|

Vocapedia >

Economy > Money, Currencies, Cash, Credit

card

Paul Combs

editorial cartoon

The Tampa

Tribune

Cagle

17 January 2008

http://cagle.com/politicalcartoons/PCcartoons/combs.asp - broken link

Don Wright

editorial cartoon

Palm Beach , FL

Cagle

18 December 2008

Uncle Sam

money UK

https://www.theguardian.com/money/series/

money-talks-comment

https://www.bbc.co.uk/programmes/b006qjnv

https://www.theguardian.com/commentisfree/2016/jul/29/

stephen-hawking-brexit-wealth-resources

http://www.nytimes.com/2014/01/19/

opinion/sunday/for-the-love-of-money.html

https://www.independent.co.uk/news/uk/home-news/

james-lawton-

flood-of-money-has-unleashed-forces-of-greed-804513.html - 4

April 2008

money USA

https://www.nytimes.com/interactive/2023/02/26/

us/printing-money-treasury.html

https://www.nytimes.com/interactive/2020/04/11/

business/economy/coronavirus-us-economy-spending.html

paper money

USA

https://www.npr.org/2025/03/15/

nx-s1-5325943/opinion-monopoly-money-is-going-digital

print money

USA

https://www.nytimes.com/interactive/2023/02/26/

us/printing-money-treasury.html

money

can't buy happiness

USA

https://www.gocomics.com/ziggy/2022/08/15

blow money USA

https://www.nytimes.com/2013/12/16/

nyregion/one-brother-reaches-out-to-another-across-the-economic-divide.html

money philosophies

USA

http://www.nytimes.com/2013/04/27/

your-money/financial-opposites-try-to-tackle-finances-together.html

Big Money USA

https://www.npr.org/2023/12/07/

1198909446/consider-this-from-npr-draft-12-07-2023

https://www.npr.org/2020/08/17/

902626429/wall-streets-big-money-is-betting-on-biden-and-democrats-in-2020

https://www.nytimes.com/2016/06/05/

opinion/sunday/big-money-rearranges-its-election-bets.html

http://www.nytimes.com/2014/11/15/us/

obama-immigration-policy-changes.html

http://www.nytimes.com/2014/04/03/

opinion/bringing-big-money-out-of-the-shadows.html

http://www.nytimes.com/2012/12/09/

business/financiers-bet-on-rental-housing.html

http://dealbook.nytimes.com/category/

special-topics/special-section-spring-2012/

big money USA

http://www.nytimes.com/2013/11/05/nyregion/in-new-jersey-

big-money-flows-to-foil-christie.html

http://www.nytimes.com/2013/10/17/

technology/facebook-changes-privacy-policy-for-teenagers.html

make big money

USA

http://www.npr.org/sections/thesalt/2016/04/08/

473548273/philly-wants-to-tax-soda-to-raise-money-for-schools

moneyless man / My year of living without money

UK

http://www.guardian.co.uk/environment/blog/2010/jun/02/

mark-boyle-moneyless-man-food-for-free

make money

UK

http://www.guardian.co.uk/money/2010/jan/14/

make-money-in-an-hour

make money

USA

http://dealbook.nytimes.com/2013/10/26/

goldman-sachs-buying-redemption/

http://www.nytimes.com/2013/01/19/

opinion/nocera-investing-in-guns.html

run out of money

UK

http://www.guardian.co.uk/science/2010/dec/14/

forensic-science-service-wound-up

run out of money

USA

https://www.npr.org/2016/04/26/

475759586/how-to-not-run-out-of-money-in-retirement

wholesale money market

London interbank offered rate

Libor UK 2012

What is Libor?

Libor is the main setter of interest

in the London wholesale money market

https://www.theguardian.com/business/2007/sep/01/

2

Libor rates UK

Libor rates are set

by the demand and supply of money

as banks lend to each other

to balance their books on a daily basis.

https://www.theguardian.com/business/2007/sep/01/2

make money

moneyspinner

money-driven culture

money pinch

'making monkeys' UK

http://www.guardian.co.uk/business/2008/nov/01/

royal-bank-scotland-vincent-cable

easy money

pocket money

value for money

dime

USA

http://www.nytimes.com/2013/07/06/us/

In-Cash-Starved-Oregon-County-Citizens-Take-Up-Patrols.html

income

USA

http://www.nytimes.com/2012/11/19/

opinion/to-reduce-inequality-tax-wealth-not-income.html

windfall UK

http://www.theguardian.com/money/2013/oct/26/

british-gas-caroline-flint-credit-windfall

http://www.guardian.co.uk/film/2012/may/16/

50m-robert-downey-jr-avengers

http://www.guardian.co.uk/uk/2011/oct/11/

euromillions-couple-give-friends-million-each

windfall USA

https://www.npr.org/2024/03/25/

1240724446/truth-social-trump-media-technology-group-trading-bond

https://www.npr.org/2024/03/22/

1240116446/trump-truth-social-dwac-stock-listing-legal-troubles

http://dealbook.nytimes.com/2011/01/18/

study-points-to-windfall-for-goldman-partners/

fortune USA

https://www.npr.org/2024/03/25/

1240724446/truth-social-trump-media-technology-group-trading-bond

dark money USA

https://www.npr.org/2019/07/17/

742427894/steve-bullock-vows-to-disentangle-dark-money-from-politics

https://www.npr.org/2019/05/07/

720050070/democrats-want-to-end-dark-money-but-first-they-want-to-use-it

http://www.nytimes.com/2016/04/29/

opinion/dark-money-and-an-irs-blindfold.html

http://www.nytimes.com/2015/07/26/

opinion/sunday/the-irs-gives-up-on-dark-money.html

http://www.nytimes.com/2014/11/09/

opinion/sunday/dark-money-helped-win-the-senate.html

dirty money

UK

https://www.theguardian.com/commentisfree/2023/sep/04/

britain-dirty-money-laundry-mps-amendment-economic-crime-corporate-transparency-bill

https://www.theguardian.com/world/audio/2019/mar/06/

super-yachts-and-private-schools-tracing-the-russian-money-troika-laundromat

https://www.theguardian.com/commentisfree/2018/apr/22/

the-sunday-essay-britain-headquarters-of-fraud

http://www.theguardian.com/uk-news/2013/nov/08/

gambling-machines-drug-money-laundering-bookies

launder dirty money

UK

https://www.theguardian.com/commentisfree/2018/apr/22/

the-sunday-essay-britain-headquarters-of-fraud

launder (...) cash

UK

https://www.theguardian.com/commentisfree/2023/sep/04/

britain-dirty-money-laundry-mps-amendment-

economic-crime-corporate-transparency-bill

dirty money

USA

http://www.nytimes.com/2013/01/03/

opinion/how-bankers-help-drug-traffickers-and-terrorists.html

blood money

USA

http://www.nytimes.com/2013/06/24/

opinion/make-gun-companies-pay-blood-money.html

hush money USA

https://www.nytimes.com/news-event/

trump-ny-hush-money-case

https://www.npr.org/2024/05/13/

1250844236/trump-trial-michael-cohen

https://www.nytimes.com/2021/07/16/

us/william-h-pauley-iii-dead.html

https://www.npr.org/2018/03/12/

592895856/stormy-daniels-offers-back-hush-money-

in-order-to-speak-about-alleged-trump-affa

http://www.npr.org/sections/thetwo-way/2016/06/22/

483075855/disgraced-former-house-speaker-dennis-hastert-

heads-to-prison-today

http://www.npr.org/sections/thetwo-way/2015/05/30/

410792027/hastert-due-to-be-arraigned-next-week

money laundering

UK

http://www.theguardian.com/uk-news/2013/nov/08/

gambling-machines-drug-money-laundering-bookies

money

laundering USA

http://www.npr.org/2017/10/24/

557162777/what-is-money-laundering-and-why-does-it-matter-to-robert-mueller

http://www.nytimes.com/2013/01/03/

opinion/how-bankers-help-drug-traffickers-and-terrorists.html

http://dealbook.nytimes.com/2012/12/10/

hsbc-said-to-near-1-9-billion-settlement-over-money-laundering/

http://dealbook.nytimes.com/2012/12/11/

hsbc-to-pay-record-fine-to-settle-money-laundering-charges/

black market

put money

away / save

savings

UK

https://www.theguardian.com/money/savings

savings rate

saver

UK

http://www.guardian.co.uk/money/2011/apr/12/

savers-struggling-despite-inflation-drop

cheque

UK

https://www.theguardian.com/money/shortcuts/2014/feb/02/

cheques-better-than-online-banking

check

USA

https://www.npr.org/2016/03/03/

468890515/is-it-time-to-write-off-checks

mint

UK

https://www.theguardian.com/world/2013/dec/31/

lord-kitchener-new-2-coin-royal-mint

mint

USA

https://www.npr.org/2025/02/10/

nx-s1-5292082/trump-penny-mint-treasury

The Royal Mint

UK

https://www.royalmint.com/

https://www.theguardian.com/world/2014/jul/05/

edith-cavell-nurse-coin-first-world-war

http://www.theguardian.com/uk-news/2014/mar/19/

a-sounder-pound-new-1-coin-unveiled

The U.S. Mint USA

https://www.npr.org/2024/01/04/

1222896091/harriet-tubman-us-mint-new-commemorative-coin

https://www.npr.org/2022/04/02/

1090468785/american-women-quarters-eleanor-roosevelt-bessie-coleman

coin / token

UK

https://www.theguardian.com/uk-news/gallery/2020/jul/10/

treasures-found-by-the-british-public-

in-pictures

http://www.theguardian.com/uk-news/2015/mar/17/

new-12-sided-pound-coin-to-be-unveiled-ahead-of-budget-announcement

https://www.theguardian.com/world/2014/jul/05/

edith-cavell-nurse-coin-first-world-war

http://www.theguardian.com/uk-news/2014/mar/19/

a-sounder-pound-new-1-coin-unveiled

http://www.theguardian.com/world/2013/dec/31/

lord-kitchener-new-2-coin-royal-mint

http://www.guardian.co.uk/uk/2011/oct/11/

new-five-pound-coin-diamond-jubilee

https://www.independent.co.uk/news/uk/

home-news/new-coins-unveiled-with-winning-design-803688.html - 2 April 2008

http://www.theguardian.com/money/2005/aug/18/

arts.artsnews

coin / token

USA

https://www.npr.org/2022/04/02/

1090468785/american-women-quarters-eleanor-roosevelt-bessie-coleman

dollar coin

USA

https://www.npr.org/2019/04/08/

711162059/government-watchdog-flips-on-dollar-coin

1-cent coin /

penny USA

https://www.npr.org/2025/02/10/

nx-s1-5292082/trump-penny-mint-treasury

https://www.npr.org/sections/money/2020/07/14/

890435359/is-it-time-to-kill-the-penny

commemorative coin

USA

https://www.npr.org/2024/01/04/

1222896091/harriet-tubman-us-mint-new-commemorative-coin

be

featured / commemorated (passive)

on a new

commemorative £5 coin UK

https://www.theguardian.com/world/2014/jul/05/

edith-cavell-nurse-coin-first-world-war

penny, pennies

USA

https://www.npr.org/sections/money/2020/07/14/

890435359/is-it-time-to-kill-the-penny

https://www.npr.org/2015/11/26/

457397908/critics-wonder-whether-pennies-make-sense-anymore

forge /

fake

UK

https://www.theguardian.com/uk-news/2014/mar/19/

a-sounder-pound-new-1-coin-unveiled

counterfeiting UK

https://www.theguardian.com/uk-news/2015/mar/17/

new-12-sided-pound-coin-to-be-unveiled-ahead-of-budget-announcement

Freshly Squeezed by Ed Stein

GoComics

June 30, 2014

cash

UK

https://www.theguardian.com/money/2020/may/16/

cash-could-be-the-latest-victim-of-coronavirus-and-may-never-recover

cash

USA

https://www.npr.org/2022/12/07/

1140558220/rising-debt-cash-stuffing-envelope-system

https://www.nytimes.com/roomfordebate/2013/12/09/

the-end-of-cash

https://www.reuters.com/article/ousiv/idUSTRE49N5VU

20081027

USA > New Jersey >

Atlantic City >

Casinos > cash cow

2014 UK

https://www.youtube.com/watch?

v=Ur5vpNXtALw&index=20&list=PLa_1MA_DEorHVeZiy1Ky-yGdcEW9qCKet

cashless society

UK

http://www.theguardian.com/commentisfree/2014/may/07/

cashless-society-new-currency-reputation-coins-notes-identity-transactions

http://www.theguardian.com/money/blog/2014/feb/15/

cashless-society-no-pain-no-gain-plastic-future

cashless / My year of living without money

UK

2 June 2010

http://www.guardian.co.uk/environment/blog/2010/jun/02/

mark-boyle-moneyless-man-food-for-free

cash register

USA

http://www.nytimes.com/2009/03/10/nyregion/10cash.html

cash cow

wads of cash

Automatic Telling Machine ATM

UK / USA

( parody: Always

Taking Money )

http://www.guardian.co.uk/money/2012/jun/01/

visa-cuts-atms-london-olympics

http://www.nytimes.com/2010/05/21/

business/global/21barron.html

http://www.nytimes.com/2008/10/31/nyregion/31nyc.html

http://www.theguardian.com/money/2005/nov/01/accounts.voluntarysector

http://www.theguardian.com/money/2005/may/19/business.accounts

decimalisation 1971

http://www.theguardian.com/money/2005/aug/18/

arts.artsnews

billion

billionaire

trillion

UK / USA

https://www.npr.org/2020/05/12/

854363884/u-s-treasury-to-borrow-3-trillion-to-finance-pandemic-relief-programs

https://www.npr.org/sections/coronavirus-live-updates/2020/03/27/

822666582/whats-in-the-2-trillion-bill-for-health-care

http://www.nytimes.com/2011/04/16/us/

politics/16congress.html

http://www.guardian.co.uk/business/2009/apr/21/

imf-huge-global-bank-losses

greed UK / USA

https://www.theguardian.com/australia-news/2020/aug/16/

greed-cruelty-consumption-the-world-is-changed-yet-its-worst-persists

http://www.nytimes.com/2013/12/25/

movies/dicaprio-stars-in-scorseses-the-wolf-of-wall-street.html

http://www.theguardian.com/politics/2013/nov/27/

boris-johnson-thatcher-greed-good

http://dealbook.nytimes.com/2013/10/26/

goldman-sachs-buying-redemption/

http://dealbook.nytimes.com/2013/08/02/

in-complex-trading-case-jurors-focused-on-greed/

http://www.guardian.co.uk/commentisfree/2013/apr/08/

margaret-thatcher-editorial

http://www.independent.co.uk/news/uk/home-news/

james-lawton-flood-of-money-has-unleashed-forces-of-greed-804513.html

Illustration: Daniel Pudles

The Guardian p. 21 12 July 2005

currency, currencies

UK

https://www.theguardian.com/business/currencies

http://www.guardian.co.uk/politics/audio/2011/dec/09/

politics-weekly-podcast-europe-cameron-treaty

http://www.guardian.co.uk/world/2011/dec/09/

euro-currency-live-discussion

currency > bill

USA

https://www.npr.org/2019/05/01/

719255254/new-canadian-currency-features-civil-rights-activist-wins-innovation-award

the world's reserve

currency > dollar USA

https://www.npr.org/2023/06/12/

1181062016/dollar-reserve-currency-debt-ceiling-sanctions-china

http://www.nytimes.com/2014/08/28/

opinion/dethrone-king-dollar.html

common currency >

euro USA

http://www.nytimes.com/2014/08/29/

opinion/paul-krugman-the-fall-of-france.html

value

USA

http://www.nytimes.com/2009/05/23/

business/economy/23dollar.html

currency war

UK / USA

http://www.nytimes.com/2010/10/24/

business/global/24g20.html

http://www.guardian.co.uk/business/2010/oct/07/

world-bank-warns-currency-crisis

currency crunch

2008 UK

http://www.independent.co.uk/news/business/news/

the-currency-crunch-british-tourists-pay-price-for-euros-strength-806996.html

http://www.independent.co.uk/opinion/commentators/

sean-ogrady-what-difference-will-the-currency-crunch-make-806998.html

currency converter

UK

https://markets.ft.com/data/

currencies?segid=70113&ftcamp=currency/home_link//tools_box/70113/

UK >

Sterling / pound / quid / £ UK / USA

https://www.theguardian.com/business/

sterling

https://www.nytimes.com/topic/subject/

british-pound

2022

https://www.npr.org/2022/09/26/

1125080014/british-pound-record-low-dollar

2019

https://www.npr.org/2019/08/29/

755014398/like-the-empire-itself-the-british-pound-is-not-what-it-used-to-be

2016

http://www.nytimes.com/2016/10/08/world/europe/for-britains-

brexit-bunch-the-party-just-ended.html

https://www.theguardian.com/business/2016/jul/06/

brexit-pound-plunges-to-30-year-lows-as-eu-fears-bite-into-global-markets-again

http://www.guardian.co.uk/business/2012/apr/30/

pound-two-year-high-euro

http://www.guardian.co.uk/world/2011/dec/09/

euro-currency-live-discussion

http://www.guardian.co.uk/business/2008/dec/28/uk-

economy-recession-gdp-2009

http://www.guardian.co.uk/business/2008/dec/15/

currencies-foreigncurrency

http://www.guardian.co.uk/politics/2008/dec/15/

treasury-pound-exchange-currency-economic

http://www.guardian.co.uk/business/2008/dec/14/

euro-economic-policy-currencies-europe

http://www.independent.co.uk/news/business/news/

sterling-hits-new-record-low-against-euro-1060664.html

http://projects.exeter.ac.uk/RDavies/arian/emu.html

http://www.independent.co.uk/news/business/news/

pound-sinks-to-record-low-against-the-euro-1017940.html

http://www.independent.co.uk/news/business/news/

value-of-pound-hits-fiveyear-low-against-dollar-968863.html

http://www.guardian.co.uk/business/2008/apr/10/currencies

http://www.independent.co.uk/news/business/news/

the-currency-crunch-british-tourists-pay-price-for-euros-strength-806996.html

http://news.bbc.co.uk/1/hi/business/6566715.stm

http://business.guardian.co.uk/story/0,,2059015,00.html

http://business.guardian.co.uk/story/0,,1960479,00.html

https://www.theguardian.com/business/2006/may/05/

money4

weak pound

UK

http://www.guardian.co.uk/business/2008/dec/28/uk-

economy-recession-gdp-2009

£50 note

UK

A new £50 note

featuring

Alan Turing,

the scientist best

known

for his codebreaking work

during the second

world war,

has been unveiled by

the Bank of England

and will go into

circulation on 23 June,

the date of his

birth.

Turing was prosecuted

for homosexual acts in 1952,

and an inquest

concluded

that his death

from

cyanide poisoning two years later

was suicide.

The Bank of England

governor,

Andrew Bailey, said:

“I’m delighted that

our new £50

features one of

Britain’s

most important scientists ...

He was also gayand

was treated

appallingly as a result.

By placing him

on our

new polymer £50 banknote,

we are celebrating

his achievements

and the values he

symbolises."

https://www.theguardian.com/science/video/2021/mar/25/

it-captures-so-much-of-turings-work-

bank-of-england-unveils-new-50-note-video

pound coin / pound note

UK

http://www.guardian.co.uk/business/2012/apr/26/

flood-fivers-five-pound-note-drought

http://www.guardian.co.uk/business/2011/sep/30/

50-pound-reward-industrial-revolution

https://www.theguardian.com/fromthearchive/story/

0,12269,1349777,00.html - 1984

UK > five-pound note / £5 note / fiver

UK / USA

http://www.npr.org/sections/thetwo-way/2016/09/

14/493946010/britain-releases-a-new-fiver-thats-a-real-survivor

http://www.guardian.co.uk/business/2013/apr/26/

winston-churchill-new-five-pound-note

http://www.guardian.co.uk/business/2012/apr/26/

flood-fivers-five-pound-note-drought

a two-dollar

pound

coppers and silver

1p, 2p, 5p, 10p, 20p and 50p coins

£1 or £2 coin

change

paper currency

USA

http://www.nytimes.com/2015/07/05/

opinion/sunday/take-jackson-off-the-20-bill-put-a-woman-in-his-place.html

banknote / note

UK

http://www.theguardian.com/money/2014/apr/28/

50-pound-notes-bank-of-england-houblon

http://www.guardian.co.uk/business/2013/apr/26/

winston-churchill-new-five-pound-note

http://www.guardian.co.uk/money/gallery/2010/mar/17/

queen-elizabeth-ii-portrait-banknotes

Winston Churchill

plastic £5 note

ends trail of paper

money G 2 June 2016

https://www.theguardian.com/business/2016/jun/02/

winston-churchill-fiver-five-pound-note-ends-paper-money-trail

tenner / £10 (col)

UK

http://www.guardian.co.uk/money/2006/dec/02/

consumernews.moneysupplement

dollar bills

USA

https://www.npr.org/2019/04/08/

711162059/government-watchdog-flips-on-dollar-coin

https://www.npr.org/sections/money/2012/04/19/

150976150/should-we-kill-the-dollar-bill

$20 bill

USA

http://www.npr.org/sections/thetwo-way/2016/04/20/

474983292/treasury-decides-to-put-harriet-tubman-on-20-bill

http://www.nytimes.com/2015/07/05/

opinion/sunday/take-jackson-off-the-20-bill-put-a-woman-in-his-place.html

historical figures on

the $5, $10 and $20 bills

http://www.nytimes.com/2016/04/21/

us/mlk-eleanor-roosevelt-susan-anthony.html

$100

bill

https://www.npr.org/sections/money/2020/09/15/

912695985/should-we-kill-the-100-bill

debit card fees

USA

http://www.nytimes.com/2011/09/30/

business/banks-to-make-customers-pay-debit-card-fee.html

http://www.nytimes.com/2011/03/08/

business/08debit.html

podcasts > before

2024

credit card

https://www.npr.org/2024/05/14/

1251295805/credit-cards-debt-inflation

https://www.npr.org/2023/09/26/

1201257895/credit-card-fees-visa-mastercard-retailers

http://www.nytimes.com/2015/11/25/

business/charles-m-cawley-founder-of-mbna-corp-dies-at-75.html

President Obama Says

Credit Card Was Declined

video

The New York Times 18 October 2014

https://www.youtube.com/watch?v=V1TbyGmVImI

https://www.reuters.com/article/newsOne/idUSTRE52921M

20090310

fall behind onpreposition

adjectivepossessive

credit card bills

https://www.npr.org/2024/05/14/

1251295805/credit-cards-debt-inflation

contactless credit

card UK

http://www.theguardian.com/technology/2015/jul/14/

apple-pay-launches-uk-how-to-use

Apple Pay /

Apple’s smartphone payments UK

http://www.theguardian.com/technology/2015/jul/14/

apple-pay-launches-uk-how-to-use

credit card fraud

USA

http://www.nytimes.com/2014/03/15/

your-money/credit-and-debit-cards/consumers-not-powerless-in-the-face-of-card-fraud.html

debit card fraud

USA

http://www.nytimes.com/2014/03/08/

your-money/after-debit-card-fraud-a-small-bank-feels-customers-frustration.html

FRONTLINE

The Secret History of the Credit Card

Aired: 11/23/2004

56:07

Expires: 10/20/2016

Rating: NR

The surprising history and clever tactics

of an industry few Americans fully understand.

https://www.pbs.org/video/

frontline-the-secret-history-of-the-credit-card/

yen

Renminbi (Yuan) USA

https://www.nytimes.com/topic/subject/

renminbi-yuan

http://www.nytimes.com/reuters/2010/09/24/

business/business-us-usa-china-yuan.html

http://www.nytimes.com/2010/03/17/

opinion/17wed1.html

http://video.nytimes.com/video/2010/02/04/world/asia/

1247466872248/china-hits-back-in-u-s-yuan-row.html

euro

convert

... into N

https://www.x-rates.com/graph/?from=EUR&to=USD&amount=1

fall to a three-week low against

N

fall to yet

another record low against the euro

count

at a money exchange bureau

parity UK

https://www.theguardian.com/business/2022/jul/12/

euro-parity-dollar-pound-two-year-lows-russia-us-interest-rate-rises

silver

https://www.reuters.com/article/hotStocksNews/idUST170319

20080303

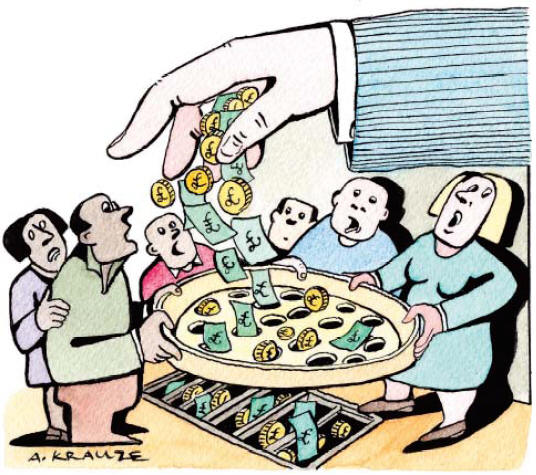

Andrzej Krauze

The Guardian p. 17 18 April 2005

Allure of the blank slate:

Naomi Klein

From

Aceh to Haiti,

a predatory form of disaster capitalism

is reshaping societies to its own design

https://www.theguardian.com/Columnists/Column/0,5673,1462290,00.html

https://www.theguardian.com/culture/2001/oct/17/artsfeatures2

USA >

American dollar / US dollar / the greenback

UK / USA

https://www.nytimes.com/topic/subject/

dollar

https://www.theguardian.com/business/

dollar

2024

https://www.npr.org/2024/06/11/

nx-s1-4990256/strong-dollar-overseas-travel-currency-exchange-rate

2022

https://www.npr.org/2022/09/27/

1124284032/strong-dollar-euro-pound-foreign-exchange-fx-inflation

https://www.nytimes.com/interactive/2022/07/16/

business/strong-dollar.html

https://www.npr.org/2022/02/06/

1072406109/digital-dollar-federal-reserve-apple-pay-venmo-cbdc

2021

https://www.theguardian.com/business/2021/apr/02/

the-us-dollars-hegemony-is-looking-fragile

2019

https://www.npr.org/sections/money/2019/07/30/

746337868/75-years-ago-the-u-s-dollar-became-the-worlds-currency-will-that-last

https://www.nytimes.com/2019/02/22/

business/dollar-currency-value.html

2017

http://www.npr.org/2017/09/19/

551294729/the-dollar-is-weaker-but-that-may-not-be-a-bad-thing

2014

http://dealbook.nytimes.com/2014/09/25/

buoyant-dollar-underlines-resurgence-in-u-s-economy/

http://www.nytimes.com/2014/08/28/

opinion/dethrone-king-dollar.html

2012

http://www.nytimes.com/roomfordebate/2012/04/04/

bringing-dollars-and-cents-into-this-century/

2011

http://www.guardian.co.uk/business/2011/apr/26/dollar-falls-new-lows

2008

https://www.reuters.com/article/hotStocksNews/idUST244803

20080313

https://www.reuters.com/article/idUST271601

20080313

https://www.reuters.com/article/hotStocksNews/idUSL11840897

20080313

https://www.theguardian.com/business/2008/mar/13/

currencies.marketturmoil

https://www.reuters.com/article/hotStocksNews/idUST6905

20080122

2006

https://www.theguardian.com/money/2006/nov/29/

lifeandhealth.business

weak dollar

dollar peg USA

http://www.nytimes.com/reuters/2010/06/20/

business/business-us-china-yuan-forecasts.html

petrodollars UK / USA

http://www.guardian.co.uk/environment/2008/nov/02/

green-energy-oil-saudi-arabia

http://www.nytimes.com/2005/10/16/

business/worldbusiness/16view.html

slip against the

Yen

cede some ground

to the Japanese yen

creep up against

the euro

greenback

USA

http://www.nytimes.com/2014/04/02/nyregion/

two-dollar-bill-is-oddity-but-some-love-the-tender.html

bill

USA

http://www.nytimes.com/2011/07/07/

business/07currency.html

$2 bill USA

http://www.nytimes.com/2014/04/02/

nyregion/two-dollar-bill-is-oddity-but-some-love-the-tender.html

buck

USA

http://www.nytimes.com/2012/10/24/

opinion/why-the-fed-should-buy-munis-not-mortgages.html

A. Krauze

editorial cartoon

Budget blues

The Audit Commission

says the government's supported housing programme

is in

danger of failing vulnerable people.

Do the experts agree?

Interviews by Matt Weaver

The Guardian

Society p. 6

Wednesday October 19, 2005

https://www.theguardian.com/society/2005/oct/19/

communities.guardiansocietysupplement

fund

fundraising

chugging, or street fundraising

UK

http://www.guardian.co.uk/money/video/2010/feb/01/

chuggers-street-fundraising

Halifax ad.

The Guardian

p. 12 8

November 2008

http://digital.guardian.co.uk/guardian/2008/11/08/pdfs/gdn_081108_ber_12_21154218.pdf

gold

USA

https://www.nytimes.com/2024/05/05/

business/china-gold-price.html

Corpus of news articles

Economy > Money, Currencies

Banks to

Make Customers

Pay Fee for Using

Debit Cards

September 29,

2011

The New York Times

By TARA SIEGEL BERNARD

and BEN PROTESS

Bank of

America, the nation’s biggest bank, said on Thursday that it planned to start

charging customers a $5 monthly fee when they used their debit cards for

purchases. It was just one of several new charges expected to hit consumers as

new regulations crimp banks’ profits.

Wells Fargo and Chase are testing $3 monthly debit card fees. Regions Financial,

based in Birmingham, Ala., plans to start charging a $4 fee next month, while

SunTrust, another regional powerhouse, is charging a $5 fee.

The round of new charges stems from a rule, which takes effect on Saturday, that

limits the fees that banks can levy on merchants every time a consumer uses a

debit card to make a purchase. The rule, known as the Durbin amendment, after

its sponsor Senator Richard J. Durbin, is a crucial part of the Dodd-Frank

financial overhaul law.

Until now, the fees have been 44 cents a transaction, on average. The Federal

Reserve in June agreed to cut the fees to a maximum of about 24 cents. While the

fee amounts to pennies per swipe, it rapidly adds up across millions of

transactions. The new limit is expected to cost the banks about $6.6 billion in

revenue a year, beginning in 2012, according to Javelin Strategy and Research.

That comes on top of another loss, of $5.6 billion, from new rules restricting

overdraft fees, which went into effect in July 2010.

And even though retailer groups had argued that lower fees were important to

keep prices in check, consumers were not likely to see substantial savings. In

fact, they are simply going to end up paying from a different pot of money.

Or as Jamie Dimon, chief executive of JPMorgan Chase, put it after passage last

year of the Dodd-Frank Act, “If you’re a restaurant and you can’t charge for the

soda, you’re going to charge more for the burger.”

Chase is now charging customers for a paper statement. It also, like many other

banks, scrapped its debit card rewards program. And customers that Chase

inherited from Washington Mutual no longer enjoy free checking accounts.

The bank is also exploring a number of other fee increases, including for online

banking, according to people with knowledge of the matter.

Bank of America’s debit fee is steeper than most of its competitors’, reflecting

the broader challenges the bank is facing after the financial crisis. The bank

has introduced an online-only account that charges customers for doing business

at a local branch. It also plans to apply its new debit card fees to anyone who

uses the card to make recurring payments like gym fees or cable bills.

Citibank is one of the few that said it would not introduce a charge for debit

card use. “We have talked to customers and they have made it abundantly clear

that ‘if you charge me to use my debit card, I would find that very irritating,’

” said Stephen Troutner, head of Citi’s banking products. Still, the bank has

made it more difficult to qualify for free checking, among other moves.

Earlier this year, Wells Fargo estimated that the Durbin rules would cost the

bank $250 million in revenue every quarter. It hopes to make up half that gap

with a variety of new products and customer fees, including the monthly debit

card fee of $3. The change is part of a “pilot program” the bank will begin on

Oct. 14 in five states across the country, including Washington and Georgia. As

of Saturday, the bank will discontinue its debit card rewards program.

Meanwhile, HSBC said that it recently increased an A.T.M. fee — to $2.50 from $2

— for certain customers when they used a competitor’s A.T.M. It also recently

introduced a debit transaction fee of 35 cents, though the first eight

transactions are free.

And at TDBank, customers will now have to pay $2 for using A.T.M.’s outside

their network.

“Durbin essentially moves the cost of debit away from merchants, and now it’s

more focused on consumers,” said Beth Robertson, director of payments research

at Javelin. “There are all sort of things happening where banks are saying,

where can we put fees in place for our service to generate revenue or how can we

reduce our costs?”

Over the last few years, consumers have increasingly shifted their spending to

debit cards from credit cards, in large part to curb their spending. But some

analysts predicted that the new fees could prompt consumers to return to credit

cards — a more lucrative alternative for the banks.

Consumers have already begun to react to the changes.

Patrick Shields, 48, said he had decided to leave Citibank, where he has held a

small-business account for his residential window cleaning business since 1986.

He was contemplating opening a personal checking account, but realized he could

do better at a credit union.

“At the credit union, they opened it free of charges, which Citi could not and

would not do,” said Mr. Shields, who noted that a personal checking account

would have cost more than the one he uses for his New York business. “Now I have

both accounts covered, and I am fee-free.”

The so-called Durbin rule quickly emerged as one of the thorniest provisions of

Dodd-Frank, touching off a long and furious fight in Washington. Wall Street

dispatched an army of lobbyists to tame the rule, ultimately yielding mixed

results.

In June, the Senate defeated a measure that would have delayed the new rule. But

just three weeks later, the Federal Reserve decided to cap the fees at 21 to 24

cents for each debit card transaction, a much lighter blow than once expected.

In a statement on Thursday, Senator Durbin, Democrat of Illinois, said that

small businesses would benefit from the new limits. “Swipe fee regulation will

still allow banks to cover the actual costs of debit transactions but will rein

in the banks’ excessive profit-taking.”

Ann Carrns contributed reporting.

Banks to Make Customers Pay Fee for Using Debit Cards,

NYT,

29.9.2011,

https://www.nytimes.com/2011/09/30/

business/banks-to-make-customers-pay-debit-card-fee.html

As Plastic

Reigns,

the Treasury Slows

Its Printing Presses

July 6, 2011

The New York Times

By BINYAMIN APPELBAUM

WASHINGTON —

The number of dollar bills rolling off the great government presses here and in

Fort Worth fell to a modern low last year. Production of $5 bills also dropped

to the lowest level in 30 years. And for the first time in that period, the

Treasury Department did not print any $10 bills.

The meaning seems clear. The future is here. Cash is in decline.

You can’t use it for online purchases, nor on many airplanes to buy snacks or

duty-free goods. Last year, 36 percent of taxi fares in New York were paid with

plastic. At Commerce, a restaurant in the West Village in Manhattan, the bar

menus read, “Credit cards only. No cash please. Thank you.”

There is no definitive data on all of this. Cash transactions are notoriously

hard to track, in part because people use cash when they do not want to be

tracked. But a simple ratio is illuminating. In 1970, at the dawn of plastic

payment, the value of United States currency in domestic circulation equaled

about 5 percent of the nation’s economic activity. Last year, the value of

currency in domestic circulation equaled about 2.5 percent of economic activity.

“This morning I bought a gallon of milk for $2.50 at a Mobil station, and I paid

with my credit card,” said Tony Zazula, co-owner of Commerce restaurant, who

spoke with a reporter while traveling in upstate New York. “I do carry a little

cash, but only for gratuities.”

It is easy to look down the slope of this trend and predict the end of paper

currency. Easy, but probably wrong. Most Americans prefer to use cash at least

some of the time, and even those who do not, like Mr. Zazula, grudgingly concede

they cannot live without it.

Currency remains the best available technology for paying baby sitters and

tipping bellhops. Many small businesses — estimates range from one-third to half

— won’t accept plastic. And criminals prefer cash. Whitey Bulger, the Boston

gangster who lived in Santa Monica for 15 years, paid his rent in cash, and

stashed thousands of dollars in his apartment walls.

Indeed, cash remains so pervasive, and the pace of change so slow, that Ron

Shevlin, an analyst with the Boston research firm Aite Group, recently

calculated that Americans would still be using paper currency in 200 years.

“Cash works for us,” Mr. Shevlin said. “The downward trend is clear, but change

advocates always overestimate how quickly these things will happen.”

Production of paper currency is declining much more quickly than actual currency

use because the bills are lasting longer. Thanks to technological advances, the

average dollar bill now circulates for 40 months, up from 18 months two decades

ago, according to Federal Reserve estimates.

Banks regularly send stacks of old notes to the Fed, which replaces the damaged

ones. Until recently, notes were simply stacked facedown and destroyed, as were

dog-eared notes, because the Fed’s scanning equipment could not distinguish

between creases and tears. Now it can. In 1989, the Fed replaced 46 percent of

returned dollar bills. Last year it replaced 21 percent. The rest of the notes

were returned to circulation where they may lead longer lives because they are

being used less often.

The futurists who have long predicted the end of paper money also underestimated

the rise of the $100 bill as one of America’s most popular exports.

For two decades, since the fall of the Soviet Union, demand has exploded for the

$100 bill, which is hoarded like gold in unstable places. Last year Treasury

printed more $100 bills than dollar bills for the first time. There are now more

than seven billion pictures of Benjamin Franklin in circulation — and the

Federal Reserve’s best guess is that two-thirds are held by foreigners. American

soldiers searching one of Saddam Hussein’s palaces in 2003 found about $650

million in fresh $100 bills.

This is very profitable for the United States. Currency is printed by the

Treasury and issued by the Federal Reserve. The central bank pays the Treasury

for the cost of production — about 10 cents a note — then exchanges the notes at

face value for securities that pay interest. The more money it issues, the more

interest it earns. And each year the Fed returns to the Treasury a windfall

called a seigniorage payment, which last year exceeded $20 billion.

To meet foreign demand, the Fed has licensed banks to operate currency

distribution warehouses in London, Frankfurt, Singapore and other financial

centers.

In March, largely because of the boom in $100 notes, the value of all American

notes in circulation topped $1 trillion for the first time.

In the United States, research suggests that the spread of electronic payment

technologies is steadily reducing the share of payments made in cash. Drivers

use E-Z Pass at toll plazas for roads and bridges. Commuters swipe stored-value

cards at turnstiles. Christmas stockings are stuffed with gift cards.

Mr. Zazula, the restaurateur, made his decision in 2009, inspired by a flight on

American Airlines, which had just introduced a no-cash policy. He said that 85

percent of his customers already paid with credit cards, and taking cash to and

from the bank was a nuisance and security risk.

Two years later, Mr. Zazula said he had no regrets.

“You still have some people that are outraged that we won’t accept cash,” he

said, “but most of it is a show because they end up having a credit card.”

But Commerce remains a rarity. Experts on payments cannot name another no-cash

restaurant. Snap, a cafe in the Georgetown neighborhood of Washington, rejected

cash in 2006, then reversed the policy a few years later.

Businesses are not required to take cash. The famous phrase “legal tender for

all debts” means that lenders — and only lenders — are required to accept the

bills. But most merchants don’t see the point in frustrating customers.

“It’s a rarity for a retailer of any size to go cash only, and it’s a rarity to

decline to accept cash at all,” said Brian Dodge of the Retail Industry Leaders

Association, a trade group.

Even the financial industry, which has promoted the spread of electronic

payments, has moved away from grand predictions.

“There’s always going to be some people, for good or nefarious reasons, who want

to use cash,” said Doug Johnson, vice president for risk management policy at

the American Bankers Association. “I’m glad I had it yesterday,” Mr. Johnson

said. “I blew out a fan belt on my car, and it’s nice to be able to give the tow

driver a twenty.”

As Plastic Reigns, the Treasury Slows Its Printing Presses,

NYT,

6.7.2011,

https://www.nytimes.com/2011/07/07/

business/07currency.html

Where Cash Registers Go

to Get Their ‘Ka-Ching’ Back

March 10, 2009

The New York Times

By JAMES BARRON

The hair dryer whines. Brian Faerman aims. Hot air blasts into a cash

register that is about as old as he is, which is 46.

That is old enough for the cash register to have black-and-white numbers that go

up and down, not a green, glowing electronic display. That is old enough to have

rows of buttons — 10 for cents, 10 for dimes, 10 for dollars and 10 beyond that.

So to ring up a $29.95 special, you have to press four separate buttons, one by

one. This is the kind of machine that is slow. It is thoughtful. It is

onomatopoeic. Ka-ching. But it is not ka-chinging the way it is supposed to. It

is not ka-chinging at all. Hence the hair dryer.

“Steel holds cold,” he says. “Machines, they need to be warm to work.”

This machine resides on a dusty shelf in a store on the Bowery, between Broome

and Delancey Streets, that still sells and repairs cash registers. Once the

Bowery was cash register heaven. Beneath the old Third Avenue el, among the

restaurant supply stores and the flophouses and the down-and-outers who lived in

them, stores trafficked in cash registers.

Now Mr. Faerman’s father, Bernard Faerman, an old man whose hair turned white in

this store, is remembering, and counting. “There were five within a radius of

five blocks,” says the father, who is 86 and still comes in most days.

The son remembers another store. The father, busy poking a screwdriver in a cash

register, remembers another, and another. Hit the total button, check the

receipt: a grand total of eight, gone now.

The father says the Bowery has always been a barometer. The son says, “The

Bowery told what was going on — what happened here happened later everywhere

else.”

It is tempting to say, glibly, that what happened is that the others cashed in,

that they made a big profit from the real estate boom that remade skid row when

there was mortgage money to be borrowed. Maybe they did, maybe they did not.

The Faermans’ neighbors now include a bank turned catering hall, the scene of

benefits running $500 a person and up. Or, walk a few blocks to a Whole Foods

store. It’s a pricey neighborhood these days. Bernard Faerman says stores rent

for $15,000 a month. Brian Faerman says it is more than that. They own their

building, and the son says it is not for sale.

Their shelves are filled with “tombstones” in different colors: orange, gold,

copper, blue, black, silver. Tombstones are what bartenders call the tallish,

slender machines that ring up beers and martinis and the occasional burger. The

Faermans sell new electronic machines, too, but it is these old ones that are

prized by restaurateurs who want that old-fashioned look behind the bar.

A walk down the aisle at their store is like a little archaeological expedition.

The cash registers show the last total they rang up: 00.55 on that one, who

knows how long ago; 50.76 on this one. That one over there still packs a mean

stomach punch when the drawer flies open.

One machine, the kind that a lot of barber shops used to have, has a bumper

sticker: “1986 N.F.C. Champions — Giants.” They won the Super Bowl that season,

too, defeating Denver, 39-20, in January 1987.

That was nine months before a stock market collapse. Bernard Faerman says

recessions are good for business. “We make more money in recession times than in

good times,” he says. “When people get laid off, they go into any kind of

business, starting up, and they need a cash register.”

The son says, “That’s what I’ve always been told.”

What about now? Are they seeing customers who are starting out on their own?

“Not yet,” he says. He talks about banks that do not lend and a nation that does

not save the stuff that goes into the drawers of the machines they deal in. If

only the economy could be fixed in a day or two, with a handful of tools and a

hair dryer.

“There’s a way certain things were made,” Brian Faerman says. “National Cash

Register was probably the greatest manufacturing company in the world. Not only

did they make their own machines; they made their own tools. They made things

the best, and that’s why these old things still work. It’s a sad thing. Things

are made cheap now.”

Where Cash Registers Go

to Get Their ‘Ka-Ching’ Back, NYT, 10.3.2009,

http://www.nytimes.com/2009/03/10/nyregion/10cash.html

Op-Ed Columnist

Where the Money Is

January 13, 2009

The New York Times

By BOB HERBERT

A trillion here, a trillion there ...

President-elect Barack Obama is warning us to expect trillion-dollar budget

deficits “for years to come.”

The economy is in a precipitous downturn and no one, on the left or right, is

advocating tax increases that would jeopardize a recovery.

In the meantime, we’re spending money as fast as we can: the Troubled Asset

Relief Program ($700 billion and counting); Mr. Obama’s proposed stimulus

program ($800 billion and counting); and important initiatives still to come,

like an overhaul of the way we pay for health care.

China, which has purchased more than $1 trillion of American debt, is getting

antsy. As Keith Bradsher of The Times has reported, the global downturn has

prompted Beijing “to keep more of its money at home, a move that could have

painful effects for U.S. borrowers.”

Mr. Obama has tried to assure the public that his administration will be as

careful as possible with its monumental spending, promising to invest wisely and

manage the expenditures well. And he has made it clear that he is aware of the

minefields that accompany mammoth long-term deficits.

At some point, however, someone is going to have to talk about raising revenue.

The dreaded T-word is going to come up: taxes.

Well, there’s a good idea floating around that takes its cue from the legendary

Willie Sutton. Why not go where the money is?

The economist Dean Baker is a strong advocate of a financial transactions tax.

This would impose a small fee — ranging up to, say, 0.25 percent — on the sale

or transfer of stocks, bonds and other financial assets, including the seemingly

endless variety of exotic financial instruments that have been in the news so

much lately.

According to Mr. Baker, the co-director of the Center for Economic and Policy

Research in Washington, the fees would raise a ton of money, perhaps $100

billion or more annually — money that the government sorely needs.

But there’s another intriguing element to the proposal. While the fees would be

a trivial expense for what the general public tends to think of as ordinary

traders — people investing in stocks, bonds or other assets for some reasonable

period of time — they would amount to a much heavier lift for speculators, the

folks who bring a manic quality to the markets, who treat it like a casino.

“It raises money in a way that comes primarily at the expense of speculation,”

said Mr. Baker. “The fees would be a considerable expense for someone who is

buying futures, or a stock, or any asset at 2 o’clock and then selling it at 3.

The more you trade, the more you pay.

“For the typical person holding stock, who is planning to hold it for a long

period of time, paying the quarter of one percent on a trade is just not that

big a deal.”

The fees, though small, could amount to a big deal for speculators because in

addition to the volume of their trades they often make their money on very small

margins. Someone who buys an asset and then sells it an hour later at a one

percent appreciation might feel quite pleased. He or she would be less pleased

at having to pay a quarter-percent fee to purchase the asset in the first place

and then another quarter percent to sell it.

This, according to Mr. Baker, is part of the beauty of the transfer tax; it

tends to curb at least some speculation. “It’s a very progressive tax,” he said,

“that discourages nonproductive activity.”

A hallmark of the Bush years has been the rampant irresponsibility — by the

White House, Congress and the general public — when it comes to matters of

finance. The costs of the wars in Iraq and Afghanistan were placed on credit

cards and off the books. Their ultimate overall costs will be in the trillions.

Incredibly, President Bush and Congress cut taxes in wartime, which is insane.

Budget deficits and the national debt are streaking toward the moon. And the

only remedy anyone has come up with for fending off Great Depression II has been

deficit spending on a scale reminiscent of World War II.

Excuse me, but did somebody say the baby boomers are about to start retiring?

Maybe the piper will never have to be paid. Maybe the deficits will someday

magically right themselves. Maybe some prosperous future generation will be more

than happy to clean up the mess we left behind.

If none of that is true, we should start looking now for some real money

somewhere. A stock transfer tax is not a bad place to start.

Where the Money Is, NYT,

13.1.2009,

http://www.nytimes.com/2009/01/13/opinion/13herbert.html

Sterling hits record low

against the euro

December 15, 2008

From Times Online

Grainne Gilmore

Sterling tumbled to a new low against the euro today, with some travellers

receiving less than €1 for every pound they exchange at airport terminals and

train stations.

The euro has risen to a record high of 89.98p, coming close to breaking through

the key 90p barrier.

The pound is now at its lowest level since the single currency was introduced in

1999 and has been weakening since the beginning of the year, though the decline

has become more marked in recent days as the UK economy worsens.

Britain is regarded, so far at least, to have been hit harder by the global

slowdown and financial crisis than the 15-nation eurozone.

This week, new figures are expected to show that UK unemployment is worsening,

increasing from 5.8 per cent to 6 per cent, while the number of people claiming

jobless benefits is forecast to have risen by 45,000 in November.

Just a few months ago, travellers could be confident of receiving at least €1.15

or €1.20 for each pound, but that amount has fallen to €1 in many foreign

exchange outlets.

Sharply falling demand for sterling-denominated assets, such as shares in

UK-listed companies, has also helped reduce demand for sterling, which has

dragged the pound lower.

But spread-betting companies are reporting a surge in business as thousands of

private investors in Britain are joining institutional investors in reckoning

that sterling has further to fall.

Sterling hits record low

against the euro, Ts, 15.12.2008,

http://business.timesonline.co.uk/tol/

business/economics/article5345534.ece

Sterling hits new record low

against euro

Wednesday, 10 December 2008

The Independent

By Tamawa Desai, Reuters

Sterling hit a record low against the euro and a basket of currencies today

as pessimism about the UK economy was reinforced by a think tank report showing

a sharp contraction in growth.

The report, which said the nation's economy shrank more than many believe in

the three months to November, kept expectations high that the Bank of England

will continue to cut interest rates aggressively.

The pound extended losses as British finance minister Alistair Darling told

parliament on Wednesday that sterling depreciation would help the country's

exporters.

By 1507 GMT, the pound had fallen to 87.83 pence versus the euro, its weakest

since the single currency was introduced in 1999.

Meanwhile, trade-weighted sterling fell to 79.7, the lowest on a daily basis

according to Bank of England records going back to 1990.

"There's really not much good to say about the pound, although it has already

fallen a long way," said Lee Hardman, currency economist at Bank of

Tokyo-Mitsubishi UFJ.

Given the prospect of lower interest rates and a rising fiscal deficit, "the

risks are still clearly to the downside," he added.

Despite sterling's losses against the euro, it rose 0.6 percent to $1.4829

(GBP=) against a broadly weaker dollar on a slight pullback in risk aversion as

global shares gained on news of a tentative agreement to bail out US carmakers.

The National Institute of Economic and Social Research said on Wednesday

Britain's economy shrank by a full percentage point in the three months to

November and the pace of contraction looked set to accelerate into the end of

the year.

"There is every reason to believe that the output decline in the fourth calendar

quarter of the year will be larger than one percent in magnitude," it said.

The report came on the heels of dismal data in manufacturing, housing and retail

sales on Tuesday, which bolstered expectations that a sharp economic downturn

will put more pressure on the central bank to ease rates further.

"Altogether, these readings made a strong case for the United Kingdom ultimately

suffering the worst recession in the developed world," Commerzbank analysts said

in a research note.

The BoE has cut key interest rates by 300 basis points since October to 2

percent, their lowest since 1951.

BoE policymaker Paul Tucker is appointed deputy governor for financial stability

for a five-year term starting next March, and arch policy dove David

Blanchflower will step down when his term expires in May, Darling told

parliament.

Sterling hits new record

low against euro, I, 10.12.2008,

http://www.independent.co.uk/news/business/news/

sterling-hits-new-record-low-against-euro-1060664.html

Money

Makes the Political World

Go Around

November 2,

2008

Filed at 11:49 a.m. ET

The New York Times

By THE ASSOCIATED PRESS

WASHINGTON

(AP) -- What's your vote worth? Because Barack Obama and John McCain can spend

about $8 to get it.

Together, the two presidential candidates have amassed nearly $1 billion -- a

stratospheric number in a campaign of record-shattering money numbers. Depending

on turnout, $1 billion means nearly $8 for every presidential vote, compared

with $5.50 in 2004.

And that's just McCain and Obama. All the presidential candidates in the

2007-2008 contest took in $1.55 billion, nearly twice the amount collected by

candidates in 2004 and three times the amount from 2000. The total includes

fundraising for the primaries as well as the general election.

Using all that cash, the candidates have traveled more miles, employed more

workers and advertised more than ever.

But it has been Obama, with his $641 million and 3.2 million donors, who has

rewritten the rules for financing campaigns.

He abandoned the public financing system -- after pledging to participate if

McCain did -- and became the first major party candidate to raise private funds

to pay for a general election since the campaign money reforms of the Watergate

era. McCain did take public funds, but Obama's success left little doubt that

taxpayer-supported presidential campaigns, as currently configured, are 20th

century relics.

Neither Obama nor McCain participated in public financing during the primaries.

McCain's acceptance of $84 million in general election public financing also

came with limitations on spending. He continued to raise money for the

Republican Party, though, which so far has spent about $100 million on his

behalf to supplement his public funds.

Obama mastered new technology, turning the Internet into an incredible political

networking tool and attracting record numbers of donors giving less than $200.

While that flood of money raised new questions about the safeguards of Internet

fundraising, it also helped dilute the role of big money donors and fundraisers.

''When you have that many contributors, I think it does, in a weird way, cleanse

the system even though it seems like that much more money,'' the Federal

Election Commission chairman, Republican Donald F. McGahn II, said recently.

''That many more contributors disperse the influence of any one contributor.''

Some of the financial highlights from the presidential campaign:

The total is almost the same as what the Federal Trade Commission says food and

beverage companies spend in a year marketing their products to children.

--Selling politics like burgers: With all that money, Obama has blanketed the

country with his message. As of mid-October, he had spent $240 million on

broadcast ads to penetrate old battlegrounds and to help create new ones. He

spent $77 million in the first two weeks of October, more than McDonald's spends

on ads in a month. He pinpointed audiences with ads on such video games as

''Guitar Hero'' and ''Madden NFL 09.''

He also went global, with national network advertising that culminated with a $4

million-plus half hour buy on prime time six days before the election. His

spending stretched McCain's resources; the Republican had spent about $116

million as of mid-October.

--Bad apple, bad money: Some fundraisers put campaigns in awkward situations.

Barack Obama donated to charity tens of thousands of dollars in donations to his

past campaigns that were linked to convicted Chicago developer Antoin ''Tony''

Rezko. Democratic Sen. Hillary Rodham Clinton returned more than $800,000 to

donors whose contributions were linked to Norman Hsu, a fundraiser who was

wanted in California on charges of bilking investors. Hsu was subsequently

indicted in New York on federal charges of fraud and violating campaign finance

laws.

--Bundle up some cold hard cash: Perfecting a fundraising practice initially

mastered by George W. Bush, presidential candidates enlisted fundraisers to

raise thousands upon thousands of dollars for them. These are the well-connected

money people to whom a campaign is ultimately indebted. Both McCain and Obama

list their fundraisers -- or bundlers, as they are known -- on their Web sites.

McCain's are easier to find than Obama's. But unlike McCain, Obama lists the

fundraisers' home towns.

--Who are those small donors, anyway: Obama has raised about half of his money

in increments of $200 or less. The average contribution is $86, the campaign

says. But the success of the Internet fundraising effort has also led to some

puzzling donors. Individuals have been credited with giving tens of thousands of

dollars to the Obama campaign, far more than the $2,300 limit. Obama has

reported more than $17,000 in contributions from a donor identified as ''Doodad

Pro'' and more than $11,000 from one identified as ''Good Will.''

''I wouldn't be surprised if the FEC doesn't address this in the next couple of

years -- what you have to put on your Web site for soliciting contributions,''

said Bradley A. Smith, a former FEC chairman and a law professor at Capital

University Law School in Columbus, Ohio.

--I show mine, you don't show yours: Federal law requires candidates to identify

only those donors who contribute, in the aggregate, more than $200. But McCain

has made his entire donor database available through his Web site. Obama has

not, drawing criticism.

------

On the Net:

Federal campaign finance law:

http://www.fec.gov/law/feca/feca.shtml

Money Makes the Political World Go Around, NYT, 2.11.2008,

http://www.nytimes.com/aponline/washington/

AP-What-It-Takes.html

Financial crisis

Pound falls to five-year low

as Bank head admits

recession

is here

• Sterling drops 4% against the US dollar

• King says banking turmoil 'almost unimaginable'

• FTSE 100 drops 2% in early trading

Wednesday October 22 2008

10.15 BST

Guardian.co.uk

Graeme Wearden and Ashley Seager

This article was first published on guardian.co.uk

on Wednesday October 22 2008.

It was last updated at 10.18 on October 22 2008.

Sterling was hammered down to a five-year low against the

dollar this morning after Mervyn King admitted for the first time that the UK is

entering a recession.

The pound began tumbling last night as the Bank of England governor told

business leaders in Leeds that the economy is shrinking and hinted at fresh

interest rate cuts.

By this morning it had fallen by seven cents to $1.6209, a drop of more than 4%.

Traders reported frantic selling as investors rushed to cut their losses by

selling the UK currency.

Sterling also fell against the euro, losing around 2% to a low of €1.2636 this

morning. The euro itself fell sharply against other currencies, hitting a

four-and-a-half-year low against the yen, and its lowest value against the

dollar since November 2006.

Shares fell sharply in London this morning, with the FTSE 100 shedding over 100

points, or 2.3%, in early trading to 4127.29.

The pound had already been hit yesterday by unexpectedly gloomy manufacturing

data showing that confidence has collapsed, and King's comments appear to have

added to concern over quite how weak the British economy now is.

Describing the banking system turmoil of recent weeks as "extraordinary, almost

unimaginable," he said the financial system had come closer to collapse two

weeks ago than at any time in the past 90 years.

"The combination of a squeeze on real take-home pay and a decline in the

availability of credit poses the risk of a sharp and prolonged slowdown in

domestic demand. Indeed, it now seems likely that the UK economy is entering a

recession," King said.

"It is surely probable that the drama of the banking crisis, which is

unprecedented in the lifetime of almost all of us, will damage business and

consumer confidence more generally."

His fears were confirmed yesterday as the CBI reported that confidence among

British manufacturers had tumbled to its lowest since July 1980, with output and

orders also collapsing.

The thinktank the National Institute for Economic and Social Research said today

that Britain entered a recession in the third quarter of the year and warns the

slump will probably last for a year or more, making it every bit as painful as

the recessions of the early 1990s or early 1980s.

City commentator David Buik said that King's speech has "put sterling to the

sword for the time being".

The Bank of England cut the cost of borrowing by half a point to 4.5% earlier

this month, as part of coordinated global action, and King hinted that rates may

come down again soon.

"During the past month, the balance of risks to inflation in the medium-term

shifted decisively to the downside," he said.

CMC Markets analyst James Hughes said that the possibility of interest rate cuts

across Europe have made the greenback more attractive - after months in which

traders bet against the dollar.

"Investors continue to flock to the dollar as speculation mounts that central

banks elsewhere will continue with aggressive rate cuts in an attempt to

stimulate growth in the near term," said Hughes.

Official data out on Friday will almost certainly show that the economy

contracted in the July to September period, having not grown at all in the

second quarter. A "technical" recession is defined as two consecutive quarters

of contraction, which experts say is the least Britain can expect this time

round.

Pound falls to

five-year low

as Bank head admits recession is here,

G, 22.10.2008,

http://www.guardian.co.uk/business/2008/oct/22/

pound-recession-interest-rates

A Shortage at the Pump:

Not of Gas, but of 4s

July 15, 2008

The New York Times

By KEN BELSON

If one is the loneliest number, then four is the hottest — at

least when it comes to gasoline.

With regular gas in New York City at a near-record $4.40 a gallon, station

managers are rummaging through their storage closets in search of extra 4s to

display on their pumps. Many are coming up short.

That’s why Vishal Nair, who runs the Lukoil station at Eighth Avenue and 13th

Street in Greenwich Village, took another plastic number last week, turned it

over and scribbled “4” on it with a black magic marker. The result was an

obviously homemade “$4.47,” but it would have to do until he received the extra

4s he ordered months ago.

“Typically, we have a lot of 9s and 1s, and we had a shortage of 3s before we

got a lot of 3s in,” Mr. Nair said.

The missing digits are an unanticipated barometer of how frequently prices are

changing. The average price of regular gasoline in New York City has risen by 35

percent this year, forcing station managers to change their price displays

almost every time they get a delivery, which can be daily at some stations.

Franchises often order numbers from their parent companies, though like

independent station owners, they can buy directly from sign companies. Sets of

40 include equal numbers of each digit, which are magnetic or slip into plastic

holders. Digits, which are often in a Helvetica font, are sold individually for

as little as a $1.50. In New York, numbers must be 4.5 or 9 inches tall.

When prices passed $4, many stations ran out of 4s, and managers improvised by

photocopying signs or stenciling numbers by hand.

The makeshift digits are legal as long as they are similar to the neighboring

numbers, said John Browne, the assistant director of enforcement for the city’s

Department of Consumer Affairs’ petroleum unit.

“As long as the color and size are correct and it is apparent what the number

is, they are fine,” said Mr. Browne, who inspected Mr. Nair’s handiwork last

Friday at the Lukoil station.

Jessica Chittenden, a spokeswoman for the state’s Department of Agriculture and

Markets, which regulates gas stations, said inspectors were being lenient

because prices were changing so rapidly and because few manufacturers made the

signs.

“People are running out of 4s and 5s, so we’re allowing them to post makeshift

numbers as long as they are the right size,” she said.

Sanjay Thakker, president of Gasoline Advertising in Clifton, N.J., said that

sales of his magnetic digits had risen as much as 20 percent this year, though

because it costs only about $10 to outfit the signs above the pumps with enough

numbers, the product is not a huge money maker.

Until extra digits arrive, improvising can be tricky. Alex Kubotki, 27, who runs

the Exxon on Coney Island Avenue at Caton Avenue in Brooklyn, ran out of 4s for

his large sign on the corner. So on Sunday, he painted a fresh “4” that was

roughly the same as the manufactured digit, and avoided using a paper number

because it might bleed in the rain.

“Everybody’s doing the same thing,” he said.

Even stations in New Jersey, where gasoline prices have only recently breached

the $4 barrier, are getting ready. At the Getty station on Tonnelle Avenue in

North Bergen, Jatinder Sarin, the manager, said he will order a bunch of new

magnetic numbers next month. He was selling a gallon of regular gasoline for

$3.85, but assumed that $4 a gallon was inevitable.

“We know it’s going to go up,” he said. “Usually it goes a digit up, and it

stays there five or six months. Let’s hope they stay at 4.”

But back in New York, stations are already grappling with the next problem.

“Now that we seem to be going to go to $5 a gallon,” Mr. Nair said, “we might

order more 5s, too.”

In fact, diesel prices are already over $5 a gallon.

On Monday, at a BP station on Coney Island Avenue and Lancaster Avenue in

Gravesend, Brooklyn, a “2” had been turned upside down to make a 5 for the large

sign on the corner.

“I don’t have enough 5s,” said Serdal Ozumer, 51, a clerk. “I got to talk to the

manager.”

Ann Farmer, Daryl Khan and Nate Schweber

contributed reporting.

A Shortage at the

Pump: Not of Gas, but of 4s, NYT, 15.7.2008,

http://www.nytimes.com/2008/07/15/nyregion/15four.html

Bush

says

strong dollar in U.S. interest

Mon Jun 9,

2008

9:43am EDT

Reuters

By Tabassum Zakaria

WASHINGTON

(Reuters) - U.S. President George W. Bush acknowledged economic concerns as he

left for Europe on Monday, saying the United States was committed to a strong

dollar and that energy prices were high.

"I'll talk about our nation's commitment to a strong dollar. A strong dollar is

in our nation's interests. It is in the interests of the global economy," Bush

said at the White House before departing for a U.S.-European Union summit in

Slovenia.

The dollar tumbled on Friday after a jump in the unemployment rate underscored

the U.S. economy's weakness and was a factor that contributed to the biggest

one-day price gain in the history of the oil market. Oil surged by nearly $11 a

barrel to a record above $139.

Europeans are concerned about the dollar's weakness and have urged the Bush

administration to speak up more forcefully in defense of the U.S. currency.

Since oil is priced in dollars, Europeans blame some of their inflation

pressures on the dollar's weakening value and fear the cheap dollar will make

their products more expensive in U.S. consumer markets.

Bush will discuss the economy with European leaders during his June 9-16 trip,

which will include stops in Germany, Italy, France and Britain.

"Our economy is large and it's open and flexible," Bush said. "Our capital

markets are some of the deepest and most liquid. And the long-term health and

strong foundation of our economy will shine through and be reflected in currency

values."

He said he recognized the public was concerned about the U.S. economy in the

face of rising energy prices.

"A lot of Americans are concerned about our economy," Bush said. "I can

understand why. Gasoline prices are high, energy prices are high."

He said he would discuss with European allies the need to advance technologies

to become less dependent on hydrocarbons. Bush reiterated his stance that the

United States should increase domestic oil production and that Congress should

allow drilling in Alaska's Arctic National Wildlife Refuge.

Record-high oil prices have raised concerns about the impact on the U.S.

economy, which is barely growing. The U.S. unemployment rate jumped to 5.5

percent in May, its highest in more than 3-1/2 years, contributing to renewed

fears that the U.S. economy was at risk of sliding into recession.

"The U.S. economy has continued to grow in the face of unprecedented

challenges," Bush said.

"We got to keep our economies flexible. Both the U.S. economy and European

economies need to be flexible in order to deal with today's challenges," he

said.

Bush said he also would discuss with European allies the need to do more to help

Afghanistan. His wife, Laura, visited Afghanistan during the weekend and

reported that she saw progress but also "there's a lot of work to be done," Bush

said.

(Editing by Bill Trott)

Bush says strong dollar in U.S. interest, R, 9.6.2008,

http://www.reuters.com/article/politicsNews/

idUSN0944596220080609

The currency crunch:

British tourists pay price

for euro's

strength

Today a euro is worth 80p,

an all-time high against the pound.

Bad news for

British holidaymakers –

but are there more serious consequences

of living next

door to the world's strongest currency?

Thursday, 10 April 2008

The Independent

By Martin Hickman, Consumer Affairs Correspondent

Tens of millions of British people will experience their own credit crunch on

holiday this year as the soaring value of the euro forces them to pay more for

everything from the price of a coffee in a Parisian cafe to a hotel room in

Barcelona. As currency traders pushed the European single currency to a record

high against the pound yesterday, holidaymakers were coming to terms with the

fact they now have almost a fifth less spending power on the Continent than a

year ago.

The 17 per cent fall since last February has come about as the euro has

powered ahead on the strength of its member economies, while the pound has

slumped, most recently because of the knock-on effects of the sub-prime collapse

in the US.

The euro's new high of 80p, reached in early trading yesterday, came after the

International Monetary Fund warned that UK growth would only hit 1.6 per cent

this year, compared with the Government's claim of up to 2.25 per cent.

The euro's surge may spur new theories from economists that the currency of the

eurozone will become the main international unit of currency as early as 2015,

upsetting almost the best part of a century of dominance of the dollar.

For holidaymakers, however, the collapse of the pound has an earthier reality

that will curtail their spending power in shops and restaurants in Ireland and

on the Continent. In practice, it means spending money of £500 earmarked for

eating out, trips and presents is now worth only £415 in the 15 eurozone states.

The 42 million foreign holidays a year that British people take are influenced

by affordability and, during the past two years, the cheap dollar has lured

thousands of Britons to stock up on designer jeans and iPods in New York.

However, the majority of foreign holidays, some 31 million, are taken in the

eurozone and going there – and staying there – has become markedly more

expensive.

As a result of the currency fluctuation, a family weekend break to Disneyland in

Paris that would have cost £456 last year costs £533 this month. A day's car

rental in Vienna that would have set back a Briton £56 now costs £67.

And those expecting to savour a meal for two Ferran Adria's acclaimed El Bulli

restaurant in Spain will find the experience has risen in price from £195 to

£236.

Many people who had been hoping to go on holiday to France or Spain may be

forced to change plans and stay at home instead.

Others may look for cheaper destinations outside the eurozone, such as Bulgaria

or Croatia.