|

Vocapedia >

Economy > Taxes

Rob Rogers

political cartoon

The Pittsburgh Post-Gazette

Pennsylvania

Cagle

24 June 2011

John A. Boehner, an Ohio Republican,

became Speaker of the House of

Representatives

in January 2011.

Related > NYT > John Boehner

https://www.nytimes.com/topic/person/john-boehner

Christopher Weyant

cartoon

Chris Weyant draws political cartoons for

The Hill,

and is also a cartoonist for The New Yorker.

Cagle

23 May 2012

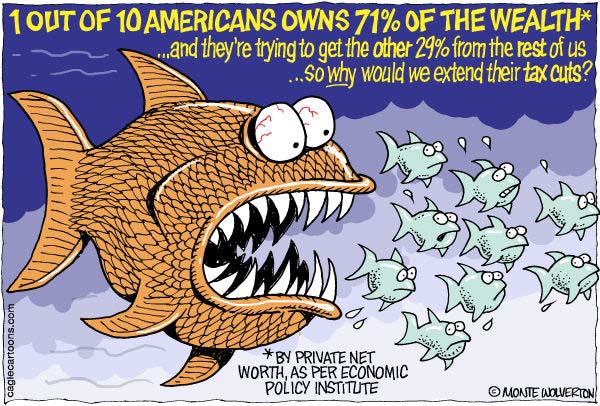

Monte Wolverton

cartoon

The Wolvertoon

Cagle

22 November 2010

Related

http://www.nytimes.com/2010/12/18/us/politics/18obama.html

http://www.nytimes.com/2010/12/08/opinion/08wed1.html

R.J. Matson

cartoon

The St. Louis Post-Dispatch and Roll Call

NY

Cagle

7 December 2010

Related

http://www.nytimes.com/2010/12/18/us/politics/18obama.html

http://www.nytimes.com/2010/12/08/opinion/08wed1.html

Dave Granlund

cartoon

Massachusetts

Cagle

7 December 2010

Related

http://www.nytimes.com/2010/12/18/us/politics/18obama.html

http://www.nytimes.com/2010/12/08/opinion/08wed1.html

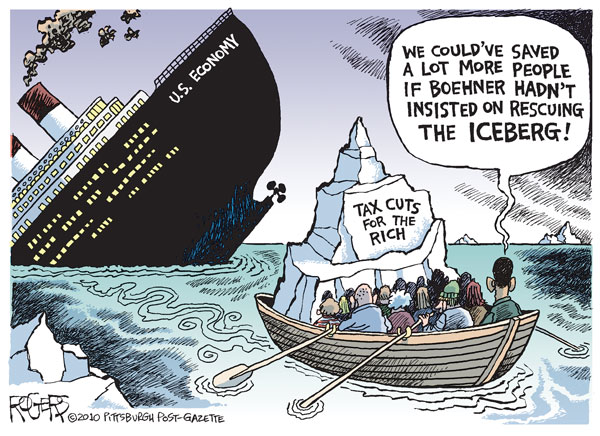

Rob Rogers

cartoon

The Pittsburgh Post-Gazette

Pennsylvania

Cagle

7 December 2010

Related

http://www.nytimes.com/2010/12/18/us/politics/18obama.html

http://www.nytimes.com/2010/12/08/opinion/08wed1.html

J.D. Crowe

cartoon

The Mobile Register

Alabama

Cagle

13 April 2010

Adam Zyglis

cartoon

The Buffalo News

Buffalo, NY

Cagle

27 November 2008

tax

UK

https://www.theguardian.com/money/2017/may/27/

tax-britons-pay-europe-australia-us

tax

USA

https://www.nytimes.com/2019/05/03/

sunday-review/tax-rich-irs.html

tax

UK

https://www.theguardian.com/money/tax

https://www.theguardian.com/commentisfree/2019/feb/02/

forget-philanthropy-super-rich-should-be-paying-proper-taxes

https://www.theguardian.com/money/2017/may/27/

tax-britons-pay-europe-australia-us

tax and spending

UK

https://www.theguardian.com/politics/taxandspending

tax USA

https://www.npr.org/2021/10/08/

1044417794/over-130-countries-clinch-a-deal-that-could-radically-reshape-how-companies-are-

https://www.propublica.org/article/

you-may-be-paying-a-higher-tax-rate-than-a-billionaire - June 8, 2021

https://www.nytimes.com/2021/04/22/

business/economy/biden-taxes.html

https://www.npr.org/2020/10/08/

919497813/hes-part-of-the-1-and-he-thinks-his-taxes-aren-t-high-enough

https://www.nytimes.com/2020/04/21/

opinion/coronavirus-wealth-tax.html

https://www.npr.org/sections/ed/2017/12/07/

568590188/what-a-tax-overhaul-could-mean-for-students-and-schools

https://www.nytimes.com/2017/12/02/

opinion/editorials/a-historic-tax-heist.html

https://www.npr.org/2017/11/02/

561639579/chart-how-the-tax-overhaul-would-affect-you

https://www.npr.org/2017/12/02/

567882076/fact-check-how-does-paul-ryans-case-for-tax-cuts-match-the-facts

https://www.npr.org/2017/12/01/

567758536/mcconnell-says-gop-has-enough-votes-to-pass-tax-bill-friday

http://www.npr.org/2017/04/18/

524569221/what-trumps-taxes-would-not-show-about-his-finances

http://www.npr.org/2017/04/17/

523960808/we-asked-people-what-they-know-about-taxes-see-if-you-know-the-answers

http://www.npr.org/2016/11/21/

502918106/president-elect-trump-proposes-to-slash-taxes-on-businesses

http://www.npr.org/2016/11/13/

501739277/who-benefits-from-donald-trumps-tax-plan

http://www.nytimes.com/2016/10/18/

opinion/the-big-companies-that-avoid-taxes.html

http://www.npr.org/2016/05/13/

477930933/reality-check-what-donald-trump-has-said-about-taxes-and-the-wealthy

http://www.npr.org/2016/02/12/

466465333/sanders-favors-a-speculation-tax-on-big-wall-street-firms-what-is-that

http://www.nytimes.com/2015/12/30/

business/economy/for-the-wealthiest-private-tax-system-

saves-them-billions.html

http://www.nytimes.com/indexes/2014/02/09/

business/yourtaxes/index.html

http://www.nytimes.com/2013/02/22/

opinion/why-taxes-have-to-go-up.html

tax USA

https://www.propublica.org/article/

you-may-be-paying-a-higher-tax-rate-than-a-billionaire - June 8, 2021

wealth tax USA

https://www.npr.org/2021/11/13/

1054711913/progressives-wealth-tax-super-rich-elon-musk-jeff-bezos

https://www.nytimes.com/2020/04/21/

opinion/coronavirus-wealth-tax.html

tax

increase USA

https://www.nytimes.com/2021/04/22/

business/economy/biden-taxes.html

slash taxes

USA

http://www.npr.org/2016/11/21/

502918106/president-elect-trump-proposes-to-slash-taxes-on-businesses

claim taxes from

online sales USA

http://www.npr.org/sections/alltechconsidered/2017/06/02/

531222247/massachusetts-tries-something-new-to-claim-taxes-from-online-sales

tax plan

USA

http://www.npr.org/2016/11/13/

501739277/who-benefits-from-donald-trumps-tax-plan

America’s Top 15 Earners

and What

They Reveal About the U.S. Tax System

USA

https://www.propublica.org/article/

americas-top-15-earners-and-what-they-reveal-about-the-us-tax-system - April

13, 2022

A Tax System Stacked Against the 99 Percent

USA 2013

http://opinionator.blogs.nytimes.com/2013/04/14/

a-tax-system-stacked-against-the-99-percent/

tax reform USA

http://www.nytimes.com/2012/12/30/

opinion/sunday/why-the-economy-needs-tax-reform.html

federal taxes

USA

http://www.nytimes.com/topic/subject/federal-taxes-us

http://www.npr.org/sections/thetwo-way/2017/03/14/

520205373/trump-paid-about-38-million-in-federal-taxes-in-2005-leaked-returns-say

tax

USA

http://www.nytimes.com/2012/11/19/

opinion/to-reduce-inequality-tax-wealth-not-income.html

http://www.nytimes.com/2011/11/28/

opinion/krugman-things-to-tax.html

taxation

USA

http://www.nytimes.com/2015/01/18/

opinion/sunday/irs-already-hobbled-likely-to-be-further-damaged.html

the wealthy

USA

http://www.npr.org/2016/05/13/

477930933/reality-check-what-donald-trump-has-said-about-taxes-and-the-wealthy

raise taxes on the

wealthy USA

http://www.npr.org/2016/01/13/

462944798/hillary-clinton-s-new-tax-proposal-likely-wont-affect-you

http://www.nytimes.com/2015/01/18/us/

president-obama-will-seek-to-reduce-taxes-for-middle-class.html

http://www.nytimes.com/2013/01/01/us/

politics/tentative-deal-is-reached-to-raise-taxes-on-the-wealthy.html

Taxing the Rich, New York Style

USA December 2011

http://www.nytimes.com/roomfordebate/2011/12/08/

cuomos-tax-deal-who-benefits-the-most/

Do taxes narrow the wealth gap?

USA September 2011

http://www.nytimes.com/roomfordebate/2011/09/19/

do-taxes-narrow-the-wealth-gap

cartoons > Cagle > Tired of taxes

USA 2011

http://www.cagle.com/news/Taxes2011/main.asp

taxman UK

http://www.independent.co.uk/news/uk/politics/

revealed-taxman-is-16322bn-out-of-pocket-1754390.html

tax receipts UK

http://www.independent.co.uk/news/uk/politics/

revealed-taxman-is-16322bn-out-of-pocket-1754390.html

tax laws USA

https://www.npr.org/2017/12/27/

573556101/taxpayers-may-feel-a-bite-from-a-new-way-of-tracking-inflation

income tax UK

http://www.theguardian.com/politics/2007/mar/22/

economy.budget2007

https://www.theguardian.com/business/2007/mar/22/

budget2007.money2

federal income tax

USA

https://www.npr.org/2020/10/02/

919175046/how-can-president-trump-pay-less-tax-than-you

tax cut UK

https://www.theguardian.com/politics/2007/mar/21/

economy.uk

tax cut USA

https://www.nytimes.com/2017/12/22/

us/politics/trump-tax-bill.html

https://www.npr.org/2017/12/20/

572157392/gop-poised-for-tax-victory-after-a-brief-delay

https://www.npr.org/2017/12/20/

572157392/gop-poised-for-tax-victory-after-a-brief-delay

https://apps.npr.org/documents/

document.html?id=4333499-Final-Version-of-GOP-Tax-Bill

https://www.npr.org/2017/12/19/

571754894/charts-see-how-much-of-gop-tax-cuts-will-go-to-the-middle-class

https://www.npr.org/2017/12/04/

568392909/is-this-the-right-time-for-a-big-tax-cut

https://www.npr.org/2017/12/02/

567882076/fact-check-how-does-paul-ryans-case-for-tax-cuts-match-the-facts

http://www.gocomics.com/phil-hands/2017/03/17

https://www.nytimes.com/2017/02/09/

business/economy/mnuchin-rule-tax-cut.html

http://www.nytimes.com/2016/12/06/

opinion/team-trumps-new-pledge-on-tax-cuts.html

tax return UK

http://www.guardian.co.uk/money/2013/jan/12/

filling-in-tax-return-common-mistakes

tax return USA

https://www.propublica.org/article/

why-do-people-want-to-see-donald-trumps-tax-returns - July 1, 2020

https://www.nytimes.com/2020/05/13/

opinion/supreme-court-trump-tax-returns.html

http://www.npr.org/2017/10/18/

558623341/emoluments-hearing-hints-at-what-may-be-at-stake-trumps-tax-returns

http://www.npr.org/2017/04/18/

524561638/simple-beats-nuance-which-is-part-of-why-trumps-not-releasing-those-tax-returns

http://www.npr.org/2017/04/15/

524122918/protesters-use-april-15-to-demand-trumps-tax-returns

http://www.npr.org/sections/thetwo-way/2017/03/14/

520205373/trump-paid-about-38-million-in-federal-taxes-in-2005-leaked-returns-say

https://www.nytimes.com/2017/01/24/

opinion/we-the-people-demand-mr-trump-release-his-tax-returns.html

http://www.nytimes.com/2016/12/12/

opinion/an-antidote-to-donald-trumps-secrecy-on-taxes.html

http://www.nytimes.com/2008/04/19/us/

politics/19taxes.html

tax filings USA

http://www.npr.org/2017/04/17/

523634144/tax-filings-seen-dipping-amid-trump-crackdown-on-illegal-immigration

tax cut USA

http://www.nytimes.com/2010/12/08/

opinion/08wed1.html

http://www.nytimes.com/2008/01/23/

opinion/23burman.html

cartoons > Cagle > Tax cuts

December 2010

http://www.cagle.com/news/TaxCuts10/main.asp

Nick Anderson

political cartoon

GoComics

December 02, 2016

http://www.gocomics.com/nickanderson/2016/12/02

Main character: President-elect Donald Trump

tax break UK

http://www.guardian.co.uk/politics/2013/jul/19/

george-osborne-tax-break-fracking-shale-environment

tax break / corporate tax break

USA

http://www.npr.org/2017/05/18/

528998663/as-trump-built-his-real-estate-empire-tax-breaks-played-a-pivotal-role

http://www.gocomics.com/nickanderson/2016/12/02

http://www.nytimes.com/2016/09/18/nyregion/

donald-trump-tax-breaks-real-estate.html

http://www.nytimes.com/2015/11/23/

opinion/giving-billions-to-the-rich.html

http://www.nytimes.com/2014/06/12/

business/international/eu-to-investigate-countries-business-tax-breaks.html

http://opinionator.blogs.nytimes.com/2013/05/22/

kill-bill/

http://www.nytimes.com/2010/05/29/

business/29carried.html

http://www.nytimes.com/2005/05/08/

business/08taxes.html

tax giveaway

fiscal stimulus UK

http://www.guardian.co.uk/politics/2012/jun/14/

mansion-house-speech-george-osborne

corporate taxes USA

http://www.npr.org/2017/08/07/

541797699/fact-check-does-the-u-s-have-the-highest-corporate-tax-rate-in-the-world

http://www.nytimes.com/2012/02/23/

opinion/reform-and-corporate-taxes.html

The Trouble With Corporate Taxes

USA February 2011

http://www.nytimes.com/2012/02/23/

business/economy/obama-introduces-plan-to-cut-corporate-tax-rate.html

http://www.nytimes.com/roomfordebate/2011/02/01/

the-trouble-with-corporate-taxes

Apple Owes Ireland $14.5 Billion In Taxes,

European Commission Says

NPR August 30, 2016

http://www.npr.org/sections/thetwo-way/2016/08/30/

491913544/apple-owes-ireland-14-5-billion-in-taxes-european-commission-says

How Apple Sidesteps Billions in Taxes

USA 2012-2013

http://www.nytimes.com/2013/05/23/

opinion/nocera-here-comes-the-sun.html

http://www.nytimes.com/2013/05/23/

business/torches-and-pitchforks-for-irs-but-cheers-for-apple.html

http://www.nytimes.com/2013/05/23/

business/torches-and-pitchforks-for-irs-but-cheers-for-apple.html

http://www.npr.org/templates/story/story.php?storyId=185839228 - May 21,

2013

http://www.npr.org/2013/05/21/

185688463/ceo-cook-to-defend-apple-before-senate-committee-hearing

http://www.nytimes.com/2013/05/03/

business/how-apple-and-other-corporations-move-profit-to-avoid-taxes.html

http://www.nytimes.com/2012/04/29/

business/apples-tax-strategy-aims-at-low-tax-states-and-nations.html

council tax

stealth tax

tax return

tax shelter USA

http://www.nytimes.com/2009/06/10/

business/10tax.html

tax hike USA

http://www.npr.org/sections/health-shots/2016/09/27/

495439481/would-californias-proposed-tobacco-tax-hike-reduce-smoking

http://www.reuters.com/article/2011/05/09/us-

taxes-us-idUSTRE7485N020110509

USA >

Internal Revenue Service IRS USA

https://www.irs.gov/

https://www.nytimes.com/topic/organization/internal-revenue-service

https://www.propublica.org/article/

family-research-council-irs-church-status - July 11, 2022

https://www.propublica.org/article/

the-secret-irs-files-trove-of-never-before-seen-records-reveal-

how-the-wealthiest-avoid-income-tax - June 8, 2021

https://www.propublica.org/article/

whos-afraid-of-the-irs-not-facebook - Jan. 23, 2020

https://www.nytimes.com/2019/05/03/

sunday-review/tax-rich-irs.html

http://www.npr.org/2017/10/05/

555975207/as-irs-targeted-tea-party-groups-it-went-after-progressives-too

http://www.nytimes.com/2016/04/29/

opinion/dark-money-and-an-irs-blindfold.html

http://www.nytimes.com/2015/01/18/

opinion/sunday/irs-already-hobbled-likely-to-be-further-damaged.html

http://www.nytimes.com/2014/02/26/

opinion/edsall-why-the-irs-scandal-wont-go-away.html

http://www.nytimes.com/2014/02/19/

opinion/change-the-rules-on-secret-money.html

http://www.nytimes.com/2013/05/23/

business/torches-and-pitchforks-for-irs-but-cheers-for-apple.html

http://www.nytimes.com/2013/04/04/

opinion/lean-in-what-about-child-care.html

cartoons > Cagle > Irritating IRS

USA 2011

http://www.cagle.com/news/IRS2011/main.asp

church status USA

church status (...)

allows organizations to shield themselves

from financial scrutiny.

https://www.propublica.org/article/

family-research-council-irs-church-status - July 11, 2022

taxpayer

UK

http://www.guardian.co.uk/business/2009/jan/25/

credit-crunch-recession

http://www.guardian.co.uk/business/2008/oct/12/

banking-economy

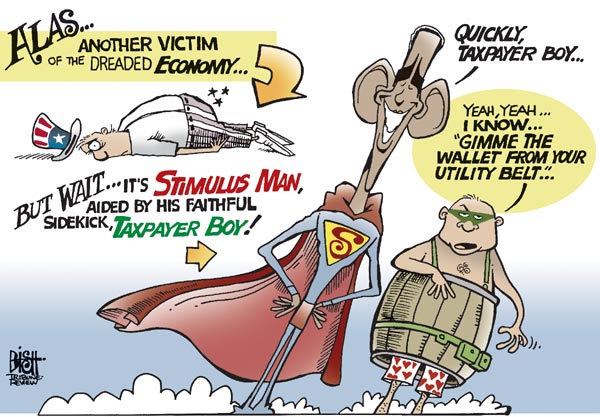

Randy Bish

political cartoon

The Tribune-Review

Pittsburgh, PA

Cagle

9 February 2009

M : U.S. president Barack Obama

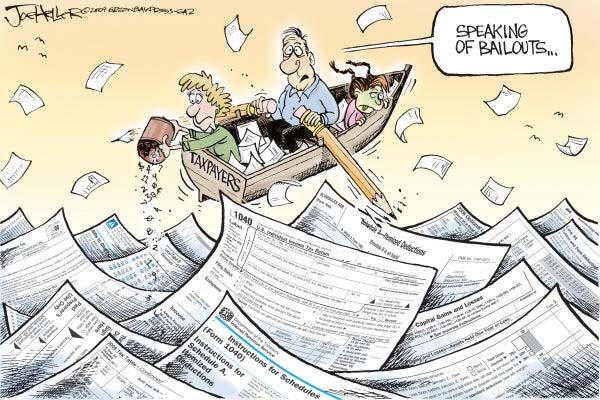

Joe Heller

political cartoon

Wisconsin

The Green Bay Press-Gazette

Cagle

31 March 2011

Freshly Squeezed

by Ed Stein

GoComics

April 13, 2014

taxpayer

USA

https://www.gocomics.com/clayjones/2016/12/04

taxpayer > W-2 form USA

https://www.propublica.org/article/

if-youre-getting-a-w-2-youre-a-sucker - April 15, 2022

at taxpayers' expense

tax > cartoons > Cagle > Terrible 1040

USA 2011

http://www.cagle.com/news/Terrible1040/main.asp

tax burden

tax loophole UK

http://www.guardian.co.uk/media/2012/nov/19/

sky-magazine-tax-loophole

tax loophole USA

https://www.npr.org/sections/ed/2017/12/28/

572587727/this-tax-loophole-for-wealthy-donors-just-got-bigger

http://www.nytimes.com/interactive/2016/

us/politics/trump-taxes-loophole.html

http://www.nytimes.com/2016/08/27/

opinion/close-my-tax-loophole.html

close tax loopholes

tax-free UK

http://www.theguardian.com/money/2007/mar/21/

budget2007.budget4

VAT UK

http://www.guardian.co.uk/business/2011/feb/15/

inflation-hit-four-per-cent-in-january

http://www.guardian.co.uk/politics/2011/jan/04/

george-osborne-vat-rise-least-damaging

http://www.independent.co.uk/news/uk/politics/

vat-up-to-20-as-osborne-piles-on-the-pain-2007269.html

VAT rise UK

http://www.guardian.co.uk/politics/2010/jun/27/

liberal-democrat-mps-vat-poor

http://www.guardian.co.uk/commentisfree/cartoon/2010/jun/27/

martin-rowson-coalition-budget-cuts

http://www.guardian.co.uk/uk/2010/jun/22/

budget-2010-vat-rise-osborne

VAT hike UK

http://www.guardian.co.uk/commentisfree/2010/jul/13/

george-osborne-hold-hike-double-dip

cut / slash

VAT UK

http://www.independent.co.uk/news/uk/politics/

brown-and-darling-slash-vat-in-16318bn-tax-gamble-1031213.html

http://www.guardian.co.uk/politics/2008/nov/23/

economy-taxandspending

VAT fraud UK

http://www.theguardian.com/business/2006/aug/14/

crime.politics

VAT villains UK

http://www.theguardian.com/business/2006/aug/14/

crime.politics

VAT fraudsters UK

https://www.theguardian.com/business/2006/jul/11/1

Her Majesty Revenue & Customs HMRC

UK

https://www.gov.uk/government/organisations/

hm-revenue-customs

https://www.theguardian.com/politics/hmrc

http://www.theguardian.com/business/2013/aug/09/

one-top-30-tax-evaders-caught

Mikhaela Reid

cartoon

Cagle

5 February 2009

Corpus of news articles

Economy > Taxes

Why the Economy

Needs Tax Reform

December 29, 2012

The New York Times

Over the next four years, tax reform, done right, could be a

cure for much of what ails the economy. Higher taxes, raised progressively,

could encourage growth by helping to pay for long-neglected public investment in

education, infrastructure and basic research. More revenue would also reduce

budget deficits, helping to put the nation’s finances on a stable path. Greater

progressivity would reduce rising income inequality, and with it, inequality of

opportunity that is both an economic and social scourge.

The big obstacle to comprehensive tax reform is the persistent Republican myth

that spending cuts alone can achieve economic and budget goals. That notion was

sounded rejected by voters during the election. Yet it still has adherents among

many Republicans, which will make it that much harder for Congress to grapple

with the bigger and more complex issue at the heart of tax reform: how to pay

for government in the 21st century.

The main problem is that the current tax code is incapable of raising the

revenue needed to pay for the goods and services of government. Over the last

four years, federal revenue as a share of the economy has fallen to its lowest

level in nearly 60 years, a result of the recession, the weak recovery and a

decade’s worth of serial tax cuts. Even with deep spending cuts, the chronic

revenue shortfall is expected to continue, swelling the federal debt — unless

taxes go up. To stabilize the debt over the next 10 years while financing more

investment would require at least $1.5 trillion to $2 trillion in new revenue,

above what could be raised by letting the top income tax rate revert to its

pre-Bush-era level of 39.6 percent.

A logical way to help raise the additional needed revenue would be to tax

capital gains at the same rates as ordinary income. Capital gains on assets held

for more than a year before selling are taxed at about the lowest rate in the

code, currently 15 percent and expected to rise to 20 percent in 2013. That is

an indefensible giveaway to the richest Americans. Research shows that the tax

breaks do not add to economic growth but do contribute to inequality. Currently,

the top 1 percent of taxpayers receive more than 70 percent of all capital

gains, while the bottom 80 percent receive only 6 percent.

Another sensible approach is to cap deductions at 28 percent, or to convert

deductions, which disproportionately benefit high-bracket taxpayers, to tax

credits, which would provide the same benefit to all taxpayers, regardless of

tax bracket. President Obama must also pursue other revenue raisers, including a

restoration of the estate tax, higher tax rates or surcharges on

multimillion-dollar incomes, and higher corporate taxes, including an end to the

deferral of tax for American companies that stash their earnings abroad.

All that would only be a start, because the new revenue would only slow the

growth of the debt in the near term. After 10 years, the pressures of an aging

population and health care costs would cause the debt to accelerate again.

With that in mind, Mr. Obama would be wise to instruct the Treasury Department

to start work on tax reform now, exploring carbon taxes, both to raise revenue

and to protect the environment; a value-added tax, coupled with provisions to

protect lower-income taxpayers from higher prices, to tax consumption and

encourage saving; and a financial transactions tax, to ensure that the financial

sector, whose profits have substantially outpaced those of nonfinancial

corporations, pay a fair share.

Not all of the proposed new taxes would gain support, but all deserve to be part

of the debate. Controlling the terms of that debate, and then advancing from

debate to action, could well be the toughest challenge of Mr. Obama’s second

term and, if met, his defining economic legacy.

Why the Economy Needs Tax Reform,

NYT,

29.12.2012,

http://www.nytimes.com/2012/12/30/

opinion/sunday/why-the-economy-needs-tax-reform.html

Race to the Bottom

December 5, 2012

The New York Times

Competition among states and cities to lure businesses in hopes of creating jobs

is not new, but it has become more fierce in recent years. An investigation by

The Times found that state and local governments are giving out $80 billion a

year in tax breaks and other subsidies in a foolhardy, shortsighted race to

attract companies. That money could go a long way to improving education,

transportation and other public services that would have a far better shot at

promoting real economic growth.

Instead, with these giveaways, politicians and officials are trying to pick

winners and losers, almost exclusively to the benefit of big corporations (aided

by highly paid lobbyists) at the expense of small businesses. Though they

promise that the subsidies are smart investments, far too often the jobs either

don’t materialize or are short-lived, leaving the communities no better off.

The three-part series by Louise Story described how in places like Texas and

Ohio, state and local governments have lavished millions of dollars in tax

breaks on corporate giants like Samsung and the Big Three automakers — even as

they faced budget deficits and were forced to cut spending on critical services.

The tax revenues forgone in this giveaway frenzy should concern Congress deeply.

After all, federal funds account for one-fifth of state and local budgets.

In one particularly egregious example in Pontiac, Mich., the State of Michigan

gave $14 million in tax credits and a state pension fund guaranteed $18 million

in bonds to a movie studio that created just 12 permanent jobs. In Texas,

Amazon.com, the online retailer, received tax abatements, sales tax exemptions

and other benefits totaling $277 million to open a warehouse that promises to

employ 2,500 people. Those benefits were granted after the retailer closed

another warehouse because of a dispute with the government involving sales

taxes.

Many governments don’t know the full value of the subsidies they hand out in the

form of tax refunds, rebates, loans, grants and more. And they don’t know if the

jobs created would have been created anyway. The fact is, numerous studies show

that such incentives result in only a small increase in jobs and that any gains

usually come at the expense of other cities and states.

Local governments would be much better off investing tax dollars in education

and public works that would deliver long-term benefits to both businesses and

workers. California, for instance, is among the least generous of the larger

states in doling out tax breaks. It gave out just $112 per capita compared with

$759 in Texas, $672 in Michigan, and $210 in New York. Its experience leaves no

doubt that investments made in public institutions like the University of

California system can remain critically important to economic growth decades

later.

The senseless race to give away billions in subsidies is, of course, hard to

stop when elected leaders think a pledge of potential jobs might help in their

next election. But even when attracting businesses is a legitimate goal, it has

to be done in ways that are fair and transparent.

The trouble with targeted incentives is that they are little more than transfers

of wealth to a handful of powerful corporations from all other taxpayers,

including other businesses. If the problem is excessive tax burdens on

businesses in general, then the solution is broad tax reform that also benefits

small business owners, who are more likely to stick around if the regional

economy weakens and who are unlikely to hopscotch around the country in search

of a bigger tax break.

Race to the Bottom, NYT, 5.12.2012,

https://www.nytimes.com/2012/12/06/

opinion/race-to-the-bottom.html

How to Get Business to Pay Its Share

May 3, 2012

The New York Times

By ALEX MARSHALL

JAMES MADISON never played with an iPhone, but he might have

had something to say about the news last weekend about Apple. Over the last few

years, the company has avoided paying billions of dollars in state and federal

taxes by routing profits through subsidiaries based in tax havens from Reno,

Nev., to the Caribbean.

This is a common practice among major American businesses, and back in 1787,

Madison saw it coming. Someday, he warned, companies could grow so large they

“would pass beyond the authority of a single state, and would do business in

other states.” To make sure the companies remained accountable to government, he

said the federal government should “grant charters of incorporation in cases

where the public good may require them, and the authority of a single state may

be incompetent.”

In other words, a National Companies Act.

Such an act would create a common corporate architecture for all American

companies doing business across state lines and internationally. It would

establish not only uniform tax policies but also national standards for the

structure of corporate boards, the power of chief executives, the relations of

management with workers and shareholders and the interaction of American

companies with other nations. National companies would have to abide by national

rules, and the option of shopping around for the most favorable laws or tax

policies simply wouldn’t exist.

It’s an idea that has been proposed and pursued many times, particularly during

the early 1900s, when companies like Standard Oil, which was a collection of

companies incorporated in various states and assembled into a national “trust,”

were becoming increasingly powerful. Theodore Roosevelt, William Howard Taft,

Woodrow Wilson and, later, Franklin D. Roosevelt all supported the creation of a

national companies law, but the measures were consistently opposed by the

business community and eventually defeated.

Today, however, considering how much effort and money American companies expend

on keeping a competitive advantage by figuring out which loopholes to exploit

from the bewildering array of rules now in effect, they might not entirely

oppose reform. In an era of global competition, it could help to have a clear

set of standards. It’s certainly what other nations have. In Germany, for

example, national legislation established rules for the structure of corporate

boards. Britain’s Parliament establishes how a corporation can be created and

what its rights and responsibilities are.

Legally, there is little doubt that the United States Congress could impose

similar rules under the Commerce Clause of the Constitution. Although the states

have traditionally been the main arena for corporate rules, the federal

government has long created national corporations, from the First Bank of the

United States in 1791 to the Corporation for Public Broadcasting in 1967.

Congress could use this same power to require that companies doing business

across state lines have national corporate charters, which would subject them to

federal rules. Alternatively, it could simply set rules for corporate

organization and conduct that would apply to all interstate companies of a

certain size.

Passing a National Companies Act won’t be easy. Companies would hire lobbyists

to push for favorable rules. And some states with particularly easy

incorporation terms, like Delaware, might resist. Around 60 percent of Fortune

500 companies are incorporated in Delaware, and the state earns a great deal in

fees and tax revenues as a result.

But the Apple controversy shows that the nation is ready for reform. While the

company is a symbol of private enterprise, its existence is made possible by a

charter that some government writes and grants. It should serve public as well

as private ends — and pay its rightful share in taxes — or it should not exist

at all.

Alex Marshall is a senior fellow

at the Regional Plan

Association,

an urban research and advocacy group,

and the author of the forthcoming book

“The Surprising Design of

Market Economies.”

How to Get Business to Pay Its Share, NYT,

3.5.2012,

http://www.nytimes.com/2012/05/04/opinion/

solving-the-corporate-tax-code-puzzle.html

Antipoverty Tax Program

Offers Relief,

Though

Often Temporary

April 17,

2012

The New York Times

By SABRINA TAVERNISE

DURHAM,

N.C. — Karen Spain spent several long months before receiving her tax refund

this year in a state of suspended panic. The rent was three months late. Her

car’s brakes were shot. And she could no longer afford to pay her electricity

bill.

So when the refund finally arrived — a $7,200 cash infusion that was about a

third of what she earned all last year as an assistant manager at an auto parts

store — it brought a certain measure of relief, both financial and

psychological. That did not last long.

“Did we celebrate?” said Ms. Spain, a 49-year-old mother of two. “No. We

maintain, that’s all we do. We are just trying to keep our heads above water.”

It is tax time, the season when the country’s largest antipoverty program, the

earned income tax credit, plows billions of dollars into mailboxes and bank

accounts of low-income working Americans like Ms. Spain. It is the most

important financial moment of the year for many people in the bottom half of the

wage bracket, a time to pay off old bills, make car repairs, buy children

clothes and maybe make a big purchase like a refrigerator or a TV.

As incomes among the country’s lowest wage earners continue to stagnate, the

credit has played a critical role in smoothing the hard edges of an unforgiving

labor market for the country’s most vulnerable workers and helping stem the tide

of income inequality that has been rising among Americans in recent decades.

Nearly one in five filers now receive the credit — about 28 million returns in

the 2010 tax year, the most recent year figures are available — representing the

highest percentage since the program began in the 1970s, according to the

Brookings Institution.

The effect has been significant. The Center on Budget and Policy Priorities, a

research group based in Washington, estimates the credit lifted about six

million Americans out of poverty last year.

“We find clear evidence that the E.I.T.C. has significantly reduced poverty

rates and income inequality,” said Raj Chetty, an economist at Harvard who has

studied the subsidy’s effect across cities. “The program is pulling up the lower

end of the income distribution.”

The credit also seems to have an important psychological side effect: It makes

people feel middle class.

“You get this feeling of, ‘Hey, I’m like them now,’ “ said Wesley Rouse, 27, a

property manager in Durham.

But the boost is often temporary. Many people who receive the credit fall back

into poverty over the course of the year, caught in the same cycle of low-wage

work and reliance on credit that put them there in the first place.

One problem is the form the credit takes. The refund can pay as much as 40

percent of a family’s annual income at once, a windfall that many experts are

now arguing should be changed by paying the refund in installments over the

year.

“It’s feast or famine,” said Mae Watson Grote, director of the Financial Clinic,

a New York-based group that teaches financial planning to low-income New

Yorkers. “It’s very hard to manage when it’s a windfall.”

That cycle has the natural force of a tide at National Pawn, a shop in a

working-class area of north Raleigh.

“We’re all cleaned out,” said Sundeep Joshi, the store’s manager, waving his

hand toward empty shelves, reflecting a whirlwind of recent purchases. But

people will start to bring things back to sell as their budgets get squeezed, he

said. By July, the back room is usually packed with pawned items. “That’s the

story every year,” he said.

Kathryn Edin, a professor of public policy at Harvard whose coming book, “It’s

Not Like I’m Poor: How Working Families Make Ends Meet in a Post-Welfare World,”

finds that recipients spent the subsidy overwhelmingly on bills and current

expenses. Less than 10 percent of the money paid out was saved, she found. “The

E.I.T.C. is one of the best social policies we’ve ever devised, but it does not

solve the fundamental problem that you still can’t live on your wages,” she

said.

For Ms. Spain, the subsidy was a lifeline. Together with other tax credits, it

pushed her family income up to about $27,000, above the federal poverty

threshold of $22,800 for a family of four in 2011. (Her husband, an unemployed

cook, did not earn much income.)

But the money went fast. Rent ate up a third. Then came brakes and a new bumper

for her 1998 Honda Civic. She paid the overdue electricity bill, reactivated her

car insurance and bought some new clothes for her two girls, ages 8 and 9.

“You get these large sums, but you have to repair things, and pay back rent, and

you owe on all your bills,” Ms. Spain said. “I’m not at the point where I can

put $500 aside and just let it sit there and grow.”

That economic vulnerability has spawned an industry of lenders who hawk

short-term loans at exorbitant rates to tide people over until tax time, said

Peter Skillern, executive director of Reinvestment Partners, a nonprofit

organization in Durham that helps low-income families file their taxes. The

practice, known as “refund anticipation lending,” was effectively banned by

federal regulators this month, but low-income filers still face an abundance of

rip-off schemes and high tax preparation fees, he said.

“It’s ‘What can I get today versus what’s coming tomorrow,’ “ said Brenda

Dozier, a payroll specialist who said her sister has relied on refund

anticipation loans. “I tell people, ‘You made it this far, just hold on.’ “

Ms. Spain said she paid a company $550 to do her taxes last year so she could

get them — and the refund — back fast, an expenditure she now regrets.

The credit may not permanently change people’s circumstances, but researchers

are finding evidence that many who receive it do not do so for very long. One

recent study found that 60 percent of those who got the benefit stopped claiming

it after two years. That is because people’s finances tend to be fluid, moving

them in and out of the program, said John Horowitz, an economist at Ball State

University in Indiana, one of the authors of the study, which examined tax

records from 1989 to 2006. One in two American families with children received

the credit at least once during that period, he said.

Ms. Spain yearns for a time when she will no longer be eligible for the credit

because she is earning more money. She remembers wistfully her former job at

Nortel that paid $85,000 a year and the feeling of going to a restaurant or a

movie without worrying about her budget.

“Someday we’ll wait and file in April,” she said. “And if we need money before

then, we’ll just go to the bank.”

Antipoverty Tax Program Offers Relief, Though Often Temporary,

NYT, 17.4.2012,

http://www.nytimes.com/2012/04/17/

us/antipoverty-tax-program-offers-relief-though-temporary.html

Reform and Corporate Taxes

February 22, 2012

The New York Times

The corporate tax system is a mess. The United States has one

of the highest corporate tax rates in the world, but too many businesses still

don’t contribute their fair share of revenue, in large part because of numerous

loopholes, subsidies and other opportunities for tax avoidance. While some

industries and companies pay little or no tax because they qualify for generous

breaks or have really good lawyers, others are taxed heavily.

There is no doubt that a system that is more competitive, more efficient — the

current mind-numbing complexity makes planning far too difficult — and more fair

would be a plus for the economy. President Obama’s framework for business tax

reform, released on Wednesday, is a welcome start for a much-needed debate on

comprehensive tax reform. But we already have two big concerns.

While the administration insists that business tax reform should not add to the

deficit, the country needs to raise more revenue to care for an aging

population, rebuild infrastructure, improve education and tackle the deficit.

Corporations, which benefit from all of those, should, as a matter of necessity

and fairness, pay more.

Our other concern is that like all tax reform, the potential for gaming the

process is ever present and unless it is vigilantly managed could actually

reduce revenue and add to the deficit.

Take the framework’s central reform: reducing the top corporate rate from 35

percent to 28 percent, while at the same time doing away with loopholes and

subsidies. In theory, it is a sound approach, which would reduce complexity

while bringing the rate in line with that of other advanced nations without

busting the budget. But, even if they made it past the lobbyists, the specific

loophole closers in Mr. Obama’s new framework — including ending subsidies for

oil and gas exploration, corporate jets and private equity partners — are far

too small to make up for dropping the top rate.

As for the big money subsidies that would have to be cut or ended to pay for a

lower rate — including less generous depreciation and reduced deductibility of

interest on corporate debt — the White House merely presents them as part of a

menu of options for “consideration.”

The framework’s call for a minimum corporate tax on the foreign earnings of

American companies is a step in the right direction. Under current law, various

tax provisions and tactics allow companies to reduce or defer taxes by shifting

ever more production and profits overseas. But the idea is blunted by the

framework’s failure to say what the minimum tax rate should be.

Nor does the framework broach other reforms like taxing foreign profits when

they are earned rather than when they are repatriated to the United States —

that could ultimately be more effective in getting multinationals to pay more.

Even with its shortcomings, Mr. Obama’s proposal presents a needed contrast to

the Republicans’ approach to corporate taxes. Last year, Dave Camp, the chairman

of the House Ways and Means Committee, proposed a top corporate rate of 25

percent without saying how he would pay for the tax cut. Mitt Romney has done

somewhat better, calling for a 25 percent rate to be coupled with “broadening”

the corporate tax base, which generally means closing loopholes. But he has yet

to say which tax breaks he would end.

Serious reform requires specific proposals, tough trade-offs and hard numbers

attached. Without all of those, this effort could too easily be hijacked by

powerful corporations and their high-paid lobbyists.

Reform and Corporate Taxes,

NYT,

22.2.2012,

http://www.nytimes.com/2012/02/23/

opinion/reform-and-corporate-taxes.html

Things

to Tax

November

27, 2011

The New York Times

By PAUL KRUGMAN

The

supercommittee was a superdud — and we should be glad. Nonetheless, at some

point we’ll have to rein in budget deficits. And when we do, here’s a thought:

How about making increased revenue an important part of the deal?

And I don’t just mean a return to Clinton-era tax rates. Why should 1990s taxes

be considered the outer limit of revenue collection? Think about it: The

long-run budget outlook has darkened, which means that some hard choices must be

made. Why should those choices only involve spending cuts? Why not also push

some taxes above their levels in the 1990s?

Let me suggest two areas in which it would make a lot of sense to raise taxes in

earnest, not just return them to pre-Bush levels: taxes on very high incomes and

taxes on financial transactions.

About those high incomes: In my last column I suggested that the very rich, who

have had huge income gains over the last 30 years, should pay more in taxes. I

got many responses from readers, with a common theme being that this was silly,

that even confiscatory taxes on the wealthy couldn’t possibly raise enough money

to matter.

Folks, you’re living in the past. Once upon a time America was a middle-class

nation, in which the super-elite’s income was no big deal. But that was another

country.

The I.R.S. reports that in 2007, that is, before the economic crisis, the top

0.1 percent of taxpayers — roughly speaking, people with annual incomes over $2

million — had a combined income of more than a trillion dollars. That’s a lot of

money, and it wouldn’t be hard to devise taxes that would raise a significant

amount of revenue from those super-high-income individuals.

For example, a recent report by the nonpartisan Tax Policy Center points out

that before 1980 very-high-income individuals fell into tax brackets well above

the 35 percent top rate that applies today. According to the center’s analysis,

restoring those high-income brackets would have raised $78 billion in 2007, or

more than half a percent of G.D.P. I’ve extrapolated that number using

Congressional Budget Office projections, and what I get for the next decade is

that high-income taxation could shave more than $1 trillion off the deficit.

It’s instructive to compare that estimate with the savings from the kinds of

proposals that are actually circulating in Washington these days. Consider, for

example, proposals to raise the age of Medicare eligibility to 67, dealing a

major blow to millions of Americans. How much money would that save?

Well, none from the point of view of the nation as a whole, since we would be

pushing seniors out of Medicare and into private insurance, which has

substantially higher costs. True, it would reduce federal spending — but not by

much. The budget office estimates that outlays would fall by only $125 billion

over the next decade, as the age increase phased in. And even when fully phased

in, this partial dismantling of Medicare would reduce the deficit only about a

third as much as could be achieved with higher taxes on the very rich.

So raising taxes on the very rich could make a serious contribution to deficit

reduction. Don’t believe anyone who claims otherwise.

And then there’s the idea of taxing financial transactions, which have exploded

in recent decades. The economic value of all this trading is dubious at best. In

fact, there’s considerable evidence suggesting that too much trading is going

on. Still, nobody is proposing a punitive tax. On the table, instead, are

proposals like the one recently made by Senator Tom Harkin and Representative

Peter DeFazio for a tiny fee on financial transactions.

And here’s the thing: Because there are so many transactions, such a fee could

yield several hundred billion dollars in revenue over the next decade. Again,

this compares favorably with the savings from many of the harsh spending cuts

being proposed in the name of fiscal responsibility.

But wouldn’t such a tax hurt economic growth? As I said, the evidence suggests

not — if anything, it suggests that to the extent that taxing financial

transactions reduces the volume of wheeling and dealing, that would be a good

thing.

And it’s instructive, too, to note that some countries already have financial

transactions taxes — and that among those who do are Hong Kong and Singapore. If

some conservative starts claiming that such taxes are an unwarranted government

intrusion, you might want to ask him why such taxes are imposed by the two

countries that score highest on the Heritage Foundation’s Index of Economic

Freedom.

Now, the tax ideas I’ve just mentioned wouldn’t be enough, by themselves, to fix

our deficit. But the same is true of proposals for spending cuts. The point I’m

making here isn’t that taxes are all we need; it is that they could and should

be a significant part of the solution.

Things to Tax,

NYT,

27.11.2011,

http://www.nytimes.com/2011/11/28/opinion/krugman-things-to-tax.html

Putting

Millionaires Before Jobs

November 3,

2011

The New York Times

There’s

nothing partisan about a road or a bridge or an airport; Democrats and

Republicans have voted to spend billions on them for decades and long supported

rebuilding plans in their own states. On Thursday, though, when President

Obama’s plan to spend $60 billion on infrastructure repairs came up for a vote

in the Senate, not a single Republican agreed to break the party’s filibuster.

That’s because the bill would pay for itself with a 0.7 percent surtax on people

making more than $1 million. That would affect about 345,000 taxpayers,

according to Citizens for Tax Justice, adding an average of $13,457 to their

annual tax bills. Protecting that elite group — and hewing to their rigid

antitax vows — was more important to Senate Republicans than the thousands of

construction jobs the bill would have helped create, or the millions of people

who would have used the rebuilt roads, bridges and airports.

Senate Republicans filibustered the president’s full jobs act last month for the

same reasons. And they have vowed to block the individual pieces of that bill

that Democrats are now bringing to the floor. Senate Democrats have also accused

them of opposing any good idea that might put people back to work and rev the

economy a bit before next year’s presidential election.

There is no question that the infrastructure bill would be good for the flagging

economy — and good for the country’s future development. It would directly spend

$50 billion on roads, bridges, airports and mass transit systems, and it would

then provide another $10 billion to an infrastructure bank to encourage

private-sector investment in big public works projects.

Senator Kay Bailey Hutchison, a Republican of Texas, co-sponsored an

infrastructure-bank bill in March, and other Republicans have supported similar

efforts over the years. But the Republicans’ determination to stick to an

antitax pledge clearly trumps even their own good ideas.

A competing Republican bill, which also failed on Thursday, was cobbled together

in an attempt to make it appear as if the party has equally valid ideas on job

creation and rebuilding. It would have extended the existing highway and public

transportation financing for two years, paying for it with a $40 billion cut to

other domestic programs. Republican senators also threw in a provision that

would block the Environmental Protection Agency from issuing new clean air

rules. Only in the fevered dreams of corporate polluters could that help create

jobs.

Mitch McConnell, the Senate Republican leader, bitterly accused Democrats of

designing their infrastructure bill to fail by paying for it with a

millionaire’s tax, as if his party’s intransigence was so indomitable that

daring to challenge it is somehow underhanded.

The only good news is that the Democrats aren’t going to stop. There are many

more jobs bills to come, including extension of unemployment insurance and the

payroll-tax cut. If Republicans are so proud of blocking all progress, they will

have to keep doing it over and over again, testing the patience of American

voters.

Putting Millionaires Before Jobs,

NYT,

3.11.2011,

http://www.nytimes.com/2011/11/04/

opinion/the-senate-puts-millionaires-before-jobs.html

Related > Anglonautes >

Vocapedia

taxes > tax avoidance, tax evasion

economy, money, taxes,

housing market, shopping,

jobs, unemployment,

unions, retirement,

debt,

poverty, hunger,

homelessness

banks > off-shore

banking

underground economy

industry, energy, commodities

|