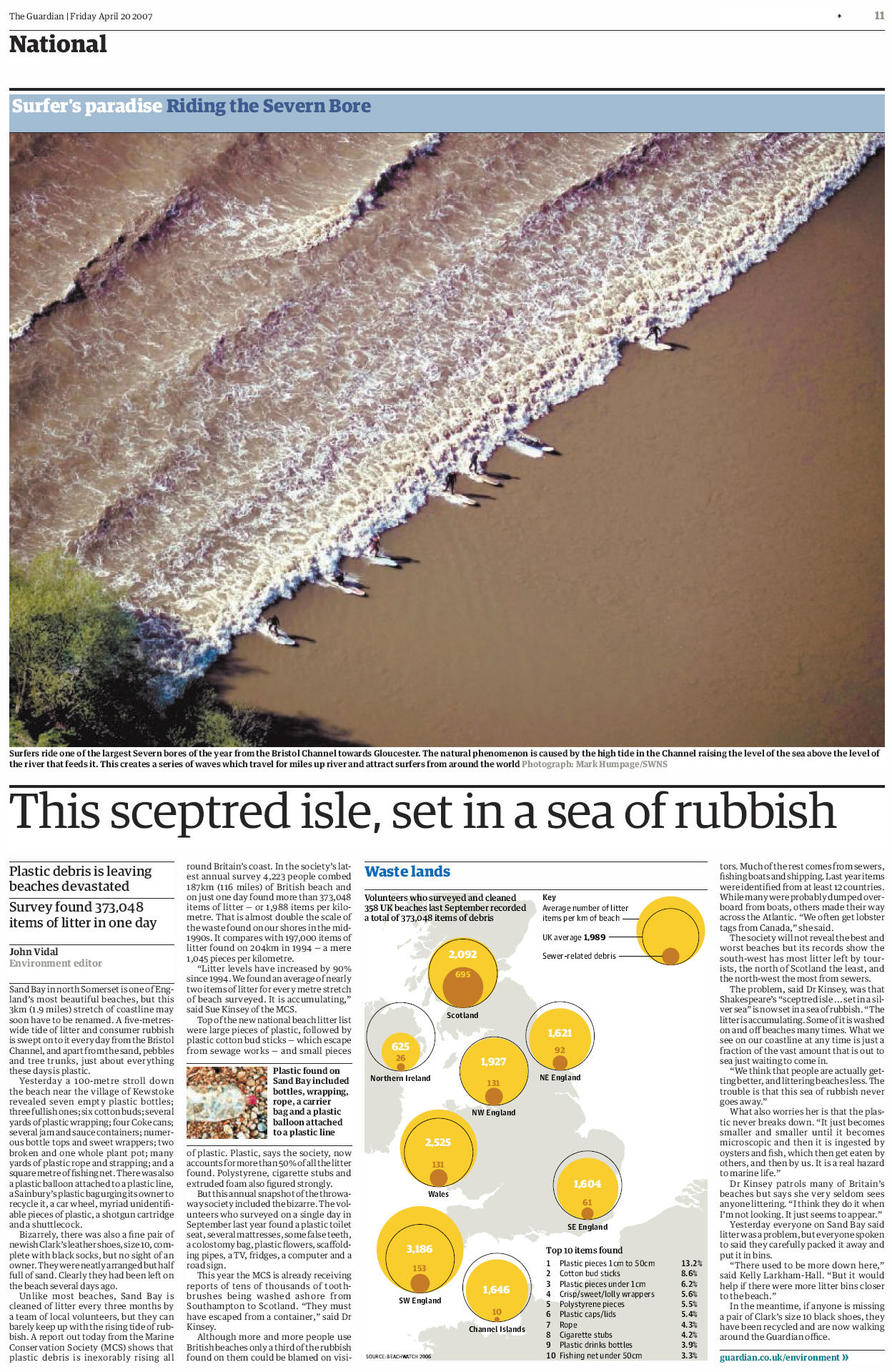

|

Vocapedia >

Language > References, Puns >

Shakespeare

17 March 2005

http://www.thesun.co.uk/article/0,,2005082056,00.html

G2

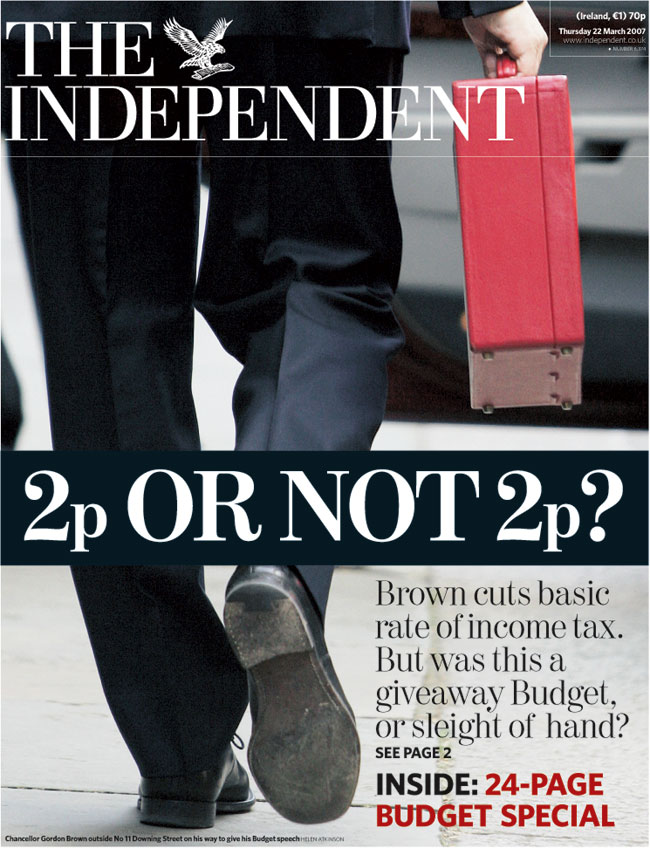

Brown opens way for early election

with unexpected cut in

income tax

Published: 22 March 2007

The Independent

By Andrew Grice, Political Editor

Brown's final budget 2007 Gordon Brown announced tax cuts for Labour's

heartlands and Middle England as he gave himself the option of calling a general

election in the autumn of next year.

In his 11th and final Budget, the Chancellor unveiled a dramatic cut in the

basic rate of income tax from 22p to 20p in the pound, the lowest for 75 years.

But the Tories accused him of a "tax con" because his give-and-take package also

abolished the 10p in the pound bottom rate of tax, currently paid on the first

£2,150 of taxable income.

His surprise tax shake-up will take effect in April next year, providing a

possible platform for Mr Brown, who is expected to become Prime Minister this

summer, to call an election in the autumn of 2008 rather than wait until 2009.

Labour MPs welcomed his targeted tax cuts, saying they would boost the party's

election prospects.

Mr Brown also used his last Budget to draw the election battle lines between

himself and David Cameron on the environment and marriage. He increased road tax

for 4x4 vehicles and petrol duty but ridiculed Tory plans to tax frequent flyers

more. He also ruled out Tory proposals to reward marriage in the tax system,

saying his strategy would benefit six of the seven million families with

children.

A war of words broke out over the winners and losers from the tax changes.

Labour claimed four out of five households would be better or no worse off but

admitted that people without children would lose. It said a single-earner couple

with two children on median earnings of £27,000 a year would be £500 a year

better off, while the same family earning £35,900 would gain £320 a year. The

Tories claimed that people earning between £5,000 and £18,000 annually would be

hit by a tax rise because of the scrapping of the 10p rate. They said a single

person with no children earning £13,000 a year would pay £112 more in tax.

Although Labour said people on low incomes would be more than compensated by Mr

Brown's tax credits, the Tories predicted that almost one in four would miss out

because they would not claim the state benefit. They also claimed that

middle-income earners on about £40,000 a year would be hit by his decision to

align the national insurance and top tax rates.

George Osborne, the shadow Chancellor, said: "This is classic smoke and mirrors

from Gordon Brown. This is not a tax-cut Budget, it is a con-trick Budget. He is

giving with one hand and taking with the other."

The Tories, who were initially wrong-footed by the 2p tax cut, later denied that

Mr Brown had stolen their tax-cutting clothes. They claimed he could no longer

attack their plans to "share the proceeds of growth" between tax cuts and public

services because he was doing the same. However, Mr Cameron now faces a dilemma

over whether to match Labour's spending or hold out the prospect of further tax

cuts.

The independent Institute for Fiscal Studies said: "The changes to personal

taxes seem to have been carefully designed to ensure that this Budget is not a

tax raid on the rich: those earning over around £42,000 a year will find their

disposable income almost unaffected by the personal tax changes. However, almost

one in five families in the UK will lose, and, unusually for a Brown Budget, the

losers come from across the income distribution, and include some families with

children."

Taxes were cut by £2.5bn overall in a broadly neutral Budget with the money

raised through green taxes and reducing reliefs on empty property. Environmental

groups welcomed Mr Brown's green measures but said they did not go far enough.

"The Budget falls short of the measures required to tackle climate change," said

Tony Juniper, director of Friends of the Earth.

The tax changes overshadowed the announcement of a squeeze on public spending in

2008-11, when spending will rise by 2 per cent on top of inflation, half the

increase in recent years. Education will be the exception as the biggest winner

in a government-wide spending review expected this summer, enjoying average

rises of 5 per cent a year.

The Chancellor also used his swansong Budget to take 600,000 pensioners out of

the tax net through more generous allowances and promised that 200,000 more

children would be lifted out of poverty through an icrease in tax credits and

child benefit, which will rise from £17.45 a week for the first child to £20 by

2010. He also cut corporation tax from 30p to 28p in the pound.

Sir Menzies Campbell, the Liberal Democrat leader, said: "The 2p cut in the

basic rate is welcome, but let us be clear that this is an income tax cut for

the wealthy dressed up as a tax cut for the poor. The big increase in taxation

is a doubling of the starting rate of income tax [from 10p to 20p in the pound].

Anyone earning less than £15,000 will pay more in income tax."

2p or not 2p? That is the

question

Gordon Brown yesterday announced a 2p cut in the basic rate of income tax, to

take effect from April 2008. But will the cut result in a windfall for most

people?

The answer for the majority of families is no. The real winners should

eventually be families on low incomes - households with less than £25,000 coming

in each year. They will benefit from the lower basic rate of tax, as well as

increases in tax credits.

For everyone else, the 2p cut will be almost entirely wiped out by two other

measures: abolishing the 10 per cent starting rate of tax and the rise in the

maximum amount of salary on which the full 11 per cent rate of national

insurance is payable.

Brown opens way for early election

with unexpected cut in income tax,

I, 22.3.2007,

http://news.independent.co.uk/uk/politics/article2381133.ece

Related > Anglonautes >

Vocapedia

describing

language, actions, things, facts, events, trends, ideas,

sounds, pictures, places,

people, personality traits, behaviour

drama, theatre > Shakespeare

(1564-1616)

|