|

Vocapedia >

Economy > USA > Fed > Interest rates

Matt Davies

political cartoon

GoComics

July 18, 2022

https://www.gocomics.com/mattdavies/2022/07/18

NPR podcasts > before 2024

USA >

Federal Reserve System / The Federal Reserve / The Fed

UK / USA

https://www.federalreserve.gov/

The Federal Reserve,

through its power to

raise and lower interest rates,

exercises more influence over economic growth

and the level of employment

than

any other government entity.

That unusual role dates from the 1970s,

when the executive branch and Congress

pulled back from the use of fiscal tools

— vast New Deal spending and targeted

tax cuts —

as a means of regulating prosperity.

http://topics.nytimes.com/top/reference/timestopics/organizations/f/

federal_reserve_system/index.html

https://www.nytimes.com/topic/organization/

federal-reserve-the-fed

https://en.wikipedia.org/wiki/

Federal_Reserve

2026

https://www.gocomics.com/drewsheneman/2026/01/21

https://www.npr.org/2026/01/13/

nx-s1-5674777/trump-federal-reserve-jerome-powell

2025

https://www.npr.org/2025/07/30/

nx-s1-5482794/trump-powell-federal-reserve-fed-

interest-rates-independence

2024

https://www.npr.org/2024/08/23/

nx-s1-5082386/fed-jerome-powell-lower-interest-rates

https://www.npr.org/2024/05/01/

1248454950/federal-reserve-inflation-interest-rates

https://www.npr.org/2024/03/20/

1239535703/federal-reserve-interest-interest-rates-inflation-powell-fed

2023

https://www.npr.org/2023/09/20/

1200327332/federal-reserve-inflation-economy-interest-rates

https://www.npr.org/2023/05/03/

1173371788/the-fed-raises-interest-rates-again-

in-what-could-be-its-final-attack-on-inflati

https://www.nytimes.com/2023/05/02/

business/economy/federal-reserve-interest-rates.html

2022

https://www.npr.org/2022/12/14/

1142757646/fed-federal-reserve-interest-rates-december-inflation-benchmark

https://www.npr.org/2022/09/29/

1125611533/volatility-stocks-bonds-recession-risk-fed-wall-street-bear-market-oil

https://www.npr.org/2022/09/29/

1125462240/inflation-1970s-volcker-nixon-carter-interest-rates-fed

https://www.propublica.org/article/

lev-menand-fed-unbound-interview - August 5, 2022

https://www.gocomics.com/stevebreen/2022/07/30

https://www.npr.org/2022/07/24/

1112770581/inflation-recession-soft-landing-rates-jobs-fed

https://www.gocomics.com/mattdavies/2022/07/18

https://www.npr.org/2022/06/22/

1106735608/powell-says-recession-a-possibility-but-not-likely

https://www.npr.org/2022/06/15/1

105026915/federal-reserve-interest-rates-inflation

https://www.npr.org/2022/03/16/

1086484178/the-federal-reserve-interest-rates-inflation

2021

https://www.npr.org/2021/06/16/

1007144176/federal-reserve-to-continue-supporting-economy-despite-surging-prices

https://www.propublica.org/article/

how-the-federal-reserve-is-increasing-wealth-inequality - April 27, 2021

https://www.nytimes.com/2021/02/02/

business/economy/federal-reserve-diversity.html

2020

https://www.npr.org/sections/coronavirus-live-updates/2020/03/23/

820073135/stocks-fall-even-after-the-feds-latest-move

https://www.npr.org/sections/coronavirus-live-updates/2020/03/23/

820057467/federal-reserve-unveils-extensive-new-measures-to-bolster-u-s-economy

https://www.npr.org/2020/03/16/

816382835/stocks-shudder-despite-emergency-measures

2018

https://www.npr.org/2018/08/01/

634423478/saying-economy-is-strong-fed-keeps-interest-rates-unchanged-for-now

https://www.npr.org/2018/01/31/

581649384/with-focus-on-unemployment-yellen-led-fed-through-tough-balancing-act

2017

http://www.npr.org/sections/thetwo-way/2017/06/14/

532942522/fed-raises-key-interest-rate-for-the-fourth-time-since-2015

2016

http://www.npr.org/2016/10/31/

500034877/why-the-fed-keeps-a-close-eye-on-consumer-prices

2015

http://www.npr.org/2015/12/15/

459821692/these-seven-charts-can-help-you-see-what-the-fed-is-doing

http://www.nytimes.com/2015/03/13/

business/still-reading-the-feds-tea-leaves-word-by-word.html

2013

http://economix.blogs.nytimes.com/2013/10/08/

what-the-fed-does-and-can-do/

http://www.nytimes.com/2013/09/19/

business/economy/fed-in-surprise-move-postpones-retreat-from-stimulus-campaign.html

http://www.nytimes.com/2013/01/19/

business/economy/fed-transcripts-open-a-window-on-2007-crisis.html

2011

http://www.nytimes.com/2011/12/21/

business/fed-proposes-new-capital-rules-for-banks.html

http://www.nytimes.com/2011/12/02/

opinion/the-fed-and-the-euro.html

http://www.nytimes.com/roomfordebate/2011/11/30/

did-the-fed-go-far-enough

http://www.reuters.com/article/2011/11/02/

us-usa-fed-idUSTRE7A057A20111102

2010

http://www.nytimes.com/2010/08/28/business/economy/28fed.html

http://www.nytimes.com/2010/02/25/business/economy/25fed.html

http://www.nytimes.com/2009/06/24/business/economy/24fed.html

http://www.nytimes.com/2009/03/11/business/economy/11fed.html

https://www.federalreserve.gov/newsevents/speech/

bernanke20090310a.htm

https://www.reuters.com/article/idUSTRE4AO69T

20081125

http://www.nytimes.com/2008/10/08/business/08fed.html

http://www.nytimes.com/2010/10/16/

business/economy/16fed.html

http://www.nytimes.com/reuters/2010/09/21/business/business-us-usa-fed.html

http://www.nytimes.com/2010/09/03/business/03commission.html

http://www.nytimes.com/2010/08/30/business/economy/30fed.html

http://www.nytimes.com/2010/08/28/business/economy/28fed.html

http://www.nytimes.com/2010/08/26/business/economy/26fed.html

2008

http://www.nytimes.com/2008/12/17/business/economy/17fed.html

https://www.reuters.com/article/ousiv/idUSTRE4AO4QY

20081125

http://www.nytimes.com/2008/10/30/business/economy/30fed.html

http://www.federalreserve.gov/newsevents/press/monetary/20080318a.htm

http://www.federalreserve.gov/newsevents/press/monetary/20080316a.htm

http://www.reuters.com/article/ousiv/idUSN1651144220080317

http://www.federalreserve.gov/newsevents/speech/bernanke20080314a.htm

https://www.reuters.com/article/ousiv/idUSN11554808

20080311

https://www.reuters.com/article/topNews/idUSN11557956

20080311

?virtualBrandChannel=10005

https://www.reuters.com/article/ousiv/idUSWAT009034

20080304

https://www.federalreserve.gov/newsevents/pressreleases/monetary

20080122b.htm

https://www.reuters.com/article/domesticNews/idUSWBT008460

20080227

https://www.federalreserve.gov/newsevents/testimony/bernanke20071108a.htm

http://news.bbc.co.uk/1/hi/business/6999821.stm

http://www.economist.com/daily/news/displaystory.cfm?story_id=9826026&top_story=1

http://news.bbc.co.uk/1/hi/business/6999821.stm

What the Fed Does, and Can Do

USA 2013

The Federal Reserveis a government agency

that regulates the American financial system

and, by extension, the broader economy.

Think of the financial system as an engine.

The Fed controls the availability of fuel,

basically by manipulating the price,

and it dictates the permissible uses of fuel.

It does these things with two goals in mind:

preventing the economy from growing too quickly,

and preventing the economy from shrinking.

The fuel, of course, is money.

And the Fed manipulates the price of money

by raising and lowering interest rates.

When the Fed wants

to slow down economic

activity,

it raises interest rates,

increasing the cost of borrowing money.

People and businesses borrow less and spend

less,

and growth slows down.

When the Fed wants to stimulate the economy,

it lowers interest rates.

People borrow more,

spend more — you get the

drift.

http://economix.blogs.nytimes.com/2013/10/08/

what-the-fed-does-and-can-do/

http://economix.blogs.nytimes.com/2013/10/08/

what-the-fed-does-and-can-do/

at the Fed

https://www.nytimes.com/2021/02/02/

business/economy/federal-reserve-diversity.html

Federal Reserve policymakers

http://www.npr.org/sections/thetwo-way/2017/06/14/

532942522/fed-raises-key-interest-rate-for-the-fourth-time-since-2015

keep interest

rates at a 23-year high

https://www.npr.org/2024/05/01/

1248454950/federal-reserve-inflation-interest-rates

raise interest rates

https://www.npr.org/2023/05/03/

1173371788/the-fed-raises-interest-rates-again-

in-what-could-be-its-final-attack-on-inflati

https://www.npr.org/2022/03/16/

1086484178/the-federal-reserve-interest-rates-inflation

http://www.npr.org/2017/03/15/

520223192/fed-to-announce-its-plans-for-interest-rates

raise interest

rates by 0.25 percent

http://www.npr.org/2017/03/15/

520301610/federal-reserve-raises-interest-rates-by-0-25-percent

interest rates > climb

https://www.npr.org/sections/thetwo-way/2018/02/09/

584488276/u-s-stock-market-opens-higher-after-a-tumultuous-week

interest rate hike

https://www.npr.org/2022/06/15/

1105026915/federal-reserve-interest-rates-inflation

rate hikes

https://www.gocomics.com/mattdavies/2022/07/18

lower interest

rates

https://www.npr.org/2024/08/23/

nx-s1-5082386/fed-jerome-powell-lower-interest-rates

benchmark federal funds interest rate

benchmark interest rate

http://www.npr.org/2017/06/14/

532969122/federal-reserve-raises-benchmark-interest-rate

http://www.npr.org/sections/thetwo-way/2017/06/14/

532942522/fed-raises-key-interest-rate-for-the-fourth-time-since-2015

http://www.nytimes.com/2008/12/17/

business/economy/17fed.html

Federal Reserve chairman > Jerome Powell

https://www.npr.org/2024/05/01/

1248454950/federal-reserve-inflation-interest-rates

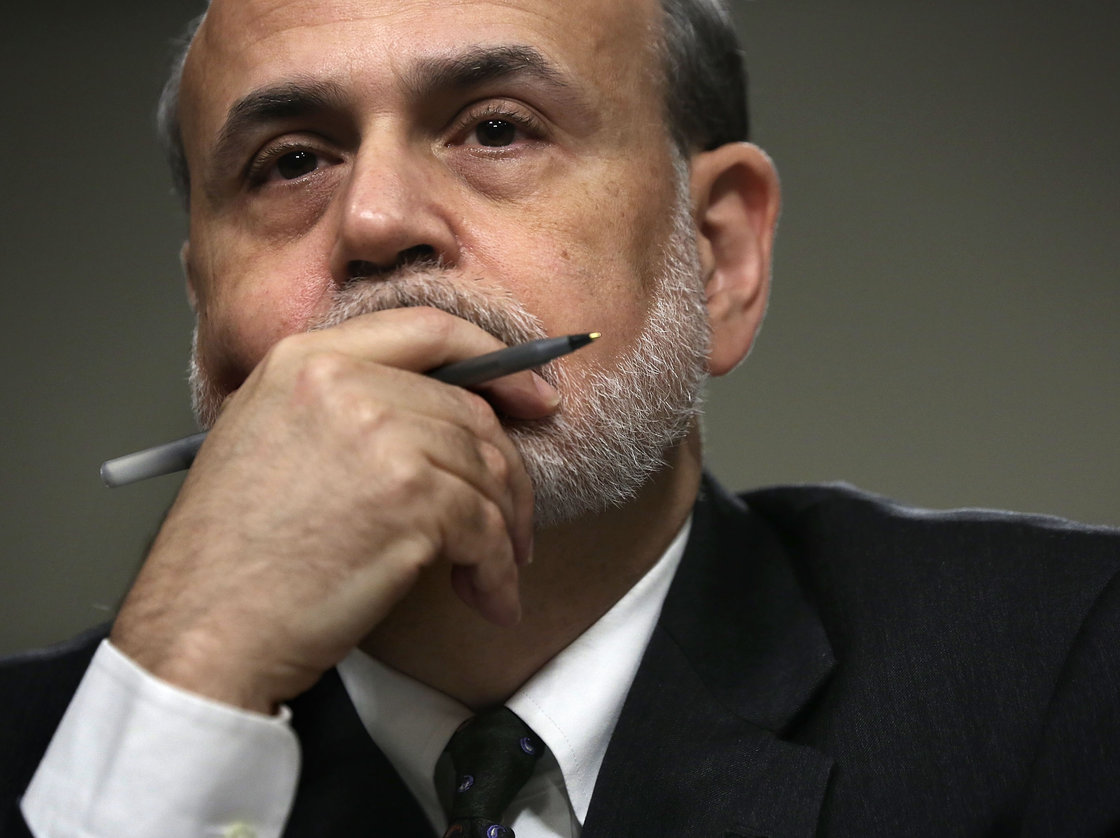

Federal Reserve Chairman Ben Bernanke

during his Capitol Hill testimony Wednesday

before the Joint Economic Committee.

Bernanke Hints That The Economy Still Needs

Help

NPR

May 22, 2013

https://www.npr.org/sections/thetwo-way/2013/05/22/

186015232/bernanke-hints-economy-still-needs-help-home-sales-rise

The Fed Chairman / Federal Reserve Board

Chairman

Ben S. Bernanke, Federal Reserve chairman

https://www.nytimes.com/topic/person/

ben-bernanke

https://www.theguardian.com/business/

ben-bernanke

https://www.nytimes.com/2015/04/16/

business/ben-bernanke-will-work-with-citadel-a-hedge-fund-as-an-adviser.html

http://www.nytimes.com/video/2013/09/18/us/politics/100000002451327/

bernanke-on-fed-stimulus-decision.html

http://www.nytimes.com/2012/09/04/

opinion/ben-bernankes-next-task.html

http://www.nytimes.com/2011/09/03/

business/vitriol-for-bernanke-despite-the-facts.html

http://www.guardian.co.uk/business/2011/apr/28/

ben-bernanke-deficit-not-sustainable

http://www.nytimes.com/2010/10/29/

business/economy/29fed.html

http://www.nytimes.com/2010/10/16/business/economy/16fed.html

http://www.nytimes.com/2010/09/03/business/03commission.html

http://www.nytimes.com/2010/08/30/business/economy/30fed.html

http://www.nytimes.com/2010/08/28/business/economy/28fed.html

http://www.nytimes.com/2010/08/26/business/economy/26fed.html

http://www.nytimes.com/2010/01/28/opinion/28blinder.html

http://www.nytimes.com/2009/12/04/business/economy/04fed.html

http://www.nytimes.com/2009/07/27/business/27bernanke.html

https://www.reuters.com/article/ousiv/idUSTRE49J51G

20081020

https://www.reuters.com/article/ousiv/idUSTRE49J5EE

20081020

http://video.on.nytimes.com/?fr_story=a9474c5bb692d2e1735e417491d3d7b9e5c6e8f9

https://www.reuters.com/article/topNews/idUSWAT009233

20080402

https://www.federalreserve.gov/newsevents/speech/bernanke20080314

a.htm

https://www.reuters.com/article/ousiv/idUSWAT009034

20080304

https://www.reuters.com/article/domesticNews/idUSWBT008460

20080227

https://www.federalreserve.gov/newsevents/testimony/bernanke20071108

a.htm

Federal Reserve Chair > Janet Yellen

2014-2018

https://www.npr.org/2018/01/31/

581649384/with-focus-on-unemployment-yellen-led-fed-through-tough-balancing-act

Fed governor > Sherman Joseph Maisel 1918-2010

http://www.nytimes.com/2010/10/07/

business/07maisel.html

fed leaders

http://www.nytimes.com/2010/07/15/

business/economy/15econ.html

fed nominees

http://www.nytimes.com/2010/07/16/

business/economy/16fed.html

The Fed Chairman / Federal Reserve Board

Chairman

Alan Greenspan 1987 to early 2006

https://www.nytimes.com/topic/person/

alan-greenspan

http://www.nytimes.com/2008/10/24/

business/economy/24panel.html

http://www.cagle.com/news/GreenspanGoof/main.asp

Corpus of news articles

Economy > Banks > USA >

Federal Reserve / Fed

Fed Cuts Key Rate to a Record Low

December 17, 2008

The New York Times

By EDMUND L. ANDREWS

and JACKIE CALMES

WASHINGTON — The Federal Reserve entered a new era on Tuesday, lowering its

benchmark interest rate virtually to zero and declaring that it would now fight

the recession by pumping out vast amounts of money to businesses and consumers

through an expanding array of new lending programs.

Going further than expected, the central bank cut its target for the overnight

federal funds rate to a range of zero to 0.25 percent and brought the United

States to the zero-rate policies that Japan used for years in its own fight

against deflation.

Though important as a historic milestone, the move to an interest rate of zero

from 1 percent is largely symbolic. The funds rate, which affects what banks

charge for lending their reserves to each other, had already fallen to nearly

zero in recent days because banks have been so reluctant to do business.

Of much greater practical importance, the Fed bluntly announced that it would

print as much money as necessary to revive the frozen credit markets and fight

what is shaping up as the nation’s worst economic downturn since World War II.

In effect, the Fed is stepping in as a substitute for banks and other lenders

and acting more like a bank itself. “The Federal Reserve will employ all

available tools to promote the resumption of sustainable economic growth,” it

said. Those tools include buying “large quantities” of mortgage-related bonds,

longer-term Treasury bonds, corporate debt and even consumer loans.

The move came as President-elect Barack Obama summoned his economic team to a

four-hour meeting in Chicago to map out plans for an enormous economic stimulus

measure that could cost anywhere from $600 billion to $1 trillion over the next

two years.

The two huge economic stimulus programs, one from the Fed and one from the White

House and Congress, set the stage for a powerful but potentially risky

partnership between Mr. Obama and the Fed’s Republican chairman, Ben S.

Bernanke.

“We are running out of the traditional ammunition that’s used in a recession,

which is to lower interest rates,” Mr. Obama said at a news conference Tuesday.

“It is critical that the other branches of government step up, and that’s why

the economic recovery plan is so essential.”

Financial markets were electrified by the Fed action. The Dow Jones industrial

average jumped 4.2 percent, or 359.61 points, to close at 8,924.14.

Investors rushed to buy long-term Treasury bonds. Yields on 10-year Treasuries,

which have traditionally served as a guide for mortgage rates, plunged

immediately after the announcement to 2.26 percent, their lowest level in

decades, from 2.51 percent earlier in the day.

Yields on investment-grade corporate bonds edged down to 7.215 percent on

Tuesday, from 7.355 on Monday. Yields on riskier high-yielding corporate bonds

remained in the stratosphere at 22.493 percent, almost unchanged from 22.732 on

Monday.

By contrast, the dollar dropped sharply against the euro and other major

currencies for the second consecutive day — a sign that currency markets were

nervous about a flood of newly printed dollars. Some analysts predict that the

Treasury will have to sell $2 trillion worth of new securities over the next

year to finance its existing budget deficit, a new stimulus program and to

refinance about $600 billion worth of maturing government debt.

For the moment, Mr. Obama and Mr. Bernanke appear to be on the same page, though

that could abruptly change if the economy starts to revive. Fed officials have

already assumed that Congress will pass a major spending program to stimulate

the economy, and they are counting on it to contribute to economic growth next

year.

In more normal times, the Fed might easily start raising interest rates in

reaction to a huge new spending program, out of concern about rising inflation.

But data on Tuesday provided new evidence that the biggest threat to prices

right now was not inflation but deflation.

The federal government reported on Tuesday that the Consumer Price Index fell

1.7 percent in November, the steepest monthly drop since the government began

tracking prices in 1947. The decline was largely driven by the recent plunge in

energy prices, but even the so-called core inflation rate, which excludes the

volatile food and energy sectors, was essentially zero.

Mr. Obama’s goal is to have a package ready when the new Congress convenes on

Jan. 6. His hope is that the House and Senate, with their bigger Democratic

majorities, can agree quickly on a plan for Mr. Obama to sign into law soon

after he is sworn into office two weeks later.

The Fed, in a statement accompanying its rate decision, acknowledged that the

recession was more severe than officials had thought at their last meeting in

October.

“Over all, the outlook for economic activity has weakened further,” the central

bank said.

“Labor market conditions have deteriorated, and the available data indicate that

consumer spending, business investment and industrial production have declined.”

The central bank added: “The committee anticipates that weak economic conditions

are likely to warrant exceptionally low levels of the federal funds rate for

some time.”

With fewer than 10 days until Christmas, retailers from Saks Fifth Avenue to

Wal-Mart have been slashing prices to draw in consumers, who have sharply

reduced their spending over the last six months. On Tuesday, Banana Republic

offered customers $50 off on any purchases that total $125. The clothing

retailer DKNY offered customers $50 off any purchase totaling $250.

Ian Shepherdson, an analyst at High Frequency Economics, said falling energy

prices were likely to bring the year-over-year rate of inflation to below zero

in January.

The Fed has already announced or outlined a range of unorthodox new tools that

it can use to keep stimulating the economy once the federal funds rate

effectively reaches zero. On Tuesday, Fed officials said they stood ready to

expand them or create new ones to relieve bottlenecks in the credit markets.

All of the tools involve borrowing by the Fed, which amounts to printing money

in vast new quantities, a process the Fed has already started. Since September,

the Fed’s balance sheet has ballooned from about $900 billion to more than $2

trillion as it has created money and lent it out. As soon as the Fed completes

its plans to buy mortgage-backed debt and consumer debt, the balance sheet will

be up to about $3 trillion.

“At some point, and without knowing the timing, the Fed is going to have to

destroy all that money it is creating,” said Alan Blinder, a professor of

economics at Princeton and a former vice chairman of the Federal Reserve.

“Right now, the crisis is created by the huge demand by banks for hoarding cash.

The Fed is providing cash, and the banks want to hoard it. When things start

returning to normal, the banks will want to start lending it out. If that much

money is left in the monetary base, it would be extremely inflationary.”

Vikas Bajaj

contributed reporting from New York.

Fed Cuts Key Rate to a

Record Low,

NYT,

17.12.2008,

https://www.nytimes.com/2008/12/17/

business/economy/17fed.html

Explore more on these topics

Anglonautes > Vocapedia

inflation

markets , stocks, stock markets, Wall Street

economy, money, taxes,

housing market, shopping,

jobs, unemployment,

unions, retirement,

debt,

poverty, hunger,

homelessness

industry, energy, commodities

USA > White-collar / corporate crime

|