|

History

> 2009 > UK > Economy (II)

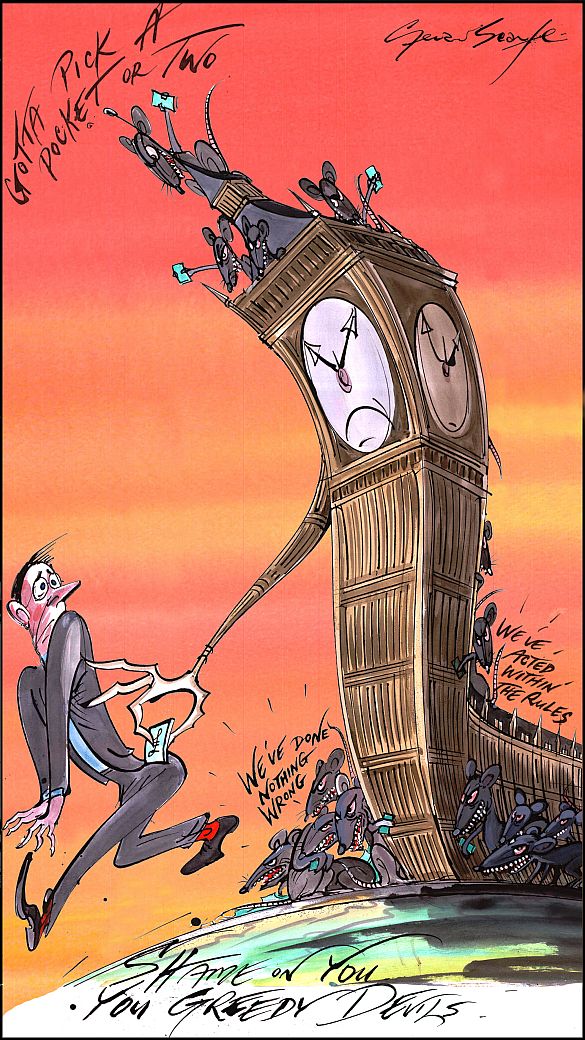

Gerald Scarfe

Sunday Times

May 10 2009

http://www.timesonline.co.uk/tol/comment/article6256945.ece

Pre-budget report:

Labour and Tories

compete in the politics

of pain

The fallout from the pre-budget report

has made the dividing lines in British politics clear

– how deep, where, and how fast

should cuts be made to reduce Britain's deficit

Sunday 13 December 2009

Toby Helm

The Observer

This article appeared on p24 of the Focus section of the Observer

on Sunday 13

December 2009.

It was published on guardian.co.uk

at 00.20 GMT on Sunday 13 December 2009.

The lights were still glowing and the arguments raging at 2am inside the

Treasury. Tempers were frayed and exhaustion was setting in. In less than 11

hours, Alistair Darling, the chancellor, would rise to his feet in the Commons

to deliver his crucial pre-budget report (PBR). But the government remained at

war.

Rows about who should take the pain, and who the gain, divided not only No 10

from No 11, but cabinet minister from cabinet minister. Even members of the same

family fought over the limited spoils on offer.

Ed Balls had emerged from negotiations delighted at having won a 0.7% increase

in his budget for schools. But his wife, Yvette Cooper, the work and pensions

secretary, was seething following a disagreement with the Treasury over personal

tax allowances. According to one account, she went "ballistic" with Darling and

at one point threatened to resign. Lord Mandelson, the business secretary, is

said to have had differences with Gordon Brown and Balls until the last moment,

when the final package was agreed.

"It is the kind of thing that happens. There are disagreements, even arguments,

right up to the end. People care. But you get there in the end," said one source

close to the discussions.

The atmosphere was highly charged because everyone in government knew it was a

crucial moment – economically and politically. With borrowing soaring towards a

staggering £178bn this financial year and debt on course to double as a

percentage of GDP compared with a few years ago, tough decisions had to be

taken. On the financial markets, traders were nervous. They wanted to hear a

hard-headed plan from Darling for bringing the deficit down. Without it,

international markets would lose faith in UK plc's ability to pay its debts,

with devastating consequences.

Yet with a general election just a few months away, economic honesty had to be

balanced against political necessity. Labour was recovering in the polls, eyeing

the possibility of a hung parliament: some were even dreaming of going one

better. "Too much honesty and austerity and people will take fright; too little

and people will smell lack of leadership and opportunism. It will be a very

difficult balancing act," said one Labour MP, shortly before Darling addressed

the House.

The opposing views inside government about how to approach the PBR – how to play

the politics of pain – had been clear for weeks. In fact, the seeds of many of

those disagreements had been sown long ago. Early in his time as chancellor, in

late 2007, Darling had been astonished and angered at Brown's attempt to prevent

him reducing economic growth forecasts. Brown feared gloomy predictions would

hurt Labour. The two men argued in private and on those occasions, ahead of the

March 2008 budget, Darling won.

The chancellor has always taken the view that he, and the Labour government,

must earn medium-term and long-term credibility by telling it as it is, rather

than massaging or hiding the truth for political gain.

In the run-up to last Wednesday, that same tension with Brown resurfaced.

Darling wanted to be far more explicit about where spending would have to be

reined in over the next four years. "Alistair takes the view that you can't

sweep all the bad news under the carpet, whereas Brown thinks, 'How will people

think this reflects on me?'," said one adviser.

Darling's officials were even asked to examine the merits of a deferred rise in

VAT that would hit everyone in the land and raise many billions. But Brown and

Balls, while aware of the need to have a credible deficit-reduction plan, were

keener to use the PBR to sharpen the political "dividing lines" with the Tories.

They knew the Conservatives had dipped in the polls since David Cameron and

George Osborne announced their austerity plans for the economy, including a pay

freeze for many public sector workers, in early October. It was a question of

emphasis and tactics. Brown and Balls looked at the PBR more as a political

opportunity and less as an economic danger. Whatever could be done on tax and

spending to discomfit the Tories, should be done. If the Tories were to complain

afterwards that Labour had been too timid about cutting the deficit, this could

play into their hands, because it would imply the Tories would tighten the screw

even more.

There were two key ways, they believed, to make the dividing lines clearer.

First, they needed tax announcements that would help sharpen the contrast in the

public mind between Labour as the party of the many, those on low and middle

incomes, and the Tories as that of the wealthy, privileged few. Second, Balls

and Brown wanted spending plans that would allow Labour to go into an election

claiming that, despite everything, it would remain the party that would defend

core public services of education, health and the police, while the Tories would

impose across-the-board cuts. "Ever since Gordon was first involved in devising

New Labour, for him it has always been about Labour investment versus Tory

cuts," said one party adviser who has known him for more than 20 years. "Nothing

will ever change that mindset."

When Darling sat down at 1.15pm on Wednesday, Brown, sitting to the left of the

chancellor, and Balls, two places farther along, were both beaming. Their

fingerprints were all over the statement Darling had just delivered. The PBR was

highly political and would hit the rich. The dividing lines were on every page.

Bankers (the kind of people Mandelson once said he did not mind getting "filthy

rich") would be stung by a new tax on their bonuses. Inheritance tax thresholds

would be frozen, meaning more people inheriting sizeable estates would be

dragged into paying death duties. (The Tories have promised to exempt all but

millionaires).

But core service would be protected for two years. Spending on schools would

rise and the budgets for health and the police would be protected. Today Brown

says on his podcast: "We will always protect those services – the services of

the mainstream majority." Yes, there was pain for the many announced by Darling,

in the form of a further 0.5% rise in national insurance contributions, except

for those earning £20,000 or less, who would be exempted. It would, however, be

pain delayed until April 2011. There would also be a cap of 1% in public sector

wage rises for two years. But there was no plan to raise VAT down the line. And

there was also little in the way of a detailed plan on how spending would be cut

by other departments over the next two years. Ministers are committed to halving

the deficit in four years, so the promise to defend core budgets on frontline

service would inevitably mean savage cuts elsewhere. But Darling's statement was

devoid of comment on where the axe would fall. How would the markets, the press,

opposition parties and, above all, voters react? Was it too harsh to be popular

and credible, or not harsh enough? How would the politics play out?

The markets barely flinched on the day of the PBR itself. In fact, the price of

gilts – the debt the government issues to raise money – rose very slightly,

indicating that investors calculated that the UK was a less risky borrower than

before. This was because Darling's borrowing forecast for this year was a

fraction lower than expected. But as so often with financial statements, it

takes time for opinion to settle. Thursday morning's headlines helped shape the

mood. They made appalling reading for the chancellor. While the Sun's headline,

"Darling just screwed more people than Tiger Woods", did not help, it was the

one in the former New Labour supporting Times – "The axeman dithereth" – that

most annoyed Darling. The Tories weighed in with charges that the government had

acted irresponsibly, and for shameful political reasons. Cameron, who has said

his party would cut spending much faster than Labour, likened the prime minister

and chancellor to "a couple of joyriders in a car, smashing up the

neighbourhood, not caring what is going to happen".

By Thursday, the markets were also buying the pessimism. Yields, or the return

enjoyed by investors holding government debt – which rise when the price of

gilts falls, indicating a higher borrowing risk – rocketed for 10-year gilts by

0.14% to 3.8%, the steepest one-day climb for months. On Friday, gilt yields

continued to increase. Moyeen Islam, from Barclays Capital, explained: "Our view

is that the PBR did very little to allay the fears of the market over whether

there is a path being outlined towards medium-term fiscal sustainability."

Inside No 10 and the Treasury, people feel sore and bruised this weekend. But as

one official put it, "no one is killing himself". They knew they had a virtually

impossible hand to play in trying to sell tax rises and a halving of the deficit

to the public just before a general election campaign.

No 10 answers its critics by insisting that sound economic thinking, rather than

political manoeuvring, determined its message in the PBR. Officials say that

four themes lay behind its approach. First was the need to protect fragile

growth in the economy by maintaining overall spending increases for another

year. A vital difference between Labour and the Tories is that the former

believe economic recovery would be choked off if spending was to be cut too

quickly. Second was the need to show its commitment to halving the deficit over

four years, an aim now backed by legislation. Third was the need to ensure

"fairness in the tax system", by getting the well-off to pay most, while

protecting low earners. And fourth was the need to "protect frontline services",

meaning schools and the health service. To those who claim he has not done

enough, Brown's allies also point out that he is pushing hard for international

agreement on a so-called Tobin tax on bank transactions that would raise

billions.

But the government's problem is that it was not just the press and the

opposition parties that laid into the PBR. Independent experts also tore into it

with increasing ferocity as the week went on. The respected Institute for Fiscal

Studies (IFS) said the unspoken result of the package was that public spending

would have to be cut by a fifth by 2013-14 in areas such as defence, higher

education, housing and transport as a result of the government's commitment to

halve the deficit but maintain spending on core services.

IFS's director, Robert Chote, was scathing about Darling's obfuscation. "The

chancellor spelt out neither how much he wanted to spend in total on public

services, nor exactly how much of this spending he was planning to protect. Even

if these numbers are not yet written in stone, it is hard to see why the

requirements of good policy-making should demand such wilful obscurity."

Such criticism is music to the ears of the Tories. Yesterday Osborne accused

Brown of "a serious dereliction of duty" in failing to address the deficit

problem. Tory frontbenchers have been told to find substantial extra savings

across the board as they prepare for government. Yet the Conservatives are also

treading a tightrope. Since their party conference in Manchester in October,

when they decided to "go for austerity" and promote themselves as the heirs to

prudence, their lead over Labour has narrowed in most opinion polls. Ken Clarke,

the shadow business secretary, has told Osborne to be careful about overdoing

talk of cuts.

Labour may be getting it in the neck for ducking hard questions and failing to

be more honest in the PBR, but the Tories will hardly be singing the most

popular campaign theme tune if it is one about the need to administer more pain

than Labour. As one leading Tory put it: "We have got to watch it a bit. It is

all very well saying we would cut faster, but there is not much point in saying

it if it scares away the voters. As George [Osborne] says, we really are all in

this same mess together."

Pre-budget report:

Labour and Tories compete in the politics of pain, O, 13.12.2009,

http://www.guardian.co.uk/politics/2009/dec/13/budget-report-labour-tories-pain

Footsie pushes above 5,000

Published: September 9 2009 20:39

Last updated: September 9 2009 20:39

The Financial Times

By Jennifer Hughes, Senior Markets Correspondent

Hopes for a flurry of company takeovers and growing belief in the strength of

economic recovery on Wednesday propelled the FTSE 100 index through the 5,000

level for the first time in almost a year.

An impressive rebound in stock markets around the world, which began in March,

has drawn fresh momentum from a potential £10.2bn bid for Cadbury, the UK

confectionery group, by US food giant Kraft.

Investors on both sides of the Atlantic are betting that the takeover move, a

sign of growing corporate confidence, could herald a pick-up in M&A across the

globe. In New York, the S&P 500 index was heading for an 11-month high, while

Europe’s leading shares rose for a fifth day in succession.

The gains took London’s blue-chip index to a close of 5,004.3, a gain of 1.15

per cent on the day, and 42.5 per cent above its low of six months ago. The last

time the FTSE 100 closed above 5,000 was September 2008, when financial markets

were in the grip of a steep sell-off following the collapse of US investment

bank Lehman Brothers.

Graham Secker, equity strategist at Morgan Stanley, said that equities, helped

by the improving economic outlook and continued support from the world’s central

banks, were enjoying a “sweet spot” that would sustain the rally for now.

“Growth is picking up and the stimulus taps are still full on. That is a pretty

good environment for stocks,” he said.

A strong performance from the heavyweight oil sector, as crude prices rose by

more than a dollar a barrel, underpinned the rise in share prices. British

Airways surged 5 per cent on hopes deals with Iberia and American Airlines were

imminent.

There were signs that “short” investors betting on price falls had been caught

out by the gains. Shares in debt-laden Yell, the directories group, have leapt

more than 150 per cent in a month after initial rallies squeezed investors who

had sold the stock short, forcing them to buy back the shares.

The Bank of England has pumped almost £150bn of cash into the financial system

and has indicated it will continue its “quantitative easing” programme at least

until the end of October. The yield on two-year gilts was 0.934 per cent, near

its lowest since the recession of the early 1990s.

But some analysts were wary of forecasting further gains. Philip Isherwood at

Evo Securities said 5,000 “is a nice big round number but we’ve had a good run

now and it is getting harder to pick value”.

Much of the equities rally has been based on the sharp improvement in market

expectations for a recovery. This has been led by so-called momentum indicators,

which have registered sharp upturns in business sentiment. “These indicators

don’t just follow a V-shape, they will falter. The question is to what extent

we’ve now double-counted any good news,” said Mr Isherwood.

Footsie pushes above 5,000, FT, 9.9.2009,

http://www.ft.com/cms/s/0/9d2ddfc4-9d77-11de-9f4a-00144feabdc0.html

The Big Question:

Why has Britain become more unequal,

and can it be changed?

Wednesday, 22 July 2009

The Independent

By Nigel Morris, Deputy Political Editor

Why are we asking this now?

Because a damning picture of an increasing dominance of top jobs by children

from the wealthiest families emerged yesterday in a strongly worded report.

It is difficult for ministers to dismiss its findings, as the detailed

analysis of the "closed shop" operating in the most prestigious professions was

commissioned by Gordon Brown and was written by a panel of experts led by the

former Health Secretary Alan Milburn.

Tony Blair committed the party to boosting social mobility a decade ago when he

told the Labour conference that the "old elites [and] establishments" had "run

our professions and our country too long".

Critics protested yesterday that the former prime minister's voter-friendly

rhetoric had not been matched by action and that landing a top job depends as

much as ever on who – rather than what – you know.

What did the study discover?

Only seven per cent of youngsters are privately educated. But 75 per cent of

judges, 70 per cent of finance directors, 55 per cent of solicitors, more than

50 per cent of top journalists and 45 per cent of senior civil servants are

public-school products.

Well-paid professional jobs continue to be passed down between the generations:

doctors, lawyers, accountants and bankers typically grow up in families with

incomes two-thirds higher than average.

Hasn't that always been the case?

Of course. But the Milburn study, Fair Access to the Professions, presents

research that the trend has accelerated in recent decades. It says: "Access to

the professions is becoming the preserve of those from a smaller and smaller

part of the social spectrum."

More stockbrokers, scientists, engineers, bankers, accountants, journalists,

doctors and lawyers in their thirties came from well-off backgrounds than their

50-year-old counterparts. The study forecasts that if action is not taken to

reverse the historical trend then the typical professional of the future will

come from the wealthiest 30 per cent of homes. In other words, the professional

elite will become even more elitist.

There are signs that some professions – including business executives,

solicitors and politicians – are becoming less public school dominated, but the

trend is only slight. Journalism, however, is more exclusive while medicine is

unchanged.

What is the reason?

Researchers believe selection procedures in some professions have been tightened

to recruit more people similar to those already in the job.

Some professions have also become virtually graduate-only. In recent decades

senior accountants could have started as bookkeepers or national journalists as

local newspaper messengers. Such career ladders, offering a chance of social

mobility, have diminished. Vocational apprenticeships rarely translate into

professional jobs.

The Milburn panel also noted a trend of upper middle-class families helping

their children get a foot in the door of their chosen career by getting them an

internship or work experience.

Wasn't opening up universities meant to change that?

The Government has moved steadily towards its long-term target of getting 50 per

cent of children in higher education. The proportion is currently 42 per cent

and British universities this year received record numbers of applicants. But

suspicions remain over how substantially this has benefited lower-income

families – particularly with the financial burden of tuition fees.

The Milburn report says: "Access to university is extremely inequitable and the

correlation between the chances of going to university and parental income has

strengthened in recent years. Far too many young people who have the ability to

go university are unable to do so because of their background."

Why does this matter to the economy?

Seven million white-collar posts need to be filled over the next decade – the

vast majority of new jobs in the economy. Struggling to achieve that could put

Britain at a competitive disadvantage with nations such as China and India

heavily investing in skills.

Mr Milburn and his team argued that it was in the interests of all the

professions to cast their net as widely as possible. The former minister, who

grew up on a council estate, called for "a second great wave of social mobility"

similar to that experienced by Britain half a century ago to help fill the

vacancies.

How does the Government respond?

Downing Street conceded that opening up the professions is an area "where we

need to do more". But it insisted that it had made widespread progress in

tackling social inequality over the last decade. It said record numbers of

students were in higher education, the highest-ever proportion of 16- to

18-year-olds were in education and training and 600,000 youngsters had been

lifted out of poverty.

How can the exclusivity be changed?

Mr Milburn believes it has to be challenged from the bottom up by encouraging

youngsters aspire to a wider range of professions. Among 88 recommendations, his

team calls for careers advice to begin in primary school and for state schools

to teach "soft skills", such as public speaking. Teamwork could be encouraged by

establishing armed services cadet forces, currently largely the preserve of

independent schools.

It backs a mentoring scheme for children from disadvantaged backgrounds and an

Obama-style "yes you can" campaign to help them raise their sights. Universities

could be opened to a wider range of people by offering "degrees without fees" to

students living at home and for universities to compile information about

undergraduates' social backgrounds. The professions should be obliged, it says,

to give more details of recruitment and internship policies.

Is there other evidence of widening inequality?

While more families have been lifted out of poverty under Labour, the gap

between the worst-off and most affluent has not closed. It has, if anything,

widened slightly. The best-off 1 per cent of the population owned 21 per cent of

the national wealth in 2003; the proportion in 1996 was 20 per cent. If housing

is excluded, the proportion of Britain's wealth concentrated in the hands if the

richest one-hundredth of citizens has jumped from 26 per cent to 34 per cent

over the period.

Will anything actually change?

Government sources say Mr Brown is sensitive to the issues raised in the report,

pointing out that he would not have commissioned it if he did not think there

was not a problem. Ministers could even begin setting out ways of tackling the

inequality as early as next week – possibly with a view to putting their ideas

to voters in the election expected next spring.

Their problem is the natural scepticism of electors who might reasonably ask:

what is the point of Labour if it has failed to boost social mobility after 12

years in power?

Has inequality widened over the last decade?

Yes...

* Top jobs increasingly go to children already in the best-off families.

* Degrees are more important than ever for landing well-paid posts.

* The gap between the wealthiest and worst-off has grown.

No...

* More youngsters from working-class homes are going to university than ever

before.

* Numbers of youngsters growing up in poverty have fallen.

* The proportion of public school-educated recruits is falling in some

professions.

The Big Question: Why

has Britain become more unequal, and can it be changed?, I, 22.7.2009,

http://www.independent.co.uk/news/uk/home-news/the-big-question-why-has-britain-become-more-unequal-and-can-it-be-changed-1755796.html

Pubs closing at rate of 52 a week

as hard-up drinkers shun

their local

July 22, 2009

From The Times

Rebecca O’Connor

The rate of pub closures is accelerating, with 52 going out of

business every week at a cost of 24,000 jobs over the past year, figures show.

Almost 2,400 pubs and bars have vanished from villages and towns in the past 12

months, according to research for the British Beer & Pub Association (BBPA).

Local pubs serving small communities have been the worst hit, the association

said.

The number of closures represents the steepest rate of decline since records

began in 1990 and has risen by a third compared with the same period last year,

when 36 pubs were closing every week.

A preference for drinking more cheaply at home, rather than going out, is

thought to have contributed to closures. A BBPA spokesman said: “The biggest

impact is the recession. There are fewer people out and fewer people spending

money in pubs and bars. Pubs are diversifying but, unfortunately, if you are a

community pub you can’t transform yourself into a trendy town centre bar.”

The BBPA said that the total number of pubs and bars has fallen from a steady

60,000 “for years” to the 53,466 still trading. It added that of the 52 premises

closing each week, 40 are local pubs and nine are high street bars. The

recession is claiming about 461 bar jobs a week, according to the figures,

compiled by CGA Strategy, the market information group.

The BBPA said that establishments that serve foods, such as gastropubs, were

more resilient, closing at a rate of only one a week. By contrast, branded pubs

and café-style bars are faring relatively well and are opening at a rate of two

every seven days.

The fall in spending in pubs and bars is the latest in a string of setbacks for

publicans in recent years. Inflationary pressures cut drinkers’ spending power

in 2007, resulting in a drop in revenue. The smoking ban in 2007 and changes to

the licensing laws have dealt further blows.

The BBPA said that higher taxes on beer imposed in the past two Budgets had

contributed to the industry’s woes, adding about £600 million to the pub

industry’s tax bill.

In addition, some of the larger pub companies, such as Punch Taverns and

Enterprise Inns, have come under scrutiny this year, with an investigation by

the Commons Business and Enterprise Committee into their tied-trade business

models. The committee said in May that it had found evidence that the behaviour

of such companies was contributing to the sharp rise in pub closures.

The BBPA said that the closure of pubs had cost the Government an estimated £254

million in tax revenue in the past 12 months — a figure rising by £5.5 million

every week. It added that job losses in the sector were costing the Government

£1.53 million a week in jobseeker’s allowance.

David Long, the chief executive of the BBPA, said: “Closing pubs are not only a

loss to communities, but a loss to the Treasury. The Government should look at

valuing and rewarding pubs as community assets. Not only would this have social

policy benefits by supporting a hub of community cohesion, but financial policy

benefits in terms of tax revenues, particularly at a time when the public purse

is stretched.”

The BBPA said that, in the past, closed pubs had often been bought by property

developers and turned into flats, but that since the decline of the property

market, pubs that had shut had less appeal to prospective buyers and had been

left boarded up. A spokesman for the association said: “While some have been

bought by other people — usually property developers rather than new landlords —

since the downturn, pubs have become a lot less attractive to developers.”

Estate agents said that pubs in villages, where local housing is in short

supply, still made a compelling case for developers. Chris Coleman-Smith, head

of auctions for Savills, said: “If it is in the back of beyond, where a pub

might struggle for trade, it is probably better off as a residential

development, either a house or a few units, for prospective homebuyers.”

Pubs closing at rate

of 52 a week as hard-up drinkers shun their local, Ts, 22.7.2009,

http://business.timesonline.co.uk/tol/business/industry_sectors/leisure/article6722488.ece

Unemployment jumps by record 281,000

The number of people claiming jobseeker's allowance

increased by a relatively small 23,800 in June to 1.56 million

Wednesday 15 July 2009

12.01 BST

Guardian.co.uk

Ashley Seager, economics correspondent

This article was first published on guardian.co.uk

at 12.01 BST on Wednesday 15

July 2009.

It was last updated

at 12.01 BST on Wednesday 15 July 2009.

Unemployment shot up by a record 281,000 in the three months to May, official

data showed today.

The rise took the jobless total to 2.38 million, the highest level since 1995,

on the broadest measure of unemployment, the ILO (International Labour

Organisation).

Youth unemployment jumped to a 16-year high of 726,000 after a quarterly rise of

95,000, while the number of people out of work for longer than a year rose by

46,000 to 528,000, the highest for 11 years.

Brendan Barber, general secretary of the TUC, said today's figures were "truly

horrendous".

"It's particularly worrying that over half a million unemployed people have been

out of work for at least a year, including 133,000 young unemployed people. With

a new generation of school and college leavers soon starting to look for work,

our unemployment crisis will get even bigger," Barber warned.

Alan Tomlinson, a partner at UK insolvency practitioners Tomlinsons, said: "This

disturbing rise in the number of unemployed reflects the rise in the number of

companies going under or struggling to survive."

There was one bright spot as the number of people claiming jobseeker's allowance

increased by a relatively small 23,800 in June to 1.56 million, although that

was the worst total since Labour came to power in 1997.

Howard Archer, economist at IHS Global Insight, said this suggested the rise in

unemployment might be tailing off.

"Overall, it is hard at the moment to be anything else than pessimistic about

the labour market," he said.

The so-called claimant count has now increased for 16 months in a row and is

more than 700,000 higher than a year ago.

Shortly after the figures were released, Jaguar LandRover delivered another blow

to the economy, announcing it would stop producing its X-Type car at its

Halewood plant on Merseyside with the loss of up to 300 jobs.

Job losses to continue

City economists generally saw little cheer in today's data, with Ross Walker of

Royal Bank of Scotland predicting the bad news would continue for many months.

"Maybe the pace of layoffs could begin to moderate towards the end of this year

but I think we're still going to be seeing job losses well into next year," he

said.

David Kern, the chief economist at the British Chambers of Commerce, predicted

unemployment would peak at about 3.2 million next year.

The number of people in work fell by 269,000 in the latest quarter to 29

million, after a record fall of 0.9% in the employment rate to 72.9%.

More than 300,000 people were made redundant in the three months to May, the

second highest figure on record, and a rise of 31,000 on the previous quarter.

Other data from the Office for National Statistics showed that vacancies fell to

a record low of 429,000 in the three months to June, down by 35,000 from the

previous quarter.

Manufacturing jobs continued to fall, down by 201,000 over the past year to a

record low of 2.6 million.

Average earnings increased by 2.3% in the year to May, up by 1.4% on the

previous month, as the effect of bonuses paid earlier in the year fell out of

the latest figures.

The number of people classed as economically inactive, including those on

long-term sick leave or who have given up looking for a job, increased by 64,000

in the latest quarter to 7.92 million, 20% of the workforce.

Unemployment jumps by

record 281,000, G, 15.7.2009,

http://www.guardian.co.uk/business/2009/jul/15/unemployment-figures-britain-jobless

Ratings agency

downgrades outlook for UK economy

• Government debt burden may approach 100% of GDP

• FTSE 100 tumbles more than 2%

• Sterling falls to $1.55 from $1.58

Thursday 21 May 2009

10.30 BST

Guardian.co.uk

Ashley Seager

Ratings agency Standard & Poor's today downgraded its outlook for the British

economy, saying it had grown increasingly worried about the country's ballooning

budget deficit.

The news pushed shares in London down sharply and caused gilt yields to soar on

renewed fears about the recession-hit UK economy. The FTSE 100 tumbled more than

2%, or 100 points, to 4352. Sterling, which had reached a six-month high of

$1.58 earlier, tumbled three cents to $1.5530.

"The outlook revision is based on our view that, even factoring in further

fiscal tightening, the UK's net general government debt burden may approach 100%

of GDP and remain near that level in the medium term," S&P credit analyst David

Beers said in a statement.

However, S&P said it was retaining the 'AAA' long-term and 'A-1+' short-term

ratings for Britain's sovereign debt, the vast bulk of which is in gilts.

"We base our opinion on our updated projections of general government deficits

in 2009-2013," Beers said, referring to the huge upward revisions to government

borrowing projections chancellor Alistair Darling unveiled in his budget on 22

April.

"These projections reflect our more cautious view of how quickly the erosion in

the government's revenue base may be repaired, the extent to which the growth in

government spending can be curtailed and, consequently, the pace at which

historically high fiscal deficits are likely to narrow," he added.

But, he said, the agency believed the overall ratings on the UK continued to be

supported by its wealthy, diversified economy, a high degree of fiscal and

monetary policy flexibility, and its relatively flexible product and labour

markets.

"However, last month's budget announcements underscored that UK public finances

are deteriorating rapidly - at a faster rate than S&P had previously assumed."

The news came as figures showed that public sector net borrowing hit a record

for April of almost £8.5bn.

But other news added to growing evidence that the economic slump may be past its

worst. Figures showed retail sales in April grew 0.9% from March, much faster

than expected, leaving them 2.6% up on a year earlier. That reinforced survey

evidence from the British Retail Consortium and the CBI that sales grew strongly

last month, boosted by Easter trading.

Other figures, though, showed mortgage lending dropped sharply in April while

business investment slumped in the first quarter of the year.

Ratings agency

downgrades outlook for UK economy, G, 21.5.2009,

http://www.guardian.co.uk/business/2009/may/21/standard-poors-uk-economic-outlook

BP profits slump 62% on plunging oil price

April 28, 2009

From Times Online

Dan Sabbagh

BP's profit plunged by 62 per cent in the first quarter of 2009 after oil

prices fell from July's record highs and demand for crude and gas declined in

weakening economics.

Net profits in the first three months of its financial year fell from $7.1

billion (£4.8 billion) in 2008 to $2.56 billion which BP blamed on what it

called "lower realizations", or lower oil prices. Despite the decline, today's

result was ahead of analysts' forecasts for profit of $2.28 billion and shares

in BP rose 1.1 per cent to 489p in early trading.

BP said that during the first quarter, the price it achieved for each barrel of

oil was $41.26, compared to $90.92 in 2008. During last year, oil prices reached

a record high of $147 a barrel in July.

Gas was sold for $3.63 per thousand cubic foot, against $5.88 this time last

year.

Even compared with the fourth quarter of last year, underlying profits were

down, again reflecting the softening oil price. Profits were off $200 million,

or 8 per cent, compared with the fourth quarter of last year.

The decline in production revenues was tempered by an 11 per cent decrease in

production costs, although this was not enough to contend with such a sharp

swing in the oil price. Income at the production and exploration division was

down 57 per cent to $4.3 billion.

Despite the trading pressures, BP increased production by 4 per cent during the

quarter, as its Thunder Horse fields in the Gulf of Mexico began to ramp up

production. The company repeated its statement that it expects production

volumes to increase during the whole year, but said the exact amount would

depend on the oil price and quota restrictions decided by OPEC, the oil

producers' cartel.

Profits at BP’s other main trading division, its refining and marketing

operation, were also down 13 per cent to $1.1 billion. Refining volumes were

"significantly worse" than a year ago, and margins were lower. BP expected the

"overall weak environment for marketing and petrochemicals to continue" into

this year.

BP was also hit by an increased pension charge, paying $368 million in

retirement costs in the three months, compared with $246 million a year ago. It

blamed a reduced "expected return on pension plan assets", reflecting the

collapse in equity markets around the world.

Despite the economic pressures, BP increased its quarterly dividend payout by 4

per cent to 14 cents a share. Aided by the weakness of the pound, in sterling

terms the dividend is 9.584p, up 40 per cent. It ended the quarter with net

debts of $26.7 billion.

BP profits slump 62% on

plunging oil price, NYT, 28.4.2009,

http://business.timesonline.co.uk/tol/business/industry_sectors/natural_resources/article6183541.ece

UK slowdown sharper than feared

The Financial Times

Published: April 24 2009 10:02

Last updated: April 24 2009 10:31

By Norma Cohen

The UK economy contracted much more sharply in the first quarter of this year

than economists expected, with output reduced in both services and

manufacturing.

It is the fastest quarterly decline in national income since the third quarter

of 1979, according to Richard McGuire, fixed income strategist at RBC Capital

Markets.

Martin Wolf: Why Britain’s predicament is so bad - Apr-23UK business confidence

stabilises - Apr-23GDP in the first three months of 2009 contracted by 1.9 per

cent from the level seen in the fourth quarter of 2008, according to the Office

for National Statistics. Economists polled by Reuters had expected an average

decline of 1.5 per cent.

“The provisional UK GDP figures for Q1 suggest that the recession has so far

been even deeper than previously thought.,” said Vicki Redwood, economist at

Capital Economics.

“It also deals an instant blow to the chancellor’s forecast of a 3.5 per cent

drop in GDP this year. For that to be achieved, GDP would have to be broadly

flat from the second quarter onwards – yet the surveys are already pointing to

another fall of 1 per cent or so in the second quarter,” she added.

Alistair Darling, the chancellor, predicted the biggest fall in output since the

Second World War in this week’s budget but maintained the UK would return to

growth of 1.5 per cent next year. His forecast was more optimistic than the

consensus of private sector forecasts.

Overall, the sharpest decline was seen in the manufacturing sector, where output

fell by 6.2 per cent from the previous quarter.

Separately, the Society of Motor Manufacturers and Traders underlined the depth

of the downturn in the car industry. It said that UK car production more than

halved in March to bring first-quarter volumes down 56.6 per cent from the year

before. Commercial vehicle production fell by 63 per cent in the quarter, after

a further steep fall in March.

Capital Economics noted that the biggest surprise in the GDP data was the 1.2

per cent contraction seen in the output of the services sector. In particular,

the decline was sharp in business and financial services.

Mr McGuire noted that quarterly contraction in business and financial services

was the sharpest since the series began in 1983.

Colin Ellis, economist at Daiwa Securities, said: “Today’s data were a sharp

reminder that the UK is still a long way away from any recovery.” He noted that

the weakness that shows in up the initial estimate of GDP explains the Bank of

England’s monetary policy committee’s decision to pump £75bn into the economy

through the banking system.

“The resulting gap between demand and potential supply is only likely to widen

further over the rest of this year – which is why the MPC has opted to pump

£75bn into the economy to boost demand. But we are increasingly nervous that the

new money may have only a limited impact on real output,” Mr Ellis said..

However, he said there may be a silver lining in the latest data because, having

contracted by 3.5 per cent in the last six months alone, there may be less of a

reduction in output in the months ahead.

UK slowdown sharper than

feared, FT, 24.4.2009,

http://www.ft.com/cms/s/0/b97c5ca0-30ad-11de-bc38-00144feabdc0.html

British Economy Shrinks 1.9 Percent in Q1

April 24, 2009

Filed at 5:06 a.m. ET

By THE ASSOCIATED PRESS

The New York Times

LONDON (AP) -- The British economy shrank in the first quarter at its

sharpest rate since the early days of Margaret Thatcher's government thirty

years ago as the financial crisis continued to wreak havoc on banks, retailing

and manufacturing.

In its first estimate for the January-March period, the Office for National

Statistics said Friday that gross domestic product, or GDP, contracted by a

massive 1.9 percent from the previous three month period -- the biggest drop

since 2.4 percent posted in the third quarter of 1979.

That was far more than the 1.6 percent decline posted in the fourth quarter of

2008 and above analysts' expectations for a more modest 1.4 percent drop.

The latest decline means that Britain's economy has shrunk for three consecutive

quarters and there are very few indications that things will improve in the near

future.

Compared with a year ago, Britain's GDP was 6.2 percent lower in the first

quarter, compared to the 4.9 percent year-on-year decline seen in the fourth

quarter of 2008.

Earlier this week, the British government laid out the hope the economy will

start to grow towards the end of this year but still forecast that output this

year will shrink by a post-World War II record of 3.5 percent.

The average postwar recession in Britain has lasted for around 15 months, which

would, if replicated during this current downturn, mean that the economy will

continue contracting until the autumn of this year. However, most economists

think that this recession will last longer, and possibly last well into 2010.

''It's early days yet, but the drop opens up the possibility of GDP in 2009 as a

whole falling by even more than the 4 percent we currently expect,'' said Vicky

Redwood, economist at Capital Economics.

According to the International Monetary Fund's latest forecasts, Britain would

likely be one of the worst hit economies because of its dependence on the

housing and financial sectors. The IMF is projecting that Britain's output will

contract by 4.1 percent this year, much more than its previous forecast of a 2.8

percent decline.

A more detailed look at the figures shows that the weakness in the economy was

broad-based, with both services and manufacturing output sharply down in the

wake of the banking crisis, the seizing up of lending and already-confirmed

recessions around the world, from the U.S. to Germany and Japan.

In a separate release, the statistics office did post some moderately good news.

It said that retail sales during March rose by a monthly 0.3 percent, primarily

because of higher food sales. The rise offered some cheer for the retail sector

after grim figures for February revealed a worse-than-expected 1.9 plunge plunge

in sales.

British Economy Shrinks

1.9 Percent in Q1, NYT, 24.4.2009,

http://www.nytimes.com/aponline/2009/04/24/business/AP-EU-Britain-Economy.html

Budget 2009: at a glance

Key details from Alistair Darling's 2009 budget

Wednesday 22 April 2009

15.34 BST

James Sturcke

Guardian.co.uk

• British economy forecast to shrink in 2009 by 3.5%. Growth forecast for

2010: 1.25%; and 2011 onwards: 3.5% a year.

• Inflation (CPI) expected to reach 1% by end of 2009. RPI will fall to -3.5% by

end of year.

• No income tax increases this year.

• Income tax rate on those earning more than £150,000 to increase from 45% to

50% from April next year, a year earlier than planned.

• Personal tax allowance of those earning over £100,000 to be withdrawn from

next April.

• Pension tax relief restricted for those on incomes over £150,000 from April

2011. It will be gradually tapered to the same 20% rate received by most people.

• Fuel duty to rise by 2% from September and 1% above indexation every April for

next four years.

• Tobacco duty to rise by 2% from 6pm today.

• Alcohol duties to rise by 2% from midnight.

Economics

• Public sector net borrowing of £175bn in 2009, some 12.4% of GDP; £173bn

next year, then £140bn, £118bn and £97bn each following year.

• UK net debt, including the cost of stabilising the banking system, at 59% this

year, 68% next year, and rising to 79% by 2013-14.

• Inflation target remains at 2%.

• Tax avoidance and evasion loopholes to be closed, resulting in £1bn of extra

revenue over the next three years.

Welfare

• The child element of the Child Tax Credit to increase by £20 from April

next year.

• £100 extra for child trust fund vouchers for new babies with disabilities,

extra £200 for those with severe disabilities.

• State redundancy pay to rise from £350 to £380 a week.

• Grandparent care for young relatives to count towards basic state pension.

• Last year's increase in winter fuel allowance to be extended for another year

– worth £250 for over-60s and £400 for over-80s.

Housing

• Stamp duty holiday on homes under £175,000 extended until end of 2009.

• £80m extension to HomeBuy Direct – the government shared equity mortgage

scheme, which has already received interest from over 32,000 people since

September.

• £500m extra support for housing industry; £100m of this for local authorities

to build energy-efficient housing.

• £50m to accelerate modernisation of housing for military families.

Savings

• Annual ISA limit to be increased from £7,200 to £10,200, half of which can

be invested in cash. From this year for over-50s, from next year for others.

Business and employment

• Loss-making companies can reclaim tax paid on profits made in past three

years. Average repayments of £4,000 expected for each year.

• Extension of scheme allowing businesses to defer tax bills.

• Support for companies' cash flow, with a top-up trade credit insurance scheme

to match private sector trade credit insurance provision.

• Additional £1.7bn funding for jobseekers.

• From January 2010 everyone aged under 25 who has been unemployed for a year to

get an offer of a job or a training place.

• £260m new money for training and subsidies, targeted to get the skills and/or

experience needed in sectors with strong future demand.

• £250m extra this year to enable 16- to 17-year-olds to stay in education.

£400m in next two years.

• Main capital allowance rate doubled to 40% to encourage firms to bring forward

investment.

• £750m investment fund to provide financial support to emerging technologies

and regionally important sectors.

• Enhanced tax relief to support investment of £50bn this year, including £10bn

to support the communications sector and extend the broadband network.

• Incentives to encourage smaller North Sea oil fields to be brought into

production.

Environment

• Car scrapping scheme offers £2,000 discount on new cars when vehicles over

10 years old are traded in.

• Carbon budget commits UK to reduce emissions by 35% by 2020.

• £435m extra support for energy efficiency measures for homes, businesses and

public places.

• £525m new support for offshore wind power projects, intended to provide enough

electricity for 3.5m households.

• £405m new funding for low-carbon technology projects.

• Most energy-efficient new power stations using combined heat and power (CHP)

technology to be exempt from climate change levy.

Budget 2009: at a

glance, G, 22.4.2009,

http://www.guardian.co.uk/uk/2009/apr/22/budget-2009-darling-glance

Budget 2009: Alistair Darling's great financial squeeze on the

rich

• Rich targeted by budget with 50% tax rate for those on over £150,000

• Restrictions on spending to be tighter than Thatcher era

• Debt to reach 80% of GDP – highest level in peacetime

Wednesday 22 April 2009

23.12 BST

Guardian.co.uk

Larry Elliott, Patrick Wintour and Heather Stewart in Washington

Alistair Darling attempted to lay down battle lines for next year's general

election with a £7bn squeeze on the rich followed by a brutal freeze on public

spending in the next parliament.

Admitting that the worst year for economic growth since 1945 would create a

£175bn hole in the public finances this year, the chancellor broke Labour's 2005

manifesto pledge not to raise income tax by lifting the top rate for those

earning more than £150,000 to 50% from next April. The "soak the rich" theme

also included the abolition of personal allowances for those earning more than

£100,000 a year and the phasing out of higher-rate pension relief for earners of

more than £150,000.

Tax experts said the 50% rate, together with the loss of the personal allowance,

would cost someone earning £150,000 a year £200 a month.

But while Darling brought forward spending as part of a £5bn boost to the

economy this year, saying it was impossible for governments to cut their way

out of recession, he laid out future plans for public spending more severe than

under Margaret Thatcher's governments in the 1980s.

Current spending on the running costs of the state would grow by just 0.7% a

year from 2011-12 but deep cuts in investment in infrastructure projects will

mean zero growth in total spending from 2013. With the national debt doubling,

to 80% of GDP by 2013, the government will be paying £43bn a year in interest

payments – more than the current schools budget.

Darling said extra spending on tackling youth unemployment, boosting

housebuilding, investing in key sectors of the economy and providing help for

pensioner savers reflected the difference between Labour and the Conservatives.

"Everything we have done - whether supporting families now, maintaining

investment in our public services and putting the nation's finances on a

sustainable path - is based on our values of fairness and opportunity," he

said. "Even in this time of global economic difficulty, we are determined to

continue building a fairer society."

Measures aimed at easing the pain of the recession and reviving the economy

included £2.5bn to keep young unemployed people off the dole, help for

pensioners, a scheme to encorage people to buy new cars and £1bn of investment

in combating climate change.

But on a day that saw unemployment rise to its highest level since Labour came

to power in 1997, David Cameron said the government had lost any claim to

economic competence."Everyone can see what an utter mess this Labour

government and this Labour prime minister have made of the British economy.

The fastest rise in unemployment in our history. The worst recession since the

second world war. And the worst peacetime public finances ever known," he said,

adding that the government was planning to borrow more in the next two years -

£348bn - than every administration in the past 300 years.

George Osborne, the shadow chancellor, signalled that if any tax rises would be

reversed by a future Tory government it would be the 0.5% increase in national

insurance. The opposition is also intent on slowing the government's planned

rate in growth of current public spending in 2010 of 1.7% but Osborne gave no

details of what the Conservatives would cut department by department, or what

would happen after 2010.

The Tories acknowledged that Labour has announced a combined freeze on public

spending by the middle of the next parliament, saying: "It is another

little-noticed political trap they have laid for us." If the Conservatives

propose tighter current spending, there will be cuts in real terms.

A Tory source said: "Brown, throughout the 1980s, said that cutting capital

spending when the public finances are a mess is precisely what shouldn't

happen. Now he's doing it."

Darling said low interest rates, the budget stimulus, a weaker pound and lower

inflation would kickstart the economy late this year, and extra spending on

hi-tech industries would provide a platform for long-term recovery.

But Treasury forecasts showing that the economy will snap back from a 3.5% drop

in growth this year to expand by 1.25% in 2010 and 3%-plus in each of the three

following years was greeted with scepticism by the City.

Sterling fell by 1.5% and the gilts market was jittery at the prospect of high

levels of government debt for years to come.

Roger Bootle, economic adviser to Deloitte, said it could be 30 or 40 years

before the level of state debt returned to its pre-recession level of 40% of

GDP.

Darling's optimism was also questioned by the International Monetary Fund which

predicted the UK would remain trapped in recession well into next year. The IMF

believes that with crashing house prices and plunging shares knocking up to

£1trn off the wealth of Britain's families, they will still be tightening their

belts long after the banking crisis is over.

It forecast a 4.1% decline in GDP this year, followed by another fall, of 0.4%,

in 2010.

Budget 2009: Alistair Darling's

great financial squeeze on the rich, G, 22.4.2009,

http://www.guardian.co.uk/uk/2009/apr/22/budget-2009-tax-rich-alistair-darling

|