|

Vocapedia >

Economy > Jobs

Pension, Retirement, 401(k)

Steve Kelley

editorial cartoon

The New Orleans Times-Picayune

Cagle

16 September 2010

Illustration: Harry Campbell

Retirement Reality

Is Catching Up With Me

NYT

MARCH 11, 2015

https://www.nytimes.com/2015/03/12/

business/retirement-reality-is-catching-up-with-me.html

retire

USA

https://www.npr.org/2020/01/17/

797305975/indianas-oldest-state-worker-is-retiring-at-102-

i-ve-been-a-pretty-lucky-guy

retired

retiree

USA

http://www.npr.org/2015/10/06/

446300013/states-to-workers-let-us-help-you-build-your-retirement-savings

http://www.nytimes.com/2015/04/04/your-money/

over-50-and-back-in-college-preparing-for-a-new-career.html

http://www.nytimes.com/2015/02/01/us/

medical-costs-rise-as-retirees-winter-in-south.html

http://www.nytimes.com/2014/11/11/us/

h-gary-morse-who-built-mecca-for-retirees-is-dead-at-77.html

http://www.nytimes.com/2010/10/13/business/13retire.html

http://www.nytimes.com/2010/01/25/opinion/l25retirees.html

http://www.nytimes.com/2010/01/18/opinion/18mon3.html

retirement

UK

http://www.guardian.co.uk/money/2008/dec/20/

retirement-pensions-family-finances-savings

retirement age

UK

https://www.theguardian.com/money/

retirement-age

https://www.theguardian.com/commentisfree/2024/feb/05/

work-until-youre-71-

it-could-be-time-to-echo-the-french-and-get-angry

https://www.theguardian.com/money/2024/feb/05/

uk-state-p

http://www.guardian.co.uk/commentisfree/cartoon/2010/jun/25/

steve-bell-government-raise-retirement-age

retirement

USA

https://www.nytimes.com/topic/subject/

401ks-and-similar-plans

https://www.nytimes.com/2024/01/06/

health/retirement-income-middle-class.html

https://www.npr.org/2020/10/02/

919494281/retirement-wont-save-for-itself-here-s-how-to-save-what-you-need

https://www.nytimes.com/2020/03/31/

climate/coronavirus-doctors-retire.html

https://www.nytimes.com/2017/02/27/

business/retirement/

rethinking-retirement-for-longer-lives-with-fewer-safety-nets.html

http://www.npr.org/2016/04/26/

475759586/how-to-not-run-out-of-money-in-retirement

http://www.npr.org/2015/11/17/

455888062/for-women-income-inequality-continues-into-retirement

http://www.npr.org/2015/10/30/

453163154/when-high-fees-stink-up-your-401-k-what-you-can-do

http://www.npr.org/2015/10/06/

446300013/states-to-workers-let-us-help-you-build-your-retirement-savings

http://www.nytimes.com/2015/03/12/business/

retirement-reality-is-catching-up-with-me.html

http://www.nytimes.com/2014/11/15/your-money/

choosing-to-live-abroad-in-retirement.html

http://www.nytimes.com/2014/11/11/us/

h-gary-morse-who-built-mecca-for-retirees-is-dead-at-77.html

http://www.pbs.org/newshour/bb/

obama-announces-retirement-savings-initiative/

http://www.nytimes.com/2014/02/01/

business/when-retirement-seems-impossible-or-just-boring.html

my retirement account

myRA USA

http://www.npr.org/sections/thetwo-way/2015/11/04/

454613224/heres-an-easier-way-to-start-moving-from-broke-to-comfortable-as-you-age

retirement security USA

"Social Security and Medicare

are two bedrock programs

that older Americans rely upon

for their retirement security,"

https://www.npr.org/2023/03/31/

1167378958/social-security-medicare-entitlement-programs-budget

Social Security

USA

https://www.npr.org/2023/03/31/

1167378958/social-security-medicare-entitlement-programs-budget

https://www.nytimes.com/2019/06/12/

business/social-security-shortfall-2020.html?

Companies scale back

on matching 401(k)

contributions

an end-of-year matching system

PBS 15 February 2014

Companies scale back

on matching 401(k)

contributions an end-of-year matching system

Video

PBS Newshour 15 February 2014

What are the implications of these changes

on the average American's retirement?

Hari Sreenivasan speaks with Lauren Young at

Thomson Reuters

about current 401(k) tactics and trends

among different industries

YouTube

http://www.youtube.com/watch?v=0g7po-eVkGE

Tax-advantaged accounts

USA

401(k) plans

and

their cousins,

the 403(b) and the 457 -

plan

and invest for retirement

https://www.nytimes.com/topic/subject/401ks-and-similar-plans

http://www.pbs.org/newshour/bb/

companies-scaling-back-matching-401k-contributions/

401(k) retirement accounts

USA

http://www.nytimes.com/2014/07/23/

opinion/a-401-k-for-all.html

http://www.nytimes.com/2008/12/21/

your-money/401ks-and-similar-plans/21retire.html

company pensions UK

http://www.theguardian.com/business/2006/oct/09/

occupationalpensions.money

http://www.theguardian.com/money/2004/sep/29/

business.labour2004

pensionable age UK

http://www.theguardian.com/politics/2005/nov/30/

turnerreport.socialexclusion

UK >

pension UK / USA

http://www.npr.org/2015/10/23/

445337261/why-is-it-so-hard-to-save-u-k-shows-it-doesnt-have-to-be

http://www.guardian.co.uk/money/2008/oct/27/

occupationalpensions-pensions

http://www.theguardian.com/uk/2004/oct/11/

money.business

pension

USA

http://www.nytimes.com/2012/09/21/

business/global/in-britain-spending-outpaces-austerity.html

http://www.nytimes.com/2011/03/11/

business/11pension.html

public sector pensions UK

http://www.guardian.co.uk/money/2008/dec/16/

xafinity-public-sector-pensions

pensioner

UK

http://www.guardian.co.uk/money/2008/dec/15/

pensions-nhs

British pension system UK

http://www.guardian.co.uk/money/2008/dec/19/

pensions-bill-2006

pension fund UK

http://www.guardian.co.uk/business/blog/2008/oct/09/

creditcrunch.pensions

pension fund

USA

https://www.npr.org/2018/02/26/

588810413/pension-funds-under-pressure-

to-sell-off-investments-in-gun-makers

http://www.nytimes.com/2008/11/25/

business/25auto.html

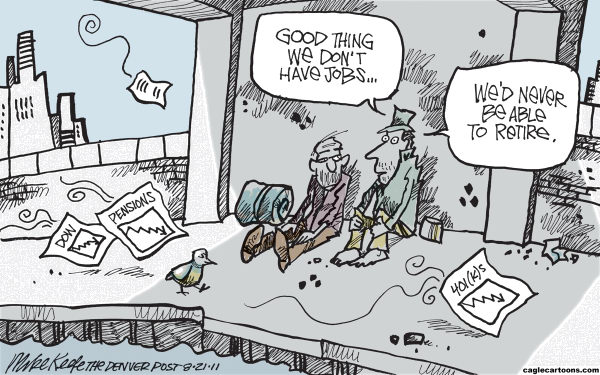

Mike Keefe

cartoon

The Denver Post

Cagle

18 August 2011

Corpus of news articles

Economy > Jobs >

Pension, Retirement, 401(k)

In Need of Cash,

More Companies

Cut 401(k) Match

December 21, 2008

The New York Times

By MARY WILLIAMS WALSH

and TARA SIEGEL BERNARD

Companies eager to conserve cash are trimming their contributions to their

workers’ 401(k) retirement plans, putting a new strain on America’s tattered

safety net at the very moment when many workers are watching their accounts

plummet along with the stock market.

When the FedEx Corporation slimmed down its pension plan last year, it softened

the blow by offering workers enriched 401(k) contributions to make up for the

pension benefits some would lose. But last week, with Americans sending fewer

parcels and FedEx’s revenue growth at a standstill, the company said it would

suspend all of its contributions for at least a year.

“We will have to work more years and retire with less money,” said Lee Higham, a

44-year-old senior aircraft mechanic at FedEx, who has worked there for 20

years. “That’s what we are up against now.”

FedEx is not the only one. Eastman Kodak, Motorola, General Motors and Resorts

International are among the companies that have cut matching contributions to

their plans since September, when the credit markets froze and companies began

looking urgently for cash. More companies are expected to suspend their matching

contributions in 2009, according to Watson Wyatt, a benefits consulting firm.

For workers, the loss of a matching contribution heightens the pain of a

retirement account balance shriveling away because of the plunging stocks

markets.

“We are taking a beating,” said another FedEx mechanic, Rafael Garcia. “In a

year, I lost $60,000 of my 401(k). You can’t make that up.”

To many retirement policy specialists, the lost contributions are one more sign

of America’s failure as a society to face up to the graying of the population

and the profound economic forces it will unleash.

Traditional pensions are disappearing, and Washington has yet to ensure that

Social Security will remain solvent as baby boomers retire and more workers are

needed to support each retiree.

The company cutbacks may mean that some employees put less money into their

retirement accounts. Even if they do not, the cuts, while temporary, will have a

permanent effect by costing many workers years of future compounding on the

missed contributions. No one knows how long credit will remain scarce for

companies, or whether companies will start making their matching contributions

again when credit loosens and business improves.

“We have had a 30-year experiment with requiring workers to be more responsible

for saving and investing for their retirement,” said Teresa Ghilarducci, a

professor of economics at the New School. “It has been a grand experiment, and

it has failed.”

In the typical 401(k) plan, the employer’s matching contribution is more than

just money for retirement. It also motivates employees to set aside more of

their own money for old age. The more that workers save in a 401(k) plan,

generally, the more “free money” they can get from their employers under the

matching provisions.

Retirement policy specialists said they did not expect employees to react

immediately to the loss of this incentive by stopping their own contributions.

Study after study has shown that employees procrastinate when it comes to

retirement-plan chores, and in this case the inertia may work, unwittingly, in

their favor.

Americans, however, are facing extreme household financial pressure.

President-elect Obama has said that he would support allowing withdrawals from

retirement plans without penalties, which would provide short-term relief but

would further undercut American’s long-term savings.

Benefits specialists said that if matching contributions continued to dwindle,

fewer newly hired workers could be expected to join 401(k) plans. And employees

might eventually slow or stop their contributions if the recession drags on and

their own cash runs short.

“The problem is, we are heading into this serious recession, and we don’t know

how long it will go on for,” said Alicia Munnell, director of the Center for

Retirement Research at Boston College. “The bottom line is, people will have

less money in their 401(k) plans, not just because the financial crisis has

decimated their assets, but also because they will not have the employer match

for some time.”

Currently, most companies that offer 401(k) plans do provide some sort of

matching contributions, according to David Wray, president of the Profit

Sharing/401(k) Council of America, an association of employers that provide such

plans.

The most typical arrangement is for employers to match 50 cents of every dollar

their employees set aside in their retirement accounts, up to 6 percent of pay.

Sometimes the match is more, sometimes less, and some employers vary it

depending on profitability. Over all, the employer’s cost usually works out to

about 3 percent of payroll.

The latest 401(k) cutbacks underscore workers’ vulnerability in an age when

companies have been replacing defined-benefit pension plans with the newer

401(k) design. Modern 401(k) plans give workers the power to opt in and out and

require them to invest their own money, bearing market risk on their own. That

may be appealing when the markets are rising, but it can be terrifying when they

fall, as they have recently.

An employer’s contributions to a traditional pension plan cannot be switched on

and off at will. Federal rules set a firm contribution schedule, with deadlines

and penalties for companies that fall behind. Employers also get significant tax

and accounting benefits from operating a traditional pension plan, so they tend

to think long and hard before freezing such a plan to save money when the

economy cools.

In a 401(k) plan, by contrast, the employer has much greater freedom to stop

making matching contributions when times are tough. The contributions are

normally measured as a percentage of payroll, and the savings from any cuts are

realized immediately. That greatly simplifies planning and making changes.

“Every percent you cut is a percent of payroll,” Ms. Munnell said. “It comes

down to the choice of laying people off, or cutting back on some fringe

benefits.”

Many of the latest 401(k) cutbacks are turning up in industries with obvious

financial problems, like the auto industry, health care and newspaper

publishing. Industries that depend on free-spending consumers, like resorts and

casinos, are also seeing cuts. Often when one company in an industry cuts its

benefits others will follow, to keep their labor costs competitive.

General Motors and Ford Motor have both suspended their matching contributions

to their salaried employees’ 401(k) accounts, although their pension plans for

unionized workers are unchanged.

Motorola, struggling to stay competitive, stopped contributions to its 401(k)

plan this month and froze its pension plan as well.

Other recent cuts have occurred at Resorts International Holdings, Vail Resorts

and Station Casinos.

In addition to stopping their 401(k) matching contributions, companies have been

freezing salaries this fall, shifting more of the cost of health care to their

workers, and laying people off.

“These are really hard times and people are losing their jobs, and in some ways,

a suspension of a 401(k) match, while bad, is probably one of the lesser evils

out there,” Ms. Munnell said.

In announcing the suspension of the contributions last week, FedEx made clear

that its workers in the sorting centers would not be the only ones feeling the

pinch. Pay to senior executives is to be cut by 7.5 percent to 10 percent, and

the chief executive, Frederick W. Smith, said he would take a 20 percent pay

cut. The cutbacks are projected to save $200 million in the remainder of the

2009 fiscal year and $600 million in the 2010 fiscal year.

In Need of Cash, More

Companies Cut 401(k) Match,

NYT,

21.12.2008,

http://www.nytimes.com/2008/12/21/

your-money/401ks-and-similar-plans/21retire.html

G.M.’s Pension Fund

Stays Afloat,

Against the Odds

November 25, 2008

The New York Times

By MARY WILLIAMS WALSH

When General Motors left Washington empty-handed last week,

among the lingering questions was whether its huge pension fund could topple and

crush the government’s pension insurance program.

When any pension fund fails, usually as part of a bankruptcy, the government

takes over its assets as well as its payments to retirees. In G.M.’s case, its

plan would dwarf the nation’s pension insurance fund.

Still, G.M. appears to have enough money in the pension fund to pay its more

than 400,000 retirees their benefits for many years — even with the markets

swooning around it. That is largely because of the conservative way G.M. has

managed the fund recently, and it explains why G.M. has not joined the long list

of companies pressing Congress for pension relief.

But this glimmer of hope in a bleak auto landscape could change drastically,

particularly if G.M. struggles along for a few more years, only to go bankrupt.

The company’s blue-collar work force is still building up new benefits with

every additional hour worked, and the pension fund will have to grow smartly to

keep up with those costs.

If G.M. continues paying people to retire early, the costs will grow even more,

because the plan will have to pay retirees for more years than it budgeted. And

G.M. is not contributing additional money to the plan right now.

Already, G.M. says it will be paying retirees about $7 billion a year for the

next 10 years. The fund’s assets were worth $104 billion at the end of 2007,

more than enough to cover its obligations of $85 billion. Since then, the assets

have declined and the obligations have grown, each by undisclosed amounts. The

company says it does not plan to add any money to the fund for the next three or

four years.

Even if G.M. were forced into bankruptcy, the government might insist that it

keep the fund, and cover any shortfalls with its own money.

“We would maintain that it can afford to keep its plan intact,” said Charles E.

F. Millard, director of the Pension Benefit Guaranty Corporation, the federal

agency that takes over failed plans. “Based on past history, we think that

argument has a reasonable chance of success.”

Whatever its ultimate fate, the G.M. fund may illustrate, against the odds, that

it is still possible to offer traditional, defined-benefit pensions even in a

historic bear market.

The other American automakers, Chrysler and the Ford Motor Company, also operate

pension funds. Ford said that its fund, which is about half the size of G.M.’s,

had a small surplus at the end of 2007. Since then, however, it is thought to

have suffered a bigger percentage of losses than G.M.’s fund, because it uses a

different investment strategy.

Little is known about the Chrysler pension fund today because the company

stopped making mandatory pension disclosures when it was taken private in August

2007.

Along with pensions, G.M. has promised to provide health care to retirees, but

those medical benefits are not guaranteed by the federal government. The total

cost of these benefits in today’s dollars was estimated at $60 billion at the

end of 2007, and G.M. had set aside only about $16 billion to cover the cost.

That year, G.M. and the United Automobile Workers agreed to let G.M. cap its

health obligations to retirees by creating a separate entity to manage the

retiree health plan, and making a big payment. The automaker has said it will

make the payment in January 2010, and its retiree health obligations will end

then. In the meantime, G.M. has issued securities to cover part of the cost and

is holding them in a subsidiary created for that purpose.

The G.M. pension is viable today because of the company’s response to the

firestorm at the beginning of this decade, said Nancy C. Everett, chief

executive of G.M. Asset Management. The unit manages the company’s domestic and

foreign pension funds, as well as other big pools of company money.

In the two years after the tech crash of 2000, most American pension funds

suffered their worst squeeze ever. Although the stock market swings are even

more severe now, pension funds have been buffered somewhat by relief provisions

written into the pension law signed in 2006.

At the time of the tech crash, most pension funds had invested heavily in

stocks, and stocks lost billions of dollars in value. At the same time, interest

rates fell to unusually low levels, causing a painful mismatch, because low

rates make retirees’ benefits more expensive for pension funds to pay. G.M.’s

pension fund finished 2002 with a shortfall of almost $20 billion, by far the

biggest of any American company.

“That was the genesis of General Motors thinking differently about how to manage

the fund,” said Ms. Everett, who was running the Virginia state employees’

pension fund at the time. She joined G.M. in 2005.

Until then, most pension officials thought stocks were their best choice,

because stocks were expected to generate more over the long run than bonds. And

pension funds were thought to have a long time horizon.

Stocks have also been a favorite pension investment because of a much-criticized

accounting rule that rewards the corporate bottom line when pension managers

invest more aggressively.

The big mismatch of 2002 showed pension officials that stocks could produce more

volatility than a mature pension fund like G.M.’s could bear. The company could

not wait for stock prices to come back up eventually, because it had 400,000

retirees waiting to be paid about $7 billion every year.

With that in mind, G.M. sold more than $14 billion of bonds in 2003 and put the

proceeds into its pension fund, making up for the preceding years’ losses. It

also put in the proceeds of the sale of its Hughes Electronics subsidiary, for a

total contribution of more than $18 billion. That was far more than the minimum

required that year.

The big contributions got rid of the fund’s shortfall. (They also gave G.M.’s

bottom line a lift, thanks to the accounting rule.)

Then, over several years, G.M. overhauled its investment portfolio, replacing

billions of dollars worth of stocks with bonds, and adding derivatives to make

the duration of the bonds better match the schedule of payments to retirees.

Bond prices can swing too, but G.M. plans to hold the bonds for their interest,

not sell them. Ms. Everett said the company believed the interest payments would

be more than enough to produce the $7 billion owed to retirees every year.

Currently, 26 percent of G.M.’s pension fund is invested in stocks — well below

the typical pension fund’s allocation. David Zion, an analyst at Credit Suisse

who tracks corporate pension funds closely, estimates that G.M.’s pension assets

have declined by about 15 percent so far this year, compared with a 24 percent

decline for the typical pension fund at America’s 500 largest companies. It will

be several more months before the size of the losses is known for sure, because

companies disclose precise pension numbers just once a year.

When asked why G.M. did not eliminate stocks from its pension fund completely,

Ms. Everett cited the controversial accounting rule.

“There’s two sides to this issue,” she said. “One is making sure your pension

fund is adequately funded, and the other is that pension income does come into

play when you’re looking at the company’s income statement.” No company is eager

to eliminate pension income if competitors still have theirs.

The Financial Accounting Standards Board has been working on revisions to keep

pension activity from affecting the corporate bottom line, but it is not

finished yet.

G.M. has a free pass on the funding rules for the next few years. It holds a

so-called credit balance — a running tally of the contributions made in past

years that were larger than the law required. In 2006, G.M.’s credit balance was

worth $44 billion. The company is using that balance to offset contributions it

would otherwise have to make. Over time, the size of the credit balance will

fall.

Ms. Everett said modeling exercises showed that a 26 percent allocation to

equities was the likeliest way to produce adequate investment returns while also

preserving the pension fund’s surplus. She said managing the surplus was her top

priority. If G.M. had to make a pension contribution, it would not have the cash

on hand to do it. The company has said it will run out of cash early next year.

Meanwhile, the cost of restructuring the company could put a heavy burden on the

pension fund. G.M.’s contract with the U.A.W. offers special benefits to workers

whose plants are shut down or who are forced to retire early. Invoking these

special benefits could make the plan’s obligations soar.

G.M.’s Pension Fund

Stays Afloat, Against the Odds,

NYT, 25.11.2008,

http://www.nytimes.com/2008/11/25/business/25auto.html

More companies

may end 401(k) match

28 October 2008

USA Today

By Chris Woodyard

As the economic slump deepens, more companies are expected to

join General Motors in suspending matches of contributions to their employees'

401(k) retirement accounts.

GM last week became only the latest on a list of well-known

companies trying to conserve cash to weather the downturn by halting 401(k)

account matches.

Also among them are Goodyear, Frontier Airlines, commercial real estate firm

Cushman & Wakefield, broadcast group Entercom and rental car agency Dollar

Thrifty Automotive Group.

Employers typically match a portion of workers' contributions as a way of

encouraging them to sock away money for their retirement and as an alternative

to funding a pension plan.

Some 2% of 248 employers surveyed this month by human-resources firm Watson

Wyatt indicated they have cut back on 401(k) matches as a way of coping with the

sinking economy. Another 4% said they may join them in coming months.

Those numbers might be even larger were it not for warnings from experts that

cutting back on 401(k) contribution matches can be a morale killer.

"It's penalizing the folks who are doing the right thing (by) contributing to

their retirement," says Alec Dike, a senior financial counselor for Watson

Wyatt. And the suspensions could backfire on companies because "it suggests you

are in worse financial straits than you really are."

But some say the 401(k) system — which has been steadily expanding as pension

benefits decline and workers become more responsible for providing for their

retirement income — was designed to provide just such flexibility to employers

when their business is struggling.

The match is easy to junk because it is essentially a form of profit-sharing by

a company, says Jack VanDerhei, research director of the Employee Benefit

Research Institute, a Washington think tank.

Frontier, for instance, was kicking in 50 cents for every dollar an employee

contributed to his 401(k) up to 10% of his pay, but stopped the matches June 1

after filing for a Chapter 11 bankruptcy reorganization.

For some, it's not the first time. GM's suspension of matches to its 401(k) plan

last week for 32,000 eligible white-collar employees was the second time this

decade that it has yanked its participation.

"I don't think anybody is happy about it, but people are pretty determined,"

says GM spokesman Tom Wilkinson.

Goodyear, which halted 401(k) matching in 2003, plans to resume starting Jan. 1.

"We're all excited it's coming back," says spokesman Scott Baughman.

More companies may

end 401(k) match,

UT,

28.10.2008,

http://www.usatoday.com/money/perfi/retirement/2008-10-28-

pension-401k-match-ending_N.htm - broken linl

Explore more on these topics

Anglonautes > Vocapedia

health care / insurance > USA > Medicare

economy, money, taxes,

housing market, shopping,

jobs, unemployment,

unions, retirement,

debt,

poverty, hunger,

homelessness

industry, energy, commodities

getting old >

hospices, retirement communities

Related

NPR > Special series > Your Money and Your Life

USA

http://www.npr.org/series/448706447/

your-money-and-your-life

|