|

Vocapedia >

Economy > Housing market > USA

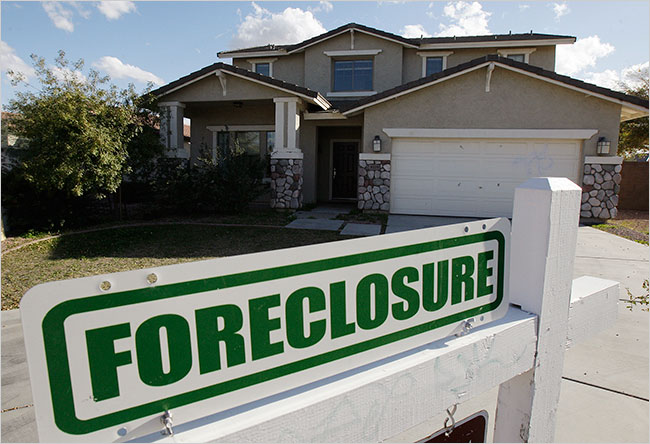

Foreclosure

A foreclosure sign

outside a home for sale in Phoenix earlier

this month.

Photograph: Ross D. Franklin

Associated Press

February 24, 2009

A Sharp Drop in Home Prices at End of Year

NYT

25 February 2009

https://www.nytimes.com/2009/02/25/

business/economy/25econ.html

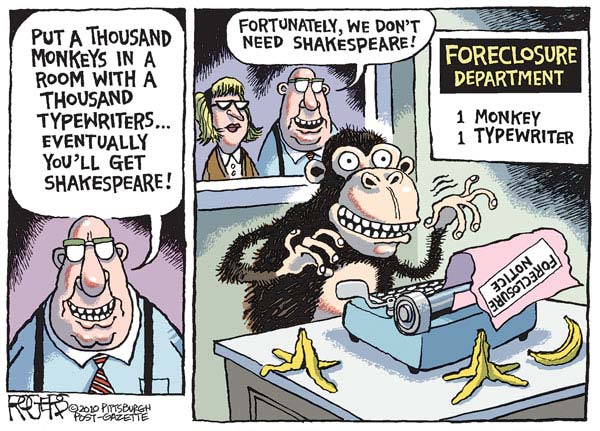

Rob Rogers

The Pittsburgh Post-Gazette

Pennsylvania

Cagle

27 October 2010

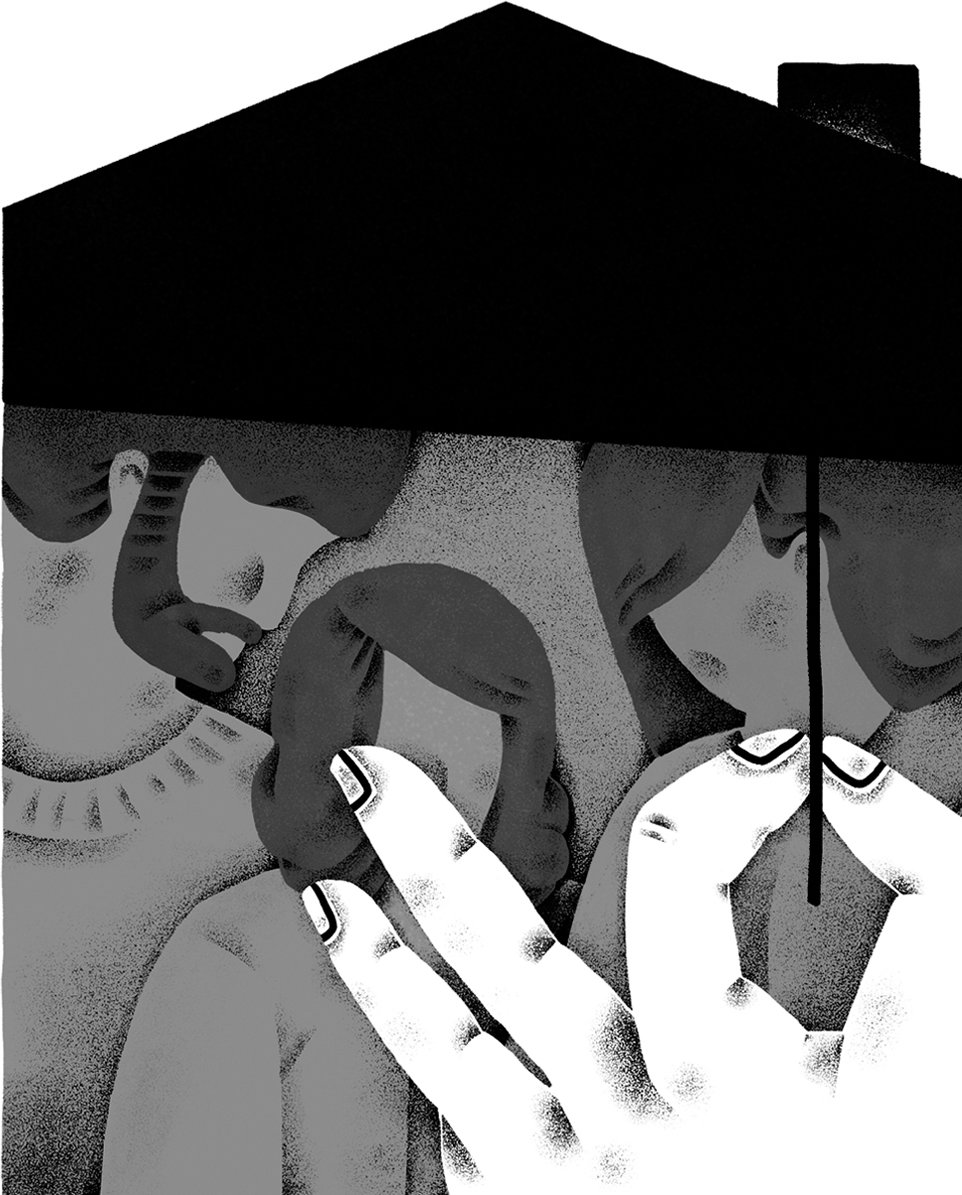

Jeannie Phan

Foreclosure Abuses, Revisited

By THE EDITORIAL BOARD

NYT

OCT. 6, 2015

https://www.nytimes.com/2015/10/06/

opinion/foreclosure-abuses-revisited.html

USA > mortgage giants > Freddie Mac and Fannie Mae

UK / USA

https://www.theguardian.com/business/freddiemacandfanniemae

http://www.nytimes.com/2010/06/20/

business/20foreclose.html

http://www.nytimes.com/2008/07/12/

business/12fannie.html

housing defaults USA

foreclosure USA

https://www.npr.org/2024/05/10/

1197959049/zombie-second-mortgages-homeowners-foreclosure

https://www.npr.org/2023/11/11/

1211855956/veterans-va-loans-foreclosure-covid-forbearance

https://www.propublica.org/article/µ

they-faced-foreclosure-not-from-their-mortgage-lender-

but-from-their-hoa -

April 7, 2022

https://www.nytimes.com/2018/02/06/

nyregion/livery-driver-taxi-uber.html

http://www.npr.org/2016/11/29/

503755613/trumps-potential-treasury-secretary-headed-a-foreclosure-machine

http://www.npr.org/2016/06/02/

480450892/trump-university-documents-reveal-aggressive-tactics-and-foreclosure-profiting

http://www.nytimes.com/2015/10/06/

opinion/foreclosure-abuses-revisited.html

http://www.npr.org/2015/03/30/

396317153/mass-tax-foreclosure-threatens-detroit-homeowners

http://www.nytimes.com/2015/03/30/

business/foreclosure-to-home-free-as-5-year-clock-expires.html

http://www.nytimes.com/2013/09/14/opinion/

deceptive-practices-in-foreclosures.html

http://www.nytimes.com/2013/01/19/business/economy/

fed-transcripts-open-a-window-on-2007-crisis.html

http://www.nytimes.com/2013/01/15/opinion/

nocera-the-foreclosure-fiasco.html

http://www.nytimes.com/2012/12/02/

business/widows-pushed-into-foreclosure-by-mortgage-fine-print.html

http://www.nytimes.com/2011/01/27/

business/27foreclose.html

http://www.nytimes.com/2011/01/09/

business/09foreclosure.html

http://www.cagle.com/news/ChristmasForeclosure10/main.asp

http://www.nytimes.com/2010/12/22/business/22lockout.html

http://www.nytimes.com/2010/10/30/your-money/30money.html

http://www.nytimes.com/2010/10/28/business/28victims.html

http://www.nytimes.com/2010/10/16/opinion/l16econ.html

http://www.nytimes.com/2010/10/16/your-money/mortgages/16money.html

http://www.nytimes.com/2010/10/15/business/15maine.html

http://www.nytimes.com/2010/10/15/opinion/15fri1.html

http://www.nytimes.com/2010/10/12/business/economy/12foreclose.html

http://www.nytimes.com/2010/09/30/business/30mortgage.html

http://www.nytimes.com/2010/04/16/opinion/16fri1.html

http://www.nytimes.com/2010/03/22/us/22foreclose.html

http://www.nytimes.com/2010/03/01/opinion/01mon1.html

http://www.nytimes.com/interactive/2010/01/03/

business/20100103-coral-audioss/index.html#

http://www.nytimes.com/slideshow/2009/12/18/business/

20091223-STRIPPED-slideshow_index.html

http://www.nytimes.com/interactive/2009/10/19/business/economy/

20091019_FORECLOSURE_AUDIOSLIDESHOW/index.html#

http://www.nytimes.com/slideshow/2009/09/30/garden/

20091001-foreclosure-slideshow_index.html

http://video.nytimes.com/video/2009/07/05/us/1194841323227/

this-land-building-then-losing-a-home.html

http://www.nytimes.com/interactive/2009/05/17/nyregion/

new-jersey/20090517_FORECLOSURE.html

http://www.nytimes.com/slideshow/2009/05/17/nyregion/

17mort_index.html

http://www.nytimes.com/2009/06/02/opinion/

02tue1.html

http://www.independent.co.uk/news/media/press/

us-foreclosure-image-is-2008-world-press-photo-1608748.html

http://www.nytimes.com/2009/02/08/us/08lehigh.html

http://www.nytimes.com/2008/11/01/business/01modify.html

http://www.nytimes.com/2008/10/19/nyregion/

19block.html

https://www.reuters.com/article/ousiv/idUSN13571692

20080313

https://www.reuters.com/article/gc03/idUSN25255649

20080226

https://www.reuters.com/article/domesticNews/idUSN01430051

20080204

face foreclosure USA

https://www.npr.org/2023/11/11/

1211855956/veterans-va-loans-foreclosure-covid-forbearance

cartoons > Cagle > Christmas foreclosures

USA December 2010

http://www.cagle.com/news/ChristmasForeclosure10/main.asp

foreclosure filings

USA

http://www.nytimes.com/2010/04/16/opinion/16fri1.html

foreclose

foreclosed house / home / property USA

http://www.nytimes.com/2008/11/11/business/11home.html

http://www.nytimes.com/2008/02/29/us/29walks.html

a house in foreclosure

USA

http://www.nytimes.com/2010/10/30/

your-money/30money.html

homeowner

USA 2008

http://www.reuters.com/article/domesticNews/idUSN1225568420080227

bargain hunter USA

2008

http://www.reuters.com/article/gc03/idUSN1559122220080225

subprime loans

— higher-rate loans to buyers with poor credit

UK / USA 2007-2008

http://www.reuters.com/article/ousiv/idUSWNA706920080313

http://www.reuters.com/article/domesticNews/idUSN2831436420080228

http://www.reuters.com/article/ousiv/idUSN2923266320080303

http://www.guardian.co.uk/business/2008/jan/30/subprimecrisis.creditcrunch

http://www.guardian.co.uk/business/2008/jan/30/europeanbanks.banking1

http://www.guardian.co.uk/business/2007/dec/31/subprimecrisis.creditcrunch

http://www.guardian.co.uk/money/2007/nov/28/lendingfigures.mortgages

loan-modification companies

USA

http://www.nytimes.com/2008/11/24/opinion/24mon1.html

predator / shark USA

http://www.nytimes.com/2008/11/24/opinion/24mon1.html

eviction USA

https://www.nytimes.com/2018/02/06/

nyregion/livery-driver-taxi-uber.html

Corpus of news articles

Economy > Housing market > USA >

Foreclosure

How Good Is the Housing News?

March 7, 2012

The New York Times

The housing market has shown signs of life recently. Home

sales have beat expectations and pending sales neared a two-year high. But

prices — the crucial measure of housing-market health — are still falling,

driven down by increasing levels of distressed sales of foreclosed properties.

That means the market, and the broader economy, which derives much of its

strength from housing, are not out of the woods — not by a long shot.

For too long, President Obama and his team have relied on the banks to

voluntarily modify troubled loans. Those efforts were focused on reducing

monthly payments, not principal — a more powerful form of relief.

Now President Obama is trying again. On Tuesday, he announced a new policy of

easier refinancings for loans that are backed by the Federal Housing

Administration. As part of the settlement announced in February, the major banks

will be required to promote loan modifications for troubled borrowers, including

principal reductions for underwater homeowners.

Mr. Obama has also promised a far-reaching investigation into mortgage abuses

that is supposed to yield more accountability from the banks and more money for

foreclosure prevention. He must deliver.

One thing is sure: Waiting for the situation to self-correct, as Mitt Romney has

recommended, won’t fix the problem. The recent good news on sales has been

driven by pent-up demand and warm winter weather that lured buyers. But more

sales won’t translate into higher prices until foreclosures abate.

In the last quarter of 2011, national home prices fell 4 percent, putting prices

back to levels last seen in mid-2002, according to the Standard &

Poor’s/Case-Shiller price index. Moody’s Analytics estimates that 3.3 million

homes are in or near foreclosure and another 11.5 million underwater homeowners

are at risk of foreclosure if the economy or their finances weaken.

Is help really on the way?

The main component of the administration’s new efforts is the recent foreclosure

settlement between the big banks and state and federal officials. In exchange

for immunity from government civil lawsuits over most foreclosure abuses, the

banks will provide $26 billion worth of relief, including principal write-downs,

to an estimated 1.75 million borrowers. That is a pittance compared with the

losses in the housing bust. But by preventing a chunk of additional

foreclosures, it could help ensure that prices do not fall much further before

bottoming out.

The settlement was announced nearly a month ago, but the specific terms have yet

to be released. One concern is that banks may have leeway to tailor loan

modifications in ways that help them clean up their balance sheets, while

leaving many homeowners deeply underwater. Another is that states may be able to

use money from the settlement for purposes other than foreclosure relief.

The investigation that is supposed to be the powerful follow-up to the

settlement has also gotten off to a worryingly slow start. Announced in January

by Mr. Obama, it still has no executive director, raising questions about the

administration’s commitment to truly holding the banks accountable. The longer

it takes to do an investigation, the longer it will take to secure verdicts or

settlements that would include money for further antiforeclosure efforts.

Because the banks held off on foreclosure while the settlement was being

negotiated, reclosure filings are set to rise in the coming year to more than

two million. That means more pain for struggling homeowners — and the economy.

By this point, homeowners should be inundated with relief, not still anxiously

awaiting help.

How Good Is the Housing News?,

NYT,

7.3.2012,

http://www.nytimes.com/2012/03/08/

opinion/how-good-is-the-housing-news.html

Homeowners

Need Help

August 21,

2011

The New York Times

Neither Congress, nor federal regulators, nor state or federal prosecutors have

yet to conduct a thorough investigation into the mortgage bubble and financial

bust. We welcomed the news that the Justice Department is investigating

allegations that Standard & Poor’s purposely overrated toxic mortgage securities

in the years before the bust. We hope the investigative circle will widen.

But a lot more needs to be done to address the continuing damage from the

mortgage debacle.

Tens of millions of Americans are being crushed by the overhang of mortgage

debt. And Congress and the White House have yet to figure out that the economy

will not recover until housing recovers — and that won’t happen without a robust

effort to curb foreclosures by modifying troubled mortgage loans.

Instead of pushing the banks to do what is needed, the Obama administration has

basically urged them to do their best to help, mainly by reducing interest rates

for troubled borrowers. The banks haven’t done nearly enough. In many instances,

they can make more from fees and charges on defaulted loans than on

modifications.

The administration needs better ideas. It can start by working with Fannie Mae

and Freddie Mac, the government-run mortgage companies, to aggressively reduce

the principal balances on underwater loans and to make refinancing easier for

underwater borrowers. If the president championed aggressive action, and Fannie

and Freddie, which back most new mortgages, also made it clear to banks that

they expect principal reductions, the banks would feel considerable pressure to

go along.

The housing numbers are chilling. Sales of existing homes fell in July by 3.5

percent, while prices were down 4.4 percent in July from a year earlier. In all,

prices have declined 33 percent since the peak of the market five years ago, for

a total loss of home equity of $6.6 trillion.

There’s no letup in sight. Currently, 14.6 million homeowners owe more on their

mortgages than their homes are worth, and nearly half of them are underwater by

more than 30 percent. At present, 3.5 million homes are in some stage of

foreclosure. Nearly six million borrowers have already lost their homes in the

bust.

Reducing principal is a better solution than lowering interest rates, because it

reduces payments and restores equity. Bankers resist, because it could force

them to recognize losses they would prefer to delay. The administration has

resisted, in part because principal reductions are seen as rewarding reckless

borrowers.

But many of today’s troubled borrowers were not reckless. Rather, they are

collateral damage in a bust that has wiped out equity and hammered jobs, turning

what were reasonable debt levels into unbearable burdens.

Housing advocates and bankruptcy experts are calling for the administration to

try new approaches. One would have Fannie and Freddie urge banks to let

underwater borrowers who file for bankruptcy apply their monthly mortgage

payments to principal for five years — in effect, reducing the loan’s interest

rate to zero.

Another solution would be for Fannie and Freddie to ease the rule for

refinancing underwater mortgages for borrowers who are current in their

payments. The lower payments on refinanced loans would help to prevent defaults

and free up money for borrowers to use for paying down principal or consumer

spending.

President Obama is reportedly planning to include housing relief measures in his

new jobs plan. Unless the plan includes strong support for principal reductions

and easier refinancings, it will not get at the root of the problem: too much

mortgage debt and too little relief.

Homeowners Need Help, NYT, 21.8.2011,

http://www.nytimes.com/2011/08/22/opinion/homeowners-need-help.html

Cost of Seizing Fannie and Freddie

Surges for Taxpayers

June 19, 2010

The New York Times

By BINYAMIN APPELBAUM

CASA GRANDE, Ariz. — Fannie Mae and Freddie Mac took over a foreclosed home

roughly every 90 seconds during the first three months of the year. They owned

163,828 houses at the end of March, a virtual city with more houses than

Seattle. The mortgage finance companies, created by Congress to help Americans

buy homes, have become two of the nation’s largest landlords.

Bill Bridwell, a real estate agent in the desert south of Phoenix, is among the

thousands of agents hired nationwide by the companies to sell those

foreclosures, recouping some of the money that borrowers failed to repay. In a

good week, he sells 20 homes and Fannie sends another 20 listings his way.

“We’re all working for the government now,” said Mr. Bridwell on a recent

sun-baked morning, steering a Hummer through subdivisions laid out like circuit

boards on the desert floor.

For all the focus on the historic federal rescue of the banking industry, it is

the government’s decision to seize Fannie Mae and Freddie Mac in September 2008

that is likely to cost taxpayers the most money. So far the tab stands at $145.9

billion, and it grows with every foreclosure of a three-bedroom home with a

two-car garage one hour from Phoenix. The Congressional Budget Office predicts

that the final bill could reach $389 billion.

Fannie and Freddie increased American home ownership over the last half-century

by persuading investors to provide money for mortgage loans. The sales pitch

amounted to a money-back guarantee: If borrowers defaulted, the companies

promised to repay the investors.

Rather than actually making loans, the two companies — Fannie older and larger,

Freddie created to provide competition — bought loans from banks and other

originators, providing money for more lending and helping to hold down interest

rates.

“Our business is the American dream of home ownership,” Fannie Mae declared in

its mission statement, and in 2001 the company set a target of helping to create

six million new homeowners by 2014. Here in Arizona, during a housing boom

fueled by cheap land, cheap money and population growth, Fannie Mae executives

trumpeted that the company would invest $15 billion to help families buy homes.

As it turns out, Fannie and Freddie increasingly were channeling money into

loans that borrowers could not afford. As defaults mounted, the companies

quickly ran low on money to honor their guarantees. The federal government,

fearing that investors would stop providing money for new loans, placed the

companies in conservatorship and took a 79.9 percent ownership stake, adding its

own guarantee that investors would be repaid.

The huge and continually rising cost of that decision has spurred national

debate about federal subsidies for mortgage lending. Republicans want to sever

ties with Fannie and Freddie once the crisis abates. The Obama administration

and Congressional Democrats have insisted on postponing the argument until after

the midterm elections.

In the meantime, Fannie and Freddie are, at public expense, removing owners who

cannot afford their homes, reselling the houses at much lower prices and

financing mortgage loans for the new owners.

The two companies together accounted for 17 percent of real estate sales in

Arizona during the first four months of the year, almost three times their share

of the market during the same period last year, according to an analysis by MDA

DataQuick.

Valarie Ross, who lives in the Phoenix suburb of Avondale, has watched six of

the nine homes visible from her lawn chair emptied by moving trucks during the

last year. Four have been resold by the government. “One by one,” she said.

“Just amazing.”

The population of Pinal County, where Mr. Bridwell lives and works, roughly

doubled to 340,000 over the last decade. Developers built an entirely new city

called Maricopa on land assembled from farmers. Buyers camped outside new

developments, waiting to purchase homes. One builder laid out a 300-lot

subdivision at the end of a three-mile dirt road and still managed to sell 30 of

the homes.

Mr. Bridwell sold plenty of those houses during the boom, then cut workers as

prices crashed. Now his firm, Golden Touch Realty, again employs as many people

as at the height of the boom, all working exclusively for Fannie Mae. The

payroll now includes a locksmith to secure foreclosed homes and two clerks

devoted to federal paperwork.

Golden Touch gets more listings from Fannie Mae than any other firm in Pinal

County. Mr. Bridwell said he was ready to jump because he remembered the last

time the government ended up owning thousands of Arizona houses, after the

late-1980s collapse of the savings and loan industry.

“The way I see it,” said Mr. Bridwell, whose glass-top desk displays membership

cards from the Republican National Committee, “is that we’re getting these homes

back into private hands.”

Selling a house generally costs the government about $10,000. The outsides are

weeded and the insides are scrubbed. Stolen appliances are replaced, brackish

pools are refilled. And until the properties are sold, they must be maintained.

Fannie asks contractors to mow lawns twice a month during the summer, and pays

them $80 each time. That’s a monthly grass bill of more than $10 million.

All told, the companies spent more than $1 billion on upkeep last year.

“We may be behind many loans on the same street, so we believe that it’s in

everyone’s best interest to aggressively do property maintenance,” said Chris

Bowden, the Freddie Mac executive in charge of foreclosure sales.

Prices have plunged. So by the time a home is resold, Fannie and Freddie on

average recoup less than 60 percent of the money the borrower failed to repay,

according to the companies’ financial filings. In Phoenix and other areas where

prices have fallen sharply, the losses often are larger.

Foreclosures punch holes in neighborhoods, so residents, community groups and

public officials are eager to see properties reoccupied. But there also is

concern that investors are buying many foreclosures as rental properties, making

it harder for neighborhoods to recover.

Real estate agents tend to favor investors because the sales close surely and

quickly and there is the prospect of repeat business. But community advocates

say that Fannie and Freddie have an obligation to sell houses to homeowners.

David Adame worked for Fannie Mae’s local office during the boom, on programs to

make ownership more affordable. Now with prices down sharply, Mr. Adame sees a

second chance to put people into homes they can afford.

“Yes, move inventory,” said Mr. Adame, now an executive focused on housing

issues at Chicanos por la Causa, a Phoenix nonprofit group, “but if we just move

inventory to investors, then what are we doing?”

Executives at both Fannie and Freddie say they have an overriding obligation to

limit losses, but that they are taking steps to sell more homes to families.

Fannie Mae last summer announced that it would give people seeking homes a

“first look” by not accepting offers from investors in the first 15 days that a

property is on the market. It also offers to help buyers with closing costs, and

prohibits buyers from reselling properties at a profit for 90 days, to

discourage speculation. Fannie Mae said that 68.4 percent of buyers this year

had certified that they would use the house as a primary residence.

Freddie Mac has adopted fewer programs, but it said it had sold about the same

share of foreclosures to owner-occupants.

The companies also have agreed to sell foreclosed homes to nonprofits using

grants from the federal Neighborhood Stabilization Program. Chicanos por la

Causa, which won $137 million under the program in partnership with nonprofits

in eight other states, plans to buy more than 200 homes in Phoenix in the next

two years. It plans to renovate them to sell to local families.

The scale of such efforts is small. The home ownership rate in Phoenix continues

to fall as foreclosures pile up and renters replace owners.

But John R. Smith, chief of Housing Our Communities, another Phoenix-area group

using federal money to buy foreclosures, says he tries to focus on salvaging one

property at a time.

“I tell them, ‘O.K., you want to unload 10 houses to that guy, fine,’ ” he said.

“ ‘Now give me this one. And this one. And one over here.’ ”

Cost of Seizing Fannie

and Freddie Surges for Taxpayers, NYT, 19.6.2010,

http://www.nytimes.com/2010/06/20/business/20foreclose.html

Finding in Foreclosure a Beginning,

Not an End

March 21, 2010

The New York Times

By JOHN LELAND

BOSTON — Jane Petion lived in her home for 15 years and saw

its value rise slowly, rise rapidly and, when the housing bubble burst, plunge

at a sickening pace that left her owing $400,000 on a house worth closer to

$250,000. Last June, her lender foreclosed on the property. The family received

notices of eviction and appeared in housing court.

Then they discovered a surprising paradox within the nation’s housing crisis:

Their power to negotiate began after foreclosure, rather than ending there.

In December Ms. Petion signed a new mortgage on her house for $250,000, with

monthly payments of less than half the previous level. She and her husband now

have a mortgage they can afford in a neighborhood that benefits from the

stability they provide. A nonprofit lender made the deal possible by buying the

house from her original mortgage company and selling it to her for 25 percent

more than its purchase price — a gain to hedge against future defaults.

“It was exactly what we needed to get back on our feet,” said Ms. Petion, who

works for a state agency. “We have income. But another bank, it would have been

easy to look at our foreclosure and say, ‘I’m sorry, we have nothing for you

now.’ ”

This counterintuitive solution — intervening after foreclosure rather than

before — is the brainchild of Boston Community Capital, a nonprofit community

development financial institution, and a housing advocacy group called City

Life/Vida Urbana, working with law students and professors at Harvard Law

School.

Though the program, which started last fall, is small so far, there is no reason

it cannot be replicated around the country, especially in areas that have had

huge spikes in housing prices, said Patricia Hanratty of Boston Community

Capital. “If what you’ve got is a real estate market that went nuts and a

mortgage market that went nuts, what you’ve got is an opportunity.”

Two years into the nation’s housing meltdown, and after hundreds of billions of

dollars of federal rescue programs, government officials and housing advocates

denounce the unwillingness of lenders to adjust the balances on homes that are

worth less than the mortgage owed on them.

Research suggests that such disparity, rather than exotic interest rates, is the

main driver of foreclosures, in tandem with a job loss or another financial

setback. The financial industry lobbied aggressively to defeat legislation that

would empower bankruptcy judges to adjust mortgage balances to properties’

market value.

That reluctance, however, eases after foreclosure, when lenders find themselves

holding properties they need to unload, Ms. Hanratty said.

“We found, frankly, the industry wasn’t ready to do much pre-foreclosure,” she

said. “But once it was either on the cusp of foreclosure or had been taken into

the bank portfolio, banks really do not want to hold on to these properties

because they don’t know how to manage them, don’t know what to do with them.”

Working with borrowed money, Boston Community Capital buys homes after

foreclosure and sells or rents them to their previous owners, providing new

mortgages and counseling to the owners, who typically have ruined credit. During

the process the families remain in their homes. Since late fall it has completed

or nearly completed deals on 50 homes, with an additional 20 in progress, Ms.

Hanratty said. The organization is now trying to raise $50 million to expand the

program.

Steve Meacham, an organizer at City Life/Vida Urbana, is one reason banks may be

willing to sell their foreclosed properties to Boston Community Capital. When

families receive eviction notices, his group holds demonstrations or blockades

outside the properties, calling on lenders to sell at market value. It also

connects the residents with the Harvard Legal Aid Bureau, whose students work to

pressure lenders to sell rather than evict by prolonging eviction and “driving

up litigation costs,” said Dave Grossman, the clinic’s director.

“So they’re being defended legally, and we’re ramping up the pressure

publicity-wise,” Mr. Meacham said. “And B.C.C. came in; they had a part that

buys properties and a part that writes mortgages. It wouldn’t work without all

three.”

A focus of the program has been the working-class neighborhood of Dorchester,

where home prices dropped 40 percent between 2005 and 2007, compared with a 20

percent drop statewide, according to research by the Federal Reserve Bank of

Boston. Foreclosures and delinquencies there are more than twice the state

average, the bank found.

In such neighborhoods, lenders and residents are hurt by evictions, which often

leave vacant properties that invite crime and drive down values of neighboring

houses, Ms. Hanratty said. “So it’s in the lenders’ interest to get fair market

value as quickly as possible, and in the interest of the community to have as

little displacement as possible.”

The program is not a solution for all lenders or distressed homeowners. After

months of post-foreclosure negotiations with her bank, Ursula Humes, a transit

police detective, is waiting for her final 48-hour eviction notice. Her

belongings are in boxes.

Mrs. Humes owed $440,000 on her home; her lender offered to sell it to Boston

Community Capital for $260,000. But after assessing Mrs. Hume’s finances, the

nonprofit asked for a lower selling price, and the lender refused.

On a recent evening, Mr. Grossman of the Harvard law clinic counseled Mrs. Humes

on her options. “This is a case that doesn’t have a happy ending,” Mr. Grossman

said.

Mrs. Humes said, “I depleted my retirement account and everything I owned, but

I’m still going to lose it.”

Many commercial lenders, similarly, would shy away from such a program because

it involves writing mortgages for borrowers who have already defaulted once — a

high risk for a small reward.

For other homeowners, though, the program is a rescue at the last possible

second. Roberto Velasquez, a building contractor, lost his home to foreclosure

last November, owing the lender $550,000. After extensive wrangling, during

which his family stayed in the house, he bought it again in March for $280,000,

a price he can afford.

On the night after he closed, he joined other members of City Life/Vida Urbana

at a foreclosed four-unit building in Dorchester from which most of the tenants

had been evicted. A group of artists projected videos on sheets in the windows,

showing silhouettes of families re-enacting their last 72 hours before eviction.

Garbage filled one of the units. Mr. Velasquez said it hurt to stand amid such

loss, but he was jubilant at his own perseverance.

“We’ve been fighting for so long,” he said, “and we win, because we’re still in

the house.”

Finding in

Foreclosure a Beginning, Not an End, NYT, 22.3.2010,

http://www.nytimes.com/2010/03/22/us/22foreclose.html

U.S. Mortgage Delinquencies

Reach a Record High

November 20, 2009

The New York Times

By DAVID STREITFELD

The economy and the stock market may be recovering from their swoon, but more

homeowners than ever are having trouble making their monthly mortgage payments,

according to figures released Thursday.

Nearly one in 10 homeowners with mortgages was at least one payment behind in

the third quarter, the Mortgage Bankers Association said in its survey. That

translates into about five million households.

The delinquency figure, and a corresponding rise in the number of those losing

their homes to foreclosure, was expected to be bad. Nevertheless, the figures

underlined the level of stress on a large segment of the country, a situation

that could snuff out the modest recovery in home prices over the last few months

and impede any economic rebound.

Unless foreclosure modification efforts begin succeeding on a permanent basis —

which many analysts say they think is unlikely — millions more foreclosed homes

will come to market.

“I’ve been pretty bearish on this big ugly pig stuck in the python and this

cements my view that home prices are going back down,” said the housing

consultant Ivy Zelman.

The overall third-quarter delinquency rate is the highest since the association

began keeping records in 1972. It is up from about one in 14 mortgage holders in

the third quarter of 2008.

The combined percentage of those in foreclosure as well as delinquent homeowners

is 14.41 percent, or about one in seven mortgage holders. Mortgages with

problems are concentrated in four states: California, Florida, Arizona and

Nevada. One in four people with mortgages in Florida is behind in payments.

Some of the delinquent homeowners are scrambling and will eventually catch up on

their payments. But many others will slide into foreclosure. The percentage of

loans in foreclosure on Sept. 30 was 4.47 percent, up from 2.97 percent last

year.

In the first stage of the housing collapse, defaults and foreclosures were

driven by subprime loans. These loans had low introductory rates that quickly

moved to a level that was beyond the borrower’s ability to pay, even if the

homeowner was still employed.

As the subprime tide recedes, high-quality prime loans with fixed rates make up

the largest share of new foreclosures. A third of the new foreclosures begun in

the third quarter were this type of loan, traditionally considered the safest.

But without jobs, borrowers usually cannot pay their mortgages.

“Clearly the results are being driven by changes in employment,” Jay Brinkmann,

the association’s chief economist, said in a conference call with reporters.

In previous recessions, homeowners who lost their jobs could sell the house and

move somewhere with better prospects, or at least a cheaper cost of living. This

time around, many of the unemployed are finding that the value of their property

is less than they owe. They are stuck.

“There will be a lot more distressed supply entering the market, and it will

move up the food chain to middle- and higher-price homes,” said Joshua Shapiro,

chief United States economist for MFR Inc.

Many analysts say they believe that foreclosures, instead of peaking with the

unemployment rate as they traditionally do, will most likely be a lagging

indicator in this recession. The mortgage bankers expect foreclosures to peak in

2011, well after unemployment is expected to have begun falling.

There was one sliver of good news in the survey: the percentage of loans in the

very first stage of default — no more than 30 days past due — was down slightly

from the second quarter. If that number continues to decline, at least the ranks

of the defaulted will have peaked.

“It’s arguably a positive, but it doesn’t undermine the fact that there are

still five or six million foreclosures in process,” Ms. Zelman said.

The number of loans insured by the Federal Housing Administration that are at

least one month past due rose to 14.4 percent in the third quarter, from 12.9

percent last year. An additional 3.3 percent of F.H.A. loans are in foreclosure.

The mortgage group’s survey noted, however, that the F.H.A. was issuing so many

loans — about a million in the last year — that it had the effect of masking the

percentage of problem loans at the agency. Most loans enter default when they

are older than a year.

When the association removed the new loans from its calculations, the percentage

of F.H.A. mortgages entering foreclosure was 30 percent higher.

The association’s survey is based on a sample of more than 44 million mortgage

loans serviced by mortgage companies, commercial and savings banks, credit

unions and others. About 52 million homes have mortgages. There are 124 million

year-round housing units in the country, according to the Census Bureau.

U.S. Mortgage

Delinquencies Reach a Record High, NYT, 20.11.2009,

http://www.nytimes.com/2009/11/20/business/20mortgage.html

Editorial

Foreclosures: No End in Sight

June 2, 2009

The New York Times

A continuing steep drop in home prices combined with rising

unemployment is powering a new wave of foreclosures. Unfortunately, there’s

little evidence, so far, that the Obama administration’s anti-foreclosure plan

will be able to stop it.

The plan offers up to $75 billion in incentives to lenders to reduce loan

payments for troubled borrowers. Since it went into effect in March, some

100,000 homeowners have been offered a modification, according to the Treasury

Department, though a tally is not yet available on how many offers have been

accepted.

That’s a slow start given the administration’s goal of preventing up to four

million foreclosures. It is even more worrisome when one considers the size of

the problem and the speed at which it is spreading. The Mortgage Bankers

Association reported last week that in the first three months of the year, about

5.4 million mortgages were delinquent or in some stage of foreclosure.

Not all of those families will lose their homes. Some will find the money to

catch up on their payments. Others will qualify for loan modifications that

allow them to hang on. But as borrowers become more hard pressed, lenders —

whose participation in the Obama plan is largely voluntary — may not be able or

willing to keep up with the spiraling demand for relief.

One of the biggest problems is that the plan focuses almost entirely on lowering

monthly payments. But overly onerous payments are only part of the problem. For

15.4 million “underwater” borrowers — those who owe more on their mortgages than

their homes are worth — a lack of home equity puts them at risk of default, even

if their monthly payments have been reduced. They have no cushion to fall back

on in the event of a setback, like job loss or illness.

This page has long argued that a robust anti-foreclosure plan should directly

address the plight of underwater homeowners by reducing the loans’ principal

balance. That would restore some equity to borrowers — and give them a further

incentive to hold on to their homes — in addition to lowering monthly payments.

The mortgage industry has resisted this approach, and the Obama plan does not

emphasize it.

With joblessness rising, lower monthly payments could quickly become

unaffordable for many Americans. In a recent report, researchers at the Federal

Reserve Bank of Boston argued that unemployment is driving foreclosures and to

make a difference, anti-foreclosure policy should focus on helping unemployed

homeowners. The report suggests a temporary program of loans or grants to help

them pay their mortgages while they look for another job.

The government will also have to make far more aggressive efforts to create

jobs. The federal stimulus plan will preserve and generate a few million jobs,

but that will barely make a dent — in the overall economic crisis or the

foreclosure disaster. Since the recession began in December 2007, nearly six

million jobs have been lost, and millions more are bound to go missing before

this downturn is over.

President Obama needs to put more effort and political capital into promoting

the middle-class agenda that he outlined during the campaign, including a push

for new jobs in new industries, expanded union membership and a fairer

distribution of profits among shareholders, executives and employees.

There will be no recovery until there is a halt in the relentless rise in

foreclosures. Foreclosures threaten millions of families with financial ruin. By

driving prices down, they sap the wealth of all homeowners. They exacerbate bank

losses, putting pressure on the still fragile financial system. Lower monthly

payments are a balm, but they are no substitute for home equity. And until more

Americans can find a good job and a steady paycheck, the number of foreclosures

will continue to rise.

Foreclosures: No End

in Sight, NYT, 2.6.2009,

http://www.nytimes.com/2009/06/02/opinion/02tue1.html

A Sharp Drop in Home Prices

at End of Year

February 25, 2009

The New York Times

By JACK HEALY

Home prices in the United States plunged at the fastest pace on record in

December, a sign that housing is likely to continue declining in the months

ahead as the economy sinks deeper into recession.

Single-family home values in 20 major metropolitan areas fell 18.5 percent in

December compared with a year earlier, according to a data released Tuesday by

Standard & Poor’s Case-Shiller home price index. Housing prices dropped 2.5

percent from November to December.

Nationwide, housing prices in the last three months of 2008 sank to their lowest

levels since the third quarter of 2003.

Prices fell in all of the 20 cities surveyed by Case-Shiller, but the declines

were starkest in Phoenix and Las Vegas as well as much of Florida and Southern

California, where development has all but dried up.

“The Sun Belt continues to get hardest hit in terms of just about any measure,”

said David M. Blitzer, chairman of Standard & Poor’s index committee.

Prices in Phoenix fell 5.1 percent in December alone, and were down 34 percent

since December 2007. In Las Vegas, which was recently rated “America’s emptiest

city” by Forbes magazine, prices dropped 4.8 percent in December and were down

33 percent for the year.

The declines for 2008 were shallowest in Dallas and Denver, where prices fell

about 4 percent.

Housing prices are now falling so quickly that economists worried that potential

buyers will stay on the sidelines and wait for the market to deteriorate

further, reinforcing the downward momentum.

“It’s a deflationary spiral,” said Dan Greenhaus, an analyst in the equity

strategy division of Miller Tabak & Company. “Prices go down, people hold back,

prices go down further, people hold back, and so on and so forth.” Although

houses are now cheaper and mortgage rates have fallen to 5.22 percent from 6.10

percent about a year ago, the rapidly deteriorating economy and rising

unemployment have scared off potential buyers, economists said. The unemployment

rate has risen to 7.6 percent nationwide, and the economy is shedding more than

500,000 jobs every month.

“We continue to believe that it is unlikely that we are anywhere near a bottom

in nationwide home prices,” Joshua Shapiro, chief United States economist at

MFR, wrote in a note.

Since the recession began in December 2007, the pace of declines in housing

prices has accelerated as the financial crisis spread and unemployment rose.

According to the National Association of Realtors, the country’s median home

price was $175,400 in December, down nearly 25 percent from its peak of $230,100

in July 2006.

The two-year decline in real-estate prices followed more than a decade of steady

growth in home prices.

A Sharp Drop in Home

Prices at End of Year, NYT, 25.2.2009,

http://www.nytimes.com/2009/02/25/business/economy/25econ.html

New Home Sales

Post 14.7 Pct Drop in December

January 29, 2009

Filed at 11:34 a.m. ET

The New York Times

By THE ASSOCIATED PRESS

WASHINGTON (AP) -- Sales of new homes plunged to the slowest

pace on record last month as the hobbled homebuilding industry posted its worst

annual sales results in more than two decades.

The Commerce Department said Thursday that new home sales fell 14.7 percent in

December to a seasonally adjusted annual rate of 331,000, from a downwardly

revised November figure of 388,000.

''This is an awful report...Builders just can't cut back fast enough, so prices

remain under downward pressure,'' Ian Shepherdson, chief U.S. economist for High

Frequency Economics, wrote in a research note.

December's sales pace was the lowest on records dating back to 1963. Economists

surveyed by Thomson Reuters had expected sales would fall to a rate of 400,000

homes.

For 2008, builders sold 482,000 homes, the weakest results since 1982, when

412,000 homes were sold.

The median price of a new home sold in December was $206,500, a drop of 9.3

percent from a year ago. The median is the point where half the homes sold for

more and half for less.

Builders have been forced to slash production during a prolonged and severe

slump in housing that has seen sales and prices plummet. December's sales

activity was depressed by the worst financial crisis in seven decades, which has

made it harder for potential buyers to get mortgage loans.

The inventory of unsold new homes stood at a seasonally adjusted 357,000 in

December, down 10 percent from November. But at the current sales pace, it would

take a more than a year to exhaust the stock as houses are dumped onto a market

already glutted by a tide of foreclosures.

''The inventory of unsold new homes is still too high,'' wrote Joshua Shapiro,

chief U.S. economist at MFR Inc. ''Prices need to fall further to stimulate

sufficient demand to begin to balance the market.''

The sales weakness in December reflected a 28 percent drop in the Northeast and

a 20 percent drop in the West. The South and Midwest posted smaller declines of

12 percent and almost 6 percent, respectively.

Earlier this month, a key gauge of homebuilders' confidence sank to a new record

low, as the deepening U.S. recession and rising unemployment erode chances for a

housing turnaround.

Sales of existing homes, however, posted an unexpected increase last month, as

consumers snapped up bargain-basement foreclosures in California and Florida.

Sales of existing homes rose 6.5 percent from November's pace, the National

Association of Realtors said Monday.

New Home Sales Post

14.7 Pct Drop in December, NYT, 29.1.2009,

http://www.nytimes.com/aponline/2009/01/29/business/AP-New-Home-Sales.html

Editorial

Mortgages and Minorities

December 9, 2008

The New York Times

The mortgage crisis that has placed millions of Americans at risk of losing

their homes has been especially devastating for black and Hispanic borrowers and

their families. It seems clear at this point that minorities were more likely

than whites to be steered into risky, high-priced loans — even when researchers

controlled for such crucial factors as income, loan size and location.

The Congress that takes office in January can start to deal with this problem by

strengthening fair-lending laws, especially the Community Reinvestment Act,

which encourages fair, sound lending practices while requiring banks to lend,

invest and open branches in low- and moderate-income areas.

Lawmakers should also extend that law to cover the often fly-by-night

mortgage-lending companies that helped drive the subprime crisis. Those

companies saddled entire neighborhoods with risky, high-priced loans that

borrowers could never hope to pay back, sold those loans to Wall Street and then

went out of business.

Congress needs to keep in mind that many of those players are surely to be back

in operation somewhere down the line. Some already have returned in the guise of

offering to help homeowners avoid foreclosure.

The need to revisit fair-lending law is evident in numerous studies of federal

lending data. A particularly striking analysis in 2006 by the National Community

Reinvestment Coalition found that nearly 55 percent of loans to

African-Americans, 40 percent of loans to Hispanics and 35 percent of loans to

American Indians fell into the high-cost category, as opposed to about 23

percent for whites. There also were troubling gender differences. Women got

less-favorable terms than men.

A classic discrimination study by the reinvestment coalition found that black

and Hispanic people who posed as borrowers received significantly worse

treatment and were offered costlier, less-attractive loans more often than

whites — even though minority testers had been given more attractive financial

profiles, including better credit standings and employment tenures. That study,

and others, go a long way to rebutting mortgage companies’ claims that lending

patterns are explained by so-called risk characteristics like credit scores.

John Taylor, the coalition’s president, told a Congressional hearing last year,

that minority borrowers were paying a “race tax.” While lenders are required to

report to the federal government such things as race, gender, census tract,

amount of loan and income, they omit credit score data. By guarding the single

most important statistic used in making loans, the lenders have given themselves

a ready shield against charges of discrimination.

But with indications of discrimination popping up everywhere, Congress has no

choice but to require lenders to report on all data that form the basis of

lending decisions, including data that would permit neutral third parties to

determine whether lenders were discriminating by race. Ideally, lenders would

have to report, not just on the borrower’s credit worthiness, but on details of

the terms and conditions of the loan itself.

Looking back, it’s hard to say whether such reporting requirements would have

forestalled the subprime crisis. Certainly, they would have given consumer

advocates and regulators more information earlier on. There is no excuse for not

putting them in place now to avoid the possibility of history repeating itself

and having all those risky, high-priced loans issued and sold off as securities

before anyone intervenes.

Mortgages and

Minorities, NYT, 9.12.2008,

http://www.nytimes.com/2008/12/09/opinion/09tue1.html

House prices fall

at fastest pace in 25 years

December 4, 2008

From Times Online

Rosie Lavan

British house prices tumbled at a record 16.1 per cent in November, marking

the sharpest drop in property values for a quarter of a century.

Figures released this morning by Halifax revealed that prices fell 2.6 per cent

in November compared with October, and are 16.1 per cent lower than in November

2007.

The year-on-year decline is deeper than falls recorded during the last recession

in the early 1990s, and is the biggest drop since 1983.

The shock fall emerged just hours before the Bank of England's Monetary Policy

Commitee (MPC) cut the interest rate again by 1 per cent to 2 per cent, after

last month reducing borrowing costs by 1.5 per cent to 3 per cent.

The reduction is likely to be accompanied by a rate cut by the European Central

Bank, which is predicted to fall by 50 basis points in the 15-nation eurozone.

Howard Archer, chief UK and European economist at IHS Global Insight, said:

"Ongoing very tight credit conditions, still relatively stretched housing

affordability on a number of measures, faster rising unemployment, muted income

growth and widespread expectations that house prices form a powerful set of

negative factors are weighing down on the housing market."

The average price of a house in the UK is back to the July 2005 level of

£163,445, but this is 124 per cent higher — or £90,000 — than the figure in

November 1998.

Mr Archer said Halifax's figures had placed further, last-minute pressure on the

Bank to deliver a large cut in rates.

IHS Global Insight predicted that interest rates would fall as low as 0.5 per

cent in the first half of the new year, and could be reduced even further.

Central banks around the world have cut interest rates ahead of today's moves.

Sweden's central bank today cut its key rate by a record 175 basis points, to 2

per cent, the third reduction since October and the biggest since 1992. It

expects rates to remain at 2 per cent throughout next year.

The Riksbank said there was an "unexpectedly rapid and clear deterioration in

economic activity since October".

New Zealand also announced a record cut of 150 basis points, bringing its rate

down to a five-year low of 5 per cent and acknowledging that further cuts would

probably be necessary.

Indonesia made a surprise 25 basis-point cut to its rate. This reduction, the

first since December last year, takes the interest rate to 9.25 per cent.

Yesterday, the Bank of Thailand cut rates by 100 basis points to 2.75 per cent,

partly in response to the recent political turmoil during which the ruling party

was dissolved and the Prime Minister forced out of office.

On Tuesday, the Reserve Bank of Australia surprised with a

larger-than-anticipated 100 basis-point cut to 4.25 per cent.

But Mr Archer added that: "...it is highly questionable how much of further

interest rate cuts by the Bank of England that mortgage lenders would pass on."

Yesterday, Gordon Brown unveiled a rescue package for homeowners who struggle to

meet their mortgage repayments if they lose their jobs or suffer a severe drop

in income.

Those with loans of up to £400,000 — typically borrowers on upper and middle

incomes — will be able to cut payments, with the taxpayer underwriting the risk

of default.

The emergency state guarantee, which will enable homeowners to defer mortgage

interest payments for up to two years, was announced unexpectedly in the debate

following the Queen's Speech yesterday.

The Prime Minister said eight big lenders which account for 70 per cent of the

market — HBOS, Abbey, Nationwide, Lloyds TSB, Northern Rock, Barclays, Royal

Bank of Scotland and HSBC — had signed up to the £1 billion plan.

Northern Rock, the nationalised lender, yesterday announced that it would follow

Royal Bank of Scotland (RBS) in delaying the issue of repossession orders by six

months.

RBS announced that it was taking the same measure on Monday.

House prices fall at

fastest pace in 25 years, 3.12.2008,

http://www.timesonline.co.uk/tol/money/property_and_mortgages/article5284863.ece

Editorial

Return of the Predators

November 24, 2008

The New York Times

The demise of the subprime mortgage industry has been hard on predatory

brokers, too. They feasted for years on bad loans until reality crashed down and

the money ran out, and there they were: sharks without a frenzy.

Now they are circling again. Predators of every sort have regrouped and returned

to their old ways, this time as loan-modification companies, inserting

themselves between hard-strapped homeowners and banks, offering to work deals —

for cash up front.

It’s a high-pressure, high-volume business, advertising in the usual low-rent

ways: talk-radio ads, Web come-ons, fliers on car windshields. The ads are full

of glossy promises, like this one for a Long Island outfit: “Reduce your

mortgage rate to as low as 4%. No refinancing — no closing costs. Reduce your

monthly payment. Foreclosures, late pays/bad credit okay.”

It’ll cost you — in this case, 1 percent of your outstanding loan, half of it in

advance.

There’s often nothing illegal about this booming and largely unregulated

business. Some shops are true scams, taking the money and running. But others

are just immoral, profiting on fear and false hopes with expensive services that

nonprofit organizations and government agencies offer for nothing.

Troubled homeowners know all about the relentlessness of the loan-rescue racket:

it fills their mailboxes and sends salespeople to lurk on their doorsteps.

Foreclosure filings are public records, and loan modifiers routinely swarm

courthouses to find leads. Loan counselors at the Long Island Housing

Partnership, a respected nonprofit in Hauppauge, N.Y., tell of scammers crashing

its housing workshops, posing as troubled borrowers, then working the crowd with

sales pitches.

And they do work hard. A call to one law firm’s toll-free number plugged on WABC

radio quickly gets a call back with a hard sell. “We have a 100 percent success

rate” in renegotiating loans, an operator sweetly vows, reluctant to say more

until you tell her what your mortgage payment is and how far behind you are.

The painful truth is that nobody has a 100 percent success rate, and not every

loan is fixable. Banks have recently made public commitments to putting more

effort into working loans out. But homeowners need to realize that the best way

to do that is directly with the lender or through a reputable nonprofit

counselor.

The for-profit loan modifier’s cruelly deceptive sales pitch is that you get

what you pay for. Nonprofit organizations, which work for no fee, say they can

strike better deals, because they have longstanding relationships with lenders

that storefront firms do not have.

But that doesn’t mean that well-meaning advocates are aggressive and effective

in finding people who need help. The government, banks and nonprofit

organizations need to be more creative and assertive to outmaneuver the

predators — to send the competing message that hope doesn’t require thousands of

dollars in cash up front, although it does mean facing up to hard truths about

one’s finances and future.

Nonprofits frequently complain about how hard it is to get at-risk homeowners to

ask for help. It’s true that people deep in debt are often embarrassed and

wrapped in blankets of denial. They don’t open mail or reliably make

appointments. But the good actors in this bad drama need to get better at

working around that problem, before more good money is thrown after bad.

Return of the Predators,

NYT, 24.11.2008,

http://www.nytimes.com/2008/11/24/opinion/24mon1.html

One in five homeowners

with mortgages underwater

Fri Oct 31, 2008

1:15pm EDT

Reuters

By Jonathan Stempel

NEW YORK (Reuters) - Nearly one in five U.S. mortgage

borrowers owe more to lenders than their homes are worth, and the rate may soon

approach one in four as housing prices fall and the economy weakens, a report on

Friday shows.

About 7.63 million properties, or 18 percent, had negative equity in September,

and another 2.1 million will follow if home prices fall another 5 percent,

according to a report by First American CoreLogic.

The data, covering 43 states and Washington, D.C., includes borrowers

nationwide, even those who took out mortgages before housing prices began to

soar early this decade.

Seven hard-hit states -- Arizona, California, Florida, Georgia, Michigan, Nevada

and Ohio -- had 64 percent of all "underwater" borrowers, but just 41 percent of

U.S. mortgages.

"This is very much a regional problem, and people tend to forget that," said

David Wyss, chief economist at Standard & Poor's, who expects home prices

nationwide to fall another 10 percent before bottoming late next year.

"Most of the country is not in bad shape," he continued. "Things seem to be

stabilizing in Michigan, but the big bubble states -- Florida, California,

Arizona and Nevada -- are still very overpriced."

About 68 percent of U.S. adults own their own homes, and about two-thirds of

them have mortgages.

JPMorgan Chase & Co, one of the biggest mortgage lenders, on Friday offered to

modify $70 billion of mortgages to keep a potential 400,000 homeowners out of

foreclosure. Bank of America Corp, which bought Countrywide Financial Corp in

July, also has a large loan modification program.

HOME PRICES, ECONOMY UNDER PRESSURE

U.S. home prices fell a record 16.6 percent in August from a year earlier, with

declines in all 20 major metropolitan areas measured by the S&P/Case-Shiller

Home Price Indices.

Foreclosure filings rose 71 percent in the third quarter to a record 765,558,

according to RealtyTrac.

Meanwhile, the Commerce Department said gross domestic product fell at a 0.3

percent rate in the third quarter. Some experts expect the worst U.S. recession

since the early 1980s.

Yet despite a series of expensive government programs to spur lending, mortgage

rates are rising, making it tougher to borrow or refinance. The rate on a

30-year fixed-rate mortgage jumped this week to 6.46 percent from 6.04 percent a

week earlier, Freddie Mac said.

Meanwhile, borrowing costs on hundreds of thousands of adjustable-rate mortgages

are expected to reset higher in the coming months. The problem may be

particularly serious for borrowers with rates tied to the London Interbank

Offered Rate, or Libor, which is abnormally high relative to benchmark U.S.

rates.

Last week, Wachovia Corp said borrowers with its "Pick-a-Pay" ARMs and living in

or near Stockton and Merced, California, owed at least 55 percent more on their

mortgages, on average, than their homes were worth. Wells Fargo & Co is buying

Wachovia.

NEVADA HARD HIT, NEW YORK AT RISK

First American CoreLogic, an affiliate of title insurance and real estate

services company First American Corp, said states with large numbers of homes

with negative equity either had rapid price appreciation, many homes bought with

subprime mortgages or as speculative investments, steep manufacturing declines,

or a combination.

Nevada was hardest hit, where mortgage borrowers on average owed 89 percent of

what their homes were worth, and 48 percent had negative equity. Michigan was

second, with an 85 percent loan-to-value ratio and 39 percent of borrowers

underwater.

New York fared best, with an average 48 percent loan-to-value ratio and just 4.4

percent of mortgage borrowers with negative equity.

But Wyss said this could change as financial market upheaval transforms Wall

Street. This month, New York City Comptroller William Thompson estimated that

the city alone might lose 165,000 jobs over two years.

"We're going to see home prices coming down pretty significantly in New York,"

Wyss said. "A lot of people are losing jobs, and won't be getting their usual

bonuses, and that leaves less money for housing."

(Reporting by Jonathan Stempel;

Additional reporting by Al Yoon;

Editing by

Brian Moss)

One in five

homeowners with mortgages underwater, R, 31.10.2008,

http://www.reuters.com/article/newsOne/idUSTRE49S3Q520081031

Families brace for holidays

without a home

Thu Oct 30, 2008

7:54am EDT

Reuters

By Lisa Baertlein

THOUSAND OAKS, Calif (Reuters) - A memento with Depression-era

humor helps Kristin Bertrand keep perspective as her family braces for a

Christmas holiday without their home.

The small ceramic dish she keeps from her grandfather reads: "Cheer up, things

could be worse." Then, in smaller type: "So I cheered up and sure enough things

got worse."

Just a few years ago, Kristin and her husband Mike Bertrand, 36, were confident

they owned their own piece of the American dream. They pulled in $140,000 a

year, owned a house, two cars, a telescope and other gadgets, and had season

tickets to Disneyland for their two kids.

But since they lost their home in May, the Bertrands live in a sparsely

furnished rental in Thousand Oaks, California, and have cut expenses to the

bone.

They've sold Kristin's set of wedding rings, given up a car and the Disneyland

passes to get back on their feet. The dish, taken when Kristin's 90-year-old

grandfather moved to a nursing home, sits on the mantel as a reminder.

"It's going to be a lean holiday for us," said Kristin, 36, who said the family

has put plans to visit relatives in Idaho on the back burner. "I think this year

we need to lay low."

Adding to their worries as the holidays approach, Mike just learned that his

consulting contract, the family's main income, will not be renewed at the end of

October.

The Bertrands' story will be played out in many versions across the United

States this holiday season, where several hundred thousand people who lost their

homes to foreclosure try to redefine how they celebrate with their families.

For the Bertrands, and others, past splurges for special occasions have already

been cut out of the household budget.

The Bertrands have kept their 13-year-old daughter McKaylee and 10-year-old son

Taylor in the loop about their financial troubles all along. The kids have long

stopped asking for money for clothes or fund-raisers, they said.

While the family had once taken McKaylee and a friend to Disneyland to celebrate

her birthday, her latest party was held at home with a borrowed karaoke machine

and a jump rope that guests fashioned from glow-in-the-dark necklaces.

NOT JUST A NUMBER

More than one million U.S. homes were lost in foreclosure from the beginning of

2007 through the end of September this year, according to RealtyTrac. Credit

Suisse estimates 6.5 million loans will fall into foreclosure over the next five

years, with the peak coming this year.

Families who have already lived through the worst of their financial troubles --

due to inflated monthly mortgage payments, the plunge in U.S. home values, or

layoffs -- have prepared for a low-key holiday.

But even people who have not fallen into dire straits expect to tone it down

this year, frightened by a plunge in financial markets that has wiped out

trillions of dollars of asset values and raised the prospect of a global

recession.

Six times as many people say they will cut back on gift-buying as those who plan

to spend more, according to a recent Reuters/Zogby poll. U.S. retailers are

bracing for their most dismal holiday sales season in nearly two decades.

Virginia Washington, a 64-year-old grandmother to 10, is already planning a more

frugal holiday as she struggles to make payments on the $207,000 loan on her

dream retirement home in Tolleson, Arizona, which is now worth about $150,000.

"The spirit will be there, though many of the things you've gotten used to over

the years may not be," she said.

Counselors who help people through the foreclosure process say that many

families just aren't making holiday plans.

"They're not as concerned about what they're going to do for the holidays, it's

more about what they're going to do to keep the home," said MaryEllen De Los

Santos, a housing counseling coordinator with the Adams County Housing Authority

in Commerce City, Colorado.

One outlier is Ann Neukomm, 57, a receptionist from Cape Coral, Florida, who

filed for bankruptcy in May and now faces foreclosure on a mortgage she took out

about two years ago.

She's thinking about using a small inheritance from her father to take her

17-year-old son on a holiday cruise.

"I'd like to do something with him because it's probably going to be the last

time," Neukommm said, referring to her son's 18th birthday, a time when many

American teenagers stop living with their parents.

De Los Santos, the housing counselor, said that in the past, families in trouble

would pour into her office at the beginning of each year. Many of them could not

make mortgage payments because they spent too much on the holidays.

Now she expects more people won't even make it to the holidays to overspend, and

predicts a flood of cases starting in early December.

One question De Los Santos asks clients is: "Do you want to have this kind of

Christmas, or to you want to spend next Christmas in your home?"

FINANCIAL SPIRAL

Archstone Consulting Chief Executive Todd Lavieri said his biggest concern is

unemployment and job insecurity. The United States has lost more than 700,000

jobs since January and experts are bracing for massive layoffs ahead.

"Saving your money to save your house will have a direct impact on holiday

spending, no question about it," said Lavieri, whose group expects this year's

holiday sales to contract when adjusted for inflation.

The Bertrands' plight began when Mike lost his job in 2007. He has worked since,

but always for lower pay.

"I was working, but I was making less money. I kept fighting and struggling to

catch up," Mike said.

In February, he lost a second job. "That was pretty much the final nail in the

coffin," said Mike.

"The fear was overwhelming," Kristin said of the foreclosure saga, which left

her feeling guilty and helpless.

While the family was not required to make mortgage payments during the year that

the Newbury Park house they bought in 2001 was in foreclosure, Mike and Kristin

said nothing felt as good as making their first payment on their rental.

"It was the best therapy," said Mike.

The couple started a support group called Moving Forward

(http://wearemovingforward.org/) to help others manage the emotional toll of

foreclosure. They worry that the holidays will pile additional stress on

families already struggling to keep their heads above water.

"We need to get through it without any casualties," Kristin said.

(Reporting by Lisa Baertlein;

Additional reporting by Tim Gaynor in Phoenix

and

Tom Brown in Cape Coral, Florida;

Editing by Michele Gershberg

and Eddie Evans)

Families brace for

holidays without a home, R, 30.10.2008,

http://www.reuters.com/article/domesticNews/idUSTRE49T01O20081030

Home Prices Tumbled in August

October 29, 2008

The New York Times

By MICHAEL M. GRYNBAUM

The beleaguered housing market found little relief in August

as home prices across the country dropped at yet another record pace, according

to a closely watched survey released Tuesday.

Home prices in 20 cities fell 16.6 percent in August compared with a year ago,

the biggest annual drop in the history of the Case-Shiller Home Price Index,

released by Standard & Poor’s, the ratings agency.

Every city included in the survey experienced a drop in prices from a year

earlier, a trend that has so far lasted five months. Phoenix and Las Vegas were

hit hardest, with prices down 31 percent in both cities. Prices declined more

than 25 percent in Los Angeles, Miami, San Diego and San Francisco.

Prices dropped a percentage point between August and July, a sign that the pace

of the decline may be slowing slightly. Only two cities — Cleveland and Boston —

had price increase for the month, compared with six in July. Prices were

unchanged in Chicago and Denver.

“The downturn in residential real estate prices continued, with very few bright

spots in the data,” David M. Blitzer, who oversees the survey, said in a

statement.

A 10-city index fell 17.7 percent year-over-year.

The housing slump has continued unabated for months, and its consequences can be

felt throughout the nation’s economy. It has led to the erosion of jobs, pain in

a number of housing-related industries, and, in part, the credit crisis that

caused the collapse of several Wall Street banks. Whirlpool, the appliance

maker, announced more layoffs and additional plants closings on Tuesday, citing

the housing slowdown. Households have also watched their home equity lines

deteriorate.

Lower prices, however, are in some sense the key to recovery, economists said,

although prices may need to fall further to lure buyers back into a market

sagging with unsold inventory.

Sales also appeared to pick up slightly in September, according to reports from

the Commerce Department and the private National Association of Realtors. Sales

of both previously owned and newly reconstructed homes rose. But inventories

remained elevated.

Housing woes are just one of the problems currently ailing the American

consumer, a fact driven home by a disastrous reading on consumer confidence

released on Tuesday by the Conference Board, a private group.

The confidence survey, which dates back decades, plunged to its lowest reading

on record, hitting 38.0 in October from 61.4 in September. Expectations are also

at an all-time low.

The enormous declines in the stock market last month appeared to have taken a

dramatic toll on sentiment among Americans. Nearly half of the 5,000 consumers

surveyed said they expected the job market to deteriorate further, and many

appeared worried about their ability to make purchases over the next few months.

“These moves are likely to have at least partially been driven by the worrying

news flow on the U.S. financial system, but it appears to be the labor market

that is the source of the bulk of the worries,” James Knightley, an economist at

ING Bank, wrote in a research note.

Home Prices Tumbled

in August, NYT, 29.10.2008,

http://www.nytimes.com/2008/10/29/business/economy/29econ.html

Britain faces crisis

as negative equity to reach 2

million

October 19, 2008

From The Sunday Times

Robert Watts and Jonathan Oliver

Collapsing house prices are plunging 60,000 homeowners a month

into negative equity, which means the country is on course for a worse crisis

than the 1990s crash.

At current trends, 2m households will enter negative equity by 2010,

outstripping the 1.8m affected at the bottom of the last housing slump.

New research from Standard & Poor’s, the ratings agency, coincides with evidence

that banks are aggressively seizing homes whose owners have slipped just a few

hundred pounds behind on their mortgage payments.

It is a further signal that the financial crisis is now infecting the real

economy as hundreds of thousands of families face the prospect of being unable

to move house because their home is worth less than the value of their mortgage.

Many more homeowners will now be afraid that the bank may suddenly repossess

their property. Repossessions have soared to 19,000 in the first half of the

year, up 40% on the previous six months. That figure is expected to rise to

26,000 in the second half of 2008.

Economists believe house prices will fall by up to 35% from their peak by 2010.

This compares with a drop of only 20% in the early 1990s.

Last night opposition politicians blamed Labour for encouraging a “culture of

indebtedness” that now threatens to cause an implosion in the housing market.

Philip Hammond, the shadow Treasury chief secretary, said: “We are now paying

the price for a decade of debt-fuelled boom, with hundreds of thousands of

people unable to sell their property, after being encouraged by the government

to overstretch themselves to get on the property ladder.”

Vince Cable, the Liberal Democrat finance spokesman, urged Gordon Brown to do

more to prevent unnecessary repossessions. “It genuinely must be a lender’s last

resort, which right now it certainly is not,” he said.

With official figures out this week expected to show Britain has fallen into

recession, Brown is planning a 1930s-style programme of public works, spending

billions on new schools, homes and transport projects. He has urged senior

colleagues to increase expenditure on big capital projects – despite forecasts

that tax revenues are about to collapse.

Brown’s ambitious plan is modelled on Franklin Roosevelt’s New Deal, which

helped drag America out of the Great Depression. A Whitehall source said: “We

cannot afford to risk the complete collapse of our construction industry. We

have to make sure that the skills have not been lost when we finally pull out of

the downturn.”

Standard & Poor’s has calculated that by the end of the month 335,000 homes will

be worth less than their mortgages. The figure represents a rise of 260,000 in

four months.

Capital Economics, the City consultancy, expects up to 2m properties will be in

negative equity by 2010 — more than in the recession of the early 1990s.

Northern Rock, the bank nationalised this year, is said to be behind a wave of

aggressive repossessions. In the nine months to the end of September, the

state-owned lender made more than 2,000 seizures.

Esther Spick, from Surrey, is three months in arrears on her Northern Rock

mortgage. The lender has launched repossession proceedings, even though she owes

just £1,200. In one case reported to The Sunday Times by a housing charity, the

bank is trying to seize a home where the owner is just £800 in arrears, even