|

Vocapedia >

Energy, industry

> Commodities

> Gold

The cloudy spots on an undated

chest X-ray

shows the effects of silicosis on a gold miner.

In 2011,

South Africa said gold

miners with silicosis

could sue for compensation,

and thousands plan to do just

that.

Photograph: NIOH/NHLS/Handout/Reuters

Boston Globe > Big Picture

> Gold

6 August 2012

http://www.boston.com/bigpicture/2012/08/gold_1.html

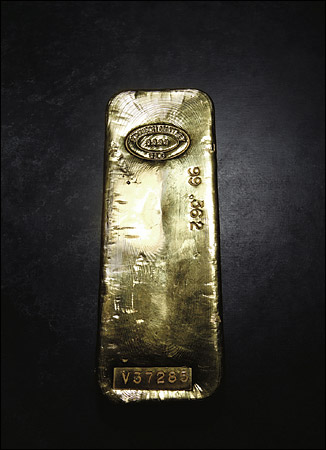

Tom Schierlitz

In Gold We Trust:

A gold ingot weighing 99.362 troy ounces (6.8 pounds) --

to "gold bugs," paper money is just paper without it.

Believing (and Believing and Believing) in Bullion

By STEPHEN METCALF

NYT

Published: June 5, 2005

http://www.nytimes.com/2005/06/05/magazine/05GOLD.html

gold

https://www.theguardian.com/business/gold

http://www.nytimes.com/2013/07/28/business/budging-just-a-little-on-investing-in-gold.html

http://www.guardian.co.uk/global-development/2013/apr/23/influx-chinese-goldminers-tensions-ghana

http://dealbook.nytimes.com/2013/04/15/golds-plunge-shakes-confidence-in-a-haven/

http://www.guardian.co.uk/environment/2011/sep/26/amazon-gold-rush-prices-soar

http://www.reuters.com/article/2011/08/19/us-markets-global-idUSTRE7725BC20110819

http://www.guardian.co.uk/business/2011/aug/19/stock-market-falls-european-debt-crisis

http://www.reuters.com/article/2011/04/29/us-markets-precious-idUSTRE73786N20110429

http://www.reuters.com/article/2011/04/21/us-gold-poll-idUSTRE73K1DF20110421

http://www.reuters.com/article/2011/04/20/us-precious-milestones-idUSTRE73J0PF20110420

http://www.reuters.com/article/2011/04/08/businesspro-us-markets-precious-idUSTRE73786N20110408

http://www.reuters.com/article/2011/04/08/us-markets-precious-idUSTRE72C3Z120110408

http://www.reuters.com/article/2011/03/02/us-markets-precious-idUSTRE71G2KM20110302

http://www.reuters.com/article/2011/02/28/us-markets-precious-idUSTRE71G2KM20110228

http://www.reuters.com/article/2011/02/18/us-markets-precious-idUSTRE71G2KM20110218

http://www.nytimes.com/2010/06/13/business/13gold.html

http://www.reuters.com/article/reutersEdge/idUSTRE51C3T020090213

http://www.usatoday.com/money/markets/2006-05-09-gold_x.htm

Boston Globe > Big Picture > Gold

6 August 2012

The pursuit of gold medals

has athletes and

fans focused

on the Olympic games in London,

but the pursuit of gold is a worldwide obsession

that extends far beyond the

realm of sport.

Investors and speculators

drove the price of gold

to dizzying heights a year ago

as they sought refuge from volatile markets.

Seeking gain in an uncertain

recession,

millions of people trade old jewelry

as cash-for-gold businesses flourish.

Throughout the ups and downs,

gold extraction continues

far from the glory of sports

and the frenzy of

markets.

Gold is dredged,

mined, and panned

in operations large and small,

often at great

risk to miners.

Processing gold

with cyanide and other chemicals

involves dangerous

environmental hazards.

What results is undeniably beautiful.

Gathered here are images

of people extracting, processing,

refining, buying,

selling, celebrating…

all of them going for gold. -- Lane Turner

http://www.boston.com/bigpicture/2012/08/

gold_1.html

gold futures

http://www.reuters.com/article/2011/04/19/us-

markets-precious-idUSTRE73786N20110419

hold

above $400 an ounce

gold

2008

http://www.reuters.com/article/hotStocksNews/idUSL1184089720080313

http://www.guardian.co.uk/business/2008/mar/13/commodities

http://www.reuters.com/article/hotStocksNews/idUSHKG36862620080303

http://www.reuters.com/article/hotStocksNews/idUST17031920080303

the rise of gold since 1968

http://www.guardian.co.uk/world/interactive/2008/jan/25/gold

gold standard

1946-1971

http://news.bbc.co.uk/2/hi/business/337802.stm

http://www.house.gov/paul/congrec/congrec2006/cr021506.htm

http://www.youtube.com/watch?v=iRzr1QU6K1o

The United States Bullion Depository

Fort Knox,

Kentucky USA

https://www.usmint.gov/about?flash=yes&action=fun_facts13

Global

stocks slide anew,

gold sets fresh record

Fri, Aug 19

2011

Reuters

By Herbert Lash

NEW YORK

(Reuters) - Equity markets slid anew and gold set a second-straight record high

on Friday as fears of a possible U.S. slide into recession and concerns related

to Europe's debt crisis kept investors on edge.

Wall Street marked a fourth week of losses, pulled lower by a 20 percent plunge

in Hewlett-Packard (HPQ.N: Quote, Profile, Research, Stock Buzz) -- its worst

day since the 1987 market crash -- after the Silicon Valley icon unveiled a

dismal outlook and a difficult corporate shake-up.

The benchmark S&P 500 index has shed 13.1 percent so far in August and is on

track for its worst month since October 2008, when the financial crisis and deep

recession mauled markets.

The day's activity seemed mild when compared with Thursday, when the yield on

10-year U.S. government bonds plummeted below 2 percent for the first time since

at least 1950 on fears the U.S. economy was careening toward a new recession.

Those fears appear valid. Bill Gross, manager of the world's largest bond fund

at PIMCO, told Reuters Insider that the week's rally in Treasury yields signaled

"not only a potential for a recession but the almost high probability of

recession."

The Dow Jones industrial average .DJI closed down 172.93 points, or 1.57

percent, at 10,817.65. The Standard & Poor's 500 Index .SPX fell 17.12 points,

or 1.50 percent, at 1,123.53. The Nasdaq Composite Index .IXIC lost 38.59

points, or 1.62 percent, at 2,341.84.

Investors halted a rush into bonds but kept pouring into gold, which posted its

biggest one-week gain in 2-1/2 years and remains on track for its biggest

one-month rise in nearly 12 years in August. Bullion is up 30 percent so far

this year.

While rising commodity prices sapped some safe-haven buying of gold, it has

gained 6 percent over the past five days.

"Right now, gold is inversely correlated with fear and nothing else. When stocks

are down, gold's up," said Frank McGhee, head precious metals trader at

Integrated Brokerage Services LLC.

Spot gold shot to a record $1,877 an ounce on volume that was the week's highest

but below last week's pace.

U.S. gold futures for December delivery settled up $30.20 at $1,852.20 an ounce.

Commodity prices rebounded after the U.S. dollar plumbed a record low against

the yen on speculation Japanese authorities will not intervene too much to halt

the yen's surge.

The dollar fell as low as 75.941 yen on trading platform EBS, but later pared

most losses. It last traded at 76.500 yen, down 0.1 percent.

Currency traders were emboldened by a Wall Street Journal report citing Japan's

top currency official as saying Japanese authorities do not plan to intervene in

the market often.

The dollar's slump turned commodity markets, where crude oil prices rose about 2

percent at one point. ICE Brent October crude closed up $1.63 at $108.62 a

barrel. U.S. crude oil settled down 12 cents at $82.26 per barrel.

The U.S. dollar index .DXY slipped 0.4 percent to 73.976. The euro was up 0.4

percent at $1.4392.

U.S. stocks at first see-sawed but turned lower by midday as European stocks

closed down on recession fears and skittishness about regional bank funding in

Europe.

"What I'm seeing right now is basically a crisis of confidence, more-so than an

economic crisis or financial crisis necessarily at this stage," said Natalie

Trunow, chief investment officer of equities at Calvert Investment Management in

Bethesda, Maryland, which manages about $14.8 billion.

MSCI's all-country world stock index .MIWD00000PUS was off 1.6 percent, while

emerging markets stocks .MSCIEF fell 2.5 percent.

European shares flirted with two-year lows. The FTSEurofirst 300 .FTEU3 index of

top European shares closed down 1.7 percent at 909.79.

U.S. Treasury yields inched up from a low of 1.97 percent on Thursday as some

investors took profits.

The benchmark 10-year U.S. Treasury note was up 1/32 of a point in price to

yield 2.06 percent.

Yields have dropped about 73 basis points on the 10-year note in August as

disappointing economic data, the Federal Reserve's low interest rate policy and

jitters over rising bank funding costs have driven investors to safe-haven

bonds.

Investors are awaiting Federal Reserve Chairman Ben Bernanke's speech on August

26 in Jackson Hole, Wyoming, for hints on how policymakers plan to address the

weakness in the economy.

(Reporting by

Rodrigo Campos,

Gertrude Chavez-Dreyfuss and Karen Brettell

in New York; Barbara

Lewis and Jan Harvey in London;

Harro ten Wolde in Frankfurt; Writing by Herbert

Lash;

Editing by Dan Grebler)

Global stocks slide anew, gold sets fresh record,

R,

19.8.2011,

http://www.reuters.com/article/2011/08/19/

us-markets-global-idUSTRE7725BC20110819

A Block

Abuzz

With the Business of Gold

August 17,

2011

The New York Times

By COREY KILGANNON

On Tuesday

morning, Arnie and Laura Goldstein, a retired couple from Rego Park, Queens,

took some gold jewelry they had been saving for years to the incredible trinket

bazaar that is the diamond district in Midtown Manhattan.

“Things I don’t wear anymore,” Mrs. Goldstein said, folding a stick of chewing

gum into her mouth and eyeing a daunting array of hawkers on the block of West

47th Street between Fifth Avenue and Avenue of the Americas.

Mr. Goldstein, a retired New York City schoolteacher, said they hoped to get

about $7,500 for the pieces. “We’ve been holding on to them for years,” he said.

“Years,” Mrs. Goldstein added.

“And now that the gold price is up,” Mr. Goldstein said, “we figured we’d come

in and see what we could get.”

The price of gold is indeed up. It soared to an all-time high last week, not

adjusted for inflation: over $1,800 an ounce for pure 24-karat gold. The spike

has set off a flurry of sales in the diamond district, which has become flooded

with people like the Goldsteins looking to sell high.

“This is a gold rush,” said Ernie Velez, 48, a jeweler and an owner of Universal

Refinery, a glass-counter booth in one of the many mini-mall exchanges on the

block where jewelry is bought and sold. Mr. Velez, an immigrant from Ecuador,

said things could get even busier.

“A lot of folks are selling, but also a lot of people think the price will keep

going up,” he said as jewelers brought small piles of gold jewelry to his

counter for estimates. Mr. Velez’s men rasped the pieces on smooth test stones

and then dabbed nitric acid on the rubbed-off gold to determine its purity.

Outside, Ramon Barrenechea, 59, of Staten Island, was capitalizing on the rush

in his own way. Mr. Barrenechea, an immigrant from Peru, makes his own flat test

stones by hand and was selling them for more than $50.

The diamond district does not particularly need a gold rush to invigorate its

sidewalks. The block always percolates with business and energy.

About $24 billion is exchanged each year in sales in and around the district,

among roughly 3,000 businesses, said Michael Toback, an executive board member

of the 47th Street Business Improvement District and an owner of Myron Toback, a

jewelry supply and refinery business on the block.

Amid all this industry, the district can be one of the strangest places in the

city. Near Fifth Avenue on Tuesday, a scruffy bear of a man with no shirt on was

scooping up rainwater and giving himself a cat bath as passers-by stared.

Hawkers from kosher delis handed out menus. One could hear New York accents, as

well as Russian and also Yiddish, spoken by the many Hasidic men who work here,

in black hats and coats.

Some of the most colorful characters were the hawkers: street-savvy men hired by

jewelry dealers to spot potential customers on the block and coax them into

their shops. The surging price of gold has cranked up the metabolism of these

figures: the swaggering, smooth-talking sidewalk representatives for the many

businesses.

“We’ve had a lot more action the past couple weeks,” said a 51-year-old hawker

named Al, who wore a “We Buy Gold” sign around his neck and courted customers by

showing a piece of paper listing the latest prices for 24-karat and lesser gold.

“Business has been good.”

Al would not give his last name (“I got grandkids — I don’t want them to know I

do this”) but said he tells customers that gold prices were so high that he was

selling rings off his fingers.

“I tell people, ‘I had a ring I bought for $40 back in the day, and I just sold

it for $200,’ ” he said.

Not all hawkers were as cheerful, complaining that sales were not brisk enough,

even as they still quoted prices as high as $1,790 an ounce on Wednesday

morning.

“A lot of people know what they have, and they’re waiting to see if they can sit

on it longer, for a better offer,” said Denis Garasimov, who said he was hawking

for Diamond District Gold Buyers. “It’s a straight-out gamble right now.”

Victor Velez, 38, an immigrant from the Dominican Republic who held a laminated

“We Buy Gold” sign, nodded as he handed out cards for the Royal Gems

Corporation.

“A lot of people are holding on to it because they are seeing how high it can

go,” Mr. Velez said.

When the Goldsteins first set foot on the block, they were approached by a

hawker named Anthony Palmer, 47, of Springfield Gardens, Queens. Mr. Palmer, who

works a small patch of sidewalk near Avenue of the Americas, said he earns $100

a day from the company he works for, and sometimes receives tips from customers

happy with the price they get for their gold.

“You see there’s no other hawkers in this spot but me — this is my fiefdom,” he

said. “That’s how it works. We respect each other’s space. When you get rogue

hawkers cutting in, sometimes you got to be forceful.”

The surge in gold prices is attracting more traffic, he said, but when it comes

to selling gold, personal needs often trump market price.

“It really ebbs and flows on people’s own economics,” he said. “You get

desperate people at the beginning and the end of the month, when they’re facing

their bills.”

A Block Abuzz With the Business of Gold, NYT, 17.8.2011,

http://www.nytimes.com/2011/08/18/nyregion/as-gold-soars-diamond-district-hawkers-lure-sellers.html

Factbox:

Gold milestones

on the road to record high

Wed Apr 20, 2011

8:44am EDT

Reuters

(Reuters) - Gold struck a record high on Wednesday at slightly above $1,500

an ounce as a weak dollar buoyed sentiment in precious metals.

Following are key dates in gold's trading history since the early 1970s:

* August 1971 - U.S. President Richard Nixon takes the dollar off the gold

standard, which had been in place with minor modifications since the Bretton

Woods Agreement of 1944 fixed the conversion rate for one Troy ounce of gold at

$35.

* August 1972 - The United States devalues the dollar to $38 per ounce of gold.

* March 1973 - Most major countries adopt floating exchange rate system.

* May 1973 - U.S. devalues dollar to $42.22 per ounce.

* January 1980 - Gold hits record high at $850 per ounce. High inflation because

of strong oil prices, Soviet intervention in Afghanistan and the impact of the

Iranian revolution prompt investors to move into the metal.

* August 1999 - Gold falls to a low at $251.70 on worries about central banks

reducing reserves of gold bullion and mining companies selling gold in forward

markets to protect against falling prices.

* October 1999 - Gold reaches a two-year high at $338 after agreement to limit

gold sales by 15 European central banks. Market sentiment toward gold begins to

turn more positive.

* February 2003 - Gold reaches a 4- year high on safe-haven buying in the run-up

to the invasion of Iraq.

* December 2003-January 2004 - Gold breaks above $400, reaching levels last

traded in 1988. Investors increasingly buy gold as risk insurance for

portfolios.

* November 2005 - Spot gold breaches $500 for the first time since December

1987, when spot hit $502.97.

* April 11, 2006 - Gold prices surpass $600, the highest point since December

1980, with funds and investors pouring money into commodities on a weak dollar,

firm oil prices and geopolitical worries.

* May 12, 2006 - Gold prices peak at $730 an ounce with funds and investors

pouring money into commodities on a weak dollar, firm oil prices and political

tensions over Iran's nuclear ambitions.

* June 14, 2006 - Gold falls 26 percent to $543 from its 26-year peak after

investors and speculators sell out of commodity positions.

* November 7, 2007 - Spot gold hits a 28-year high of $845.40 an ounce.

* January 2, 2008 - Spot gold breaks above $850.

* March 13, 2008 - Benchmark gold contract trades over $1,000 for the first time

in U.S. futures market.

* March 17, 2008 - Spot gold hits an all-time high of $1,030.80 an ounce. U.S.

gold futures touch record peak of $1,033.90.

* September 17, 2008 - Spot gold rises by nearly $90 an ounce, a record one-day

gain, as investors seek safety amid turmoil on the equity markets.

* Jan-March 2009 - Gold-backed exchange-traded funds report record inflows in

the first quarter as financial sector insecurity spurs safe-haven buying.

Holdings of the largest, the SPDR Gold Trust, rise 45 percent to 1,127.44

tonnes.

* February 20, 2009 - Gold rises back above $1,000 an ounce to a peak of

$1,005.40 as investors buy bullion as a safe store of value as major economies

face recession and equity markets tumble.

* April 24, 2009 - China announces it has raised its gold reserves by

three-quarters since 2003 and now holds 1,054 tonnes of the precious metal,

boosting expectations it may add further to its reserves.

* August 7, 2009 - European central banks opt to renew their earlier agreement

to limit gold sales over a five-year period, setting the sales cap at 400 tonnes

a year.

* September 8, 2009 - Gold breaks back through $1,000 an ounce for the first

time since February 2009 on dollar weakness and concerns over the sustainability

of the economic recovery.

* December 1, 2009 - Gold climbs above $1,200 an ounce for the first time as the

dollar drops.

* December 3, 2009 - Gold hits record high at $1,226.10 an ounce, with dollar

weakness and expectations for central banks to diversify reserves into gold

driving prices higher.

* May 11, 2010 - Gold reaches fresh record high above $1,230 an ounce as fears

over the contagion of debt issues in the euro zone fuel safe-haven buying.

* June 21, 2010 - Gold jumps to a new high at $1,264.90 an ounce as underlying

fears over financial market stability and sovereign risk combine with dollar

weakness to push the metal through resistance at its previous high.

* Sept 14, 2010 - Gold climbs back to record highs, this time at $1,274.75, as

global markets reflect renewed uncertainty on the economic outlook.

* Sept 16-22, 2010 - Gold hits record highs for five successive sessions,

peaking at $1,296.10, as investors flock to bullion after the Fed signals it may

consider further quantitative easing, weakening the dollar and raising fears

over future inflation.

* Sept 27 - Spot gold prices touch the $1,300 an ounce mark for the first time.

* Oct 7 - Gold rallies to a record high above $1,360 an ounce as the dollar

comes under pressure from building expectations for the U.S. Federal Reserve to

take extra measures to keep interest rates low and prop up the economy.

* Oct 13 - Gold jumped to record highs near $1,375 an ounce as the dollar

continued to languish, with the U.S. unit coming under pressure after minutes

from the Fed's September meeting signaled the U.S. economy may need further

stimulus.

* Nov 8 - Gold prices break through the $1,400 an ounce mark for the first time

as haven buying prompted by renewed budget problems in Ireland more than offset

a sharp dollar bounce.

* Dec 7 - Gold reaches a fresh record high above $1,425 an ounce, driven by fund

buying ahead of year-end, jitters over the euro zone debt crisis and speculation

for further U.S. monetary easing.

* January 2011 - Gold prices fall more than 6 percent in their worst monthly

performance in over a year as a revival in risk appetite diverts investment to

higher-yielding assets.

* March 1 - Gold recovers to hit a record high at $1,434.65 an ounce as unrest

in Tunisia and Egypt spreads across the Middle East and North Africa, boosting

oil prices.

* March 7 - Gold extends record highs to $1,444.40 an ounce as oil prices hit

their highest in 2- years after protests are quashed in Saudi Arabia and as

violence in Libya rages.

* March 24 - The resignation of Portuguese prime minister Jose Socrates pushes

the euro zone debt crisis back to center stage, lifting gold prices to a record

above $1,447 an ounce.

* April 20 - Gold climbed to a record high at $1,500.16 an ounce, supported by a

weak dollar and concerns over a sovereign debt crisis.

(Compiled by Atul Prakash, Jan Harvey,

Himani Sarkar and Amanda Cooper)

Factbox: Gold milestones

on the road to record high, R, 20.4.2011,

http://www.reuters.com/article/2011/04/20/

us-precious-milestones-idUSTRE73J0PF20110420

Gold

rises to record

above $1,440 on Mideast unrest

NEW

YORK/LONDON | Wed Mar 2, 2011

12:58pm EST

By Frank Tang and Jan Harvey

NEW

YORK/LONDON (Reuters) - Gold rose to a record high for a second straight day on

Wednesday, breaching $1,440 an ounce as political unrest in Libya and surging

oil prices prompted investors to pile in.

Unrest across the Middle East and North Africa, which unseated leaders in

Tunisia and Egypt before spreading to Libya, Bahrain, Yemen, Oman and Iran,

fueled safe-haven buying on fears that tensions could flare across the entire

region.

"You have political problems all over the world, a Federal Reserve bank that

still erred on the side of easing rather than tightening, rising commodities

prices in general, and growing disdain for fiat currencies generally," said

Dennis Gartman, author of the Gartman Letter, an daily investment newsletter.

"It will be illogical for gold not to be going higher," he said.

Two U.S. warships were passing through the Suez Canal on Wednesday, heading for

the waters off Libya to pressure that country's ruler, Muammar Gaddafi, to step

down. Gaddafi launched a land and air offensive to retake territory from rebels

in Libya's eastern region.

At a meeting of Arab foreign ministers in Cairo on Wednesday, Iraqi Foreign

Minister Hoshiyar Zebari said the Libya crisis is an internal Arab affair and

foreign powers should refrain from any intervention.

RECORD

TERRITORY

Spot gold rose 0.4 percent to $1,439.19 an ounce by 12:00 p.m. EST, after

peaking at an all-time high of $1,440.10. The metal fixed at $1,435.50 an ounce

in London.

U.S. gold futures for April delivery rose $7.90 to $1,439.10.

Gold is building on a 6 percent rise in February, its biggest one-month climb

since August.

World stocks declined as unrest in the Middle East and North Africa drove up oil

prices and pushed investors into safer assets.

Rising oil prices will support gold's status as an inflation hedge, analysts

said, if they appear to curb global growth. "They could very well impact (growth

in) Europe, the United States as well, and indeed China," said VM Group analyst

Carl Firman.

"That will give rise to uncertainty, it will lower demand predictions for, for

instance, copper, and where it knocks industrial metals and equities, gold will

probably benefit," he said.

U.S. crude futures rose above $101 a barrel as escalating violence in Libya

threatened the OPEC nation's oil infrastructure and markets braced for a

potentially prolonged disruption.

Federal Reserve Chairman Ben Bernanke said on Tuesday the surge in oil prices is

unlikely to hurt the U.S. economy, boosting gold as he offered no hint that the

U.S. central bank was considering winding down its loose monetary policy.

RISK

APPETITE WANES

Violence in the region cooled appetite for higher-risk assets such as stocks and

boosted so-called safe havens like German government bonds, the Swiss franc and

gold.

Silver rose to a peak of $34.96 an ounce, its strongest level since early 1980.

It later rose 0.4 percent to $34.79 an ounce.

Holdings in the world's largest silver exchange-traded fund, the iShares Silver

Trust, rose to 10,693.68 tones on March 1, their highest since January 14.

The trust reported a slight recovery in its holdings last month after they

posted their biggest ever one-month fall in January.

Platinum gained 0.9 percent to $1,855.49 an ounce and palladium climbed 0.4

percent to $817.47.

Prices at 12:13 p.m. EST.

(Reporting

by Frank Tang and Jan Harvey;

editing by Jim Marshall)

Gold rises to record above $1,440 on Mideast unrest, R,

2.3.2011,

http://www.reuters.com/article/2011/03/02/

us-markets-precious-idUSTRE71G2KM20110302

Funds boost gold ETFs to record

Fri Feb 13, 2009

9:52am EST

Reuters

By Frank Tang - Analysis

NEW YORK (Reuters) - Investors expecting years of inflation and global

economic instability are pouring money into securities backed by gold bullion,

helping turn a simple safe haven into a mainstream asset class.

SPDR Gold Trust GLD.PGLD.A, popularly known as GLD, said the gold bullion it

owned rose by more than 100 tonnes to 970.57 tonnes as of Thursday, which marked

the biggest weekly gain in the history of the gold-backed exchange-traded fund.

However, fund managers say that setbacks in the price of gold are possible

following a sharp rally when investors small and large are piling into the

yellow metal.

GLD is now the second biggest U.S. ETF, with market value of $27.5 billion,

which ranks it behind only the popular SPDR S&P 500. GLD currently owns more

gold bullion than the government of Japan, according to the World Gold Council.

Holdings of COMEX Gold Trust IAU.P, another U.S. gold ETF, also climbed to a

record high 70 tonnes on Friday.

Diversification into gold out of traditional asset classes, such as stocks,

bonds and currencies, by many sizable non-gold investment funds has fueled GLD's

rally. Some pension funds and advisors to wealthy investors are now recommending

5 to 7 percent allocation toward gold and gold stocks.

"More and more generalist money managers are looking at gold. A lot of money

mangers find comfort with the idea of owning gold via GLD. It's quite convenient

to own the GLD, versus having to pay warehouse costs on your own," said Brian

Hicks, co-manager of the $500 million Global Resources Fund at Texas-based U.S.

Global Investors.

Gold ETFs are listed on stock exchanges and offer investors exposure in bullion

without taking physical delivery. Sponsors of the funds buy a matching amount of

physical gold and keep it in bank vaults.

Hicks' fund currently owns more than 4 percent of GLD, which is the largest

single position of his fund.

U.S. gold futures for April delivery climbed on Thursday above $950 an ounce,

the loftiest level since July. They traded at $940 on Friday, but have still

risen almost 20 percent from their low in January.

GOLD AS LONG-TERM INFLATION HEDGE

The furious rally in bullion stems from the inflationary expectation arising

from the U.S. government's need to borrow more than $2 trillion to finance a

bank rescue plan and to enact an aggressive package to stimulate the world's

biggest economy and help reverse a global slowdown.

"The government does not know what it is doing, but it's doing a lot to it. It's

just a matter of time for the Federal Reserve to come in to inflate the system,"

said Axel Merk, portfolio manager of California-based Merk Mutual Funds, which

have more than $310 million of assets.

"It (gold) is moving more toward the mainstream. There are retail investors, but

it is also becoming part of the asset allocation of larger fund managers having

a portion in gold. That also shows me that we are far away from the top of the

gold market," Merk said.

There was recent market talk about a shortage of physical gold bullion as more

investors turned to gold as a safe haven.

However, George Milling-Stanley, manager of investment and market intelligence

of WGC, which helped launch GLD in 2004, said there was "not any problem

whatsoever" for GLD's authorized dealers to acquire gold bars to create new

shares.

Dennis Gartman, independent investor and author of the daily Gartman Letter,

said that the low yield of currencies and U.S. Treasury bonds because of

stimulus plans by central banks made gold -- which produces no interest -- more

attractive.

However, Gartman also said the price of gold could easily retrace back to the

$920 level because of over-extended buying in too short a period of time.

"It's a little worrisome that so many people are piling in," Gartman said.

(Editing by Walter Bagley)

Funds boost gold ETFs to

record,

R, 13.2.2009,

http://www.reuters.com/article/reutersEdge/idUSTRE51C3T020090213

Related > Anglonautes >

Vocapedia

industry,

energy, commodities

economy, money, taxes,

housing market, shopping,

jobs, unemployment,

unions, retirement,

debt,

poverty, hunger,

homelessness

Earth >

animals, wildlife,

resources,

agriculture / farming,

population,

waste, pollution,

global warming,

climate change,

weather,

disasters, activists

|