|

Vocapedia >

Economy >

Jobless claims > USA

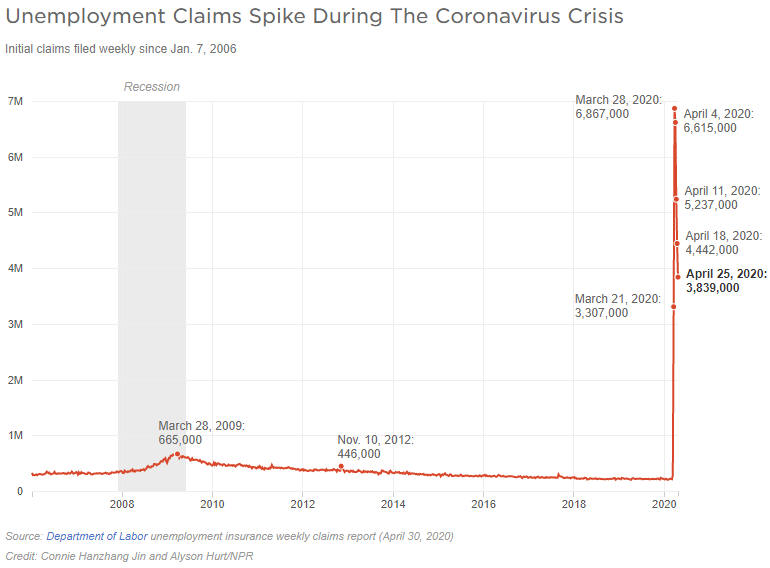

A Staggering Toll: 30 Million Have Filed For Unemployment

NPR

April 30, 2020 8:33 AM ET

https://www.npr.org/sections/coronavirus-live-updates/2020/04/30/

848021681/a-staggering-toll-30-million-have-filed-for-unemployment

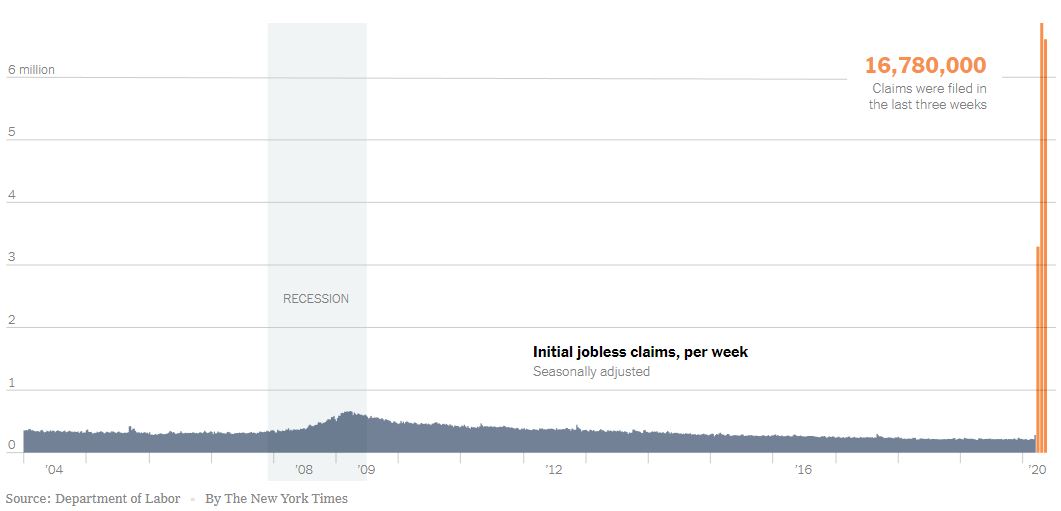

‘Sudden Black Hole’ for the Economy With Millions More

Unemployed

Jobless claims now exceed 16 million

as shutdowns from the coronavirus pandemic widen

and problems with getting benefits persist.

NYT

April 9, 2020

https://www.nytimes.com/2020/04/09/

business/economy/unemployment-claim-numbers-coronavirus.html

U.S. jobless claims / unemployment claims / claims for jobless

benefits

https://www.npr.org/2021/01/21/

959151638/unemployment-claims-stay-stubbornly-high-as-biden-takes-office

https://www.npr.org/2020/04/15/

835174390/unemployment-money-not-reaching-millions-of-people-who-applied

https://www.nytimes.com/2020/04/09/

business/economy/unemployment-claim-numbers-coronavirus.html

https://www.npr.org/2020/03/27/

822944544/episode-986-america-unemployed

https://www.npr.org/2020/03/26/

821580191/unemployment-claims-expected-to-shatter-records

https://www.nytimes.com/interactive/2020/03/19/

upshot/coronavirus-jobless-claims-states.html

http://www.usatoday.com/money/economy/2008-10-23-

jobless-claims_N.htm

file for unemployment / file

claims for jobless benefits /

people claiming

unemployment benefits /

unemployment claims / claims for unemployment benefits

https://www.npr.org/sections/coronavirus-live-updates/2020/07/23/

894579091/job-picture-worsens-millions-more-file-for-unemployment-in-reversal

https://www.npr.org/sections/coronavirus-live-updates/2020/05/14/

855755518/36-5-million-have-filed-for-unemployment-in-8-weeks

https://www.npr.org/sections/coronavirus-live-updates/2020/04/30/

848021681/a-staggering-toll-30-million-have-filed-for-unemployment

https://www.npr.org/sections/coronavirus-live-updates/2020/04/30/

848021681/a-staggering-toll-30-million-have-filed-for-unemployment

https://www.npr.org/sections/coronavirus-live-updates/2020/04/23/

841876464/26-million-jobs-lost-in-just-5-weeks

https://www.npr.org/sections/coronavirus-live-updates/2020/04/02/

825383525/6-6-million-file-for-unemployment-another-dismal-record

unemployment offices

https://www.npr.org/sections/coronavirus-live-updates/2020/04/30/

848021681/a-staggering-toll-30-million-have-filed-for-unemployment

States’ Funds for Jobless

Are Drying Up

December 15, 2008

The New Tork Times

By JENNIFER STEINHAUER

With unemployment claims reaching their highest levels in decades, states are

running out of money to pay benefits, and some are turning to the federal

government for loans or increasing taxes on businesses to make the payments.

Thirty states are at risk of having the funds that pay out unemployment benefits

become insolvent over the next few months, according to the National Association

of State Workforce Agencies. Funds in two states, Indiana and Michigan, have

already dried up, and both states are borrowing from the federal government to

make payments to the unemployed.

Unemployment taxes are collected by states from employers, but the rate varies

from state to state per employee. In good times states build up trust funds so

that when unemployment is high there is enough money to cover the requests for

benefits, which are guaranteed by the federal government.

“You don’t expect the loans to happen this early in a jobs slump,” said Andrew

Stettner, the deputy director of the National Employment Law Project, an

advocacy organization for low-wage workers. “You would expect that the states

should, even when they are not well prepared, to have savings.”

The Labor Department said last week that initial applications for jobless

benefits rose to 573,000, the highest reading since November 1982. It is

recommended that states keep at least one year of peak-level benefits in their

trusts, but many have not, and already some states are far worse off than

others.

Indiana’s unemployment trust fund went insolvent last month, and has borrowed

twice from Washington since then — the first such loans to the state since 1983.

It also expects to request an additional $330 million early next year.

Michigan, which has been borrowing money from the federal government for the

past few years to replenish its fund, is now $508.8 million in the hole and

unable to repay it. Next month the state, where the unemployment rate is more

than 9 percent, will begin levying a special “solvency tax” against some

employers to replenish its trust fund.

California, New York, Ohio, Rhode Island and other states are inching toward

insolvency as well, and may have to borrow from the federal government to get

through at least the first quarter of 2009.

In South Carolina, officials recently requested a $15 million line of credit.

“Right now we have $40 million in our trust fund, and we are paying out around

$11 million a week,” said Allen Larson, deputy executive director for the

unemployment insurance program at the South Carolina Employment Security

Commission. “So we think it is going to be very close as to whether or not we

can get through this year. We have never experienced anything like this.”

Officials in New York said the state’s trust fund has about $314 million,

compared with $595 million last year, and will most likely have to borrow from

the federal government in January.

The situation puts states, many of them facing huge deficits, in an even tighter

vise. As more people lose their jobs, the revenue base that the benefits are

drawn from shrinks, making it harder to pay claims. Adding to that burden is

that states will eventually have to pay back what they borrow.

Some states are worried about next year because the lion’s share of unemployment

taxes are collected early in each year, and they are not sure the money will

stretch through the end of the next year. The maximum amount of income the

federal government can tax employers for each worker is $7,000. (The amount

ranges from about $7,000 to about $25,000 for state taxes.)

“It is something that we are concerned about,” said Kim Brannock, a spokeswoman

for the Office of Employment and Training in Kentucky, where the unemployment

trust fund balance now sits at $133 million, compared with $250 million a year

ago. The fund has not borrowed money from the federal government since the

1980s. “At this point we are solvent,” she said, “but we are monitoring the

situation.”

States that come up short have the option of borrowing from the federal

government, but if the loan is not paid back within the federal fiscal year, 4.7

percent interest is accrued, which cuts into states’ general funds.

“With longer term solvency issues due to the sharp increase in unemployment,

federal borrowing quickly becomes expensive,” said Loree Levy, a spokeswoman for

the Employment Development Department in California, which is already facing a

multibillion dollar budget gap. “We are anticipating interest payments of $20

million in 2009-10 and if nothing is done to revise the revenue generation model

the interest would be $150 million in 2010-11.”

As such, they are then forced to raise taxes or cut services, or both.

Robert Vincent, a spokesman for the Gtech Corporation, a technology company for

the lottery industry based in Rhode Island, said, “Unemployment taxes are one of

a number of taxes that make it difficult to do business here.”

In many cases, states that have kept unemployment tax rates artificially low —

or in some instances decreased them — find themselves in the worst pickle now.

Indiana legislators, for example, reduced the tax rates to businesses by 25

percent in 2001.

“So, frankly, they created the perfect storm,” said John Ruckelshaus, the deputy

commissioner for the Indiana Department of Workforce Development. “The

Legislature will have to go in and look at the whole unemployment trust find

first thing when they begin their session.”

At the same time payments have gone up in some states.

To recalibrate the balance, several states are raising taxes on businesses —

often through an automatic increase that is triggered when fund levels are

endangered — to keep the unemployment checks flowing. An example is the Michigan

solvency tax, which will be levied against employers whose workers have received

more in benefits than the companies have contributed in unemployment insurance

taxes, to the tune of $67.50 per employee.

In Rhode Island, where the unemployment rate is 9.3 percent, the taxable wage

base will go to $18,000 from $14,000 in 2009, the highest rate in a decade.

“There is a possibility that we might be slightly under the funds we need come

the end of the first quarter,” said Raymond Filippone, the assistant director of

income support at the Rhode Island Department of Labor and Training. The state

has not borrowed from the federal government since 1980, he said.

“Many states have not raised that tax in years,” said Scott Pattison, executive

director of the National Association of State Budget Officers in Washington.

“Some states have automatic triggers. But then of course you have businesses

saying, ‘Whoa, you are raising taxes on me when we are having a tough time and

it is a recession, too.’ ”

Still, some said they were thinking beyond the dollars.

“In these times of financial stress every extra cost is a concern,” said Linda

Shelton, the spokeswoman for Lifespan, a large health care system in Rhode

Island. “However there are many things that worry us even more. We are much more

concerned about Rhode Island’s budget crisis, about rising unemployment, the

rising number of uninsured and the continuing cuts to health care.”

States’ Funds for Jobless Are Drying Up, NYT,

15.12.2008,

http://www.nytimes.com/2008/12/15/us/15funds.html

U.S. Loses 533,000 Jobs

in Biggest Drop Since 1974

December 6, 2008

The New York Times

By LOUIS UCHITELLE, EDMUND L. ANDREWS

and STEPHEN LABATON

This article was reported by Louis Uchitelle,

Edmund L. Andrews and Stephen

Labaton

and written by Mr. Uchitelle.

The government’s report of a giant job loss in November, the biggest monthly

decline in a generation, puts more pressure on Congress and the administration

to move quickly on a stimulus package, mortgage relief and perhaps financial aid

for Detroit’s big automakers.

The nation’s employers cut 533,000 jobs in November, the Bureau of Labor

Statistics reported Friday.

Not since December 1974, toward the end of a severe recession, have so many jobs

disappeared in a single month — and the current recession, far from ending,

appears to be just gathering steam.

“We are caught in a downward spiral in which employment, incomes and spending

are collapsing together,” said Nigel Gault, chief domestic economist for IHS

Global Insight. “With private spending frozen, we have no choice but to rely on

a stimulus package to revive the economy.”

The unemployment rate rose to 6.7 percent, up just two-tenths of a percentage

point from October, but up six-tenths over the last three months. More than

420,000 men and women who had been working or seeking work in October left the

labor force in November.

More significantly, the unemployment rate does not include those too discouraged

to look for work any longer or those working fewer hours than they would like.

Add those people to the roster of the unemployed, and the rate hit a record 12.5

percent in November, up 1.5 percentage points since September.

Noting that 1.9 million jobs have been lost since the start of the recession a

year ago — two-thirds of them since September — President-elect Barack Obama

invoked public spending as the best way to get a dead-in-the-water economy

moving again. “This painful crisis,” he said in a statement, is an opportunity

“to improve the lives of ordinary people by rebuilding roads and modernizing

schools for our children,” and by investing in clean energy projects.

A goal of all this spending is to generate 2.5 million jobs over the next two

years, he said, repeating an earlier pledge. Given the accelerating job losses,

hitting that target would barely recover the jobs that have disappeared over the

last year.

As part of Friday’s announcement, the government revised higher its estimates of

jobs lost in September and October. Instead of 524,000 jobs disappearing in

those months, 723,000 were lost, or a total of 1.2 million jobs in just three

months. In all, jobs have been lost in each of the last 11 months.

“Obama is being deliberately unclear about those 2.5 million jobs,” said Robert

Pollin, a University of Massachusetts economist. “He is not going to add 2.5

million on top of recovering the 1.9 million that have been lost so far this

year.”

Despite the deterioration of the labor market, Democrats in Congress and a

lame-duck president remain in a standoff over rescue measures.

At its core, the stalemate between the Republicans and the Democrats springs

from fundamentally different views about the nature of the crisis and the role

of government in resolving it. The White House contends that it has rightly

focused on the credit and housing markets, while the Democrats see economic

problems that can be resolved only through broader intervention.

New efforts to adopt a broad economic package are likely to wait until the new

president takes office and Democrats have bigger majorities in Congress. That

delay poses the possibility of a deeper recession, according to some experts.

President Bush, appearing in front of cameras on Friday morning at the White

House, said he was “concerned about our workers who have lost jobs.” But he

offered no hint of softening his opposition to either a stimulus package or a

bailout of the automobile industry, saying that the measures already put in

place by the Treasury Department and the Federal Reserve to ease credit problems

would take time to work.

Shortly after his appearance, a White House spokesman, Scott Stanzel, dashed any

expectation of a change in policy when he said that officials expected a

stimulus package would “happen in the next administration.”

Support is building for a significant stimulus package as the economy slips into

a deep recession. Most forecasters expect the gross domestic product to contract

in the current fourth quarter at an annual rate of 4 or 5 percent, and continue

to contract through most of next year, shrinking by 2 percent for all of 2009 —

a contraction that has occurred only once since World War II: in 1982, a year of

severe recession.

“If there was any doubt that a very large fiscal stimulus is required, then the

numbers we have been getting recently should dispel that doubt,” said Jan

Hatzius, chief domestic economist for Goldman Sachs. To offset the private

sector retrenchment, he added, “we will need a stimulus package of $600 billion

at an annual rate, or $1.2 trillion over two years.”

Economists and policy makers increasingly share his estimate of what it will

take to revive America’s $14 trillion economy, with Democratic leaders talking

recently about a stimulus package of $400 billion or more.

Though any broad economic package seems to be delayed, Democrats still had faint

hopes of approving next week a rescue package for the car companies. Their goal

would be to prevent far more rapid deterioration in the job market.

The latest job numbers were stark evidence of a breakdown in consumer spending

and business investment since mid-September, when the Treasury Department and

the Federal Reserve decided to let Lehman Brothers fail, delivering a shock to

the financial sector. Almost simultaneously, stock prices began a free fall,

undermining the wealth and the retirement accounts of millions of Americans.

“We have recorded the largest decline in consumer confidence in our history,”

said Richard T. Curtin, director of the Reuters/University of Michigan Survey of

Consumers, which started its polling in the 1950s.

Job loss has played a big role in this erosion, he acknowledged. But so have

fewer hours of work, smaller bonuses, less overtime, falling home prices,

falling stock prices and a drumbeat of job cut announcements — the most recent,

this week, from big names like AT&T, Viacom, CVS, DuPont and the Avis Budget

Group.

The Dow Jones industrial average, down more than 20 percent since mid-September,

fell Friday morning in response to the November jobs report, but recovered later

and gained 259.18 points, or 3 percent, by the end of trading, to close at

8,635.42.

With home prices still in decline, one in 10 mortgage holders was either

delinquent on loans in September or in foreclosure, the Mortgage Bankers

Association reported Friday. That was up from 9.2 percent in June and the

highest percentage since the association began to collect this data 30 years

ago.

The mortgage crisis makes lenders ever more reluctant to lend for the purchase

of homes, autos and other big consumer items. In more normal times, lenders

bundle these loans into securities and sell them. The buyers of these securities

have disappeared in the current credit crisis, however, and the Federal Reserve

is considering ways for lenders to borrow from the Fed, using the securities as

collateral.

Jobs disappeared last month from every sector of the economy except health care

and state government, which mainly added educators. The biggest losses were in

manufacturing, construction, retailing — despite the first month of Christmas

shopping — financial services, hotel and restaurant work and temporary workers.

Over the course of the recession, 604,000 jobs — nearly one-third of the total —

have been eliminated in manufacturing, and the Big Three automakers promise more

layoffs to qualify for a federal bailout.

“Business shut down in November,” said Mark Zandi, chief economist at Moody’s

Economy.com. “Businesses are in survival mode and are slashing jobs and

investment to conserve cash. Unless credit starts flowing soon, big job losses

will continue well into next year.”

The administration says its recent actions are beginning to make credit flow

more easily. “We are pulling some very significant levers on the economy right

now, through what we’re doing with Treasury and what we’re doing with the Fed,”

said Tony Fratto, a White House spokesman.

Jack Healy contributed reporting.

U.S. Loses 533,000 Jobs

in Biggest Drop Since 1974, NYT, 6.12.2008,

http://www.nytimes.com/2008/12/06/business/economy/06jobs.html

Jobless Rate Rises to 6.7%

as 533,000 Jobs Are Lost

December 6, 2008

The New York Times

By LOUIS UCHITELLE

With the economy deteriorating rapidly, the nation’s employers shed 533,000

jobs in November, the 11th consecutive monthly decline, the government reported

Friday morning, and the unemployment rate rose to 6.7 percent.

The decline, the largest one-month loss since December 1974, was fresh evidence

that the economic contraction accelerated in November, promising to make the

current recession, already 12 months old, the longest since the Great

Depression. The previous record was 16 months, in the severe recessions of the

mid-1970s and early 1980s.

“We have recorded the largest decline in consumer confidence in our history,”

said Richard T. Curtin, director of the Reuters/University of Michigan Survey of

Consumers, which started its polling in the 1950s. “It is being driven down by a

host of factors: falling home and stock prices, fewer work hours, smaller

bonuses, less overtime and disappearing jobs.”

The jobless rate was up from 6.5 percent in October. The job losses far exceeded

the 350,000 figure that was the consensus expectation of economists.

Over all, the job losses since January now total more than 1.9 million, with

most coming in the last three months as consumers and businesses cut back

sharply in response to the worsening credit crisis.

The report on Friday by the Bureau of Labor Statistics included sharp upward

revisions in job-loss figures for October (to 320,000 from the previously

reported 240,000) and for September (to 403,000 from 284,000).

The employment report increased the likelihood that Congress, with the support

of President-elect Barack Obama, will enact a stimulus package by late January

that could exceed $500 billion over two years. More than half that money would

probably be channeled into public infrastructure spending. Many economists

consider such investments an effective way to counteract, through federally

financed employment, the layoffs and hiring freezes spreading through the

private sector.

“Basically $100 billion of public investment in such things as roads, bridges

and levees would generate two million jobs,” Robert N. Pollin, an economist at

the University of Massachusetts, said. “That would offset the two million jobs

that we are now on track to lose by early next year.”

The manufacturing sector has been particularly hard hit, losing more than half a

million jobs this year. That is nearly half the 1.2 million jobs lost since

employment peaked in December and, in January, began its uninterrupted decline.

The cutbacks seem likely to accelerate as the three Detroit automakers close

more factories and shrink payrolls even more as they try to qualify for the

federal loans they asked Congress this week to approve.

While manufacturing has led the way, the job cuts are rising in nearly every

sector of the economy. “My sense is there is just a collapse in demand,” said

Marc Levinson, research director for the union Unite Here, whose 450,000 members

are spread across apparel manufacturing, hotels, casinos, industrial laundries,

airport concessions and restaurants. “Our members are being laid off big time,”

Mr. Levinson said.

The latest jobs report came during a week of compelling evidence that the

American economy is falling precipitously. On Monday, the National Bureau of

Economic Research ruled that a recession — the 12th since the Depression — had

begun last December, even earlier than many people had thought.

That news was followed by fresh reports of cutbacks or declines in construction

spending, home sales, consumer spending, business investment and exports. And

companies in every industry sector announced layoffs this week, including AT&T,

the telecommunications company, with 12,000 job cuts; DuPont, the chemical

company, 2,500; and Viacom, the media company, 850.

Even retail sales in the Christmas season were off sharply. The International

Council of Shopping Centers on Thursday described November sales at stores open

at least a year as the weakest in more than 30 years.

With all this in mind, and particularly the shrinking employment rolls,

economists are estimating that the gross domestic product is contracting at an

annual rate of 4 percent or more in the fourth quarter, after a decline of 0.3

percent in the third quarter.

“Our G.D.P. forecast for 2009 is now minus 1.8 percent, rather than minus 1

percent,” HIS Global Insight, a forecasting and data gathering service, informed

its clients in an e-mail message this week, explaining that all the latest bad

news left it no choice but to issue a sharp downward revision.

“We see the unemployment rate at 8.6 percent by the end of 2009,” Global Insight

said.

Jobless Rate Rises to

6.7% as 533,000 Jobs Are Lost, NYT, 6.12.2008,

http://www.nytimes.com/2008/12/06/business/economy/06jobs.html

Job Centers See

Crush of People in Need

November 24, 2008

The New York Times

By DAMIEN CAVE

FORT LAUDERDALE, Fla. — They have little in common: Ron Jones, 52, short and

strong, a union carpenter with decades of work experience; and Jerome Grant, 20,

tall and thin, a Jamaican immigrant with a degree in culinary arts. But the

economy has pushed them to the same difficult place.

On a recent morning, they sat across from each other at a one-stop career center

here, feverishly applying for two months of temporary work with United Parcel

Service. The pay was $8.50 an hour. There were 150 slots, and more than 300

applicants.

“You just hope you get your name called,” Mr. Grant said, eyeing the

interviewers. Mr. Jones agreed, saying, “You got to get in where you fit in.”

If a fit can be found anywhere, it would probably be here at one of 2,942

one-stop career centers that Congress established 10 years ago. They each play

host to a web of federal programs for the needy or unemployed, offering

training, job listings and, in most states, access to welfare programs like food

stamps and unemployment insurance.

Essentially, they are the emergency rooms of today’s sick economy — and they are

increasingly overwhelmed. Just a few feet from Mr. Jones, Lequila McGauley, a

single mother of two in heels, was also hoping for a chance to carry boxes.

Gregory Sapp was learning to use a computer for the first time at age 52.

A few years ago, they were working. Now, with the nation’s jobless claims at a

16-year high, they are among the 20 million people expected to use federal

workforce services in 2008, up from 14 million in 2005, according to the Labor

Department.

Congress has extended unemployment benefits, which helps, but the Department of

Labor also reports that this year’s federal budget for workforce programs was

cut by 1.74 percent, to $3.7 billion, continuing a decrease of 14 percent from

2000 to 2007.

Economists say the full impact is easy for lawmakers to miss. Many people apply

for unemployment through the Internet, cutting down on actual lines. And those

most in need are largely invisible — unskilled, less educated and

disproportionately black or from immigrant communities.

“It’s a mix of the most vulnerable and people who are in a state of shock,” said

Lawrence F. Katz, a former chief economist at the Labor Department who teaches

at Harvard.

Here in Broward County, the real estate boom was bigger and so was the bust. As

a result, in the last three months, 36,000 people have come looking for jobs

through the one-stop system, an increase of 60 percent over last year, while the

number of jobs posted has declined by more than a third.

The number of families receiving public assistance has also jumped by 40

percent.

“The current state of things has affected just about everybody, from the lowest

to the highest,” said Kelly Allen, a vice president of Workforce One, the

public-private partnership that runs this one-stop and two others in the county.

“And it really puts those folks who may have been on the edge further behind.”

The race to survive begins every morning. On a recent day, long lines started to

form at the county’s largest one-stop office in Fort Lauderdale within an hour

of its 8 a.m. opening. Dozens of men and women waited patiently, standing or

sitting in blue chairs near a sign that said “America’s People ... America’s

Talent ... America’s Strength!”

Mr. Sapp, working on an assessment of his current skills (graphic arts, no;

finance, no), said he was hoping for an office job. He had worked most of his

life behind the wheel, or at a stove. “I was a jack of all trades,” Mr. Sapp

said, “but my specialty was cooking.”

He started to struggle in 2000, during the last economic dip, and in March of

last year, he was let go from a catering company. Temporary jobs became all he

could find: a swing shift working security; a Sunday missing church for a few

hours of manual labor. And now, he said, those jobs had dried up, too.

“I’m just tired of sitting around,” Mr. Sapp said. “I’m used to being active.”

And then he smiled, revealing a front tooth like an exclamation point. When

asked why, he said, “Things have to get better because it can’t get any worse.”

He said that he was more hopeful because President-elect Barack Obama would soon

be in the White House, and that he could wait a few years for the new president

to “put in action what he promised the American people.”

“I feel blessed,” he said. “Really blessed.”

His positive outlook was all the more striking with additional conversation. Mr.

Sapp, whose eyes brightened when he spoke about cooking, said he now went to

food pantries to stay fed. His divorce five years ago left him alone, and

because he could not afford to pay rent he lived in what he described as “a

barter situation.” He shares with a sick older man and woman, cooking, cleaning

and caring for them in exchange for lodging.

Others at the one-stop also said that cobbling life together with family and

friends had become the norm.

Mr. Grant, who came here from Jamaica five years ago with plans to send money

home, survives with the help of his girlfriend. Mr. Jones said he had gotten by

since February — the last time his carpentry skills brought him steady work —

with unemployment insurance, plus help from his 28-year-old daughter.

Ms. McGauley, meanwhile, said she could not survive without her sister and

mother. “The hardest part for me is the day care aspect,” she said.

Her daughter, Janiya, 2, stood quietly beside her digging through a pint-sized

purse. Like many others, they had been to the one-stop before. This time Ms.

McGauley arrived around 9 a.m. to apply for the U.P.S. job, to be a driver’s

assistant from now until Christmas. She waited several hours for an interview,

and unlike much of the competition she had relevant experience. From 2000 to

2004, she said, she had served in the Army working on supply logistics. She also

worked part time for DHL before being let go in July.

She said she would prefer a full-time job, doing just about anything. But she

also acknowledged the reality. Unemployment among blacks like herself, Mr.

Jones, Mr. Grant, Mr. Sapp and nearly every other customer in the Fort

Lauderdale one-stop reached 11.1 percent in October, far above the national

average of 6.5 percent.

The Princeton scholar Cornel West, who is black, highlighted such figures in a

recent appearance at the Miami book fair, noting that the election of Mr. Obama

could not make the nation “post-racial” or “race transcendent” when such

disparities still existed.

But like many others here, Ms. McGauley had more immediate concerns — her

expectations more kitchen table than ivory tower. “I just want to pay a bill,

and get some Christmas gifts,” she said. A few weeks out was as far ahead as she

could see. “I just want to get to next year and say, ‘O.K., it’s time to start

over,’ ” she said. “I just got to keep going until then.”

Later on, she said she had started receiving a little help from the government;

$336 a month in food stamps since June. But that was it — no unemployment, no

cash assistance. Like millions of other Americans coming through one-stop

centers across the country, she said she really just wanted work.

Her interview with the U.P.S. recruiter seemed to go well. So did the interviews

for Mr. Jones and Mr. Grant, who left with a smile as bright as his

sunshine-yellow shirt. “I got a 30-70 chance,” he said, seeming to stand taller.

“Seventy percent I’ll get it.”

The recruiters told them that a background check would be completed quickly and

that they would be notified in the next few days if they were hired. Ms.

McGauley said she was told to be ready to work as of the following Monday, and

initially she said she felt sure that she would get the job. But it was the 30th

position she had applied for since early November, and the longer she waited

without getting a call, the less sure she felt.

“I’m kind of skeptical now,” Ms. McGauley said a few days after applying. “I’m

going to check out another job at Home Depot.”

Job Centers See Crush of

People in Need, NYT, 24.11.2008,

http://www.nytimes.com/2008/11/24/us/24jobs.html

Jobless Ranks Hit 10 Million,

Most in 25 Years

November 8, 2008

Filed at 3:52 a.m. ET

The New York Times

By THE ASSOCIATED PRESS

WASHINGTON (AP) -- The nation's jobless ranks zoomed past 10

million last month, the most in a quarter-century, as piles of pink slips shut

factory gates and office doors to 240,000 more Americans with the holidays

nearing. Politicians and economists agreed on a painful bottom line: It's only

going to get worse.

The unemployment rate soared to a 14-year high of 6.5 percent, the government

said Friday, up from 6.1 percent just a month earlier. And there was more grim

news from U.S. automakers: Ford Motor Co. and General Motors Corp., American

giants struggling to survive, each reported big losses and figured to be

announcing even more job cuts before long.

Barack Obama, in his first news conference as president-elect, said the nation

was facing the economic challenge of a lifetime but expressed confidence he

could deal with it.

''Immediately after I become president, I'm going to confront this economic

crisis head on by taking all necessary steps to ease the credit crisis, help

hardworking families, and restore growth and prosperity,'' he said after meeting

with economic advisers in Chicago. ''I'm confident a new president can have an

enormous impact.''

Wall Street revived somewhat after two days of big losses. The Dow Jones

industrials rose 248 points.

Still, the Labor Department's unemployment report provided stark evidence that

the economy's health was deteriorating at an alarmingly rapid pace. The jobless

rate was 4.8 percent just one year ago.

About 10.1 million people were unemployed in October, the most since the fall of

1983. More people have jobs now, since the population has grown, but it's still

a staggering jobless figure. With employers slashing jobs every month so far

this year, some 1.2 million positions have disappeared, over half in the past

three months alone.

Like Obama, President Bush expressed confidence that things would get better:

''Our economy has overcome great challenges before, and we can be confident that

it will do so again.''

But economists were much less upbeat than politicians.

''There is no light at the end of the tunnel, and the outlook is pitch black,''

said Richard Yamarone, economist at Argus Research.

And Bernard Baumohl, chief global economist at the Economic Outlook Group, said

the report ''depicts an economy still in free fall and without a safety net

anywhere in sight.''

All the economy's woes -- a housing collapse, mounting foreclosures, hard-to-get

credit and financial market upheaval -- will confront Obama when he assumes

office in January. Unemployment is expected to keep rising during his first year

in office, while record budget deficits will crimp his domestic agenda.

October's jobless rate was the highest since March 1994 and now has surpassed

the 6.3 percent 2003 high after the most recent recession. The government also

said job losses were worse than first reported for the preceding two months,

284,000 rather than 159,000 in September and 127,000 rather than 73,000 in

August.

Many economists believe the unemployment rate will climb to 8 percent or 8.5

percent by the end of next year before slowly drifting downward. Some think

unemployment could even hit 10 or 11 percent -- if an auto company should fail.

In any case, the rate is likely to move higher even if the economy is on

somewhat stronger footing by the middle of next year as some hope. That's

because companies won't be inclined to ramp up hiring until they feel certain

that a recovery has staying power.

Joshua Shapiro, chief economist at consulting firm MFR Inc., said another reason

the unemployment rate can keep climbing -- even after a recession is over -- is

because people tend to flock back to the labor market when they sense their job

prospects might be better. ''It takes (people) awhile to figure out, 'Hey,

there's jobs out there,''' Shapiro said.

In the 1980-1982 recession -- considered the worst since the Great Depression in

terms of unemployment -- the jobless rate rose as high as 10.8 percent in late

1982 just as the recession ended, before inching down.

Friday's report was worse than analysts had expected. They had been forecasting

a jobless rate of 6.3 percent with payrolls falling about 200,000.

Factories, including auto makers, construction companies, especially home

builders, retailers, mortgage bankers, securities firms, hotels and motels and

educational services, all cut jobs. As did temporary help firms -- a barometer

of future hiring. All those losses more than swamped the few gains elsewhere,

including in the government, health care and in accounting and bookkeeping.

Private companies cut 263,000 jobs, the most since the country was beginning to

emerge from the 2001 recession. It marked the 11th straight month of such

reductions.

The grim numbers spurred calls from Democrats on Capitol Hill to provide fresh

relief. House Speaker Nancy Pelosi said Democrats, in a lame-duck session later

this month, will push to enact another economic stimulus package of around $100

billion, possibly including provisions to create jobs through big public works

projects.

Obama said if the session doesn't bring passage, the measure will be his first

priority as president in January.

He has called for about $175 billion in new stimulus spending, including money

for roads, bridges and aid to hard-pressed states. He wants a rebate of $500 for

individuals, $1,000 for families and a new $3,000 tax credit for businesses for

each new job created.

Workers with jobs saw only modest wages gains in October. Average hourly

earnings rose to $18.21, a 0.2 percent increase from the previous month. Over

the past year, wages have grown 3.5 percent, but paychecks aren't stretching far

because high food, energy and other prices have propelled overall inflation at a

faster pace.

The economy has lost its footing in just a few months. It contracted at a 0.3

percent pace in the July-September quarter, signaling the onset of a likely

recession. It was the worst showing since the 2001 recession, and reflected a

massive pullback by consumers.

As consumers watch jobs disappear, they'll probably retrench even further,

spelling more trouble. Analysts say the economy is still shrinking in the

current October-December quarter and will contract further in the first quarter

of next year. All that more than fulfills a classic definition of a recession:

two straight quarters of contracting economic activity.

''The U.S. recession is deepening,'' said Michael Gregory, economist at BMO

Capital Markets Economics. The final quarter of this year is getting off to a

''particularly ugly'' start.

------

AP Economics Writer Christopher S. Rugaber

contributed to this report.

Jobless Ranks Hit 10

Million, Most in 25 Years, NYT, 8.11.2008,

http://www.nytimes.com/aponline/business/AP-Financial-Meltdown.html - broken

URL

Jobless Rate at 14-Year High

After Big October Losses

November 8, 2008

The New York Times

By PETER S. GOODMAN and MICHAEL M. GRYNBAUM

Squeezed by tight credit and plunging spending power, the

American economy is losing jobs at the fastest pace since 2001, and the losses

could accelerate to levels not seen since the deep recession of the early 1980s.

Employers shed 240,000 more jobs in October, the government reported Friday

morning, the 10th consecutive monthly decline and a clear signal that the

economic slowdown is troubling households and businesses.

Since August, the economy has lost 651,000 jobs — more than three times as many

as were lost from May to July. So far, 1.2 million jobs have been lost this

year.

“Clearly, these are very bad numbers,” said Nigel Gault, chief domestic

economist at IHS Global Insight. “Businesses had been paring back for most of

the year, but I suspect that it had been more caution on hiring rather than

firing,” Mr. Gault said. “In September, they decided, ‘O.K., look, this isn’t

just a mini-recession, this is a full-blown recession. We better take some

action.’ And they did.”

The unemployment rate climbed to 6.5 percent, the highest level since 1994 and

up from 6.1 percent the month before.

The Labor Department also steeply revised down its employment numbers for the

third quarter. Employers slashed 284,000 jobs in September, far higher than the

159,000 that was initially reported. In August, 127,000 jobs were lost, compared

with the previous estimate of 73,000.

“The U.S. consumer, which for so many years was the global engine of growth, is

now the world economy’s Achilles heel,” Joshua Shapiro, an economist at MFR, a

research firm, wrote in a note.

The latest signs of distress seemed certain to inject more urgency into the

debate over another round of government stimulus to spur spending, and is more

evidence that President-elect Barack Obama will inherit a deeply troubled

economy.

Mr. Obama has in recent months called for another package of so-called stimulus

spending initiatives. Democratic leaders in the House suggested this week that

they might seek swift passage of $60 billion worth of measures that would extend

unemployment benefits and food stamps, while aiding states whose tax revenues

have plummeted. They would then pursue a broader package that could reach $200

billion in spending once Mr. Obama takes office.

The Bush administration has criticized Democratic proposals for immediate aid,

raising the specter of a veto.

On Friday, a spokeswoman for President Bush, Dana Perino, called the employment

numbers “a stark reminder of how critical it is we keep focused on utilizing”

the programs that Washington has put in place, including a $700 billion bailout

of the financial system.

“We know what the main problems are — tight credit and housing markets — and we

have the tools to solve them,” Ms. Perino said. “The programs we’re putting in

place will improve the flow of credit to consumers and businesses that will spur

economic growth, job creation and stabilization of our financial markets.”

Above all, the latest monthly snapshot of the job market reinforced how the

economy remains gripped by a potent combination of troubles — plunging housing

prices, tight credit and shrinking paychecks — with all three operating at once

in a downward spiral.

Companies have been hiring tepidly and laying off workers throughout the year as

business has slowed, while cutting working hours for those on the payroll.

Millions of Americans accustomed to borrowing against homes to finance spending

have lost that artery of cash as home prices have fallen.

Wages have effectively shrunk for most workers, as rising costs for food and

fuel have more than absorbed meager increases in pay. That has further crimped

American proclivities to spend.

In October, weekly wages for rank-and-file workers — those not in supervisory or

managerial positions — grew just 2.9 percent from October 2007, well below the

rate of inflation.

The health care industry and public schools were the only sectors of the economy

that showed more than notional growth last month. Otherwise, the losses were

deep and broad. The troubles in the auto industry led to thousands of layoffs at

car dealerships and factories that produce car parts. Tens of thousands of

workers at manufacturers and construction companies lost their jobs.

Janitors, administrative workers and temporary employees were hit hard, with

57,000 jobs lost in October. Even general merchandise stores, which have seen an

increase in business because of lower prices and more budget-minded consumers,

laid off 18,000 workers last month.

The 284,000 jobs lost in September was the biggest monthly toll since November

2001, in the aftermath of the terrorist attacks in New York and Washington.

All of this has cut into spending power. Consumer spending dropped between July

and September — the first quarterly decline in 17 years — further eroding the

motivation for businesses to hire.

Friday’s report offered signs that the pressures on workers are rapidly

intensifying. Between January and August, the economy lost about 75,000 jobs a

month, according to preliminary numbers from the Bureau of Labor Statistics. The

pace has more than doubled since then.

Many economists now expect the unemployment rate to reach 8 percent by the

middle of next year, a level not seen in 25 years. Most forecasts envision the

economy shrinking well into the next year and perhaps until 2010.

Recent days have offered new indications of trouble. On Thursday, several

retailers announced sharp declines in sales in October, suggesting that consumer

spending would continue to tighten. The annual pace of auto sales fell sharply

in October, down 15 percent compared with September, according to an analysis

from Goldman Sachs.

The widely watched Institute for Supply Management survey fell in October to

depths last seen 26 years ago, reflecting shrinking industrial activity and

suggesting weakening demand for goods as the economy slows.

That weakness has gone global, as many other major economies also are hit by the

slowdown — from Spain and Britain to Japan and Brazil — and as the financial

crisis now restricts economic activity in much of the world.

At the same time, banks continued to tighten their purse strings in October,

according to a survey of senior loan officers conducted by the Federal Reserve.

Economists construed the survey as an indication that even healthy companies and

many households were having difficulty securing capital, further braking the

economy and making prospects more difficult for American workers.

Many economists expect this picture to worsen as the consequences of the global

financial crisis ripple out to businesses and households. Though the $700

billion taxpayer-financed bailout has staved off fears of an imminent collapse

and restored some order to the financial system, it has not persuaded banks to

lend freely. Credit remains tight for businesses and homeowners.

Jobless Rate at

14-Year High After Big October Losses, NYT, 8.11.2008,

http://www.nytimes.com/2008/11/08/business/economy/08econ.html

Longer-Term Jobless Benefits

Hit 25-Year High

November 6, 2008

Filed at 1:12 p.m. ET

The New York Times

By THE ASSOCIATED PRESS

WASHINGTON (AP) -- The number of out-of-work Americans

continuing to draw unemployment benefits has surged to a 25-year high, while

shoppers turned extra frugal, further proof of the damage from sinking economy,

credit problems and financial stresses.

The Labor Department reported Thursday that the number of people continuing to

draw unemployment benefits jumped by 122,000 to 3.84 million in late October. It

was the highest level since late February 1983, when the country was struggling

to recover from a long and painful recession.

New filings for jobless benefits last week dipped to 481,000, a still-elevated

level that suggests companies are in a cost-cutting mode.

The work force was much smaller in February 1983, when the number of people

continuing to claim benefits was 3.88 million.

At that time, about 87.2 million Americans were in the work force, compared to

almost 134 million today. That's one reason the unemployment rate was 10.4

percent in February 1983, compared to 6.1 percent last month.

Still, the increase in people continuing to draw unemployment benefits is an

indication that laid-off workers are having a harder time finding new jobs.

Democrats in Congress are pushing to include an extension of unemployment

benefits in a new stimulus package, which could be taken up this month. Benefits

typically last 26 weeks.

Congress approved a 13-week extension of benefits in June, and the department

said about 773,000 additional people claimed benefits through that program for

the week ending Oct. 18, the most recent data available. That extension is

scheduled to end next June.

Americans hit by layoffs, shrinking nest eggs and other stresses are pulling

back even more, sending sales at many big retailers down in what may have been

the weakest October in decades. That further darkened the outlook for the

holiday sales season.

Target Corp. and Costco were among the many retailers reporting sales declines

last month. Wal-Mart Stores Inc., the world's largest retailer, however, logged

a sales gain.

On Wall Street, stocks slumped. The Dow Jones industrials were down about 350

points in afternoon trading.

Hoping to prevent a deep recession, the Federal Reserve last week ratcheted down

interest rates last week to 1 percent and left the door open to further

reductions.

The country's economic state has rapidly deteriorated in just a few months. The

economy contracted at a 0.3 percent pace in the July-September quarter,

signaling the onset of a likely recession. It was the worst showing since the

last recession, in 2001, and reflected a massive pull back by consumers.

With the economy sinking and consumers appetites flagging, employers have been

slashing jobs. They are expected to cut around 200,000 jobs when the government

releases the October employment report on Friday. The unemployment rate -- now

at 6.1 percent -- is expected to climb to 6.3 percent in October.

As American consumers watch jobs disappear and their wealth shrink, they'll

probably retrench even further.

That's why analysts predict the economy is still shrinking in the current

October-December quarter and will continue to contract during the first quarter

of next year. All that more than fulfills a classic definition of a recession:

two straight quarters of contracting economic activity.

Yet another report out Thursday showed the efficiency of U.S. workers slowed

sharply in the summer as overall production, or output, declined, reflecting the

hit to consumers from housing, credit and financial troubles.

Productivity -- the amount an employee produces for every hour on the job --

grew at an annual pace of 1.1 percent in the July-September quarter, down from a

3.6 percent growth rate in the second quarter, the Labor Department reported.

With productivity growth slowing, labor costs picked up. Unit labor costs -- a

measure of how much companies pay workers for every unit of output they

produce-- increased at a 3.6 percent pace in the third quarter, compared with a

0.1 percent rate of decline in the prior period.

The 1.1 percent productivity growth logged in the summer beat economists'

expectations for a 0.8 percent growth rate. The pickup in labor costs-- while

welcome to workers -- was faster than the 2.8 percent pace economists were

forecasting.

Economists often look at labor compensation for clues about inflation. These

days, however, the Federal Reserve and analysts are more concerned about the

economy's feeble state. While the pick up in labor costs might raise some

economists' eyebrows, the Fed is predicting inflation pressures will lessen as

the economy loses traction.

The 1.1 percent productivity gain was the smallest since the final quarter of

last year, while the increase in labor costs was the biggest since that time.

Longer-Term Jobless Benefits Hit 25-Year

High, NYT, 6.11.2008,

http://www.nytimes.com/aponline/washington/AP-Economy.html - broken URL

159,000

Jobs Lost in September,

the Worst Month in Five Years

October 4,

2008

The New York Times

By PETER S. GOODMAN

The

American economy lost 159,000 jobs in September, the worst month of retrenchment

in five years, the government reported on Friday, amplifying fears that an

already painful downturn had entered a more severe stage that could persist well

into next year.

Employment has diminished for nine consecutive months, eliminating 760,000 jobs,

according to the Labor Department’s report. And that does not count the

traumatic events of recent weeks, as a string of Wall Street institutions

collapsed, prompting the $700 billion emergency rescue package approved by

Congress on Friday.

“It’s a dismal report, and the worst thing about it is that it does not reflect

the recent seizure that we’ve seen in the credit markets,” said Michael T.

Darda, chief economist at MKM Partners, a research and trading firm in

Greenwich, Conn. “There’s really nothing good about this report at all. We’ve

lost jobs in nearly every area of the economy, and this is going to get worse

before it gets better because the credit markets have deteriorated basically on

a daily basis for the last few weeks.”

Though the bailout may restore order to the financial system and eventually

filter through the economy by making it easier for businesses to secure capital,

few analysts expect it to swiftly reverse the nation’s fortunes. Housing prices

continue to fall, eroding household wealth just as millions suffer the weight of

unmanageable debt. The deteriorating job market has taken paychecks out of the

economy, reinforcing a predilection for thrift that has cut sales from car

showrooms to hair salons.

Banks should see their balance sheets improve as the government relieves them of

disastrous investments, yet they may remain skittish and reluctant to lend.

“At best, the bailout stops a much deeper decline in activity,” Mr. Darda said,

“but it’s not like they’re going to do this and all of the sudden the clouds

part and the skies are clear.”

Only a few weeks ago, many economists still held hopes that the economy might

recover late this year or early next. But with the job market now contracting

faster, and fear dogging the financial system, the broad assumption has taken

hold that 2008 is a lost cause.

Most economists have concluded that the economy will struggle well into next

year. More pessimistic forecasts envision the economy remaining weak through

most or all of next year.

“This is an economy in recession, and every dimension of the report confirms

that,” said Ethan S. Harris, an economist at Barclays Capital. “This has been

preceded by a slow-motion recession. Now we’re going into the full-speed

recession that will last somewhere between three and five quarters.”

For the first eight months of the year, the economy lost an average of 75,000

jobs each month. September’s report more than doubled the pace.

“A lot of companies came to the realization that there was no momentum in the

economy to pick them up in the second half of 2008,” said Steve Drexel, chief

executive of Corestaff Services, a staffing company in Houston. “They had been

hanging on to people and hoping things would improve, but now a lot companies

are just sort of retrenching.”

The unemployment rate remained steady at 6.1 percent in September, but

economists said that reflected how people who had given up looking for work were

not counted. Over the last year, the unemployment rolls have swelled by 2.2

million, to 9.5 million. On Friday, Goldman Sachs forecast that the jobless rate

would reach 8 percent by the end of next year, which would be the highest in 25

years.

In Charlotte, Mich., Sean Schwartz, 26, has been out of a job for nearly two

months since his last stint as a construction worker. His $750-a-week paycheck

has been replaced by a $620.10 unemployment check every other week.

Mr. Schwartz and his wife — who works at Wal-Mart — have a 2-year-old daughter

and are expecting a baby in December. His job search has turned up little beyond

fast-food jobs at a fraction of his previous earnings. Mr. Schwartz is becoming

anxious.

“We’re not getting the bills paid,” he said, estimating that his family is

behind $5,000 on medical bills for his daughter and his wife’s prenatal care.

“It’s rough. There’s nothing really out there.”

As the impact of Wall Street’s distress ripples out, economists expect

opportunities to grow leaner still. On Friday morning, banks needing to borrow

from other banks were paying nearly 4 percent more in interest than the Treasury

offers on savings bonds — a spread reflecting a general unwillingness to part

with cash. That spread was wider than after the 1987 stock market crash.

“It sets us up for some really grim news in the immediate future,” said Robert

Barbera, chief economist at the research and trading firm ITG. “Credit was

already hard to get in early September. But it’s really impossible to get now.”

The report amounted to a catalog of woes afflicting Americans who depend on

paychecks.

Manufacturing lost 51,000 jobs in September, bringing the decline so far this

year to 442,000. Retailers lost 35,000 jobs, and construction shed 35,000.

Employment in transportation and warehousing slid by 16,000.

Jobs in financial services dropped by 17,000, and have slipped by 172,000 since

employment peaked in that part of the economy in December 2006. Health care

remained a bright spot, adding 17,000 jobs in September. Mining added 8,000

jobs.

Government payrolls grew by 9,000 jobs — a trend with a limited shelf life as

the economic slowdown shrinks tax revenue.

Doug Fleming has been out of work since last fall, when he lost his job as a

quality inspector for a home builder in Anderson, Ind. Nearly 800 résumés later,

he has received no offers. “Maybe it’s my age,” said Mr. Fleming, 41.

His wife has emphysema but has visited the doctor only once in the last year

because his family lacks health insurance, he said. His daughter, 15, was hoping

to talk her way into her high school’s homecoming football game on Friday

evening, unable to afford a ticket.

Unemployment rose to 11.4 percent among African-Americans in September, and to

19.1 percent among teenagers.

More than 21 percent of those receiving unemployment checks have been without

work for more than six months, up from 17.6 percent a year ago, the report said.

In the suburbs of Richmond, Va., Ginny Hoover, a single mother, has been out of

a job since November, when she lost her clerical position at a pharmaceutical

company. Her $500-a-week take-home pay became a $285-a-week unemployment check.

Barring an extension of those benefits by Congress — something blessed by the

House of Representatives on Friday — Ms. Hoover, 48, received her last check

this week.

“I’ve completely exhausted my savings, which was supposed to be a down payment

for a house,” she said.

Initially, Ms. Hoover sought another office position. “Now, I’ll apply for

anything that has a paycheck attached to it,” she said. Her current focus: a job

selling cellphone service at a kiosk at a Costco store for $7 an hour — less

than half of what she earned in her last position. “It won’t even cover my

rent,” she said.

The number of Americans working part time because their hours were cut or they

could not find a full-time job increased by 337,000 in September, to 6.1 million

— a jump of 1.6 million over the last year, and the highest number since 1993.

Average weekly wages for some 80 percent of the American work force have risen

by a meager 2.8 percent over the last year, with the gains more than reversed by

increases in the prices of food and fuel.

“This economy is just not creating near enough economic activity to generate

wage or income growth,” said Jared Bernstein, senior economist at the

labor-oriented Economic Policy Institute in Washington. “That has serious living

standards implications.”

159,000 Jobs Lost in September, the Worst Month in Five

Years,

NYT,

4.10.2008,

http://www.nytimes.com/2008/10/04/business/economy/04jobs.html

Related > Anglonautes >

Vocapedia

economy, money, taxes,

housing market, shopping,

jobs, unemployment,

unions, retirement,

debt,

poverty, hunger,

homelessness

industry, energy, commodities

feelings

> feeling down

health > viruses > Coronaviruses > SARS-CoV-2 virus

COVID-19 disease / pandemic > late 2019-2020

|