|

Vocapedia >

Economy > Housing market > UK

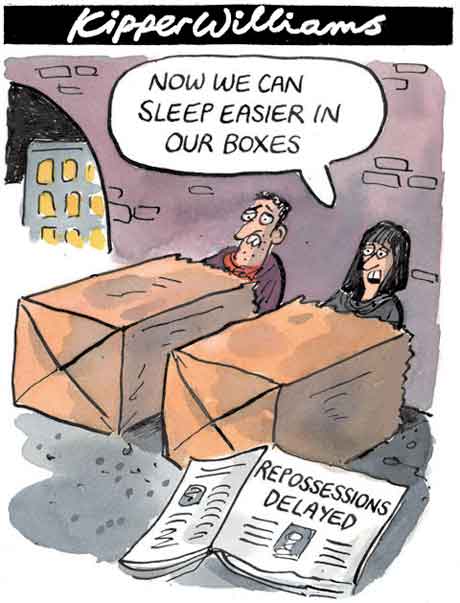

Repossessions

Kipper Williams

http://www.guardian.co.uk/business/gallery/

2008/sep/23/creditcrunch.marketturmoil?picture=340610725

G

Thursday 4

December 2008

https://www.theguardian.com/politics/2008/dec/04/

brown-mortgage-interest-break-repossessions

repossess

https://www.theguardian.com/business/2005/apr/28/

housing.money

repossessions

https://www.theguardian.com/money/repossessions

http://www.guardian.co.uk/news/datablog/interactive/2011/nov/10/repossessions-england-wales-map

http://www.guardian.co.uk/news/datablog/interactive/2011/nov/10/repossessions-england-wales-map

http://www.guardian.co.uk/money/2009/feb/20/repossessions-homeowners

http://www.guardian.co.uk/politics/2008/dec/04/brown-mortgage-interest-break-repossessions

http://www.guardian.co.uk/money/2008/nov/21/repossessions-mortgages

http://www.guardian.co.uk/money/2008/nov/01/repossessions-mortgages-credit-recession-crunch

http://www.guardian.co.uk/money/2008/oct/28/repossessions-debt

http://www.guardian.co.uk/money/2008/jun/20/houseprices.mortgages

http://www.guardian.co.uk/money/2008/may/09/debt.property

http://www.guardian.co.uk/money/2008/may/09/mortgages.property

https://www.theguardian.com/money/2007/sep/21/business.houseprices

https://www.theguardian.com/business/2006/nov/04/politics.money

http://www.theguardian.com/money/2006/feb/03/creditanddebt.business

Interactive map

Repossessions in England and Wales:

where are

they worst? 10 May 2012

Which local authorities

have the highest repossession rates?

http://www.guardian.co.uk/news/datablog/interactive/2011/nov/10/repossessions-england-wales-map

buy-to-let repossessions

2009

http://www.telegraph.co.uk/finance/personalfinance/investing/4733030/

The-Council-of-Mortgage-Lenders-Buy-to-let-repossessions-double.html

mortgage repossession orders

http://www.independent.co.uk/money/mortgages/increase-in-mortgage-repossession-orders-824904.html

be repossessed

http://www.guardian.co.uk/lifeandstyle/2009/feb/28/squatting-repossession

for sale

evictions

vacancies

squat

http://www.guardian.co.uk/lifeandstyle/2009/feb/28/squatting-repossession

House prices fall

at fastest pace in 25 years

December 4, 2008

From Times Online

Rosie Lavan

British house prices tumbled at a record 16.1 per cent in November, marking

the sharpest drop in property values for a quarter of a century.

Figures released this morning by Halifax revealed that prices fell 2.6 per cent

in November compared with October, and are 16.1 per cent lower than in November

2007.

The year-on-year decline is deeper than falls recorded during the last recession

in the early 1990s, and is the biggest drop since 1983.

The shock fall emerged just hours before the Bank of England's Monetary Policy

Commitee (MPC) cut the interest rate again by 1 per cent to 2 per cent, after

last month reducing borrowing costs by 1.5 per cent to 3 per cent.

The reduction is likely to be accompanied by a rate cut by the European Central

Bank, which is predicted to fall by 50 basis points in the 15-nation eurozone.

Howard Archer, chief UK and European economist at IHS Global Insight, said:

"Ongoing very tight credit conditions, still relatively stretched housing

affordability on a number of measures, faster rising unemployment, muted income

growth and widespread expectations that house prices form a powerful set of

negative factors are weighing down on the housing market."

The average price of a house in the UK is back to the July 2005 level of

£163,445, but this is 124 per cent higher — or £90,000 — than the figure in

November 1998.

Mr Archer said Halifax's figures had placed further, last-minute pressure on the

Bank to deliver a large cut in rates.

IHS Global Insight predicted that interest rates would fall as low as 0.5 per

cent in the first half of the new year, and could be reduced even further.

Central banks around the world have cut interest rates ahead of today's moves.

Sweden's central bank today cut its key rate by a record 175 basis points, to 2

per cent, the third reduction since October and the biggest since 1992. It

expects rates to remain at 2 per cent throughout next year.

The Riksbank said there was an "unexpectedly rapid and clear deterioration in

economic activity since October".

New Zealand also announced a record cut of 150 basis points, bringing its rate

down to a five-year low of 5 per cent and acknowledging that further cuts would

probably be necessary.

Indonesia made a surprise 25 basis-point cut to its rate. This reduction, the

first since December last year, takes the interest rate to 9.25 per cent.

Yesterday, the Bank of Thailand cut rates by 100 basis points to 2.75 per cent,

partly in response to the recent political turmoil during which the ruling party

was dissolved and the Prime Minister forced out of office.

On Tuesday, the Reserve Bank of Australia surprised with a

larger-than-anticipated 100 basis-point cut to 4.25 per cent.

But Mr Archer added that: "...it is highly questionable how much of further

interest rate cuts by the Bank of England that mortgage lenders would pass on."

Yesterday, Gordon Brown unveiled a rescue package for homeowners who struggle to

meet their mortgage repayments if they lose their jobs or suffer a severe drop

in income.

Those with loans of up to £400,000 — typically borrowers on upper and middle

incomes — will be able to cut payments, with the taxpayer underwriting the risk

of default.

The emergency state guarantee, which will enable homeowners to defer mortgage

interest payments for up to two years, was announced unexpectedly in the debate

following the Queen's Speech yesterday.

The Prime Minister said eight big lenders which account for 70 per cent of the

market — HBOS, Abbey, Nationwide, Lloyds TSB, Northern Rock, Barclays, Royal

Bank of Scotland and HSBC — had signed up to the £1 billion plan.

Northern Rock, the nationalised lender, yesterday announced that it would follow

Royal Bank of Scotland (RBS) in delaying the issue of repossession orders by six

months.

RBS announced that it was taking the same measure on Monday.

House prices fall at

fastest pace in 25 years,

Ts,

3.12.2008,

http://www.timesonline.co.uk/tol/money/property_and_mortgages/

article5284863.ece

Families brace for holidays

without a home

Thu Oct 30, 2008

7:54am EDT

Reuters

By Lisa Baertlein

THOUSAND OAKS, Calif (Reuters) - A memento with Depression-era

humor helps Kristin Bertrand keep perspective as her family braces for a

Christmas holiday without their home.

The small ceramic dish she keeps from her grandfather reads: "Cheer up, things

could be worse." Then, in smaller type: "So I cheered up and sure enough things

got worse."

Just a few years ago, Kristin and her husband Mike Bertrand, 36, were confident

they owned their own piece of the American dream. They pulled in $140,000 a

year, owned a house, two cars, a telescope and other gadgets, and had season

tickets to Disneyland for their two kids.

But since they lost their home in May, the Bertrands live in a sparsely

furnished rental in Thousand Oaks, California, and have cut expenses to the

bone.

They've sold Kristin's set of wedding rings, given up a car and the Disneyland

passes to get back on their feet. The dish, taken when Kristin's 90-year-old

grandfather moved to a nursing home, sits on the mantel as a reminder.

"It's going to be a lean holiday for us," said Kristin, 36, who said the family

has put plans to visit relatives in Idaho on the back burner. "I think this year

we need to lay low."

Adding to their worries as the holidays approach, Mike just learned that his

consulting contract, the family's main income, will not be renewed at the end of

October.

The Bertrands' story will be played out in many versions across the United

States this holiday season, where several hundred thousand people who lost their

homes to foreclosure try to redefine how they celebrate with their families.

For the Bertrands, and others, past splurges for special occasions have already

been cut out of the household budget.

The Bertrands have kept their 13-year-old daughter McKaylee and 10-year-old son

Taylor in the loop about their financial troubles all along. The kids have long

stopped asking for money for clothes or fund-raisers, they said.

While the family had once taken McKaylee and a friend to Disneyland to celebrate

her birthday, her latest party was held at home with a borrowed karaoke machine

and a jump rope that guests fashioned from glow-in-the-dark necklaces.

NOT JUST A NUMBER

More than one million U.S. homes were lost in foreclosure from the beginning of

2007 through the end of September this year, according to RealtyTrac. Credit

Suisse estimates 6.5 million loans will fall into foreclosure over the next five

years, with the peak coming this year.

Families who have already lived through the worst of their financial troubles --

due to inflated monthly mortgage payments, the plunge in U.S. home values, or

layoffs -- have prepared for a low-key holiday.

But even people who have not fallen into dire straits expect to tone it down

this year, frightened by a plunge in financial markets that has wiped out

trillions of dollars of asset values and raised the prospect of a global

recession.

Six times as many people say they will cut back on gift-buying as those who plan

to spend more, according to a recent Reuters/Zogby poll. U.S. retailers are

bracing for their most dismal holiday sales season in nearly two decades.

Virginia Washington, a 64-year-old grandmother to 10, is already planning a more

frugal holiday as she struggles to make payments on the $207,000 loan on her

dream retirement home in Tolleson, Arizona, which is now worth about $150,000.

"The spirit will be there, though many of the things you've gotten used to over

the years may not be," she said.

Counselors who help people through the foreclosure process say that many

families just aren't making holiday plans.

"They're not as concerned about what they're going to do for the holidays, it's

more about what they're going to do to keep the home," said MaryEllen De Los

Santos, a housing counseling coordinator with the Adams County Housing Authority

in Commerce City, Colorado.

One outlier is Ann Neukomm, 57, a receptionist from Cape Coral, Florida, who

filed for bankruptcy in May and now faces foreclosure on a mortgage she took out

about two years ago.

She's thinking about using a small inheritance from her father to take her

17-year-old son on a holiday cruise.

"I'd like to do something with him because it's probably going to be the last

time," Neukommm said, referring to her son's 18th birthday, a time when many

American teenagers stop living with their parents.

De Los Santos, the housing counselor, said that in the past, families in trouble

would pour into her office at the beginning of each year. Many of them could not

make mortgage payments because they spent too much on the holidays.

Now she expects more people won't even make it to the holidays to overspend, and

predicts a flood of cases starting in early December.

One question De Los Santos asks clients is: "Do you want to have this kind of

Christmas, or to you want to spend next Christmas in your home?"

FINANCIAL SPIRAL

Archstone Consulting Chief Executive Todd Lavieri said his biggest concern is

unemployment and job insecurity. The United States has lost more than 700,000

jobs since January and experts are bracing for massive layoffs ahead.

"Saving your money to save your house will have a direct impact on holiday

spending, no question about it," said Lavieri, whose group expects this year's

holiday sales to contract when adjusted for inflation.

The Bertrands' plight began when Mike lost his job in 2007. He has worked since,

but always for lower pay.

"I was working, but I was making less money. I kept fighting and struggling to

catch up," Mike said.

In February, he lost a second job. "That was pretty much the final nail in the

coffin," said Mike.

"The fear was overwhelming," Kristin said of the foreclosure saga, which left

her feeling guilty and helpless.

While the family was not required to make mortgage payments during the year that

the Newbury Park house they bought in 2001 was in foreclosure, Mike and Kristin

said nothing felt as good as making their first payment on their rental.

"It was the best therapy," said Mike.

The couple started a support group called Moving Forward

(http://wearemovingforward.org/) to help others manage the emotional toll of

foreclosure. They worry that the holidays will pile additional stress on

families already struggling to keep their heads above water.

"We need to get through it without any casualties," Kristin said.

(Reporting by Lisa Baertlein;

Additional reporting by Tim Gaynor in Phoenix

and

Tom Brown in Cape Coral, Florida;

Editing by Michele Gershberg

and Eddie Evans)

Families brace for

holidays without a home, R, 30.10.2008,

http://www.reuters.com/article/domesticNews/idUSTRE49T01O20081030

Editorial

The

American Dream in Reverse

October 8,

2007

The New York Times

For the

first time since the Carter administration, homeownership in the United States

is set to decline over a president’s tenure. When President Bush took office in

2001, homeownership stood at 67.6 percent. It rose as the mortgage bubble

inflated but is projected to fall to 67 percent by early 2009, which would come

to 700,000 fewer homeowners than when Mr. Bush started. The decline, calculated

by Moody’s Economy.com, is inexorable unless the government launches a heroic

effort to help hundreds of thousands of defaulting borrowers stay in their

homes.

These days, modest relief efforts are in short supply, let alone heroic ones.

Some officials seem to think that assistance would violate the tenet of personal

responsibility that borrowers should not take out loans they cannot afford. That

is simplistic.

The foreclosure crisis is rooted in reckless — and shamefully underregulated —

mortgage lending. Many homeowners — mainly subprime borrowers with low incomes

and poor credit — are now stuck in adjustable-rate loans that have become

unaffordable as monthly payments have spiked upward. Their predicament is not

entirely of their own making, and even if it were they would need to be bailed

out because mass foreclosures would wreak unacceptable damage on the economic

and social life of the nation.

The relief efforts so far have been too little, too late. In August, the White

House established a program to allow an additional 80,000 borrowers to refinance

their loans through the Federal Housing Administration — on top of 160,000 who

were already eligible. That’s not enough. Foreclosure filings soared to nearly

244,000 in August alone.

Federal regulators and Treasury officials are urging mortgage lenders and

mortgage servicers to do their utmost to modify loan terms for at-risk

borrowers, but saying “please” hasn’t worked. To be effective, modifications

must reduce a loan’s interest rate or balance or extend its term, or some

combination of the three. Gretchen Morgenson reported recently in The Times that

a survey of 16 top subprime servicers by Moody’s Investors Service found that in

the first half of the year, modifications were made to an average of only 1

percent of loans on which monthly payments had increased.

What’s missing is executive leadership to bring together many players, including

lenders, servicers, bankers and various investors. All of them are affected

differently depending on whether and how a borrower is rescued, which makes it

difficult to agree on a rescue plan. But all of them also made megaprofits

during the mortgage bubble. Under firm leadership, they could come up with a way

to modify many loans that are now at risk.

Democratic Congressional leaders have called on the Bush administration to

appoint one senior official to lead a foreclosure relief effort. The White House

dismissed the idea, saying, in effect, that it’s doing enough.

Congress should move forward on other remedies. The most important is to mend an

egregious flaw in the current bankruptcy law that prohibits the courts from

modifying repayment terms of most mortgages on a primary home. Two bills, one in

the House and one in the Senate, would treat a mortgage like other secured debt,

allowing a bankruptcy court to restructure it so that it’s affordable for the

borrower. That would give defaulting homeowners and their advocates much needed

leverage in dealing with lenders and servicers. Creditors would presumably

prefer to cut a deal with a borrower rather than be subject to the decision of a

bankruptcy judge.

The administration and Congress should work to avoid mass foreclosures.

Meanwhile, bankruptcy reform would give borrowers a shot at keeping their homes.

The American Dream in Reverse, NYT, 8.10.2007,

http://www.nytimes.com/2007/10/08/opinion/08mon1.html

'Housing

boom over'

as UK bank chaos grows

· Economist

warns of sharp downturn

· Tory leader attacks Brown over crisis

Sunday

September 16, 2007

The Observer

Heather Stewart

and Lisa Bachelor

Britain's

house price growth will be halved next year as the global financial crisis

exacerbates the impact of rising mortgage rates, according to Nationwide, the

biggest mortgage lender.

After the

dramatic bail-out of high street bank Northern Rock underlined the impact of the

American 'sub-prime' mortgage crisis on Britain's financial sector, Fionnuala

Earley, Nationwide's group economist, said she expected house price inflation to

slow to around 3 per cent next year.

Thousands of anxious customers queued outside Northern Rock branches for a

second day yesterday, ignoring calls for calm from the Chancellor, Alistair

Darling, and the bank's management, and sparking fears of a full-blown 'run' on

the bank.

Speaking to

Channel 4 News last night, Darling said he had been assured by the Financial

Services Authority that Northern Rock was capable of meeting its financial

obligations to its customers.

In the

first signs of political fallout from the crisis, David Cameron accused Gordon

Brown of failing to rein in public and private borrowing over the last decade,

saying the nation's economic growth is based on a 'mountain of debt'. Writing in

today's Sunday Telegraph, the Tory leader says: 'This government has presided

over a huge expansion of public and private debt without showing awareness of

the risks involved.

'Though the current crisis may have had its trigger in the United States...

under Labour our economic growth has been built on a mountain of debt.'

House price growth was running at just below 10 per cent in August, but

Nationwide believes it will have dropped to 7 per cent by December and continue

slowing throughout next year.

The worldwide credit crunch that pushed Northern Rock to the brink of collapse

could make a housing market slowdown worse, Earley warned. 'I think all it can

do is make it [the market] cooler: that comes through sentiment, and through

expectations.'

With base interest rates at a six-year high of 5.75 per cent, economists said

that the feelgood factor was already evaporating and that the Northern Rock

crisis could deal a fresh blow to confidence.

'This confirms some of the fears that people had, and reinforces the idea that

they need to be more circumspect, and that money is tighter,' said Richard

Hyman, director of retail research firm Verdict.

'It couldn't have come at a worse time: consumer confidence was already heading

south,' said Kevin Hawkins, director general of the British Retail Consortium,

though he added that, as long as Northern Rock was the only casualty, the

effects could be short-lived.

A report from property website Rightmove, released on Friday, showed that

property prices fell in the last month for the first time in three years. It is

expected that, although there will be overall growth in the housing market, some

areas of the UK could suffer significant price decline.

Meanwhile, Northern Rock apologised to customers last night, saying it was

'disappointed to see uncertainty caused'. The apology came amid growing

speculation of a takeover bid, with HSBC and Lloyds TSB both being mooted as

potential suitors. Insiders are predicting that a takeover could occur within

weeks to secure the bank's future. One plan currently being looked at by City

bankers is to divide the company's £100 billion mortgage portfolio between some

of the major banks.

Savers have been rushing to pull out their cash since it emerged last Thursday

that Darling had sanctioned an emergency loan from the Bank of England to

prevent Northern Rock going bust.

One couple had even camped outside Northern Rock's Cheltenham branch in

Gloucestershire overnight, desperate to withdraw the £1m proceeds of a house

sale. 'We were told that because our money was in an online account we wouldn't

be able to withdraw it there and then,' said Fiona Howard. 'That money is our

lifeline, as we are living in rented accommodation at present.'

'Housing boom over' as UK bank chaos grows,

O,

16.9.2007,

https://www.theguardian.com/money/2007/sep/16/

houseprices.business

Related > Anglonautes >

Vocapedia

USA > race relations > housing segregation / discrimination

economy, money, taxes,

housing market, shopping,

jobs, unemployment, unions, retirement,

debt,

poverty, homelessness

industry, energy, commodities

Related

The Guardian > House prices

https://www.theguardian.com/money/houseprices

Loot

http://www.loot.com/property

|