048/price-controls-black-markets-and-skimpflation-

the-wwii-battle-against-inflation

https://www.npr.org/2022/01/18/

1073797789/inflation-omicron-big-plunge-markets-stocks-bonds

2021

https://www.npr.org/2021/12/15/

1064478567/inflation-hot-federal-reserve-interest-rates-bond-taper

https://www.npr.org/2021/12/10/

1062794539/november-cpi-inflation-high-prices-for-consumers

https://www.npr.org/2021/11/13/

1055315389/inflation-president-biden-groceries-gas-food-energy-prices

https://www.npr.org/2021/11/10/

1054019175/inflation-surges-to-its-highest-since-1990

https://www.npr.org/2021/11/03/

1051478945/federal-reserve-inflation-jobs-employment

https://www.npr.org/2021/08/11/

1026493316/workers-are-getting-pay-raises-

and-it-could-end-up-contributing-to-high-inflatio

https://www.npr.org/2021/07/13/

1014697915/inflation-is-still-high-used-car-prices-could-help-explain-what-happens-next

https://www.nytimes.com/2021/07/08/

business/economy/inflation-redux.html

https://www.npr.org/2021/06/10/

1004806688/inflation-is-surging-the-price-of-a-toyota-pickup-truck-helps-explain-why

https://www.npr.org/2021/05/29/

1001023637/think-inflation-is-bad-now-lets-take-a-step-back-to-the-1970s

2016

https://www.npr.org/2016/10/31/

500034877/why-the-fed-keeps-a-close-eye-on-consumer-prices

2014

https://www.nytimes.com/2014/03/03/

opinion/krugman-the-inflation-obsession.html

2011

https://www.reuters.com/article/2011/04/07/

us-usa-economy-inflation-idUSTRE7367BZ20110407/

2008

https://www.reuters.com/article/domesticNews/idUSWBT008460

20080227

1982

https://www.nytimes.com/1982/04/18/

business/inflation-hurts-but-deflation-could-be-worse.html

headline inflation USA

Headline inflation reflects price changes on all items,

while core inflation excludes

volatile food and energy

categories.

https://www.npr.org/2023/08/10/

1193189937/inflation-consumer-prices-cpi-economy-soft-landing-interest-rates-fed

core inflation UK

https://www.theguardian.com/commentisfree/picture/2023/may/27/

rishi-sunak-sleeps-on-as-his-demons-gather-around-cartoon

core inflation USA

Headline inflation reflects price changes on all items,

while core inflation excludes

volatile food and energy

categories.

https://www.npr.org/2023/08/10/

1193189937/inflation-consumer-prices-cpi-economy-soft-landing-

interest-rates-fed

https://www.npr.org/2024/05/15/

1251545285/eggs-milk-and-other-grocery-prices-fall-as-overall-inflation-eases

https://www.npr.org/2023/08/10/

1193189937/inflation-consumer-prices-cpi-economy-soft-landing-

interest-rates-fed

overall inflation USA

https://www.npr.org/2024/05/15/

1251545285/eggs-milk-and-other-grocery-prices-fall-

as-overall-inflation-eases

https://www.npr.org/2024/03/03/

1233963377/auto-home-insurance-premiums-costs-natural-disasters-inflation

rampant inflation

UK

https://www.theguardian.com/commentisfree/2022/may/27/

rampant-inflation-breaks-the-status-quo-

no-wonder-the-government-is-spooked

stubborn inflation

USA

https://www.npr.org/2023/09/20/

1200327332/federal-reserve-inflation-economy-interest-rates

inflation watchers

UK

https://www.theguardian.com/business/nils-pratley-on-finance/2022/may/30/

as-food-and-fuel-costs-rise-

there-is-no-doubt-the-poorest-are-hardest-hit

shrinkflation

USA

https://www.npr.org/sections/planet-money/2024/07/09/

g-s1-8534/shrinkflation-inflation-price-consumers-law

turn negative

UK

https://www.theguardian.com/business/2015/may/19/

uk-inflation-turns-negative

expensive

USA

https://www.npr.org/2023/12/16/

1219574403/economy-inflation-prices-wages-disinflation-deflation-interest-rates

eat away at N standard

of living UK

https://www.theguardian.com/news/audio/2023/may/15/

is-the-uk-in-the-grip-of-greedflation-

podcast - Guardian podcast

rising bills

UK

https://www.theguardian.com/news/audio/2023/may/15/

is-the-uk-in-the-grip-of-greedflation-podcast

‘greedflation’

UK

It’s a concept that

is being called ‘greedflation’

– where companies are

using the alibi of a global crisis

to bolster their

profit margin by putting up prices

more

than they could

otherwise get away with.

https://www.theguardian.com/news/audio/2023/may/15/

is-the-uk-in-the-grip-of-greedflation-

podcast - Guardian podcast

‘greedflation’

USA

https://www.nytimes.com/2024/06/06/

us/politics/biden-inflation-greedflation-economy.html

price

UK

https://www.theguardian.com/news/audio/2023/may/15/

is-the-uk-in-the-grip-of-greedflation-

podcast - Guardian podcast

food prices

UK

https://www.theguardian.com/commentisfree/picture/2022/aug/20/

cost-of-living-crisis-winter-is-coming-

cartoon - Guardian cartoon

food prices

USA

https://www.npr.org/2024/09/06/

g-s1-20833/clever-and-commonsense-ways-to-save-money-on-groceries

grocery prices

USA

https://www.npr.org/2024/07/10/

nx-s1-5033145/inflation-food-grocery-prices-economy

groceries

USA

https://www.npr.org/2024/09/06/

g-s1-20833/clever-and-commonsense-ways-to-save-money-on-groceries

gas prices

USA

https://www.npr.org/2023/12/12/

1218660706/economy-inflation-consumer-prices-interest-rates-

federal-reserve-recession

prices

USA

https://www.gocomics.com/mattdavies/2023/11/15

put up prices

UK

https://www.theguardian.com/news/audio/2023/may/15/

is-the-uk-in-the-grip-of-greedflation-

podcast - Guardian podcast

pricey

USA

https://www.npr.org/2022/10/31/

1131903418/holiday-flights-pricey-packed-book-now-fares-rise

food inflation > coffee prices UK

https://www.theguardian.com/business/2011/apr/21/

commodities-coffee-shortage-price-rise-expected

food prices > go up

USA

https://www.npr.org/2022/03/31/

1090086246/grocery-store-food-prices-increase-2022-usda-report

United States Department of Agriculture > Food Price Outlook

https://www.npr.org/2022/03/31/

1090086246/grocery-store-food-prices-increase-

2022-usda-report

inflation > soar

UK / USA

https://www.npr.org/2022/06/10/

1103995329/inflation-americans-spending-consumer-behavior-prices

https://www.theguardian.com/business/2008/oct/14/

record-inflation

2009-2011 >

inflation

USA

https://www.nytimes.com/2011/09/16/

business/economy/consumer-inflation-higher-than-expected.html

https://www.nytimes.com/2011/09/19/

opinion/a-little-inflation-can-be-a-dangerous-thing.html

http://www.nytimes.com/2010/10/16/business/economy/16econ.html

http://www.nytimes.com/2009/08/02/business/economy/02view.html

Consumer Price Index

USA

http://www.nytimes.com/2011/09/16/

business/economy/consumer-inflation-higher-than-expected.html

inflation rate UK

http://www.guardian.co.uk/business/2009/jun/16/inflation-remains-above-target

1948-2009 >

UK inflation since 1948 UK

https://www.theguardian.com/news/datablog/2009/mar/09/

inflation-economics

high inflation

USA

https://www.npr.org/2021/11/13/

1055315389/inflation-president-biden-groceries-gas-food-energy-prices

surge in inflation UK

https://www.theguardian.com/business/2010/jan/19/

inflation-surges-in-december

soaring inflation UK

https://www.theguardian.com/news/datablog/2009/mar/09/

inflation-economics

soaring inflation

USA

https://www.npr.org/2022/04/12/

1092134413/inflation-food-prices-gasoline-gas-interest-rates

soaring electricity

bills USA

https://www.npr.org/2022/09/13/

1122371879/electricity-utilities-gasoline-gas-prices-inflation-

august-cpi-consumer-prices

inflationary spike

USA

https://www.npr.org/2021/11/13/

1055315389/inflation-president-biden-groceries-gas-food-energy-prices

a spike in inflation

cost of living

UK

https://www.theguardian.com/business/2022/dec/19/

unheard-voices-of-the-uk-cost-of-living-crisis-a-photo-essay

https://www.theguardian.com/commentisfree/picture/2022/aug/20/

cost-of-living-crisis-winter-is-coming-cartoon - Guardian cartoon

https://www.theguardian.com/business/2022/may/26/

cost-of-living-how-the-payments-affect-people-in-various-scenarios

cost of living crisis

UK

https://www.theguardian.com/business/2022/dec/19/

unheard-voices-of-the-uk-cost-of-living-crisis-a-photo-essay

cost of living USA

https://www.npr.org/2021/11/13/

1055315389/inflation-president-biden-groceries-gas-food-energy-prices

rising cost of living

USA / UAE

https://www.gocomics.com/viewsamerica/2022/10/26

surging cost of living

hardship

USA

https://www.npr.org/2022/02/10/

1079947570/rent-electricity-and-grocery-prices-continue-to-increase-faster-than-paychecks

cripple

USA

https://www.npr.org/2022/07/25/

1112915507/inflation-rural-america-gas-prices-economy

increase

USA

https://www.npr.org/2022/02/10/

1079947570/rent-electricity-and-grocery-prices-continue-

to-increase-faster-than-paychecks

https://www.npr.org/2021/11/13/

1055315389/inflation-president-biden-groceries-gas-food-energy-prices

rise USA

https://www.npr.org/2024/03/03/

1233963377/auto-home-insurance-premiums-costs-natural-disasters-inflation

https://www.npr.org/2022/04/12/

1092134413/inflation-food-prices-gasoline-gas-interest-rates

jump USA

https://www.npr.org/2022/04/12/

1092134413/inflation-food-prices-gasoline-gas-interest-rates

moderate

USA

https://www.npr.org/2023/12/12/

1218660706/economy-inflation-consumer-prices-interest-rates-

federal-reserve-recession

cool USA

https://www.npr.org/2023/12/16/

1219574403/economy-inflation-prices-wages-disinflation-deflation-interest-rates

The retail prices index (RPI),

the broadest

measure of inflation UK

https://www.theguardian.com/money/2009/mar/24/

inflation-deflation-cpi-index

The government's

preferred measure of

inflation,

the consumer prices index CPI

UK

https://www.theguardian.com/business/2012/may/22/

uk-inflation-drops-mervyn-king

https://www.theguardian.com/business/2009/mar/24/

rpi-inflation-zero

Q&A: Inflation and deflation UK

https://www.theguardian.com/money/2009/mar/24/

inflation-deflation-cpi-index

wholesale inflation

drop UK

https://www.theguardian.com/business/2008/nov/18/

inflation-cpi-falls

pace of inflation

the specter of inflation

inflation data

USA

https://www.npr.org/2022/02/10/

1079947570/rent-electricity-and-grocery-prices-continue-to-increase-

faster-than-paychecks

tame inflation data

look

tame USA

https://www.nytimes.com/2010/10/16/

business/economy/16econ.html

interest rates

UK

https://www.theguardian.com/business/

interest-rates

https://www.theguardian.com/business/2023/dec/08/

higher-interest-rates-inflation-debt

disinflation

USA

So what does it

actually mean

when inflation is

easing?

Simply put,

falling inflation, or "disinflation,"

means prices are

rising more slowly

than they had been.

That's a good thing.

Grocery prices have

climbed

less than 2% in the

last 12 months,

compared to a 12%

jump the previous year,

which gave many

people sticker shock

at the supermarket.

What many people want

to see,

however, is

"deflation,"

when prices actually

come down.

Falling prices are

not generally good

for the economy, though.

https://www.npr.org/2023/12/16/

1219574403/economy-inflation-prices-wages-disinflation-deflation-interest-rates

https://www.npr.org/2023/12/16/

1219574403/economy-inflation-prices-wages-

disinflation-deflation-interest-rates

https://www.nytimes.com/2023/08/14/

opinion/columnists/economists-disinflation-interest-rates.html

Corpus of news articles

Economy >

Inflation

Inflation Slowed in August,

Reflecting a Weak Economy

September

15, 2011

The New York Times

By CHRISTINE HAUSER

The rate

of inflation in the United States slowed slightly in August, when a rise in food

prices was tempered by easing prices for gasoline and automobiles, according to

government statistics released Thursday.

The Labor Department said the Consumer Price Index rose 0.4 percent last month,

a slight deceleration compared with the 0.5 percent rise in July. The index,

although it reflects just one month of data, is a closely watched indicator that

guides analysts in assessing the economy. Other reports released Thursday showed

weakness in the jobs market and an uncertain outlook for manufacturing.

“The story is very much the same: that economic growth is slow,” said Kurt J.

Rankin, economist for PNC Bank, about the day’s data.

The inflation figures for August reflected the volatility in prices for items

such as food and energy. Prices for gasoline moderated, with a 1.9 percent rise

in August after a 4.7 percent jump in July. Food prices rose 0.5 percent

compared with 0.4 percent in July.

When those components were stripped from the index, the core C.P.I. showed that

prices rose in August at the same rate as in July, 0.2 percent. That was in line

with analysts’ forecasts in a survey compiled by Bloomberg News.

On a year-over-year basis, the core C.P.I. was up 2 percent in August compared

with 1.8 percent in July.

Paul Ballew, a former Federal Reserve economist and now chief economist at

Nationwide, said that the August C.P.I. number was consistent with expectations

set earlier by such things as automobile prices, which were basically flat in

August.

“Those pockets of weakness were in areas already expected and known,” he said.

Of more importance to investors were events in the European debt crisis and

speculation as to what Federal Reserve policy makers would say after a meeting

next week, Mr. Ballew said. Although the chairman of the Fed, Ben S. Bernanke,

has given no sign that there would be fresh stimulus measures, market watchers

were weighing the possibility of any measures that would promote the economic

recovery in the United States.

With the year-over-year core C.P.I. at 2 percent, it was bumping up against the

top limit of the Fed’s unofficial target rate. But the Fed also relies on

another closely watched measure of inflation, the price index for personal

consumption expenditures, which was up 1.6 percent in the 12 months that ended

in July, the latest government data shows.

“It definitely gives him room under the ceiling, if they want to ease policy,”

said Kevin Logan, senior economist at HSBC. One such move would be for the Fed

to shift bonds in its portfolio to bring down longer-term interest rates. But

the central bank cannot raise rates, Mr. Rankin of PNC Bank said, because it

would slow economic activity.

In addition, the latest figures show that inflation is set to outpace wage

growth, which would be a “significant blow” to potential economic growth because

70 percent of the economy is based on consumer spending, Mr. Rankin said.

“Even those with jobs are not able to put that money back into the economy in a

way that would create jobs,” he said. “Now we are getting to the point with this

inflation number, even those with jobs are less capable of driving economic

activity.”

Steve Blitz, the senior economist for ITG Investment Research, also said that

the latest data did not add any impetus to notions that the Fed would respond

with policy action at its meeting on Sept. 20-21.

“I think because of the headline number and all of the conservative politics

behind it, this certainly does not give Bernanke any cover towards doing

anything big,” Mr. Blitz said. “The only thing that is going to give him the

cover is what is going on in Europe.”

Mr. Blitz said the C.P.I. data reflected more of a shift in prices rather than

inflation, because there was no accompanying rise in wages, and some elements of

the data suggest the possibility of future economic activity in specific sectors

as capital is directed more efficiently.

For example, rents are a factor pushing the index higher, Mr. Blitz said, but

that could be positive for the economy if it continues because it can spur

construction in multifamily homes and rental housing.

In addition, a weaker dollar is also pushing up the C.P.I., which means imported

goods are more expensive. Domestic producers might see an opening to compete

with imported products.

“Here what you have is an interesting mix of price signals that could very well

help growth going forward,” Mr. Blitz said.

A weekly report from the Labor Department showed that for the second consecutive

week, initial claims for jobless benefits rose, increasing by 11,000 in the week

ended Sept. 10 to 428,000. That was up from the previous week’s 417,000, which

was revised up from 414,000.

Economists generally take any level over 400,000 as a continued sign of weakness

in the labor market.

In addition, the Federal Reserve reported that industrial production increased

0.2 percent in August after having advanced 0.9 percent in July.

Total industrial production for August was 3.4 percent above its level of a year

ago, the Fed said.

Inflation Slowed in August, Reflecting a Weak Economy,

NYT,

15.9.2011,

https://www.nytimes.com/2011/09/16/

business/economy/consumer-inflation-higher-than-expected.html

Americans to Fed:

prices are too high

Thu Apr 7, 2011

6:38pm EDT

NEW YORK

Reuters

By Daniel Trotta

NEW YORK

(Reuters) - On the streets of America, the debate over inflation is over. Prices

are too high and rising too fast, many people say.

"The government says inflation is low, but that's not what I'm seeing at the

grocery story," Jorge Alberto, an 88-year-old retiree in Miami, said walking out

of a supermarket. "My pension is being put to the test."

Policy-makers at the U.S. Federal Reserve largely agree that promoting economic

growth is still more urgent that constraining a nascent pick-up in consumer

prices.

They look beyond the volatile fuel and food prices that have pushed up inflation

and focus instead on data showing little if any upward rise in wages, something

they would see as the seed of a sustained and broad-based rise in prices.

"I don't think the Federal Reserve has a clue about us little people," said J.

McKeever, an instructor at the Montessori Institute of Milwaukee.

"I am very frugal, so I watch what I spend. And what I have noticed in recent

months is that I have less money before than I used to, while making the same

amount of money and having to pay for health care," she said.

Across the country, Americans tell of a disconnect between the real economy they

live in and the macroeconomic picture as described by economic indicators.

Consumer prices rose 0.5 percent in February from January, and 2.1 percent over

the previous year but the rates were half that when stripping out food and

energy.

"There are no salary increases and you know you have the pressure at work to

cut, but on a personal level everything else keeps going up. You never seem to

be able to catch up," said Paty Peterson, 50, of suburban San Francisco.

Policy-makers at the Fed must weigh how much the perception of inflation might

trigger actual price increases. The worry would be if businesses pushed up

prices to cover their rising costs and workers in turn demanded higher wages to

cover theirs -- which could spark a self-feeding cycle.

Consumers' inflation expectations rose briskly in March, according to the

Thomson Reuters-University of Michigan survey.

U.S. households are facing higher prices for staple products such as Tide

laundry detergent and Hershey chocolate bars as cocoa, sugar, oil, wheat, corn

and other commodity prices climb.

Major consumer products makers have said in recent weeks that they will be

raising prices including Procter & Gamble Co (PG.N: Quote, Profile, Research,

Stock Buzz), which said it would raise laundry detergent prices 4.5 percent in

June. Kimberly-Clark Corp (KMB.N: Quote, Profile, Research, Stock Buzz) is

raising prices on diapers, baby wipes and toilet paper as much as 7 percent.

"My grocery bill is up 30 percent over last year," said Cheryl Holbrook, 47, who

educates her seven children at home in Mobile, Alabama. "We have to pinch every

little penny and make it squeak."

The Fed's hawks, who stress the risks of inflation, have stepped up their

argument that it may be time to wind down the central bank's $2.3 trillion

securities-buying program to stimulate the economy. So far, they have been

out-argued by those who see recovery from the Great Recession as fragile and

still in need of a boost.

The European Central Bank, by contrast, on Thursday raised interest rates for

the first time since 2008 to contain rising prices.

If underlying prices rise, or an inflationary psychology starts to take hold,

the Fed could change course.

A recent Reuters poll found long-term expectations for the food and fuel prices

that have pushed inflation higher in recent month are on the rise.

Consumers meanwhile complain that food and gasoline consume too much of their

income, forcing difficult decisions to stay within budgets.

Eileen Reilly, 72, a retired resident of the Chicago suburb of Geneva, said

higher gasoline and food prices have forced her to drive less, buy a cheaper

food for her dog Lucky, and stop taking pills for a liver condition she declined

to identify.

"My doctor said I could die if I don't take them," Reilly said, rolling her

eyes. "I told him that I'm 72 and I'll be dead soon as it is. Besides, it was

either the pills or the car and the dog. And I need the car and I love the dog."

(Reporting by

Kevin Gray in Miami,

Mark Felsenthal in Washington,

Verna Gates in Birmingham,

Alabama,

Nick Carey in Chicago, Brad Dorfman in Chicago,

John Rondy in Waukesha,

Wisconsin,

Peter Henderson in San Francisco)

(Writing by Daniel Trotta)

Americans to Fed: prices are too high, R, 7.4.2011,

http://www.reuters.com/article/2011/04/07/

us-usa-economy-inflation-idUSTRE7367BZ20110407 - broken link

Economic

View

How a

Little Inflation

Could Help a Lot

August 2,

2009

The New York Times

By TYLER COWEN

BECAUSE

fiscal stimulus has not yet been a striking success, perhaps it’s time to

consider new monetary remedies for the economy.

That is the argument of Prof. Scott Sumner, an economist at Bentley College in

Waltham, Mass., who is little known outside academic circles but whose views

have been spreading, thanks to his blog, TheMoneyIllusion

(blogsandwikis.bentley.edu/themoneyillusion/).

Professor Sumner proposes that the Federal Reserve make a firm commitment to

raising expectations of price inflation to 2 to 3 percent annually.

In his view, policy makers in Washington are doing too much with fiscal policy —

overspending and running excess deficits — and not doing enough on the monetary

side.

While his views are controversial, they are based on some assumptions that are

not. It is commonly agreed among economists that deflation brings layoffs and

sluggish investment. Yet, energy price shocks aside, we have been seeing

downward pressure on prices. Futures markets and Treasury Inflation-Protected

Securities — more precisely, the spread between the yield on TIPS and

traditional securities — suggest current expectations that inflation will remain

well under 1 percent. Economists generally agree that this is not ideal, and

Professor Sumner urges the Fed to try especially hard to overcome the

deflationary pressures.

But how would the Fed accomplish this feat? This is where his recommendations

get interesting.

The Fed has already taken some unconventional monetary measures to stimulate the

economy, but they haven’t been entirely effective. Professor Sumner says the

central bank needs to take a different approach: it should make a credible

commitment to spurring and maintaining a higher level of inflation, promising to

use newly created money to buy many kinds of financial assets if necessary. And

it should even pay negative interest on bank reserves, as the Swedish central

bank has started to do. In essence, negative interest rates are a penalty placed

on banks that sit on their money instead of lending it.

Much to the chagrin of Professor Sumner, the Fed has been practicing the

opposite policy recently, by paying positive interest on bank reserves —

essentially, inducing banks to hoard money.

The Fed’s balance sheet need not swell to accomplish these aims. Once people

believe that inflation is coming, they will be willing to spend more money.

In other words, if the Fed announces a sufficient willingness to undergo extreme

measures to create price inflation, it may not actually have to do so. Professor

Sumner’s views differ from the monetarism of Milton Friedman by emphasizing

expectations rather than any particular measure of the money supply.

The Keynesian critique of this remedy is that printing more money won’t

stimulate the economy because uncertainty has put us in a “liquidity trap,”

which means that the new money will be hoarded rather than spent. Professor

Sumner responds that inflating the currency is one step that just about every

government or central bank can take. Even if success is not guaranteed, it seems

that we ought to be trying harder.

Arguably, we can live with 2 or 3 percent inflation, especially if it stems the

drop in employment. Consistently, Professor Sumner argues that the Fed should

have been more aggressive with monetary policy in the summer of 2008, before the

economy started its downward spiral. Somewhat tongue in cheek, he once wrote on

his blog: “Like a broken clock the monetary cranks are right twice a century;

1933, and today.”

It may all sound too simple to be true, but has the status quo been so good as

to silence all doubts? Many advocates expected that the $775 billion allocation

to fiscal stimulus would be followed rapidly by generous funding for health care

and other reforms. But at the moment, the American public, rightly or wrongly,

is blanching at higher government spending and higher taxes. In contrast, a Fed

stance in favor of mild price inflation need not require higher taxes or larger

budget deficits.

While these arguments have not won over the economics profession, neither have

they been refuted. Economists like Paul Krugman have suggested that a public Fed

policy favoring 2 or 3 percent price inflation isn’t politically realistic in

today’s environment. Still, mild inflation might still be a better shot than

hoping for a fiscal stimulus that is big enough, rapid enough and ambitious

enough to work.

IF there is a flaw in Professor Sumner’s argument, it is that aggregate demand

doesn’t always drive business recovery. Circa 2007, for reasons of their own

making, various sectors of the economy were in a vulnerable position. These

included real estate, the automobile industry and retail sales. Higher price

inflation would not have solved their problems, which stemmed from basically

flawed business models that depended on rampant credit. Still, a different Fed

stance might have limited the secondary fallout from the financial crisis.

Of course, there’s a risk that inflation could get out of hand and rise above 2

or 3 percent. That said, the Fed has battled inflation successfully in the past,

and could do so again if necessary.

Professor Sumner has been working for 20 years on what he hopes will be a

definitive economic history of the Great Depression. In this manuscript,

tentatively titled “The Midas Curse: Gold, Wages, and the Great Depression,” he

argues that Sweden in the 1930s made a credible commitment to expansionary

monetary policy and had a milder depression as a result.

Professor Sumner’s proposals may not be public policy now. But if there is one

thing economists should know, it is that we should not underestimate the power

of an idea.

Tyler Cowen

is

a professor of economics

at George Mason University.

How a Little Inflation Could Help a Lot,

NYT,

1 August 2009,

https://www.nytimes.com/2009/08/02/

business/economy/02view.html

Explore more on these topics

Anglonautes > Vocapedia

UK > Bank of England, Interest rates

USA > Federal Reserve, Interest rates

consumers >

energy costs

consumers

> bills

consumers > credit

deflation, stagflation

economy, money, taxes,

housing market, shopping,

jobs, unemployment,

unions, retirement,

debt,

poverty, hunger,

homelessness

economy, cycles, business, markets, prices, taxes >

up

economy, cycles, business, markets, prices, taxes >

down

industry, energy, commodities

beliefs, emotions, feelings, mindset, mood

|