|

History

> 2009 > UK > Economy (I)

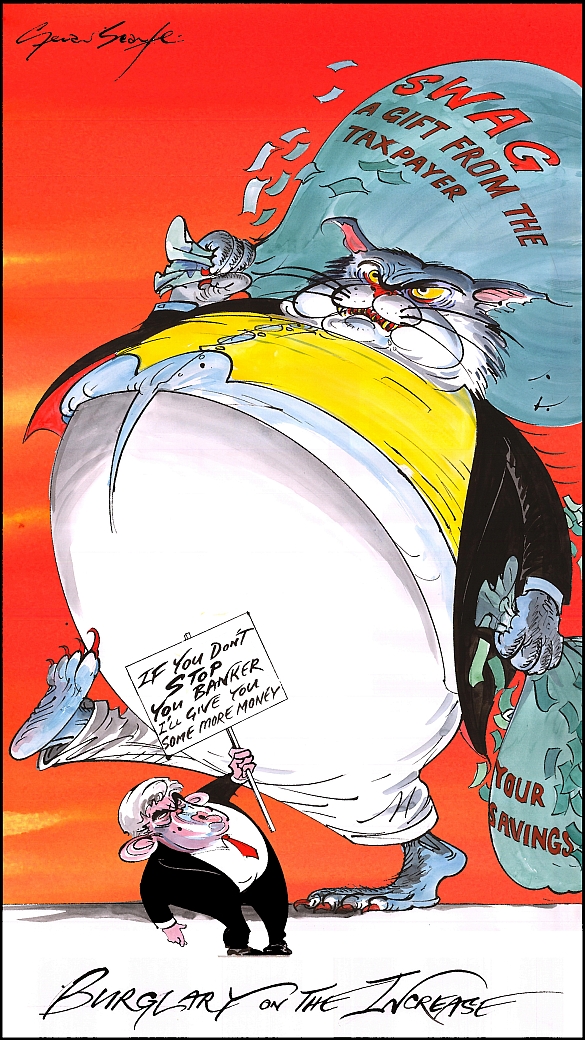

Gerald Scarfe

Sunday Times

January

25 2009

http://www.timesonline.co.uk/tol/comment/article5577804.ece - brohen link

Bottom: Prime Minister

Gordon Brown

UK recession is worse than forecast

March 27, 2009

From Times Online

Carl Mortished

A sudden collapse in the building sector caused the British

economy to fall into an even steeper decline in the final quarter of last year,

according to revised government figures published today.

New data showed a shrinkage of 1.6 per cent in gross domestic product (GDP)

during the final three months of 2008 compared with earlier estimates of a 1.5

per cent decline.

The fall in GDP is the sharpest quarter-on-quarter decline since 1980.

On an annual basis, GDP fell by 2 per cent, more than the 1.9 per cent

previously estimated, and the steepest year-on-year fall since 1991 - the last

time Britain was in recession.

The sharpest decline was in the construction sector, which has been dogged by

the slump in demand for new houses.

Output in construction plunged by 4.9 per cent during the final quarter compared

with an earlier estimate of 1.1 per cent, while the slowdown in manufacturing

accelerated to 4.5 per cent compared with the 1.8 per cent fall in the previous

quarter.

Meanwhile, household spending came under the cosh from strained budgets but the

state enlarged its share of the economy, spending more as households reined in.

Consumer expenditure was down 1 per cent during the period but government

expenditure rose by 1.3 per cent and at the end of last year was 4.4 per cent

higher than the same period in 2007.

In January, figures confirmed that the UK was officially in recession after the

ONS data revealed that GDP had shrunk during two consecutive quarters - the

technical definition of a recession.

Last week, the International Monetary Policy (IMF) stamped out hopes the UK

economy would begin to see some recovery by Christmas with predictions that the

recession will continue into 2010.

The IMF forecasts that UK GDP will plunge by 3.8 per cent in 2009, far worse

that initial expectations of a 2.8 per cent contraction and will shrink by a

further 0.2 per cent next year.

The forecast contrasts with Spencer Dale, chief economist at the Bank of

England, who said today that "economic conditions may start to improve later

this year" when the "substantial" stimulus begins to take effect.

Howard Archer, chief UK and European economist at IHS Global Insight, said

consumer spending will come under more pressure from rising unemployment, which

is running at 2.03 million and is expected to hit 3.3 million by the end of

2010, as well as reduced income growth.

Earlier this week, the Retail Price Index measure of inflation, which is used as

a benchmark for wage deals by employers across the country, fell to 0 per cent

and is widely expected to fall into negative territory this year.

He added: "Business investment is being slashed in the face of sharply weakened

final demand, rising levels of spare capacity, worsening cash flows and very

tight credit conditions, deteriorating profitability, and serious concerns and

uncertainties about the potential length and depth of the recession."

UK recession is worse

than forecast, Ts, 27.3.2009,

http://business.timesonline.co.uk/tol/business/economics/

article5985498.ece

Welcome

to the inescapable era of no money

For the next ten years

British politics

is going to be about living

with the consequences of the State

being flat broke

March 11, 2009

From The Times

Daniel Finkelstein

We are insolvent. Out of money. Financially embarrassed.

Strapped. Cleaned out. We are skint, borassic lint, Larry Flynt, lamb and mint.

We are lamentably low on loot. We are maxed out. We are indebted, encumbered, in

hock, in the hole. We are broke, hearts of oak, coals and coke. It doesn't

matter whether money can buy us love, because we haven't got any.

Welcome to the era of no money. The central fact of British politics in the next

ten years, and perhaps longer, is not hard to spot. British politics isn't going

to be dominated by interesting debates on the future of capitalism. It isn't

going to be the stage for a revival of interest in democratic socialism. It

isn't going to play host to the interplay of competing ambitious projects. No.

We're in for a hard slog. Because what British politics is going to be about in

the next ten years is living with the consequences of the State being broke, of

the Government running out of money.

I don't mean to make a meal of this. It's just that sometimes when I listen to

the political debate, I wonder if everyone is still connected with reality.

They're all busy announcing new schemes and White Papers or dreaming of tax cuts

and so forth, and no one seems to talk much about the cash. La la la la (fingers

in ears). The Conservatives occasionally bring it up, a little gingerly. They

think the problem is going to land on their plate, after all. But they are also

worried about being seen as gloomy, so they try not to bang on about it.

Let's look at a few figures. In January the Institute for Fiscal Studies

published its 2009 Green Budget. Having described the incredibly painful cuts in

projected public spending that have already been announced, the IFS says: “If

the public finances evolve as the Treasury hopes, this tightening would have to

remain in place until the early 2030s before debt returns below the ceiling of

40 per cent of national income Gordon Brown set as one of his two fiscal rules

in 1997.”

Only one thing: the IFS - like most informed observers - does not think the

public finances will evolve as the Treasury hopes. Things will be far worse. The

Government or its successor will need a further £20billion a year. A further

£20billion of tax rises or spending cuts on top of its already very difficult,

tough plans. And, adds the IFS, “even if it acts, public sector debt may well

not return to pre-crisis levels for more than 20 years”.

Twenty years is a political age. Twenty years ago Tony Blair was Shadow

Secretary of State for Energy and George Osborne was studying for his A levels.

The era of no money will define politics long into the distance, as far as the

eye can see.

If you want to understand what this will mean for the Left then consult the

books of the Labour thinker, Tony Crosland. On this point they bear rereading

even if some of them are more than 50 years old. Crosland insisted that the

future of socialism depended on being able to raise the level of economic growth

and state spending. Without growth Labour would not be able to redistribute, or

at least it would face a titanic struggle trying to do so. As it pursued

equality it would be fiercely resisted by an army of losers.

This has not been a merely theoretical point. Every Labour government has kept

its unstable coalition of leftist dreamers, truculent union men and hard-nosed

managerialists together by spending money. Money is how the NHS was created as

Nye Bevan bought off the doctors and, more than 50 years later, money was how Mr

Blair kept his Government afloat.

New Labour was made possible because steadily increasing state spending allowed

important choices to be avoided. The Government could give out more in benefits

to the low paid, spend cash on the NHS to cover up its failures, buy off the

unions and all without alienating the middle class too badly. If it proposed

market reforms, to burnish its credentials as a progressive party, it could buy

off the left-wing critics with taxpayers' cash. No more. In the era of no money,

the Left will have to choose. And choosing will be grim.

But things will be grim for the Right, too. Many Conservatives have lived in a

dreamworld. Cutting spending would be easy. Cutting tax is a moral necessity.

They are about to find out just how difficult it is even to control the amount

Government pays out. Consumers of public services have rising expectations and

most of the services are labour intensive. Both these things keep pushing up

costs, even if government does nothing.

And Tory ideology robs them of the one escape route that the Left retains. They

can't very well start putting up taxes - at least not greatly, at least not for

an extended period. The party leadership is going to find it hard enough

restraining the demand for tax cuts from activists and newspapers, tax cuts that

the era of no money make impossible.

The Tories will aim, of course, to make services more efficient and to get

government out of wasteful projects altogether. Yet even this will prove hard.

Reform costs money. Making people redundant, moving offices, sending out

circulars full of new instructions, keeping interest groups happy while making

controversial changes - it all costs money. And (here's a point I may not have

mentioned) there is no money.

It will not be open to David Cameron to be the mirror image of Mr Blair - to

move gently towards Tory goals while using spending to keep his opponents

always, always slightly off balance. In the era of no money a much more bloody

clash will prove almost impossible to avoid. The Left will not find themselves,

as the Right did in 1997, confused and with little to say. The battle with the

Tories over tax and public spending will seem familiar. Then again, they might

like to recall that when those were the battlelines, they lost.

Welcome to the

inescapable era of no money,

Ts, 11.3.2009,

http://www.timesonline.co.uk/tol/comment/columnists/daniel_finkelstein/

article5883988.ece

RBS record losses

raise prospect of 95% state ownership

• Bank makes loss of £24bn

• Taxpayer could end up owning 95%

• Row over £650,000 pension for failed boss Goodwin

Thursday 26 February 2009

08.57 GMT

Guardian.co.uk

Jill Treanor

This article was first published on guardian.co.uk

at 08.57 GMT on Thursday 26

February 2009.

It was last updated at 09.14 GMT

on Thursday 26 February 2009.

Royal Bank of Scotland has suffered the biggest loss in

British corporate history - more than £24bn - and admitted today the taxpayer

could end up owning 95% of the bank if its losses continue to mount.

The troubled bank needs to sell up to £19.5bn new B shares to the taxpayer in

order to insure £300bn of its most troublesome assets. As a result, the

taxpayer's voting rights over the bank would increase to 75% from almost 70%

now. But Stephen Hester, the new chief executive, said the government's

"economic interest" could rise to 95% "depending on how things work out".

On a conference call with reporters this morning, Hester said he "wanted to be

honest and clear" on the government's stake because "we live in an uncertain

world". But the voting influence of the taxpayer would be restricted to 75%, he

said.

The scale of the losses suffered by the bank exacerbated the row about a

£650,000 pension being drawn by former chief executive Sir Fred Goodwin, who is

50 and left last month after almost a decade at the helm.

Treasury minister Stephen Timms said the current RBS board was "extremely

concerned" by the pension deal, which threatens to undermine government claims

that it would not reward failure.

Hester said today the payments were part of the contractual entitlement to

Goodwin and were agreed by the government at the time of the initial October

bail-out.

The figures from RBS showed a statutory loss of £40bn, which falls to £24.1bn if

technical issues relating to the bank's acquisition of ABN Amro are ignored. It

largely comprises £7.8bn of trading losses and £16.8bn of writedowns caused by

paying too much for acquisitions, notably ABN.

The City had been braced for £20bn of writedowns so the overall loss is slightly

lower than expected.

But Derek Simpson, joint leader of Unite, said: "These historic and humiliating

losses bring into sharp focus just how recklessly RBS's former management team

have behaved.

"The whole country is paying the price through job cuts and repossessions on a

massive scale. It is time to take control and fully nationalise this bank.

"You cannot have a state bail-out on one hand while allowing the spectre of

thousands of job losses to loom over staff on the other," he said.

Hester today set out the detail of the radical restructuring he intends to

undertake to try to set RBS back on a course to recovery. He outlined seven

goals and which involve the bank shrinking by 20% and did not dispute

speculation that up to 20,000 jobs from a 177,000 workforce could be axed.

• Shift £240bn of assets to a non-core division for disposal/run down over three

to five years

• Deliver substantive change in all core division businesses

• Centre on UK with smaller, more focused global operations

• Radically restructure global banking and markets, taking out 45% of capital

employed

• Cut more than £2.5bn out of the group's cost base

• Have access to the government asset protection scheme

• Drive major changes to management, processes and culture

Hester said: "Our aspiration is that RBS should again become one of the world's

premier financial institutions, anchored in the UK but serving individual and

institutional customers here and globally, and doing it well".

The bank's offices in 36 of the 54 countries in which it operates around the

world will be cut back or sold. But major "global hubs" will remain.

New chairman Sir Philip Hampton made a fresh apology to shareholders. Last year

their shares were trading at 400p. In early trading today they were 28.1p.

Hampton said: "An inevitable but regrettable consequence of the successive

capital raising exercises has been the dilution of the interests of existing

shareholders. My predecessor Sir Tom McKillop apologised to shareholders for the

impact on them of the erosion of their investments, a sentiment I echo. Those of

us now charged with leading the group are committed to implementing measures

which will allow us to restore the group to standalone financial health in the

interests of all shareholders."

The bank also took a £7bn charge to cover impairment of loans that have turned

sour.

Executives had spent much of the night locked in talks about the asset protect

scheme to insure £300m of its most troublesome assets. In turn the bank will

issue £13bn of a new class of B shares and a further £6.5bn at a later date to

pay for the scheme which forces the taxpayer to take on additional risk. In

return, RBS will lend a further £25bn this year and a further £25bn next year to

try to kick start the economy. The fee will be spread over seven years in the

bank's accounts.

Hester confirmed Nathan Bostock had been hired from Abbey National to run the

assets which will be disposed of or shut down. Gordon Pell, a long-standing

board member, is also delaying his retirement and being appointed deputy chief

executive.

RBS record losses

raise prospect of 95% state ownership,

G, 26.2.2009,

https://www.theguardian.com/business/2009/feb/26/

rbs-record-loss

UK car production falls 58.7pc

UK car production fell 58.7pc in January,

confirming the

dramatic decline in the country's motor industry.

Last Updated: 12:02PM GMT 20 Feb 2009

The Daily Telegraph

By Graham Ruddick

The steep decline comes as car makers including Ford, Honda,

Toyota, Nissan, BMW's Mini and Jaguar Land Rover cut production and jobs.

The data from the Society of Motor Manufacturers and Traders (SMMT) marks a

further decline from December, when production fell by 47.5pc compared to a year

earlier.

Paul Everitt, the SMMT chief executive, said the rapid decline highlights the

"critical" need for further Government measures to support the sector.

Worldwide sales of new cars have plunged amid a lack of available finance and

confidence among consumers. In response, auto companies have been forced into

drastic restructurings and asking for state aid.

Lord Mandelson, the Business Secretary, has made £2.3bn of emergency loans

available for car makers in the UK. But Mr Everitt believes incentive schemes to

encourage motorists to replace their old cars are required, along with measures

to boost car dealers' liquidity so they can afford to purchase vehicles.

"The extent of the decline highlights the critical need for further government

action to deliver the measures already announced and ease access to finance and

credit,” he said.

"European markets have been lifted by scrappage incentive schemes and SMMT

continues its call for a UK plan to boost the new vehicle market and support

employment throughout the sector. The motor industry reiterates its request for

an urgent government response.”

The figures, which also show a 59.9pc fall in the production of commercial

vehicles, cap a pitiful week for the industry. On Monday, 850 jobs were cut at

BMW's Mini factory near Oxford, prompting employees to pelt management with

fruit. The following day GKN, which makes car parts, axed 564 jobs "entirely due

to the dramatic and sustained reduction in customer orders".

In the US, General Motors and Chrysler have told the government they require

$16.6bn (£11.7bn) of financial support.

The car makers plan to axe 47,000 jobs worldwide – including 26,000 outside of

Europe. GM Europe is also looking to offload Swedish auto-maker Saab and

potentially sell stakes in the Opel and Vauxhall brands.

The UK Government said it was "considering" GM's plans – which include a request

for $6bn of support from governments outside the US.

UK car production

falls 58.7pc,

DTel, 20.2.2009,

http://www.telegraph.co.uk/finance/financetopics/recession/4732308/

UK-car-production-falls-58.7pc.html

Home repossessions jump 54%

as mortgage arrears soar

February 20, 2009

From Times Online

Grainne Gilmore

The number of people losing their homes rose by 54 per cent

last year, while the number of homeowners in arrears soared by 70 per cent,

figures show.

Lenders repossessed some 40,000 homes last year, fewer than the 45,000 than had

been forecast, the Council of Mortgage Lenders said. But some 219,000 people

were three or more months behind with their mortgage payments at the end of the

year, up from 127,500 at the end of 2007.

The CML has forecast that 500,000 people could fall behind with three or more

mortgage payments this year.

The CML said that the lower repossession figures indicated that lenders were

making "strenuous efforts" to try to keep people in their homes.

Seperate figures from the Ministry of Justice, also published this morning, show

that the number of mortgage possession claims lodged by lenders dropped by 32

per cent in the final three months of last year compared to the same period in

2007.

However the number of possession orders passed by judges rose by 14 per cent

year on year, with 29.095 orders granted. Not all orders result in people losing

their homes hoewever, as borrowers can still strike an agreement with lenders

even after the order has been granted.

The Government this morning revealed new details of its Homeowner support

scheme, which is aimed at cutting the number of repossessions.

Margaret Beckett, the Housing Minister said: “We are determined to do everything

possible to ensure repossession is always a last resort, and are taking action

to give real help now to households most in need.

“Our mortgage rescue scheme is up and running, more free legal and debt support

is available than ever before, and we have increased financial assistance to

help people pay their mortgage if they’ve lost their job.

Michael Coogan, the director general of the CML, said that there was a rise in

the numbers of borrowers handing back their keys or abandoning their properties.

"We strongly urge borrowers to contact their lender and work with them before

taking this step, as there may be other solutions. Borrowers are still liable

for their debt, even if they leave the property, so working through their

problems is much more likely to be in their best interests," Mr Coogan said.

Home repossessions

jump 54% as mortgage arrears soar, Ts, 20.2.2009,

http://business.timesonline.co.uk/tol/business/economics/article5771541.ece

Lloyds warns of £10bn HBOS loss

Published: February 13 2009 14:15

Last updated: February 13 2009 15:14

The Financial Times

By John O’Doherty and Bryce Elder

Lloyds Banking Group warned on Friday that its HBOS subsidiary

would report a pre-tax loss of £10bn for the full year, hit by £7bn of

impairments in its corporate division.

The figure is significantly above estimates made by analysts such as those at

Credit Suisse, which anticipated a £4.8bn loss from the bank.

The news hit London banking stocks hard. Lloyds shares dived

more than 40 per cent before recovering slightly to trade 28.5 per cent lower at

65p. Barclays sank 15 per cent before rallying to stand 3.8 per cent lower at

101p and Royal Bank of Scotland was 5 per cent lower at 22.8p, having earlier

hit a session low of 19.8p, down 17.5 per cent.

Banking sector stocks had rallied from record lows last month after comments

from government officials helped ease fears of nationalisation. However, it

remains the worst performing industry group for the year to date, with the FTSE

350 Banks Index slumping 25 per cent.

Lloyds’ warning also hit sterling, which was trading off session highs against

the dollar in response.

The group, formed by the government-sponsored merger of Lloyds-TSB and HBOS last

year, said that pre-tax profits at the standalone Lloyds banking division (as it

existed before the merger) would be in the region of £1.3bn, roughly in line

with what analysts had been expecting.

However, in the past two months HBOS had been affected by “increasingly

difficult market conditions, an acceleration in the deterioration of credit

quality and falls in estimated asset values”.

It said the impairments were some £1.6bn higher than it had expected when it

unveiled the merger last November.

The losses were mainly driven by a £4bn hit from “market dislocation” and

approximately £7bn of impairments in HBOS’s corporate division. As a result,

Lloyds said that underlying pre-tax losses at HBOS would be £8.5bn, which when

combined with impairments and ancillary losses would total £10bn. There will be

an additional £900m tax charge on top of this.

Eric Daniels, chief executive, said in a statement: ”HBOS’s 2008 results have

been adversely affected by the impact of market dislocation, which accelerated

significantly in the last quarter of 2008, and the additional impairments

required on the HBOS corporate lending portfolios. These impairments primarily

reflect the application of a more conservative recognition of risk and the

further deterioration in the economic environment.”

Lloyds said its core tier 1 capital ratio at the end of the year was in the

range of between 6-6.5 per cent, in excess of its regulatory capital

requirements.

Lloyds warns of £10bn

HBOS loss, FT, 13.2.2009,

http://www.ft.com/cms/s/0/eefff408-f9d6-11dd-9daa-000077b07658.html

Sterling extends losses

as BofE cuts growth forecast

Published: February 11 2009

11:14

Last updated: February 11 2009

11:14

Thez Fiancial Times

By Peter Garnham

The pound extended its losses on Wednesday as the Bank of

England signalled it was prepared to take unconventional steps to boost the UK

economy.

Mervyn King, the Bank’s governor, said the UK economy was in deep recession and

that the risks to economic growth lay “heavily to the downside” as the

government wrestled with problems in the UK financial system.

In its quarterly Inflation Report, the Bank cut its growth

forecasts sharply and predicted UK inflation would fall well below its 2 per

cent target if interest rates remained at their current level.

This heightened expectations that the Bank would deliver a further cut in UK

interest rates after lowering them by 50 basis points to 1 per cent after its

monetary policy committee meeting last month.

But it was comments that the Bank would embark on a policy of quantitative

monetary easing once interest rates fell to zero that undermined sterling.

Mr King said the central bank would ‘certainly’ be buying Gilts and the supply

of money needed to be increased.

“In other words, Mr King is talking about turning on the printing press, which

would effectively de-base the value of the pound,” said Paul Mackel at HSBC.

“On the back of Mr King’s comments the path of least resistance is for sterling

to weaken.”

The pound fell 1 per cent to $1.4385 against the dollar, lost 1.2 per cent to

£0.8987 against the euro and fell 1.6 per cent to Y129.36 against the yen.

Meanwhile, the dollar and the yen remained supported on Wednesday after sharp

gains in the previous session.

Both currencies rallied strongly on Tuesday as disappointment following the US

government’s bank rescue plan boosted safe haven demand for the dollar and yen.

The turnaround in sentiment stemmed the recent rebound in higher-risk

currencies, with the pound one of the main underperformers reflecting the

exposure of the UK economy to the financial sector.

Analysts said the market expected to see clear and decisive guidance from the

new US administration, but were disappointed by the lack of detail concerning

the pricing of distressed assets, the epicentre of the financial system’s

problems.

“The market, correctly, doesn’t much care about tax rebates and public spending,

as it understands these well and generally deems it a sideshow compared to the

enormity and confusion surrounding bank balance sheets and lending confidence,”

said Maurice Pomery at IDEAGlobal.

“The statement failed to deliver.”

The yen rose 0.7 per cent to Y89.87 against the dollar, climbed 0.5 per cent to

Y116.37 against the euro and gained 0.9 per cent to Y58.71 against the

Australian dollar.

The dollar eased 0.2 per cent to $1.2945 against the euro and edged 0.2 per cent

lower to SFr1.1534 against the Swiss franc.

Meanwhile, the Swedish krona dropped sharply after the Riksbank, the country’s

central bank, cut interest rates by more than expected after its policy meeting.

The bank slashed rates by 100 basis points to a record low of 1 per cent and

said it might have to cut rates further. Analysts had been predicting a 50

basis-point move.

The Swedish krona fell 1.5 per cent to SKr8.3640 against the dollar and dropped

1.8 per cent to SKr10.8350 against the euro.

Audrey Childe-Freeman at Brown Brothers Harriman said the fact that Sweden’s

yield advantage was falling by the month and had almost disappeared would weigh

on the krona in the short term.

However, she said over a longer-term perspective, the pro-active fiscal and

monetary policy mix endorsed by the Swedish authorities may be rewarded.

“Clearly that is not today’s story, but it is worth bearing in mind,” said Ms

Childe-Freeman.

Sterling extends

losses as BofE cuts growth forecast, FT, 11.2.2009,

http://www.ft.com/cms/s/0/9aacf07e-f82b-11dd-aae8-000077b07658.html

Unemployment hits 12-year high of 1.97m

February 11, 2009

From Times Online

Grainne Gilmore

Unemployment rose by 146,000 to 1.97 million between October

and December, the highest level of unemployment since August 1997, after Labour

came to power.

Today's figure is lower than City economists had forecast, who had been

expecting unemployment to reach two million in the final three months of the

year.

However, the number of redundancies in the three months to December 2008 was

259,000, the highest figure since comparable records began in 1995.

Last month, the number of people claiming jobseeker’s allowance rose to a

ten-year high, rising by 73,800 to 1.23 million.

Some 438,100 more people signed up for benefits last year.

City economists expect the jobless figures to deteriorate again in the coming

months.

Vicky Redwood, of Capital Economics, said: "Much worse is to come — these

figures won’t even fully reflect the effects of Q4’s sharp contraction in the

economy.

"We still think unemployment will reach 3.5 million by the end of 2010."

Paul Kenny, general secretary of the GMB union, said: “What a bleak day for our

economy and for the workers and families of those now jobless.

“All across the world workers are losing their jobs daily at a very fast rate in

this bankers’ recession."

Unemployment rose fastest in the West Midlands in the final three months of the

year, increasing by 1.2 per cent compared to the previous quarter. In contrast,

unemployment fell by 0.1 per cent in London, and 0.2 per cent in Yorkshire and

the Humber.

The new figures emerged as Gordon Brown hosted a meeting with business leaders

in an attempt to publicise efforts to expand the number of posts offered at

Jobcentres.

Executives from Sainsbury's, Royal Mail, Whitbread, Centrica, National Express

and Travelodge all attended the first meeting of the National Employment

Partnership in Downing Street this morning.

Mr Brown said: “Around this table are some of the biggest employers in the

country. I realise these are very difficult times because of the global

financial recession.

“But I am sure, by working together in partnership, we can make a difference to

the employment opportunities and success of the economy.”

Mr Brown emphasised that despite growing unemployment, there were still 500,000

vacancies in the economy.

Unemployment hits

12-year high of 1.97m, Ts, 11.2.2009,

http://business.timesonline.co.uk/tol/business/economics/article5707365.ece

Leading article:

Britain's bankers

still have tough

questions to answer

The job of the Treasury Select Committee is only half complete

Wednesday, 11 February 2009

The Independent

The grand Parliamentary inquisition of four of Britain's most prominent

failed bankers yesterday might not have delivered the merciless evisceration

many in the country had been hoping for, but it at least succeeded in getting

Sir Fred Goodwin, Sir Tom McKillop, Andy Hornby and Lord Stevenson to offer a

public account of themselves.

The apology that the former heads of the Royal Bank of Scotland and the

Halifax Bank of Scotland delivered at the outset of the hearing was a study in

ambiguity. The bankers were sorry for "the turn of events" and for "all the

distress" caused, but not, it seems, for their own conduct. Their real failure,

they argued, was one of omission rather than commission: they failed to

anticipate that the flow of credit in the world financial system would come to

an abrupt stop.

The Treasury Select Committee, to its credit, did not let them get away with

that generous interpretation of their failings. MPs on these committees often

adopt a scatter-gun approach to the interrogation procedure of witnesses. This

time they were well briefed and reasonably well co-ordinated. And it became

apparent over the course of the hearing that this quartet of bankers simply lost

control of their businesses.

The admission extracted from Mr Hornby that "the bonus system has proved to be

wrong" provides an important contribution to the present public debate about

bankers' remuneration. It is much harder to justify such payments if the head of

a failed bank believes they were a factor in his institution's downfall.

Yet an even bigger test for MPs on the Treasury Committee will come today when

John Varley, the chief executive of Barclays, and Stephen Hester, brought in to

manage the stricken RBS, come before them. For all the attention the inquisition

of Sir Fred and Mr Hornby attracted, they are essentially yesterday's men. Those

in the hot seat today are still players.

Mr Varley, in particular, needs to answer some tough questions, both about the

manner in which he has run his bank in recent years and about how he intends to

run it going forward. The committee needs to find out why Barclays chose to

eschew the Government capital on offer last October, preferring instead to raise

more expensive funding from the Middle East. There is a widespread belief in the

financial world that the motivation was to avoid any Government interference in

the bank's remuneration practices.

There is also some scepticism in the City over Barclays' methods of valuing its

assets. Can Mr Varley guarantee that there will be no nasty surprises in store

for shareholders? There is a clear public interest in getting an answer to this.

If Barclays' attempt to go without state support does end in disaster, the

Government would have to clean up the mess. Barclays is, in that dreaded phrase,

"too big to fail".

Mr Hester cannot be called to account for the woeful past performance of RBS.

But there is a good deal to ask him about the bank's future, not least the

question of whether he is running the bank primarily in the interests of its

remaining private shareholders, or the taxpayer, which now owns a majority of

the business?

MPs must also demand an explanation from both men of why they are still planning

to pay their staff bonuses despite the fact that the share price of their

respective institutions has collapsed. The Treasury committee made a decent

start yesterday. But this inquisition is far from over.

Leading article:

Britain's bankers still have tough questions to answer, I, 11.2.2009,

http://www.independent.co.uk/opinion/leading-articles/leading-article-britains-bankers-still-have-tough-questions-to-answer-1606269.html

Dave Brown

The Independent

10 February 2009

http://www.independent.co.uk/opinion/the-daily-cartoon-760940.html

Prime Minister Gordon Brown

Bankers on trial

Mark Steel:

New Labour encouraged

every aspect of this

avarice

The people who couldn't see

what was obvious are allowed to carry on

Wednesday, 11 February 2009

The Independent

The real point about a minister saying this is the worst economic crisis for

100 years, is it shows they haven't got a clue. That figure was plucked out of

nowhere, unless there was a really dreadful crisis in 1909 that no one ever

noticed before. Maybe the minister's just seen Mary Poppins, and the scene where

the bank goes bust, he thinks is footage of a real financial crash.

So his next statement to Parliament will be "In order to steady the financial

markets we are proposing tuppence tuppence tuppence a bag, feed the birds,

tuppence a bag. THAT is the sound economic sense that can rescue our banks,

rather than the ill-thought-out soundbites from the party opposite."

Why not say it's the worst for 2,000 years, when the great crash of 9AD was

caused by the gross overvaluation of aqueducts? Or the worst for 65 million

years, when the Jurassic currency disaster led to bankers throwing themselves

from the top of brontosaureses, followed by the eventual disappearance of all

dinosaurs, despite the Prime Minister having boasted: "We have finally put an

end to the cycle of evolution and extinction."

Next week a minister will announce that the Bank of England has revised its

forecasts, and instead of the crisis getting as bad as diarrhoea, as it first

thought, it now expects it could be as bad as gastroenteritis, and the IMF

believe it could even reach the point where it's like one of those days when

it's coming out of both ends at once. But with careful fiscal handling this

should be easing by the last quarter of 2010.

You have to admire the front of these ministers for saying anything at all about

what's happening, given they insisted for years there would never ever again

ever be a cycle of boom and bust.

Similarly an army of experts assured us on a daily basis that this boom couldn't

possibly crash like previous booms because this boom was still going on whereas

all previous ones had ended, and previous booms were founded on a manic belief

that wealth could go up and up without any basis in reality, whereas this one

was built on the sound footing that everything really is somehow suddenly worth

twice as much so TAKE AS MUCH AS YOU CAN RIGHT NOW IT CAN'T EVER STOP!!!

For example, one of the bankers questioned yesterday said it was "not possible

to envisage" the banking crash. But in every office, every pub, every

launderette, there were people who managed to envisage exactly that. If Gordon

Brown had got them to write his chancellor's speech, so that it went: "The

bubble's got to burst sometime. I mean, you can't base an economy on pretending

everything's doubled in value, and who's going to pay for these bankers' bonuses

– WE are, that's who. I commend this budget to the House," he might not be in

his present trouble.

Instead the people who couldn't possibly envisage what was obvious are allowed

to carry on. To be fair, ministers have expressed their annoyance at the

bankers' bonus system, so presumably there will now be a series of adverts in

which a furtive banker buys a boat, while the camera zooms in to his sweaty face

and a voice says: "Banking cheats – we're closing in."

One answer may be a review of how this bonus system came about. As if the

Government's making out it's only just heard about it and they're as outraged as

everyone else. Maybe Brown will make a statement to the nation in which he says:

"HOW much do they pay themselves? Well no WONDER we're in a pickle, you just

wait 'til I get my hands on them."

But New Labour urged and encouraged every aspect of this corporate avarice. It

was defined from the beginning by characters like Mandelson making speeches such

as: "In the modern Labour Party we are relaxed about those who express an

insatiable and pathological desire for self-enrichment at the expense of our

fellow man that borders on the truly evil."

They grovelled to every banker, and now they want to set up a review to see how

that happened. If only Karen Matthews had thought about it, she could have said:

"Instead of going to jail, why don't I set up a review to see how I kidnapped my

own daughter," and got herself six months' work.

Mark Steel: New Labour

encouraged every aspect of this avarice, I, 11.2.2009,

http://www.independent.co.uk/opinion/commentators/mark-steel/mark-steel-new-labour-encouraged-every-aspect-of-this-avarice-1606275.html

Bankers apologise

and back calls for review of bonus culture

Former bosses of RBS and HBOS

apologise to the Treasury select committee

for

the events that led up to their banks

being taken largely into public ownership

Tuesday 10 February 2009

15.26 GMT

Guardian.co.uk

Andrew Sparrow and agencies

This article was first published on guardian.co.uk

at 15.26 GMT on Tuesday 10

February 2009.

It was last updated

at 15.27 GMT on Tuesday 10 February 2009.

Senior bankers today backed calls for a review of the City bonus culture as

they apologised to MPs for their role in events leading up to RBS and HBOS

having to be rescued from the verge of collapse.

Sir Fred Goodwin and Sir Tom McKillop, respectively the former chief executive

and chairman of RBS, and Andy Hornby and Lord Stevenson, respectively the former

chief executive and chairman of HBOS, were quizzed about bonuses during a

Commons Treasury select committee hearing in which they were accused of being

"in denial" about their role in the banking crisis.

Although all four started their evidence by apologising, at times they faced

hostile questioning and after the hearing was over the committee chairman, John

McFall, accused them of displaying "a hint of arrogance".

During the session, which lasted for more than three hours, the four admitted

that they did not anticipate the events that led to RBS and HBOS having to be

rescued, but they insisted that others had also failed to anticipate global

credit drying up in the way that it did. The hearing also featured:

• Goodwin and McKillop conceding that RBS's decision to buy the Dutch bank ABN

Amro was a mistake

• All four witnesses admitting that they did not have formal banking

qualifications

• Hornby admitting that he was being paid £60,000 a month to work as a

consultant for his old bank

• John Mann, a Labour MP, asking Goodwin if he had a "different moral compass"

from other people, and Jim Cousins, another Labour MP, asking McKillop if he had

taken legal advice on the nature of criminal negligence. Goodwin said there was

no reason for Mann to question his integrity and McKillop said he had not asked

for such advice

• Michael Fallon, a Tory MP, accusing Goodwin of "destroying a great British

bank"

• McKillop admitting he did not fully understand some of the complex financial

instruments his bank was using

• McFall telling the bankers that the RBS board contained "the brightest and the

best" and suggesting the complexity of modern banking, not individual

incompetence, was to blame for what went wrong.

At the start of the session Goodwin, who in the past has been criticised for not

showing sufficient regret for his role in what happened to RBS, said he was

offering "profound and unqualified apologies for all the distress that has been

caused". He said that he was repeating an apology he had already given to

shareholders.

Stevenson, McKillop and Hornby also repeated apologies that they said they had

made in the past.

RBS is now 68% owned by the state and has been propped up with £20bn of public

money.

HBOS has been entirely swallowed by Lloyds TSB in the newly formed Lloyds

Banking Group after the lender fell victim to the financial crisis.

RBS, HBOS and merger partner Lloyds were supported with £37m in taxpayers' cash

last autumn as the financial system came close to collapse.

On bonuses, three of the bankers agreed that the City's bonus system needed to

be reviewed.

McKillop said: "I believe that the events that have occurred and the situation

we are now in should give us an opportunity to look fundamentally at the

remuneration practices going forward. But I do believe that it needs to happen

across the board."

Goodwin said that the bonus system was "something that should be looked at", but

he said he did not accept that the bonus culture had encouraged illegitimate

risk-taking at RBS.

Hornby said he thought bonuses should be tied to long-term performance, and that

instead of being paid annually, they should be paid over three to five years.

"There is no doubt that the bonus system in many banks around the world has

proven to be wrong in the last 24 months," Hornby told MPs, "in that, if people

are rewarded [in] purely short-term cash form and are paid very substantial

short-term cash bonuses without it being clear whether these decisions over the

next three to five years have proven to be correct, that is not rewarding the

right type of behaviour."

Goodwin and McKillop were also asked about RBS's decision to buy the Dutch bank

ABN Amro, which led to RBS having to write off £20bn. Michael Fallon told

McKillop: "You have destroyed a great British bank. You have cost the taxpayer

£20bn."

McKillop said: "The deal was a bad mistake. At the time it did not look like

that ... There was widespread support for it."

The bankers came under a particularly fierce grilling from John Mann, a Labour

member of the committee.

Addressing Goodwin, Mann asked him whether he had a "different moral compass"

from other people. He also asked him if his integrity and ethics were

representative of the banking profession as a whole.

Goodwin replied: "Reflecting on everything that has happened, I think there is a

case for questioning some of the [decisions] that I have made. I'm not aware of

any basis for questioning my integrity as a result of it all."

Referring to HBOS, Mann said that he had had letters from HBOS employees saying

they were "ashamed" to work for the bank. He asked Hornby to confirm that he was

now working for Lloyds TSB, the bank that subsequently took over HBOS, as a

consultant on a salary of £60,000 a month.

Mann said Hornby's salary would pay the wages of 36 low-paid bank staff. "Why is

failure being rewarded? Why are you still getting this money?" he asked.

Hornby said he was being paid £60,000 a month, but that he had said that he only

wanted the arrangement to continue for three months and that, if they still

wanted him after that, he would work for free.

Hornby went on: "Can I please reiterate in terms of your impression about being

rewarded for failure that I invested every single penny of my bonus in shares? I

have lost considerably more money since I have been chief executive than I have

earned."

George Mudie, a Labour member of the committee, told the four that, having

listened to them, he had the impression that they were "all in bloody denial"

about their role in what went wrong.

Stevenson denied that. "We are not in denial," he told Mudie.

"There are many things that we regret. I do think that in a number of areas it's

a fact that very carefully arranged risk management systems were developed ...

which regrettably did not spot scenarios coming up that have come up.

Stress-testing did not stress-test adequately."

During the hearing, in a hint that the four bankers may escape severe personal

criticism when the committee publishes its conclusions, McFall suggested that

individual bankers were not to blame and that the problems were structural.

Addressing McKillop, McFall said the RBS board contained "the brightest and the

best" and that as a result "there has to be something more fundamental there".

McFall said that experts had told the committee that they would have difficulty

understanding the full scale of RBS's liabilities.

"Therefore you cannot lay the charge that it's incompetence. There has to be a

system problem there. I put it to you that the expansion of new financial

instruments increases the complexity to such an extent that people did not

really understand them."

McKillop replied: "I agree with the thrust of your question."

At another point Sir Peter Viggers, a Tory MP, asked the witnesses if they

understood the full complexities of the financial vehicles that their "clever

young men" were creating.

McKillop replied: "You said 'full complexities'. I would say no."

After the hearing McFall told the World at One that he was glad the bankers had

apologised but that he thought they had not showed full contrition.

"Was there a hint of arrogance still there? Absolutely," he said.

McFall also said the hearing had shown that the business model the bankers had

been using had been "flawed".

Bankers apologise and

back calls for review of bonus culture, G, 10.2.2009,

http://www.guardian.co.uk/business/2009/feb/10/bankers-apologise-rbs-hbos-treasury-committee

RBS, Morgan Stanley and UBS

to axe 6,500 jobs

Royal Bank of Scotland, Morgan Stanley and UBS

are cutting more than 6,500 jobs

in the latest blow to the ailing financial

services industry.

10 Feb 2009

Last Updated: 6:45PM GMT

The Daily Telegraph

By Jonathan Sibun

RBS said it was in consultation with staff over plans to make

2,300 UK employees redundant. The cuts will affect about 2pc of UK staff.

Morgan Stanley kicked off its latest redundancy programme as part of a global

restructuring that will see as many as 2,000 staff lose their jobs, hundreds of

whom are likely to be UK based.

The majority of the RBS and Morgan Stanley redundancies are expected to come

from back-office operations.

UBS said it would axe a further 2,200 jobs in its troubled investment bank. The

Swiss institution expects staff numbers in the division to have shrunk to 15,000

by the end of this year, down from 26,000 in October 2007.

RBS, which claimed compulsory redundancies would be kept to a minimum, said the

cuts would not affect customer-facing branch staff.

"It is essential that we consistently review our business to ensure that we are

able to operate as efficiently as possible, especially in the current economic

circumstances," said Alan Dickinson, chief executive of RBS UK.

"Staff have given everything they have over the last year, which makes the

decision to cut any job an extremely tough one."

Banks have been forced to reduce headcount sharply as business has dried up and

the global recession has intensified.

A Morgan Stanley spokesman said: "We are continually evaluating business

conditions in an effort to be right-sized for the current environment."

The US bank has already made 8,680 – or about 6pc – of its global workforce

redundant. RBS has cut about 3,950 jobs.

The redundancies come as Deutsche Bank became the latest investment bank to

announce a sharp fall in bonuses. Staff were told the size of their bonuses

yesterday with the average payout down 60pc year-on-year.

The job cuts are not confined to banks. City law firm Lovells has revealed plans

to cut up to 94 staff, while call-centre operator Sitel said it was making 220

employees redundant.

Luxury carmaker Bentley said it is also cutting 220 jobs and revealed all staff

will take a 10pc pay cut.

RBS, Morgan Stanley and UBS to axe 6,500

jobs, DT, 10.2.2009,

http://www.telegraph.co.uk/finance/newsbysector/banksandfinance/4582814/RBS-Morgan-Stanley-and-UBS-to-axe-6500-jobs.html

Personal bankruptcies hit new record

Friday 6 February 2009

10.41 GMT

Guardian.co.uk

Larry Elliott, economics editor

This article was first published on guardian.co.uk

at 10.41 GMT on Friday 6

February 2009.

It was last updated

at 10.48 GMT on Friday 6 February 2009.

Personal bankruptcy hit a record level and company failures soared by 50% as

the collapse in the economy in the final three months of 2008 took its toll,

official figures showed today.

Data from the Insolvency Service revealed that the steepest decline in output in

almost 30 years led to 19,100 people being declared bankrupt - a 22% increase on

the fourth quarter of 2007.

A further 10,000 people took out individual voluntary arrangements (IVAs) under

which interest on debt is frozen in exchange for set repayments each month.

The total of 29,444 people being declared insolvent was up 18.5% on a year

earlier and was higher than during the recession of the early 1990s.

The 1.5% contraction in the economy in the wake of the financial market mayhem

last autumn also claimed 4,607 companies - a 52% increase in liquidations on the

October to December period of 2007.

Economists warned that the level of bankruptcies was set to increase as

unemployment rose and the problems caused by the credit crunch meant people were

no longer able to borrow their way out of trouble.

Howard Archer, chief UK and European Economist at IHS Global Insight, said:

"Unfortunately, the marked rise in the number of individual insolvencies in the

fourth quarter of 2008 is a harbinger of what is very likely to be seen through

2009.

"Deep economic contraction, sharply rising unemployment, higher debt levels,

lower equity prices, and more and more people being trapped in negative equity

will exact an increasing toll over the coming months.

"While the substantial cuts in interest rates by the Bank of England will

obviously help some people, they are likely to be insufficient to save many from

insolvency."

Alan Tomlinson, partner at licensed insolvency practitioners Tomlinsons, said:

"I have been an insolvency practitioner for over 25 years and have never seen so

many companies, from all sectors, going to the wall. Trading conditions have

never been so tough and given the bleak economic outlook it could be some time

yet before they begin to improve.

"The appalling economic conditions are claiming more and more victims, as

companies in all sectors make redundancies or simply fail.

"What is especially interesting is that more people have gone down the

bankruptcy rather than the IVA route, which is a reflection of the fact that

lenders have tightened up the criteria for the acceptance of IVAs."

The Insolvency Service figures also showed a 75% jump in the number of people

declared insolvent in Scotland during the final quarter at 5,807, although the

figure was slightly down on the total for the previous quarter.

In Northern Ireland insolvencies increased by 39% year-on-year to 443 during the

three months to the end of December.

Nick O'Reilly, president of insolvency professionals' trade body R3, said: "What

today's figures mean is that in 2008 we saw a staggering 350 people becoming

insolvent in the UK every day. For 2009 our members believe this number will

reach in excess of 430 people a day for the whole of the UK.

"The outlook is bleak for the next two years, when insolvency practitioners

expect to see in excess of 158,000 personal insolvencies annually.

"We'll start to see the knock-on effects of increasing business failures and

redundancies on personal financial situations."

Personal bankruptcies

hit new record, G, 6.2.2009,

http://www.guardian.co.uk/business/2009/feb/06/bankruptcy-ivas-insolvencies

Britain 'headed'

for deepest slump in 60 years

As consumers cut their spending on a scale not seen for decades,

Britain will enter the gravest recession of the post-war era

February 4, 2009

From The Times

Gary Duncan, Economics Editor

The sharpest plunge in consumer spending since the Second World War will

drive Britain this year into its deepest economic slump for 60 years, according

to the country's leading economic research institute.

The headlong retreat from the high street by consumers is set to reach a scale

not seen for generations, the National Institute of Economic and Social Research

says in a bleak assessment of Britain's worsening prospects.

Consumer spending this year is set to plummet by 3.8 per cent - double the scale

of a previous record annual drop, of 1.6 per cent, suffered in 1991, the

institute forecasts.

The grim trend, already clear from the waning fortunes of troubled retailers,

marks a sharp reversal after a decade in which consumer spending climbed at an

average of almost 3.5 per cent a year.

The institute throws its weight behind a growing number of forecasts that

Britain faces its gravest recession in the postwar era.

It expects the UK economy to shrink this year by 2.5 per cent and it concludes

that the decline would be even steeper, at 2.7 per cent, but for the spillover

into Britain from President Obama's planned $800billion (£558billion) stimulus

measures in the United States.

The plunge in consumer spending predicted by the institute comes des-pite an

expected resurgence in Britons' earnings growth, with real disposable incomes of

households tipped to rise by 3.3 per cent this year, after an anaemic 1.5 per

cent increase last year.

The boost to British competitiveness from a weak pound will offer a rare glimmer

of hope, helping UK exports to rise by 2.4 per cent next year and pave the way

for a recovery, the institute finds.

However, the first glimmerings of recovery will not emerge until this winter,

with GDP set to keep falling through the third quarter.

The depth of the recession is set to take a big toll on the Government's

finances, the report adds.

The Chancellor will be forced to borrow £128billion in 2009-10, £10billion more

than his £118billion projection, and up to £140billion in the 2010-11 financial

year.

It says that after excluding the cost of financial sector rescues such as

Northern Rock, national debt will be 70 per cent of GDP by 2012-13, against the

Treasury's 57 per cent forecast and almost double the 36.5 per cent for 2007.

— The Bank of England has lent £185 billion to Britain’s banks under its special

liquidity scheme, it has revealed. The scheme, under which banks and building

societies were allowed to swap illiquid assets for UK Treasury Bills, closed

last Friday. It was launched last April. Describing use of the scheme as having

been “considerable”, the Bank said that 32 banks and building societies had

accessed the scheme — more than four fifths of those able to do so. The Bank

said that they had swapped assets worth some £287 billion for UK Treasury Bills,

but said that its valuation of these securities, as of last Friday, was only

£242 billion.

Britain 'headed' for

deepest slump in 60 years, Ts, 4.2.2009,

http://business.timesonline.co.uk/tol/business/economics/article5654764.ece

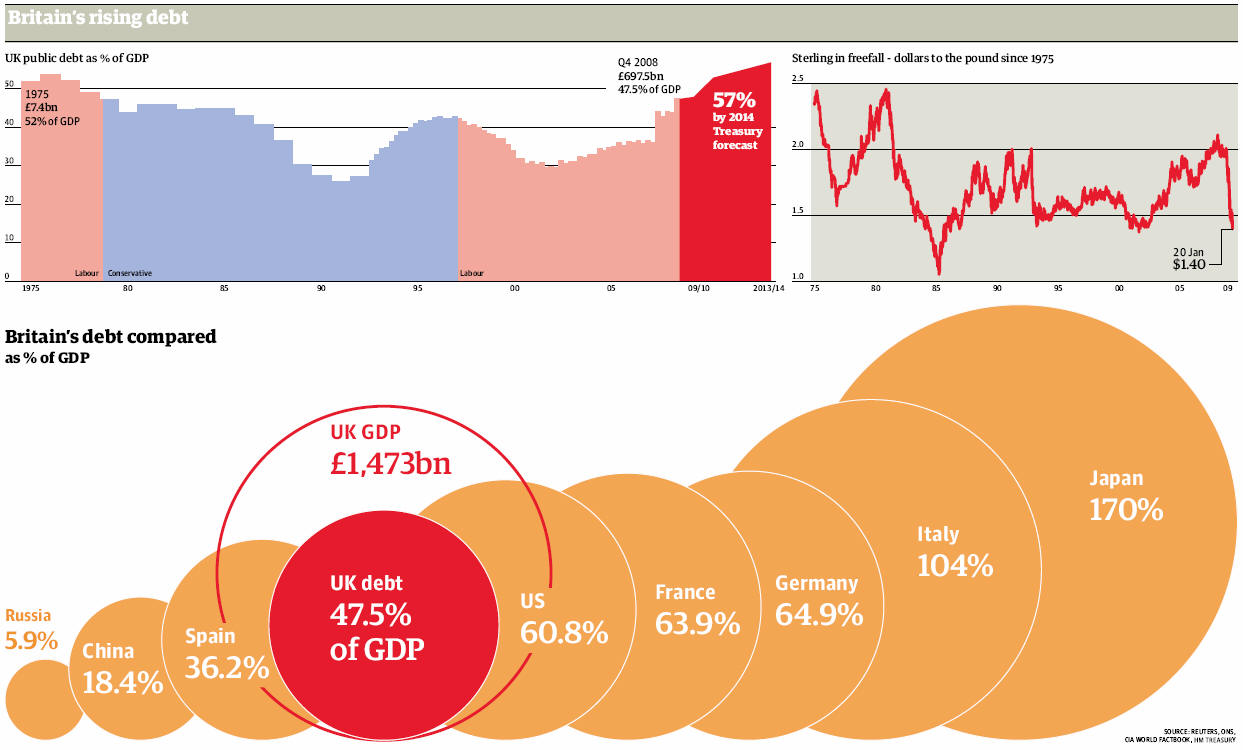

Q&A:

How much does Britain actually owe?

Sunday 25 January 2009

The Observer

Heather Stewart

This article was first published on guardian.co.uk at 00.01 GMT on Sunday 25

January 2009.

It appeared in the Observer on Sunday 25 January 2009 on p27 of the Focus

section.

It was last updated at 00.14 GMT on Sunday 25 January 2009.

Official figures from last week showed that the government had

run up total debts of £697.5bn, or 47.5% of GDP, by the end of 2008. That

includes just over £100bn for the nationalisation of Northern Rock and the

recapitalisation of Royal Bank of Scotland.

How does that compare with other countries?

Ranked by our debt-to-GDP ratio, we came 18th of 28 members of the Organisation

of Economic Co-operation and Development in 2007, clocking in at 30.4% on the

OECD's measure. A number of other major economies had higher levels of

borrowing: Japan's debt was worth 85.9% of its GDP, for example, and Italy's

well over 100%. Debt levels in many countries are likely to explode in the years

ahead, too, as governments spend billions of dollars on recapitalising their

financial sectors, and boosting public spending to kick-start the economy.

Is the debt mountain about to get much bigger?

Yes: the Office for National Statistics has said that the liabilities of RBS,

thought to be around £1.7tn, will soon have to appear on the government's

balance sheet, because its shareholding, of almost 70%, gives it enough

managerial control over the battered bank to make it a public institution.

However, the minutiae of the statisticians' rules mean that although RBS's

liabilities will turn up on the books, many of its assets - such as the homes on

which mortgages are secured - will not. So the eye-watering debt figures we are

likely to see over the next year are a bit misleading. Even without the banking

rescues, though, public debt has already hit 40.4% of GDP, bursting through the

40% limit the prime minister laid down as one of his fiscal rules when Labour

came to power. And as recession eats away at tax revenues, and the government

spends billions of pounds on Keynesian fiscal stimulus, the chancellor's

forecasts show debt peaking at more than £1tn, or 57.4% of GDP by 2012-13.

What about Alistair Darling's latest bank rescue package?

The government announced last Monday that it would introduce a taxpayer-backed

insurance scheme, allowing the banks to cap their losses on so-called "toxic"

assets, if the loans go sour. That could potentially expose the public to vast

losses and the unknown size of the black hole helped to send sterling into a

tailspin last week. But the Treasury insists that many of the loans will

eventually come good - and the banks are paying the government a fee for its

trouble.

Is Britain at risk of "going bankrupt"?

It is highly unlikely. The government currently borrows about 35% of its total

debts from foreign investors and there is as yet little evidence of them heading

for the door: the German and Greek governments have had more problems borrowing

money in the capital markets in the past few weeks than the UK. However, if

foreign investors do go off gilts, then yields will be driven up - so, in

effect, taxpayers will end up paying higher interest rates to borrow money.

Much of the cash the government needs can continue to be borrowed from taxpayers

at home - pension funds such as government bonds, or gilts, because they can

match the fixed returns against their liabilities, and cash is pouring into

National Savings, which are invested in gilts as nervous savers shun risky

looking banks. If overseas investors lose confidence in the UK, we will have to

fund the debts ourselves, in effect, borrowing from our own future income. That

could prolong the downturn and force the Bank of England to keep interest rates

lower, and for longer, than it otherwise might have done, to compensate for the

tightening of fiscal policy, but it doesn't mean we are "bust".

Will we have to "call in the IMF", as David Cameron claimed last week?

Again, it's not impossible, but highly unlikely: it would only happen if the

government was unable either to meet a debt repayment, or to roll over, or

"refinance" the debt with investors, in the capital markets. Ireland, Turkey and

Greece all look much closer to that extreme than the UK. The verdict of credit

ratings agency Moody's last week was that increasing borrowing in the

short-term, in order to limit the length and severity of the recession, is a

"calculated risk," which it doesn't think endangers the UK's creditworthiness.

Spain and Greece have had their ratings downgraded, however, and Ireland has

been warned that it could face the same fate.

If the problem in the first place was too much borrowing, isn't it dangerous to

try to fix it by borrowing even more?

Yes, but the government believes the risk of allowing the credit markets to

seize up, potentially driving the economy into full-blown depression, is even

greater. As Mervyn King, governor of the Bank of England, put it last week:

"This is the paradox of policy at present - almost any policy measure that is

desirable now appears diametrically opposite to the direction in which we need

to go in the long term."

Q&A: How much does

Britain actually owe?, O, 25.1.2009,

http://www.guardian.co.uk/business/2009/jan/25/uk-recession

Official:

£40,000 loss for every taxpayer

Latest City figures reveal that the plummeting stock market

and plunging house prices

have wiped out £1.2 trillion

of Britain's national wealth

Sunday 25 January 2009

Heather Stewart and Gaby Hinsliff

The Observer

This article was first published on guardian.co.uk

at 00.01 GMT on Sunday 25

January 2009.

It appeared in the Observer on Sunday 25 January 2009

on p4 of the News section.

It was last updated at 02.34 GMT on Sunday 25 January 2009.

Every taxpayer in the country has lost almost £40,000 since

the onset of the credit crunch, as plunging house prices and the savage sell-off

in stock markets have obliterated £1.2 trillion of Britain's national wealth.

The combined impact of the property downturn and the slide in share prices has

wiped out the equivalent of a full year's economic output, according to research

by analyst Dharval Joshi at City bank RAB Capital, £38,700 for every one of

Britain's 31 million taxpayers.

"We're only halfway through; there's more destruction to come before we

stabilise," said Joshi, predicting that as much as £2 trillion could be knocked

off the value of assets.

Even by the end of 2008, just six months into what many analysts believe will be

a prolonged recession, he calculates that £700bn has been lost in the housing

market since the downturn began, plus £500bn from Britons' pension pots and

share portfolios.

With public anger at senior bankers, regulators and politicians growing as the

scale of the damage becomes clear, Gordon Brown will use a speech tomorrow to

demand tighter international regulation of banks. He will argue that the crisis

was exacerbated because no regulators, no ministers and startlingly few banking

executives knew what assets had been sold to whom.

The prime minister will try to build a consensus around curbs on irresponsible

banking practices later this week at the World Economic Forum in Davos, the

annual gathering of tycoons and politicians. The Commons Treasury select

committee will also seek to hold the industry to account over short-selling bank

shares when it cross-examines five leading hedge fund managers

on Tuesday.

The Conservatives seized on Joshi's research yesterday to accuse the government

of failing to protect consumers. Philip Hammond, shadow chief secretary, said:

"Gordon Brown said he'd ended boom and bust, but he's presided over the biggest

asset bubble in living memory and now we are all paying the price. Confidence in

Brown's economic management has evaporated at home and the relentless decline of

the pound shows that the rest of the world thinks the same."

Sterling declined sharply on the foreign exchanges last week, amid fears that

the government's insurance scheme to protect banks against losses on 'toxic'

assets - details of which are still being finalised this weekend - could expose

the taxpayer to billions of pounds of additional liabilities.

Official figures revealed on Friday that the economy contracted by 1.5% in the

final three months of 2008, underlining the severity of the downturn. Lord

Myners, the City minister, said the economy was undergoing a "correction". "We

know that there were elements of a bubble, not just in credit markets and share

prices, but also in things like art and jewellery. There's a correction back

towards an equilibrium. That's why we're taking the action that we are to

support those who are most exposed."

But Liberal Democrat treasury spokesman Vince Cable said the government should

have warned the public earlier that the housing market in particular was in the

grip of an out-of-control boom. "They failed in their responsibility by failing

to recognise the seriousness of the problem. We were rushing towards the edge of

the cliff."

Rapid declines in wealth alarm economists, because consumers tend to respond by

cutting spending, exacerbating recession. Danny Gabay of City consultancy Fathom

said consumers had previously boosted their spending power by borrowing against

their houses, but by the last quarter of 2008 mortgage borrowers were actually

paying down equity, with a potentially devastating impact on spending.

"If you bought your house for £100,000 and some bloke in a pinstripe suit tells

you it's worth £200,000, then you feel like you're being conservative if you

only borrow an extra £25,000," said Gabay, who is concerned that the knock-on

impact of the housing crash on families' spending habits has only just begun.

Joshi said Britain's housing boom and resulting bust meant the economy was

likely to take longer to recover than America's, where consumers have more of

their savings tied up in shares, which tend to see recovery faster.

Official: £40,000

loss for every taxpayer, O, 25.1.2009,

http://www.guardian.co.uk/business/2009/jan/25/credit-crunch-recession

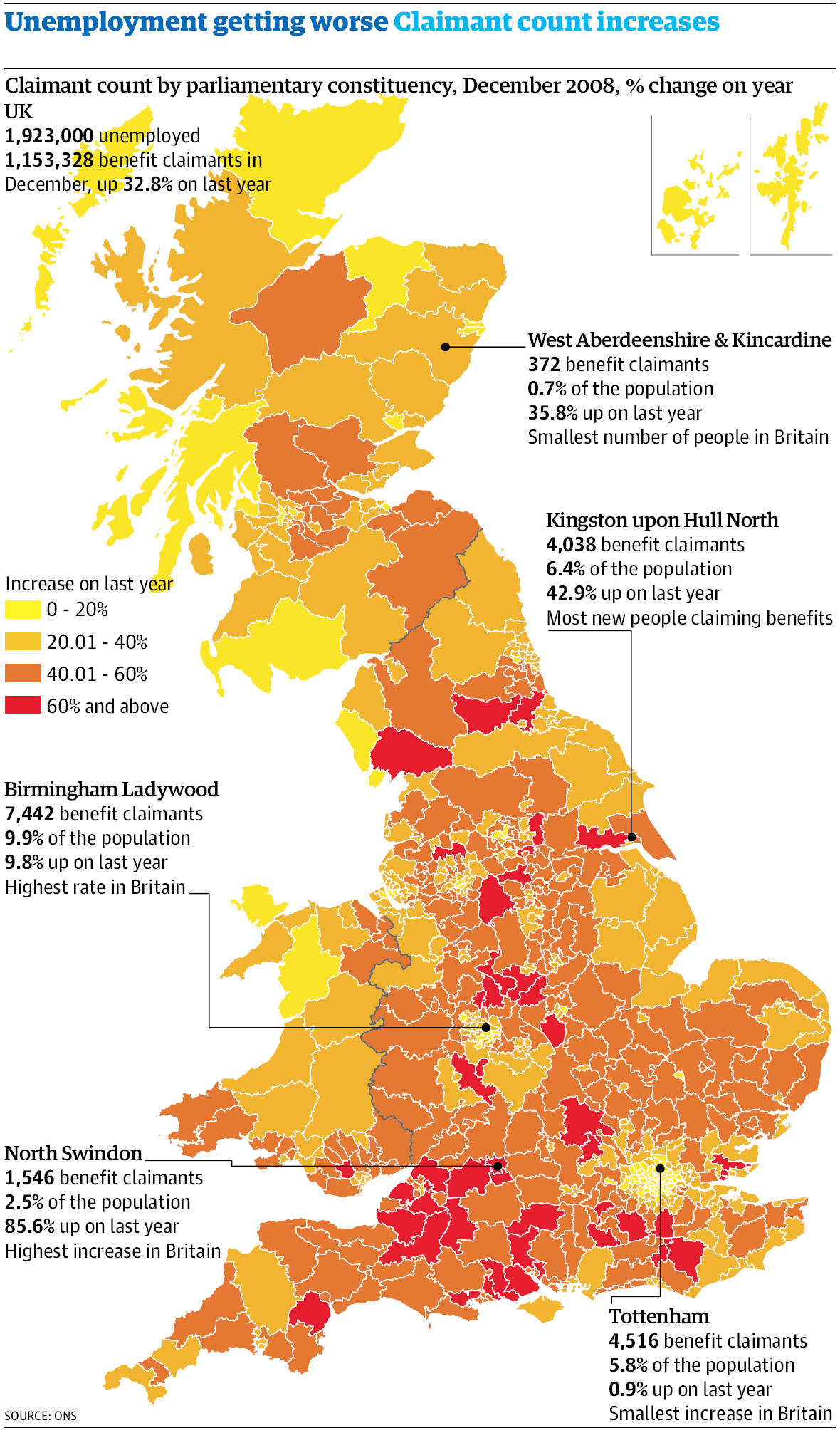

The Guardian p. 31

22 January 2009

http://digital.guardian.co.uk/guardian/2009/01/22/pdfs/gdn_090122_ber_31_21731567.pdf

The Guardian p. 18

22 January 2009

http://digital.guardian.co.uk/guardian/2009/01/22/pdfs/gdn_090122_ber_18_21731547.pdf

Inflation fails

to match hopes of steeper fall

January 20, 2009

From Times Online

Grainne Gilmore

Inflation fell by 3.1 per cent in December, its biggest fall

since 1992, but failed to match hopes of a steeper 2.7 per cent fall.

Consumer Price Index (CPI) inflation from 4.1 per cent in November to 3.1 per

cent last month, which is the lowest rate since April 2008 but still above the

Bank of England's 2 per cent target.

However, the drop was less pronounced than City economists had forecast. Howard

Archer, chief UK and European economist at IHS Global Insight said: "...the

decline was significantly less than expected given the VAT cut, lower oil prices

and apparent intensified discounting on the high street in the run-up to

Christmas.

"This suggests that not all of the VAT cut was passed on, and it is also likely

that sterling's weakness had some upward impact."

Sales by clothes shops helped drive down inflation - clothes prices in December

were more than 10 per cent lower than in December 2007, compared to a 7.3 per

cent fall in November. Falling petrol prices also helped ease the pressure on

consumers wallets.

The cost of a litre of petrol fell by 6 pence between November and December,

compared with a rise of 1.7 pence last year.

RPI inflation, which includes housing costs, dropped more sharply to 0.9 per

cent in December from 3 per cent in November as the swingeing interest rate cuts

by the Bank of England were passed on to homeowners.

The Bank of England has forecast that CPI inflation will fall to below its

target of 2 per cent this year, and could even drop to as low as 1 per cent.

City economists expect that RPI inflation will soon fall into negative

territory.

Inflation fails to

match hopes of steeper fall, Ts, 20.1.2009,

http://business.timesonline.co.uk/tol/business/economics/article5551705.ece

Credit crunch part two

Government ready to step in

as banks take another hammering

Monday 19 January 2009

The Guardian

This article was first published on guardian.co.uk

at 00.01 GMT on Monday 19

January 2009.

It appeared in the Guardian

on Monday 19 January 2009 on p7 of the UK news

section.

It was last updated

at 09.11 GMT on Monday 19 January 2009.

What is wrong with the banks?

It's all about confidence and the deterioration of the real economy. Before

Christmas there was a consensus that the UK's national income would shrink by

around 1% this year. Now economists are talking about 2% to 3%. A worse slump

than expected means many more unemployed and thousands more homes repossessed.

For the banks, that spells more pain as people default on their mortgages and

turn good loans into bad ones.

Will our savings be safe, or are we another meltdown?

Last November the government faced the collapse of Royal Bank of Scotland and

HBOS, the owner of Halifax. While the banks may need some more capital, and

therefore come under even greater ownership by the taxpayer than they are now,

the government is ready and willing to step in before things reach a new crisis

point. Investments, whether in stocks and shares, property or in more esoteric

assets like commodities, are another matter. They are all on the way down. World

trade has slumped along with the US, European and UK economies and there is

little likelihood of things picking up this side of 2010.

Is it the credit crunch part two?

The steep rise in bad debt is expected to trigger at least £40bn of bad-debt

write-offs when the UK's main banks report their annual results next month. The

collective figure could be as high as £200bn for all the losses on loans and

investments. Banks argue they cannot get lending under way without putting a

floor under their bad debt provisions. In other words, their finances are so

battered by last year's credit crunch that they cannot help passing on the

effects of the second wave credit crisis to consumers and businesses without

further support from the government.

What are the plans to solve the crisis?

Top of the list is an insurance scheme that would effectively underwrite the

loans of banks in trouble. A scheme could, for instance, leave the banks to pick

up the tab for further falls of up to 10% in the value of assets they hold,

leaving the taxpayer to reimburse them for the rest. The government is also

considering pumping more capital into the banks to replace the money lost from a

mass exodus of investors in the last week. Ministers could decide to forego the

estimated £1bn a year the banks must repay on the money lent to them by the

taxpayer. If the insurance scheme fails, we could become the proud owners of

what will probably be called the "Bank of Reconstruction and Recovery", formerly

referred to as a Bad Bank, that will take all the nasty, toxic loans off the

banks' books.

Is a Bad Bank likely?

Not at the moment. Most people in the banking industry argue it would take

months to determine which loans fit the bill and how much the government should

pay the banks for them.

Why is Barclays taking such a hammering?

Hubris is the word that comes to mind for many observers. Barclays refuses to

accept government money and is betting that its investment banking division will

generate such huge profits they dwarf any losses on home loans. Rather than take

government funds, it preferred to tap foreign investors who wanted a higher

interest rate. Investors don't like this idea and they don't like investment

banking any more, because it played a big part in the downfall of the

international banking system.

Government ready to step in as banks take

another hammering, G, 19.1.2009,

http://www.guardian.co.uk/business/2009/jan/19/credit-crunch-banks-government

RBS shares dive 70%

on mounting debt fears

January 19, 2009

From Times Online

Dearbail Jordan, Tom Bawden and Martin Waller

Q&A: what's in the bailout?

Shares in Royal Bank of Scotland (RBS) plunged by 70 per cent today to a new low

amid fears the Government will fully nationalise the struggling lender, which

expects to report a £28 billion loss for the year and admitted that more could

be on the way.

RBS' loss, which will be confirmed on February 26 when it announces it full-year

results, emerged as the Government revealed a second package of measures

designed to encourage banks to start lending money again to ease the credit

crunch.

As part of the measures, RBS revealed that the Government will increase its

current 58 per cent stake in the bank to 70 per cent. Last October, the

Government injected £20 billion into RBS as part of the Treasury's first banking

bailout attempt.

Both Gordon Brown, the Prime Minister, and Alistair Darling, the Chancellor,

refused this morning to comment on whether RBS will be fully nationalised,

joining Northern Rock, which became state-owned last year.

However, speculation is mounting that RBS will be taken into state-ownership and