|

Vocapedia >

Economy > Consumers

Stores / shops, Shoppers,

Malls, Shopping, Retail

industry

Illustration: Ben Jennings

Ben Jennings

on the

uphill struggle of the cost of living crisis – cartoon

G

Wed 22 Jun 2022

20.02 BST

Last modified on Mon 4 Jul 2022

21.46 BST

https://www.theguardian.com/commentisfree/picture/2022/jun/22/

ben-jennings-on-the-uphill-struggle-of-the-cost-of-living-crisis-cartoon

Related > The Guardian >

Opinion cartoons > Ben Jennings

https://www.theguardian.com/profile/ben-jennings

Shoppers at a Target store

during a sale on Thanksgiving Day.

Data from as many as 110 million customers

is believed to have

been stolen.

Photograph: Michael Reynolds

European Pressphoto Agency

A Sneaky Path Into Target Customers’ Wallets

NYT

Jnauary 17, 2014

https://www.nytimes.com/2014/01/18/

business/a-sneaky-path-into-target-customers-wallets.html

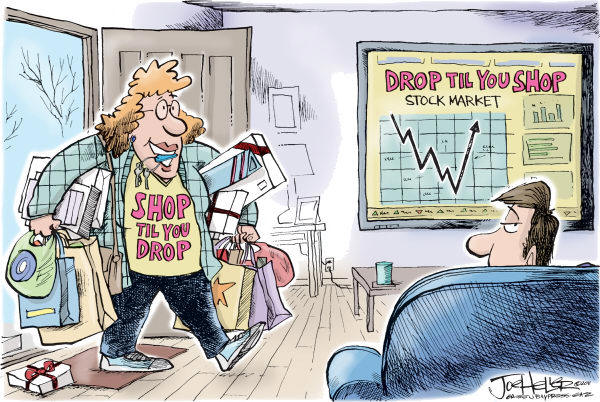

Joe Heller

cartoon

Joe Heller has been the editorial cartoonist

for the Green Bay Press-Gazette since 1985,

before that he was the cartoonist

for the West Bend News.

Cagle

28 November 2011

Rob Rogers

cartoon

The Pittsburgh Post-Gazette

Pennsylvania

Cagle

19 November 2010

Related > Holiday shopping

http://www.cagle.com/news/Shopping10/6.asp

shop

UK

https://www.theguardian.com/technology/2014/aug/18/

how-ebay-transformed-way-people-shop

shop

UK

http://www.theguardian.com/fashion/2013/oct/06/

high-street-internet-virtual-shopping

shopfront UK

https://www.theguardian.com/artanddesign/gallery/2021/jul/10/

open-all-hours-manchester-shopfronts-of-the-early-80s-in-pictures

empty shop

UK

https://www.theguardian.com/business/2019/sep/27/

number-of-empty-shops-in-uk-at-highest-level-for-five-years

ghost shops UK

https://www.theguardian.com/artanddesign/2022/nov/27/

closed-martin-amis-ghost-shops-kent-in-pictures

shopping > overconsumption / over-consumption

UK

https://www.theguardian.com/lifeandstyle/2021/may/30/

should-we-all-stop-shopping-how-to-end-overconsumption

shopping centers USA

https://www.nytimes.com/2024/06/09/

business/shopping-centers-mall-demand-comeback.html

shop

USA

https://www.nytimes.com/2017/04/15/

business/from-zombie-malls-to-bonobos-americas-retail-transformation.html

http://www.nytimes.com/2013/11/29/

business/many-holiday-shoppers-buy-first-and-eat-later.html

go

shopping

shopping list

USA

http://www.npr.org/2017/02/20/

515685098/mattress-no-longer-delegated-to-bottom-of-shopping-list

hit shops

UK

https://www.guardian.co.uk/technology/2010/apr/01/

ipad-apple-goes-on-sale

store

UK

https://www.theguardian.com/world/2020/mar/14/

apple-closes-all-stores-across-world-outside-china-due-to-covid-19

USA > store

UK / USA

https://www.theguardian.com/cities/2018/jul/04/

in-big-tech-v-big-retail-the-real-losers-are-store-workers-sears-amazon

https://www.npr.org/sections/thetwo-way/2018/01/05/

575932533/sears-kmart-and-macys-will-close-more-stores-in-2018

retail stores USA

https://www.nytimes.com/2018/09/03/

business/retail-walmart-amazon-economy.html

mom-and-pop stores USA

https://www.nytimes.com/2017/06/25/

business/economy/amazon-retail-jobs-pennsylvania.html

convenience store

UK

https://www.theguardian.com/business/2015/aug/22/

convenience-stores-artisan-produce-supermarkets

market, grocery store > food seserts

USA

https://www.propublica.org/article/

food-desert-grocery-store-cairo-illinois - August 9, 2024

thrift shop / store

USA

https://www.npr.org/2023/09/01/

1197221461/thrift-store-painting-rare-wyeth-worth-quarter-million

Macy’s NYC, USA

https://www.nytimes.com/2014/11/02/business/

for-macys-a-makeover-on-34th-street.html

department store USA

https://www.nytimes.com/2020/04/21/

business/coronavirus-department-stores-neiman-marcus.html

UK > department store > John Lewis

UK

https://www.theguardian.com/business/

johnlewis

https://www.theguardian.com/business/2014/apr/19/

john-lewis-150th-anniversary-co-op

Blustons ladieswear UK

https://www.theguardian.com/business/2015/mar/17/

a-stitch-in-time-blustons-ladieswear-in-london-to-shut-up-shop-after-84-years

grocery stores

USA

http://www.nytimes.com/2008/12/13/

business/13private.html

grocer

shop for groceries

USA

https://www.nytimes.com/2017/10/14/

us/union-jobs-mexico-rexnord.html

buy groceries

USA

https://www.npr.org/2022/02/02/

1077300038/some-families-are-being-forced-

to-choose-between-remote-learning-and-school-meal

shop prices UK

https://www.theguardian.com/business/2006/aug/02/

interestrates

price tag USA

https://www.npr.org/sections/money/2018/02/28/

589278258/planet-money-shorts-the-invention-of-the-price-tag

annual cost of a child's toys: £715

2005

http://www.theguardian.com/money/2005/jun/10/

shopping.toys

shopper USA

https://www.nytimes.com/2024/11/29/

business/black-friday-holiday-shopping.html

https://www.nytimes.com/2013/11/30/

business/young-bored-and-looking-for-a-deal.html

shopaholic UK

https://www.theguardian.com/film/filmblog/2009/feb/25/

comedy-romance

materialism UK

https://www.theguardian.com/commentisfree/2014/may/07/

how-materialism-makes-us-sad-empathy-charity

shop theft UK

https://www.theguardian.com/business/2013/nov/12/

shop-thefts-rise-economic-downturn-bites

shoplifter

UK

https://www.theguardian.com/commentisfree/2025/feb/25/

welcome-to-britain-in-2025-

where-there-is-a-heist-in-my-local-shop-and-no-one-is-surprised

https://www.theguardian.com/news/audio/2023/jul/17/

has-britain-become-a-country-of-shoplifters-

podcast - Guardian podcast

shoplifting

USA

https://www.nytimes.com/2008/12/23/us/23shoplift.html

shoplifting UK

https://www.theguardian.com/lifeandstyle/2009/jun/13/

shoplifting-women

shoplifter UK

https://www.theguardian.com/lifeandstyle/2009/jun/13/

shoplifting-women

steal

UK

https://www.theguardian.com/lifeandstyle/2009/jun/13/

shoplifting-women

shopping UK

https://www.independent.co.uk/news/uk/this-britain/

it-was-our-national-pastime-ndash-

but-now-shopping-is-just-so-over-1026305.html - 20 November 2008

shopping list

https://www.reuters.com/article/lifestyleMolt/idUSN17444805

20080417

spree /

shopping spree USA

https://www.npr.org/2021/11/15/

1055796115/warehouses-are-overwhelmed-by-americas-shopping-spree

http://www.nytimes.com/2012/11/24/business/

rising-consumer-optimism-fuels-an-annual-spree.html

splash out on N

USA

http://www.theguardian.com/uk-news/shortcuts/2014/mar/30/

yummies-young-urban-males-personal-grooming

free-spending on N

shopping errand

go shopping

bargain hunting

queue and

crowd for bargains

UK

http://www.theguardian.com/uk-news/gallery/2013/dec/26/

boxing-day-sales-in-pictures

get the best deal

UK

http://www.theguardian.com/money/video/2013/sep/24/

how-to-reduce-supermarket-bill-video

item

purchase

haggler

USA

http://www.nytimes.com/2008/03/23/business/23haggle.html

'Sorry, we're closed'

bar code USA

http://www.nytimes.com/2012/12/13/

business/n-joseph-woodland-inventor-of-the-bar-code-dies-at-91.html

http://www.nytimes.com/2011/06/16/

business/16haberman.html

charity shop

UK

http://www.guardian.co.uk/uk/2010/oct/03/

glasgow-charity-shop-donation-cancer

shopper UK / USA

http://www.nytimes.com/2012/12/22/technology/

as-shoppers-hop-from-tablet-to-pc-to-phone-retailers-try-to-adapt.html

http://thelede.blogs.nytimes.com/2012/11/22/coverage-of-black-friday/

https://www.theguardian.com/business/2008/dec/26/

creditcrunch-consumerpages

http://www.telegraph.co.uk/finance/newsbysector/retailandconsumer/3950030/

Boxing-day-bonanza-sales-promise-record-discounts-for-shoppers.html

budget shoppers USA

http://www.nytimes.com/2010/09/22/business/22dollar.html

shopping UK

http://www.independent.co.uk/news/uk/this-britain/

megamall-is-this-the-future-of-shopping-969624.html

binge shopping

used plastic shopping bag

USA

https://www.nytimes.com/2013/05/19/

sunday-review/should-america-bag-the-plastic-bag.html

Plastic fantastic: vintage carrier bags - in

pictures UK

https://www.theguardian.com/artanddesign/gallery/2021/jan/02/

plastic-fantastic-vintage-carrier-bags-

in-pictures - Guardian picture gallery

big spenders

goods

luxury goods

UK

https://www.theguardian.com/global/2024/apr/29/

tell-us-are-you-splurging-on-luxury-goods-you-can-ill-afford

brand UK

http://www.guardian.co.uk/money/shortcuts/2012/may/23/rise-own-brand

label UK

http://www.guardian.co.uk/money/shortcuts/2012/may/23/rise-own-brand

shopping basket UK

http://www.guardian.co.uk/money/shortcuts/2012/may/23/rise-own-brand

trolley UK

https://www.theguardian.com/money/blog/2013/mar/28/

goodbye-supermarkets-lived-year-without-multinationals

corner

shop

corner

shop business

mall

USA

https://www.npr.org/2024/11/28/

nx-s1-5188418/mall-of-america-shopping-entertainment-amusement-park

https://www.nytimes.com/2020/04/28/

business/coronavirus-shopping-malls-simon.html

https://www.npr.org/2017/05/02/

526560158/a-rapid-shakeup-for-retailers-as-consumer-habits-change

Simon

Property Group,

the

biggest operator of malls in the United States - April 2020

https://www.nytimes.com/2020/04/28/

business/coronavirus-shopping-malls-simon.html

USA > shopping mall

UK / USA

https://www.theguardian.com/artanddesign/gallery/2022/oct/21/

the-death-of-the-american-shopping-mall-in-pictures

https://www.nytimes.com/2017/07/26/

fashion/an-ode-to-shopping-malls.html

megal-mall

UK

http://www.independent.co.uk/news/uk/this-britain/

megamall-is-this-the-future-of-shopping-969624.html

at the mall

dead malls USA

http://www.nytimes.com/2015/01/04/

business/the-economics-and-nostalgia-of-dead-malls.html

store

USA

https://www.nytimes.com/2010/11/10/

business/10small.html

chainstores

outlet

UK

https://www.theguardian.com/world/2020/mar/14/

apple-closes-all-stores-across-world-outside-china-due-to-covid-19

corner stores

department stores

megastores

USA

http://www.nytimes.com/2008/03/23/

business/23haggle.html

supermarket UK

https://www.theguardian.com/business/

supermarkets

http://www.theguardian.com/money/video/2013/sep/24/

how-to-reduce-supermarket-bill-video

http://www.guardian.co.uk/money/blog/2013/mar/28/

goodbye-supermarkets-lived-year-without-multinationals

http://www.independent.co.uk/news/uk/home-news/

cost-of-a-shopping-basket-soars-in-the-phoney-supermarket-price-war-865803.html

http://www.guardian.co.uk/money/2008/jun/27/consumeraffairs.familyfinance

https://www.theguardian.com/business/2007/apr/01/supermarkets.observerbusiness

https://www.theguardian.com/society/2006/jun/28/communities.foodanddrink

https://www.theguardian.com/business/2006/may/18/supermarkets.ethicalliving

https://www.theguardian.com/gall/0,8542,1589655,00.html

https://www.theguardian.com/money/2005/oct/07/

consumeraffairs.supermarkets

https://www.theguardian.com/business/2005/apr/12/

supermarkets.tesco

supermarket group

supermarket giant Tesco - the UK's biggest

retailer UK

https://www.theguardian.com/business/

tesco

http://www.theguardian.com/business/2013/oct/21/

food-waste-tesco-reveals-most-bagged-salad-and-half-its-bread-is-thrown-out

http://www.guardian.co.uk/film/2010/aug/07/tesco-movie-trolleywood

http://www.guardian.co.uk/business/2009/apr/21/tesco-record-profits-supermarket

http://www.guardian.co.uk/business/2008/dec/11/tesco-retail

http://www.guardian.co.uk/business/2008/dec/03/

tesco-morrisons-supermarket-advertisements

Morrisons UK

http://www.guardian.co.uk/business/2008/dec/03/

tesco-morrisons-supermarket-advertisements

Woolworths / Woolies UK

https://www.theguardian.com/business/

woolworths

http://www.guardian.co.uk/business/gallery/2008/dec/11/

woolworths-closing-down-sale?picture=340653013

http://www.guardian.co.uk/business/cartoon/2008/dec/12/woolworths

http://www.guardian.co.uk/business/gallery/2008/nov/19/

woolworths-history-retail-gallery?picture=339830590

food

and consumer goods giant

food prices

UK

http://www.guardian.co.uk/business/gallery/2008/sep/23/

creditcrunch.marketturmoil?picture=337937519

eat

UK

http://www.guardian.co.uk/business/gallery/2008/sep/23/

creditcrunch.marketturmoil?picture=337937358

till UK

https://www.theguardian.com/commentisfree/2023/nov/12/

unexpected-human-at-the-till-

cashiers-are-making-a-comeback

https://www.theguardian.com/business/2021/oct/23/

end-of-the-checkout-queue-

stores-rush-to-deploy-till-free-technology

at the till UK

https://www.theguardian.com/commentisfree/2023/nov/12/

unexpected-human-at-the-till-

cashiers-are-making-a-comeback

self-checkout machines

UK

https://www.theguardian.com/commentisfree/2023/nov/14/

destroy-self-checkout-machines-supermarket-boycott

https://www.theguardian.com/business/2021/oct/23/

end-of-the-checkout-queue-

stores-rush-to-deploy-till-free-technology

checkout queue UK

https://www.theguardian.com/business/2021/oct/23/

end-of-the-checkout-queue-

stores-rush-to-deploy-till-free-technology

supermarket checkout jobs

UK

https://www.theguardian.com/money/2019/mar/25/

automation-threatens-15-million-workers-britain-says-ons

deploy till-free technology

UK

https://www.theguardian.com/business/2021/oct/23/

end-of-the-checkout-queue-

stores-rush-to-deploy-till-free-technology

automation UK

https://www.theguardian.com/money/2019/mar/25/

automation-threatens-15-million-workers-britain-says-ons

scan barcode to

enter UK

https://www.theguardian.com/business/2021/oct/23/

end-of-the-checkout-queue-

stores-rush-to-deploy-till-free-technology

no scanning UK

https://www.theguardian.com/business/2021/oct/23/

end-of-the-checkout-queue-stores-

rush-to-deploy-till-free-technology

cash

cashiers UK

https://www.theguardian.com/commentisfree/2023/nov/12/

unexpected-human-at-the-till-

cashiers-are-making-a-comeback

cashier-free shops UK

https://www.theguardian.com/commentisfree/2024/apr/10/

amazon-ai-cashier-less-shops-humans-technology

humans UK

https://www.theguardian.com/commentisfree/2023/nov/14/

destroy-self-checkout-machines-supermarket-boycott

https://www.theguardian.com/commentisfree/2023/nov/12/

unexpected-human-at-the-till-cashiers-are-making-a-comeback

checkout UK

http://www.guardian.co.uk/environment/2008/may/29/

food.householdbills1

customer / patron

UK

http://www.guardian.co.uk/money/2008/jun/27/

consumeraffairs.familyfinance

customer

USA

http://www.nytimes.com/2014/01/18/

business/a-sneaky-path-into-target-customers-wallets.html

consumer habits

USA

http://www.npr.org/2017/05/02/

526560158/a-rapid-shakeup-for-retailers-as-consumer-habits-change

prospect

afford

Main

Street / St.

USA

http://www.nytimes.com/2008/03/21/

business/21econ.html

retail crash

UK

https://www.theguardian.com/commentisfree/2021/apr/11/

returning-high-street-retain-crash-chnaged-covid-restriction-england

retail

USA

https://www.nytimes.com/2024/06/09/

business/shopping-centers-mall-demand-comeback.html

https://www.npr.org/2021/06/25/

1009405116/richard-altuna-dies-restoration-hardware-starbucks-pottery-barn-gap

https://www.npr.org/2017/12/16/

566934885/cabelas-sale-sends-ripples-of-anxiety-through-rural-nebraska-town

http://www.npr.org/2017/05/02/

526560158/a-rapid-shakeup-for-retailers-as-consumer-habits-change

https://www.nytimes.com/2017/04/15/

business/retail-industry.html

https://www.nytimes.com/2017/04/15/

business/from-zombie-malls-to-bonobos-americas-retail-transformation.html

http://www.npr.org/2014/02/17/

278651994/demographic-shifts-contribute-to-the-changing-face-of-retail

retail industry

UK

https://www.theguardian.com/business/retail

retail industry USA

https://www.npr.org/sections/thetwo-way/2018/01/05/

575932533/sears-kmart-and-macys-will-close-more-stores-in-2018

retail sites UK

https://www.theguardian.com/business/2019/sep/27/

number-of-empty-shops-in-uk-at-highest-level-for-five-years

retail jobs > women's jobs

UK

https://www.theguardian.com/lifeandstyle/2018/jul/24/

their-jobs-are-disappearing-how-the-demise-of-the-high-street-is-killing-womens-jobs

retail jobs USA

https://www.nytimes.com/2017/06/25/

business/economy/amazon-retail-jobs-pennsylvania.html

high street / retail sector / retail

UK

https://www.theguardian.com/commentisfree/2021/apr/11/

returning-high-street-retain-crash-chnaged-covid-restriction-england

https://www.theguardian.com/lifeandstyle/2020/mar/05/

top-pf-the-shops-oxford-street-survived-death-high-street

https://www.theguardian.com/lifeandstyle/2018/jul/24/

their-jobs-are-disappearing-how-the-demise-of-the-high-street-is-killing-womens-jobs

http://www.theguardian.com/lifeandstyle/2014/may/17/

mary-portas-im-one-of-the-best-in-the-world

http://www.theguardian.com/fashion/2013/oct/06/

high-street-internet-virtual-shopping

http://www.guardian.co.uk/business/2013/jan/15/

hmv-death-british-high-street

http://www.guardian.co.uk/business/2011/jan/21/

retail-sales-worst-december-on-record

http://www.guardian.co.uk/lifeandstyle/2011/jan/14/

makeup-for-black-women-high-street

http://www.guardian.co.uk/business/2008/dec/29/

high-street-retailers-administration

http://www.guardian.co.uk/business/2008/dec/24/

high-street-retailers-retail

http://www.guardian.co.uk/business/2008/nov/20/

woolworths-retail-high-street-christmas

http://www.guardian.co.uk/business/2008/apr/12/

highstreetretailers.retail

http://www.theguardian.com/business/2007/may/01/

highstreetretailers.retail

http://www.theguardian.com/business/2005/aug/30/

highstreetretailers

retail hacks USA

retail spending

USA

https://www.npr.org/sections/coronavirus-live-updates/2020/12/16/

946783072/shoppers-stayed-away-from-stores-and-restaurants-sending-sales-lower

retail crash UK

http://www.theguardian.com/business/2005/may/08/

highstreetretailers.observerbusiness

British Retail Consortium

UK

https://www.theguardian.com/lifeandstyle/2018/jul/24/

their-jobs-are-disappearing-how-the-demise-of-the-high-street-is-killing-womens-jobs

high street shops / stores UK

http://www.guardian.co.uk/business/2008/nov/29/

interest-rates-high-street-stores

http://www.guardian.co.uk/business/2008/jan/03/

bankofenglandgovernor

on the high street

UK

http://www.theguardian.com/fashion/gallery/2014/apr/15/

summer-skirts-below-the-knee

major dollar chains

Dollar General, Family Dollar and Dollar

Tree USA

https://www.nytimes.com/topic/company/

dollar-general-corporation

https://www.nytimes.com/2010/09/22/

business/22dollar.html

an

unexpected bounce in retail sales

wholesale prices USA

2006-2013

https://www.npr.org/blogs/thetwo-way/2013/04/12/

177015385/wholesale-prices-plunge-but-so-do-retail-sales

the

venture capital group circling retailer WH Smith

UK

http://www.theguardian.com/business/2004/jul/12/

highstreetretailers

chain

entertainment chain > Zavvi

UK

http://www.guardian.co.uk/business/2008/dec/24/

zavvi-administration-jobs

neighbourhood retailer

big-box retailers USA

https://www.nytimes.com/2017/06/25/

business/economy/amazon-retail-jobs-pennsylvania.html

retail sales UK

http://www.theguardian.com/fashion/fashion-blog/2013/dec/26/

boxing-day-sale-shopping-tips-post-christmas

http://www.independent.co.uk/news/business/news/

retail-sales-at-lowest-level-since-early-2006-970413.html

http://www.guardian.co.uk/business/2007/nov/15/retail.ukeconomy

http://www.theguardian.com/business/2006/nov/16/interestrates

retail sales USA

https://www.npr.org/2021/04/15/

987597284/signs-of-economic-boom-emerge-

as-retail-sales-surge-jobless-claims-hit-pandemic

http://www.nytimes.com/2009/01/03/

business/media/03marketing.html

http://www.nytimes.com/2008/12/05/

business/economy/05shop.html

http://www.nytimes.com/2008/11/07/

business/07retail.html

retailer UK

www.theguardian.com/business/2016/apr/12/uk-

retailers-sales-hit-by-bad-weather-and-early-easter

https://www.reuters.com/article/reutersEdge/idUSTRE4AK003

20081121

http://www.guardian.co.uk/business/2008/nov/20/

woolworths-retail-high-street-christmas

retailer USA

https://www.nytimes.com/2020/06/01/

business/stores-protests-damage.html

http://www.npr.org/2017/05/02/

526560158/a-rapid-shakeup-for-retailers-as-consumer-habits-change

http://www.npr.org/2017/04/18/

524271447/its-survival-in-doubt-sears-struggles-to-transform-once-again

http://www.nytimes.com/2013/11/29/

business/many-holiday-shoppers-buy-first-and-eat-later.html

http://www.nytimes.com/2012/12/22/

technology/as-shoppers-hop-from-tablet-to-pc-to-phone-retailers-try-to-adapt.html

http://www.nytimes.com/2011/12/23/

business/retailers-are-slashing-prices-ahead-of-holiday.html

brick-and-mortar retailers

USA

http://www.npr.org/2015/12/27/

461134577/brick-and-mortar-stores-go-further-to-get-you-in-the-door

big retailer USA

http://www.nytimes.com/2011/01/17/

business/17grocery.html

Wal-Mart Stores

- the world’s largest retail chain

USA

Wal-Mart,

a chain of discount stores

started by Sam Walton in

1962,

has become a central figure in scores

of social, economic and political debates,

from health care to immigration to gun control.

Supporters contend

that the chain's legendary low prices

have democratized

consumption,

allowing low-income households

to afford flat-screen televisions and nine-layer

lasagna.

Critics say

those low prices have depressed domestic wages

and exported manufacturing jobs to foreign countries,

hurting Americans more than helping them.

http://topics.nytimes.com/top/news/business/companies/

wal_mart_stores_inc/index.html

https://www.npr.org/sections/thetwo-way/2018/02/28/

589436112/dicks-sporting-goods-ends-sale-of-assault-style-rifles-

citing-florida-shooting

http://www.npr.org/sections/thetwo-way/2016/02/18/

467227749/wal-mart-had-a-tough-year-

but-workers-and-shoppers-got-a-boost

http://www.npr.org/sections/thetwo-way/2015/08/26/

434960318/wal-mart-to-end-sales-of-some-semi-automatic-rifles-citing-low-demand

http://www.npr.org/blogs/thesalt/2015/04/02/

396892753/when-wal-mart-comes-to-town-what-does-it-mean-for-workers

http://www.nytimes.com/2011/12/06/

business/global/wal-mart-hears-a-familiar-complaint-in-india.html

http://www.nytimes.com/2011/10/12/

opinion/wal-marts-layaway-plan.html

http://www.nytimes.com/2011/01/20/

business/20walmart.html

http://www.nytimes.com/2010/11/17/

business/17shop.html

http://www.nytimes.com/2009/11/24/

business/24shop.html

http://www.nytimes.com/2008/11/22/

business/22walmart.html

Toys R Us

https://www.npr.org/sections/thetwo-way/2018/03/14/

592882488/game-over-for-toys-r-us-chain-going-out-of-business

marketers

USA

https://www.nytimes.com/2011/04/21/

business/21marketing.html

Corpus of news articles

Economy > Consumers

Shopping, Retail industry, Retailers, Stores

Retailers Try to Adapt

to Device-Hopping Shoppers

December 21, 2012

The New York Times

By CLAIRE CAIN MILLER

and STEPHANIE CLIFFORD

Ryan O’Neil, a Connecticut government employee, was in the

market to buy a digital weather station this month. His wife researched options

on their iPad, but even though she found the lowest-price option there, Mr.

O’Neil made the purchase on his laptop.

“I do use the iPad to browse sites,” Mr. O’Neil said, but when it comes time to

close the deal, he finds it easier to do on a computer.

Many online retailers had visions of holiday shoppers lounging beneath the

Christmas tree with their mobile devices in hand, making purchases. The size of

the average order on tablets, particularly iPads, tends to be bigger than on

PCs. So retailers poured money and marketing into mobile Web sites and apps with

rich images and, they thought, easy checkout.

But while visits to e-commerce sites and apps on tablets and phones have nearly

doubled since last year, consumers like Mr. O’Neil are more frequently using

multiple devices to shop. In many cases, they are more comfortable making the

final purchase on a computer, with its bigger screen and keyboard. So retailers

are trying to figure out how to appeal to a shopper who may use a cellphone to

research products, a tablet to browse the options and a computer to buy.

“I’ve been yelling at customers for two years, saying, ‘Mobile, mobile, mobile,’

” said Jason Spero, director of mobile sales and strategy at Google. “But the

funny thing is, now we’re going to say: ‘Don’t put mobile in a silo. It’s also

about the desktop.’ ”

The challenges are daunting, though. It is technically difficult to track

consumers as they hop from phone to computer to tablet and back again. This

means customers who, say, fill shopping carts on their tablets have to do all

the work again on their PCs or other devices. The biggest obstacle, retailers

say, is that the tools used to track shoppers on computers — cookies, or bundles

of data stored in Web browsers — don’t transfer across devices.

Instead, retailers are figuring out how to sync the experience in other ways,

like prompting shoppers to log in on each device. And being able to track people

across devices gives retailers more insight into how they shop.

The retailers’ efforts are backed by research. While one-quarter of the visits

to e-commerce sites occur on mobile devices, only around 15 percent of purchases

do, according to data from I.B.M. According to Google, 85 percent of online

shoppers start searching on one device — most often a mobile phone — and make a

purchase on another.

At eBags, customers are shopping on their tablets in the evening and returning

on their work computers the next day. But eBags has not yet synced the shoppers

across devices, so customers must build their shopping carts from scratch if

they switch devices.

“That is a blind spot with a lot of sites,” said Peter Cobb, co-founder of

eBags. “It is a requirement moving forward.”

At eBay, one-third of the purchases involve mobile devices at some point, even

if the final purchase is made on a computer.

At eBay, once shoppers log in on a device, they do not need to log in again.

Their information, like shipping and credit card details and saved items, syncs

across all their devices. If an eBay shopper is interested in a certain handbag,

and saves that search on a computer, eBay will send alerts to her cellphone when

a new handbag arrives or an auction is about to end.

“They might discover an item on a phone or tablet, do a saved-search push alert

later on some other screen and eventually close on the Web site,” said Steve

Yankovich, who runs eBay Mobile. “People are buying and shopping and consuming

potentially every waking moment of the day.”

ModCloth, an e-commerce site for women’s clothes, said that while a quarter of

its visits come from mobile devices, people are not yet buying there in the same

proportion, though they are becoming more comfortable with checking out on those

devices.

“She’s visiting us more on the phone, but she’s actually transacting somewhere

else,” said Sarah Rose, vice president of product at ModCloth.

For example, a shopper will skim through new arrivals on her phone while on the

bus and add items to her wish list, then visit that evening on her tablet to

make a purchase, Ms. Rose said.

To take advantage of this behavior, ModCloth urges shoppers to log in after just

a few clicks on the Web site on a phone or computer, so information like credit

card numbers and items saved in a shopping cart on another device are

accessible. Then if a laptop shopper adds a skirt to her shopping cart and

later, it is about to sell out, ModCloth can send her an e-mail, which she will

often click on her phone to buy the skirt, Ms. Rose said. Logged-in users who

visit the site using multiple devices are 2.5 times more likely to place an

order than those on a single device, according to the company.

On Etsy, where 25 percent of the visits but 20 percent of the sales come from

mobile devices, the site syncs items in the shopping cart, favorite items,

purchasing history and conversations with sellers.

Many other e-commerce sites, however, still lack an easy way for shoppers to use

different devices.

The New York Times logged in to the Web sites of some large retailers and added

items to the shopping cart, then logged in to the mobile site or app to see if

the cart was reflected there.

Amazon.com, Nordstrom, Target, Macy’s and Gap showed items across devices.

Walmart did, too, though with some hiccups; it required logging out of and back

into the mobile site to update the cart, and on the app, a shopper had to choose

the “sync with online cart” option.

Others, though, did not sync across devices, including Newegg, Kohl’s,

RadioShack and J. Crew, so shopping on a different device required filling the

shopping cart from scratch.

Newegg is working on syncing the shopping carts, said Soren Mills, its chief

marketing officer, because customers are asking for that. The information

gleaned about customers that way is also critical for retailers, he said, so

they can personalize sites and offers based on consumers’ browsing and purchase

history.

“We have to recognize the customer, so we look to get a single view of the

customer,” he said.

Retailers could use information like this to show different ads to shoppers with

cellphones standing in a store at lunch hour than to those using a tablet at 9

p.m., Mr. Spero at Google said.

Despite the hesitance of shoppers like Mr. O’Neil to buy on mobile devices, some

technology industry analysts say people just need time to grow comfortable with

new technology.

“It’s just like in the old days, 15 years ago, the conversation was people are

researching what they want on their PCs but still going to the store to buy,”

said Marc Andreessen, a venture capitalist. Mr. Andreessen is involved with

e-commerce companies like eBay and Fab, both of which he said had strong mobile

sales. “I think that’s a temporary phenomenon.”

Retailers Try to Adapt to Device-Hopping

Shoppers,

NYT,

21.12.2012,

https://www.nytimes.com/2012/12/22/

technology/as-shoppers-hop-from-tablet-to-pc-to-phone-r

etailers-try-to-adapt.html

In These

Lean Days,

Even Stores Shrink

November 9,

2010

The New York Times

By STEPHANIE CLIFFORD

SANTA ANA,

Calif. — A temporary wall slices the Anchor Blue store here in half. On one side

are abandoned dressing rooms, a few mannequins and no customers. On the other

are racks jammed with clothing and accessories — and more customers than ever

coming into the store.

Tom Shaw, the head of Anchor Blue, a clothing chain for teenagers, looked with

approval at the 2,500 square feet of empty space that his company still rents.

Foot traffic is up more than 7 percent, the chain says, and sales have increased

nearly 23 percent since the trial remodeling last year.

“We don’t want a department-store feel,” Mr. Shaw said. “With that much product

in that much space you can get lost, not know where to go.”

Anchor Blue is among a growing number of retailers thinking small — chopping off

big chunks of stores or moving to more efficient spaces. The change reflects two

trends in the retail world: Chains looking for new ways to cut costs in the sour

economy, and consumers demanding a less sprawling shopping experience as they

spend with greater purpose.

“The customer walks in the door, and often sees a huge selection of stuff in a

multibrand store, and can’t figure out what to buy and ends up buying nothing,”

said Paco Underhill, founder and chief executive of Envirosell, a

Manhattan-based company that advises stores on shoppers’ behavior. “We have

reached the apogee of the big box, meaning that we can’t grow the store or the

shopping mall any bigger, or get any more time or money out of somebody’s

pockets.”

Big chains like Bloomingdale’s and Nike are trying smaller stores, as are

specialty retailers like Charlotte Russe. Mr. Underhill said most of his clients

are exploring the idea, which can require creative thinking.

The new Bloomingdale’s in Santa Monica, Calif., for example, saves space with

dressing rooms that retract into the ceiling. Charlotte Russe uses free-standing

glass walls that can be rearranged. At Nike, the cash registers are wired into

movable counters.

The smaller stores help clean retailers’ balance sheets. Rents drop, and smaller

amounts of inventory cost less. Retailers can also reduce payroll costs because

fewer employees are needed. At the Anchor Blue store here in Santa Ana, three

employees now work on the floor instead of four.

Retail chains “saw their lives flash before their eyes in the financial crisis

downturn,” said John D. Morris, an analyst with BMO Capital Markets, a financial

services provider. “When you’re looking at such a severe slowdown as they were

in consumption, you worry about the commitment in real estate.”

Mr. Shaw said he reduced the amount of clothing in the Santa Ana store by about

15 percent, removing many slower-moving items like unpopular sizes — and

increasing profitability. As leases expire on its 118 stores, Anchor Blue is

moving into spaces about half their size .

“You’re placing a sizable bet when you’re buying a lot of inventory and filling

up a 6,000-square-foot box,” he said.

The financial success of many smaller stores is simple, retail analysts and the

stores say: Smaller spaces are cheaper, and can be easily changed to carry the

most profitable, fastest-selling inventory. The stepped-up foot traffic at the

Anchor Blue store in Santa Ana, and the sales increase, for example, are both

above the chain’s averages.

“It certainly enhances the productivity,” Mr. Morris said of the smaller spaces.

Bloomingdale’s store in Santa Monica, which opened this summer, is about 105,000

square feet on two floors, less than one-eighth the size of the chain’s

Manhattan flagship store. The developer packaged in the third floor, but

Bloomingdale’s declined the extra room, said Michael Gould, chairman and chief

executive of Bloomingdale’s.

Mr. Gould said he wanted a smaller store to move through inventory faster. The

Santa Monica store dropped two slower-moving categories, home and children’s,

that are often found in other Bloomingdale’s stores. It has also saved space

with innovations like a mobile rack, that resembles those dry cleaners use, on

the second floor ceiling that moves mannequins and clothes.

“You have a store that’s turning very quickly,” he said.

In addition, Mr. Gould said, many shoppers have responded to a more focused

retail experience — stores that have been stripped of the distractions and

temptations of unwanted merchandise — as the success of Bloomingdale’s smaller

Manhattan store in SoHo, opened in 2004, has demonstrated.

“We can be very specific to a customer and to a marketplace, and that’s what we

need to do,” he said.

Nike is also looking at flexible layouts as it experiments with smaller stores.

The typical Niketown store is more than 50,000 square feet, while its prototype

“brand experience” store, opened in Santa Monica in August, is just 22,000

square feet. Nike has no plans to open more Niketowns, opting instead for

smaller options like the “brand experience” store.

The driving force was to make shopping simple, said Tim Hershey, Nike’s vice

president and general manager of North American retail. “Customers are always

asking us to make it easy,” he said.

Almost all the elements of the new Nike store can be rearranged at a moment’s

notice. Each wall contains horizontal slats about six inches apart, and almost

every piece of hardware — the circle of metal that holds a soccer ball, the wire

cages that contain socks — can be hooked into the wall slats. Freestanding

tables and locker-compartmentlike display cases are on wheels. A big orange

station where the cash registers are housed looks like the only permanent

fixture in the store — but it is not.

“It’s wired to be relocated in multiple places,” Mr. Hershey said. “We like

where it’s at but we haven’t been through a holiday. Live and learn.”

Charlotte Russe, which has more than 500 outlets nationally, is also

experimenting with a new concept store in Santa Monica that is about 25 percent

smaller than the norm.

Jenny Ming, the chief executive, ordered freestanding glass walls to distinguish

between types of clothes. “It just makes it more shoppable,” she said. “So many

stores now, it’s just big, you throw everything in there,” Ms. Ming said.

For maximum versatility and efficiency, each fixture has been designed for

multiple purposes. A metal rod that lies perpendicular to the wall can hold

shoes on plastic hooks, underwear looped through a leg hole or hangers.

Ms. Ming tried stacking shoe boxes on the selling floor so customers could

select their sizes without waiting for a clerk. But that backfired, she said, as

boxes were scattered, requiring extra staff (and money) for cleanup.

The boxes are back in the storage area, the experience pointing to an axiom of

the new smaller-is-better movement. “It’s building in as much flexibility as

possible,” Ms. Ming said.

In These Lean Days, Even Stores Shrink,

NYT, 9.11.2010,

https://www.nytimes.com/2010/11/10/

business/10small.html

In Recession,

Strategy Shifts for Big Chains

June 20, 2009

The New York Times

By STEPHANIE ROSENBLOOM

Shopping as we know it is on the brink of major change.

Hammered by the recession, some of the nation’s biggest retailers are seizing

the moment to reinvent their business strategies. And the impact will mean both

sweeping changes in the merchandise on their shelves and subtler alterations,

like how many pantyhose to keep in stock.

High-end stores like Neiman Marcus, Saks and Coach will offer more midpriced

merchandise. Many chains, including Wal-Mart, will carry less inventory and

fewer brands. The likes of Sears and J. C. Penney will put self-service

computers in stores so customers can browse collections or buy out-of-stock

items. And retailers of all stripes will offer more exclusive merchandise and

more attentive customer service.

One of the biggest changes consumers are likely to see is greater

personalization and regionalization of merchandise.

An initiative known as “My Macy’s” requires the retailer’s merchandisers and

other planners to go into stores each week to learn from the sales staff — who

keep logs at the cash registers — what shoppers are requesting, snapping up or

complaining about.

For instance, when strapless and bare-shouldered dresses were selling well

everywhere except Salt Lake City and Pittsburgh, Macy’s employees in those

stores knew the problem was that their customers wanted more modest dresses. So

they passed that information on to the merchandisers. Out went the strapless

dresses; in came dresses with cap sleeves. And sales went from lackluster to

robust.

Under the new system it will not be unusual for a local Macy’s to stock the

merchandise customers request, be it wide-width shoes or Sean John suits, and

for those offerings to be different from the ones in a Macy’s store 100 miles

away.

“I think what Macy’s is embarking on is perhaps the largest transformation in

our company in a couple of decades,” said Terry J. Lundgren, president and chief

executive.

The Macy’s change is just one example of a wide range of initiatives retailers

are pursuing as they struggle to cope with an economy where sales are lower than

they were just a few years ago.

At high-end stores, the era of ever-escalating prices on luxury goods appears to

be over. In the future, consumers will still be able to buy chic brand names,

but at a wider range of prices.

“Our customer loves our brands,” said Stephen I. Sadove, chairman and chief

executive of Saks. “They don’t want to trade down to lower brands. But they want

more of a range in price within the brands that they love.”

And that is what retailers intend to give them. Burton M. Tansky, president and

chief executive of Neiman Marcus Group, told investors on a conference call last

week that “we’re working with the designers to try and ease a portion of their

collections into a new price range.”

Prices will also be lower at some “affordable luxury” chains, like Coach, which

is increasing the proportion of handbags it sells for less than $300. About 50

percent of the company’s handbags will cost $200 to $300, in contrast to about

30 percent of handbags last year.

Another change is that consumers will have fewer brands from which to choose.

Wal-Mart, Target, Home Depot, and PetSmart are just a few of the chains

winnowing their brands. As Home Depot’s executive vice president for

merchandising, Craig Menear, put it: consumers are “time-starved” and “looking

for simplification in the entire shopping experience.”

That may delight minimalists, because it will be easier to find items on the

shelves. But it also limits choice.

Another potential drawback for consumers is that stores may run out of stock

more quickly than in the past because, as Mr. Lundgren of Macy’s explained,

“retailers learned that you can’t get out of the merchandise that you ordered

months before.”

“Instead,” he said, “you’re more likely to see retailers ordering fewer of each

individual size and taking that risk that they’ll sell out and not capture every

sale, rather than the risk of having too much inventory left over to mark down.”

Another trend is on the horizon: seasonal transitions for apparel will probably

have shorter lead times. With strapped consumers buying only what they need when

they need it, it has occurred to retailers that selling swimsuits to New Yorkers

in early March is not necessarily a winning strategy. And so chains are

beginning to work with suppliers to shorten the time between ordering and

delivering merchandise.

Consumers will also see even more of the exclusive collaborations between

retailers and prominent designers that are so prevalent today. That will help

distinguish stores as well as avoid price wars because the same items will not

be sold at multiple chains.

Yet another change will be the obliteration of any remaining divide between

online and in-store shopping.

In Sears stores, “appliance research centers” with computers are enabling

customers to compare local competitors’ prices. (If Sears does not offer the

best price, it will match the lowest offer and hand over 10 percent of the

difference.) Four J. C. Penney stores in Dallas are testing “FindMore” machines

the size of arcade games, letting customers see every item J. C. Penney sells

and find out if the item they want is in the store or online.

Shopping by cellphone will also become widespread.

“Everything we are developing is with a mind-set that it’s going to be running

on a handset,” said J. C. Penney’s chief information officer, Thomas M. Nealon.

Despite all the new technology, consumers will be getting more attention from

sales staff. During the last few years, retailers did not have to work hard to

separate consumers from their dollars.

But those days are over. More middle-market chains are striving for

Nordstrom-quality service to win customers. Even Home Depot has adopted its

“most extensive customer service training ever,” its chairman and chief

executive, Frank Blake, told investors and retailing analysts last week.

Of course, luxury chains have always featured a high level of attentiveness. But

the chains say that in this economy, customers have heightened expectations.

Saks, for one, has invested tens of millions of dollars in the last year on

software that provides its sales staff easy access to information about client

purchases and preferences, so that a returning customer might be greeted by a

sales representative who recalls the shopper’s suit size and penchant for

Christian Louboutin heels.

Economists and analysts forecast that it will take up to 10 years to return to

2007 levels of consumer spending — which makes now a good time for retailers to

re-imagine the future. Paul A. Laudicina, chairman and managing officer of A. T.

Kearney, the management consulting firm, noted that major consumer innovations

like Neoprene and Teflon came out of the Depression.

Mr. Lundgren pointed out that if consumers were still throwing money around,

stores might not want to alter strategies that were still working.

But with today’s recession, he said, “now is the time to aggressively rock the

boat.”

In Recession,

Strategy Shifts for Big Chains, NYT, 20.6.2009,

http://www.nytimes.com/2009/06/20/business/20retail.html

Retail Sales Are Weakest in 35 Years

December 5, 2008

The New York Times

By STEPHANIE ROSENBLOOM

The nation’s retailers turned in the worst sales figures in at least a

generation on Thursday, starting the holiday shopping season with double-digit

declines across a broad spectrum of stores.

For many chains, the precipitous sales drops that took hold in September and

October got worse, not better, in November, despite relatively strong sales in

the few days after Thanksgiving.

The International Council of Shopping Centers, an industry group, described

November’s figures as the weakest in more than 35 years. Declines were recorded

in every retail segment the group tracks, with the biggest coming from

department stores, with sales down 13.3 percent compared with November a year

ago, and specialty apparel retailers, down 10.4 percent.

Some retailers, though, have begun to figure out how to manage in the bleak

environment, selling huge amounts of merchandise at steep discounts to generate

cash. That will erode profits, of course. Department store profits will most

likely plummet 20 to 60 percent in the final three months of the year, said Bill

Dreher, senior retailing analyst with Deutsche Bank Securities. But retailers

who are unloading merchandise early in the season are at least demonstrating an

ability to take control.

“Even if they’re giving away the product, it reduces inventory levels and keeps

the problem from continuing,” Mr. Dreher said. “It shows retailers are being

disciplined.”

Retail stocks rallied Thursday as investors interpreted the sales report as

showing that, with sufficient discounts, goods can be sold in volume despite the

poor economy. The Standard & Poor’s retail index rose 1.5 percent.

The discounts being dangled by stores are the biggest retailing analysts have

ever seen. “When did you ever see, on Dec. 1, 70 percent off apparel on the high

end?” said Claire Gruppo, managing director of Gruppo, Levey & Company, a New

York investment bank. “You just don’t.”

Any retailer that refused to trot out jaw-dropping bargains in November paid the

price.

For example, Abercrombie & Fitch, the chain that uses sexy bodies in seductive

poses to sell clothes to teenagers and young adults, has refused to get on the

discount bandwagon. In November, sales at stores open at least a year, an

important measure of retail health, fell a whopping 28 percent for the company,

in contrast to a 2 percent increase for the period a year ago.

That is a far worse decline than previous months: Sales at Abercrombie & Fitch

stores open at least a year were down 14 percent in September and 20 percent in

October.

Saks, on the other hand, has driven consumers into shopping frenzies with

eye-popping deals on luxury names like the Armani Collezioni and Zac Posen. The

tactic worked: In November, Saks had only a 5.2 percent decline in sales at

stores open at least a year, clawing its way up from months of double-digit

declines.

Other stores that improved their lot in November took a page from the same

playbook. Neiman Marcus, for example, has also been selling luxury goods at

startling discounts. Sales at Neiman Marcus stores open at least a year fell

11.8 percent in November — better than the 15.8 percent drop in September and

the 27.6 percent dive in October.

“If you don’t understand the consumer and his mood right now and you’re doing

things as usual,” said Walter Loeb, president of Loeb Associates, a consultant

firm, “you’re not going to get any business.”

Stunning declines have become the norm in retailing since sales first plunged in

September amid the financial crisis. The November figures indicate the downturn

is migrating to some discount and warehouse stores, some of which even had sales

growth in October.

Ken Perkins, president of Retail Metrics, a research firm, said either Wal-Mart

Stores was stealing market share from its bargain competitors or the whole

sector was softening.

At Target, sales at stores open at least a year tumbled 10.4 percent, in

contrast to a 10.8 percent increase a year ago. Sales at Target were down 3

percent in September and 4.8 percent in October.

Sales at Kohl’s stores open at least a year sank 17.5 percent, in contrast to a

10.2 percent increase last year. Sales at Kohl’s stores dropped 5.5 percent in

September and 9 percent in October. Sales at Costco were down 5 percent in

November after a 7 percent increase in September and a 1 percent dip in October.

Even some stores with October sales increases lost their edge in November.

Children’s Place, which had a 4 percent sales increase in October, sank 7

percent in November. Aéropostale, which was up 1 percent in October, was down 5

percent in November.

Of all the major retailers, only Wal-Mart and BJ’s Wholesale Club, two of the

country’s best-known discount chains, thrived, in part because of robust grocery

sales. Wal-Mart, in fact, enjoyed the biggest grocery sales spike in its

history.

With new lines of brand-name merchandise from makers like Sony and Samsung, and

with rock-bottom prices and an ability to move high volumes of merchandise,

Wal-Mart seems to have cornered the market on Christmas this year.

The company began the critical holiday season by exceeding expectations. Sales

at stores open at least a year increased 3.4 percent in November, not including

fuel, compared with a 1.5 percent increase a year ago.

(The company made a point of being subdued in its sales announcement, noting its

sadness that a worker, Jdimytai Damour, had been trampled to death at a Wal-Mart

in Valley Stream, N.Y., when rowdy shoppers burst through the doors on Black

Friday.)

Sales at BJ’s Wholesale Club stores were up 4.1 percent in November, not

including fuel, compared with a 7.7 percent increase a year ago.

Many retailers were buoyed by sales over Black Friday weekend, which increased

about 0.9 percent, compared with a 6.5 percent increase last year, according to

ShopperTrak, a research firm. Yet the weekend after Thanksgiving did not account

for the majority of retailers’ November sales. Results for the month were

weakened, many people in retailing said, by the calendar — a later Thanksgiving

this year meant fewer post-Thanksgiving shopping days in November.

“The Thanksgiving weekend improvement was not enough to significantly alter the

month’s outcome,” Linda M. Farthing, president and chief executive of Stein

Mart, said in a statement on Thursday. “We expect to continue aggressive

promotional activity through the remainder of the year.”

It was a plan echoed on Thursday by other retailers, like American Eagle

Outfitters and Kohl’s.

John D. Morris, an analyst with Wachovia whose Holiday Sale Rack Index tracks

promotions at specialty mall retailers, said discounts were up 12 percent

compared with last year. That may not sound like much, but it is the biggest

jump in the decade-long history of the index. Usually, a big promotional period

sends the index up 5 percent.

“It’s a terrible story for retailers and their margins,” said Michael Unger, a

principal with Archstone Consulting. “But if you’re a consumer looking for a

good deal, you will find it.”

Retail Sales Are Weakest

in 35 Years, NYT, 5.12.2008,

http://www.nytimes.com/2008/12/05/business/economy/05shop.html

Mega-mall:

Is this the future of shopping?

He's built a global empire of malls.

Now, in London,

Frank Lowy is about

to unveil his boldest project yet

– just as

recession hits.

Does he know something we don't?

Rob Sharp reports on a £1.7bn gamble

Thursday, 23 October 2008

The Independent

On a building site in west London, 8,000 contractors are

crawling across a gargantuan, soon-to-be-finished shopping centre. Lifts raise

builders in hi-vis jackets as they finish painting restaurant exteriors. Droves

of stone masons hurriedly shift huge granite slabs into their final resting

places. Sparks from welding torches cascade to the floor. Rivers of polythene

wrapping snake as far as the eye can see.

When Boris Johnson opens its doors on Thursday next week, Westfield London will

be Britain's largest urban shopping centre. Sprawling across 43 acres just north

of Shepherd's Bush Green, it will house 265 shops, with Tiffany & Co, Louis

Vuitton, Gucci, Prada and De Beers offering glitz alongside Waitrose, Russell &

Bromley, Marks & Spencer and other familiar high-street names. There will be

dozens of restaurants, a library, and two new London Underground stations to

bring in the masses. Those who drive will have the option of employing the

services of a 70-strong team of valets. Needless to say, this is no ordinary

shopping centre. Its makers are marketing it as the cutting edge of "retail

experiences".

Costing £1.7bn, it is also the biggest venture – in monetary terms – that the

development company, Westfield, has ever undertaken. Back in 2004, when

Westfield bought the site, it must have seemed an irresistible way to ride the

consumer boom. Given the current economic climate, it feels like an even more

audacious move than the company may have intended. Household budgets are under

pressure; consumer confidence is far from buoyant. Earlier this week, The Ernst

& Young Item Club, an influential forecasting agency, predicted that consumer

expenditure on everything from food, clothes, holidays, household bills, home

improvements and entertainment will fall by 1.2 per cent in 2009. This compares

with an average annual growth of 3.5 per cent over the past decade.

One would think such statistics would send a shiver down the spine of even the

most hardened of businessmen. But Westfield's chairman Frank Lowy, who turned 78

yesterday, is no ordinary corporate suit. According to Australian media reports,

he boasts a fortune of £2.4bn, making him the richest man in Australia. Born in

Slovakia, he arrived in Australia in 1953 after spending a period shortly after

the Second World War in a refugee camp in Cyprus. After founding Westfield in

1959 with business partner John Saunders (who died in 1997 aged 75), Lowy has

grown his company into the biggest publically listed retail property group in

the world. It is valued at more than £26bn, and leases 10 million square metres

of retail space to 23,000 retailers in 119 centres around the world. In the

company's homeland, as many people speak of "going to Westfield" as they do of

"going shopping".

But pulling off this audacious development is more than just a question of

battling economic forces. Local residents are far from pleased about the effects

of bus routes imposed by Hammersmith and Fulham council to serve the new centre.

Writing in the London Evening Standard this week, the novelist Sebastian Faulks

slammed the new routes planned for areas close to the development for running

through some of the capital's historic conservation areas. He also described how

the council's consultation over the new routes was radically under-resourced,

and how new buses will add unnecessary pollution and congestion to already busy

and dirty streets. In addition, the scheme – located just three miles from

London's West End – will draw customers away from already cash-strapped Oxford

Street shops. For years, Westfield London has been spoken of as the nail in the

coffin of Oxford Street.

Meanwhile, tax authorities in Australia are investigating Lowy amid claims by

the US Senate that he hid £42m from the Australian Taxation Office. But this is

all in a day's work for a man who obtained a shrapnel scar on his forehead when

fighting for the Israeli army. Westfield London, experts say, will still manage

to bring a smile to his lips.

Lowy was born into a Jewish family in 1930 in Fil'akovo, a rural town in what

was then Czechoslovakia. According to the official biography on the Westfield

website, at an early age he helped his mother to run the family grocery shop.

When the Second World War broke out, his family sold their shop and fled to

Budapest. Here, Lowy helped his older brother, John, run a metalware business,

but the family was soon hit by tragedy. When the Nazis invaded Hungary in March

1944, Lowy's father was captured and sent to Auschwitz, where he eventually

died. Without the family's main breadwinner, Lowy supported his mother by

foraging for food.

When the war ended, Lowy left Europe for Israel. On his way, he was picked up by

the British Army and spent several months in a refugee camp in Cyprus. After his

release, he reached Israel, aged 17, to join the nation's Golani Brigade, an

army unit fighting in the 1948 Arab-Israeli war.

When the war finished the same year, Lowy spent a brief time working in a bank,

and studying to become an accountant at night school. Eventually, he decided to

go to Australia, to where many members of his family had already moved. He

arrived there on 26 January 1952, carrying a small suitcase, and possessing only

a basic knowledge of English. "All those events shaped my life," Lowy said in an

interview earlier this month. "It's a requirement to have some sort of paranoia.

You have to think of what can go wrong even when times are good. So you can

never enjoy your success fully."

In Sydney, the man who would become a property magnate managed to scrape

together enough cash to buy a van. He began work as a deliveryman, and it was

then that he met Saunders, another Holocaust survivor, who had set up a small

shop in the outskirts of Sydney. The pair's first business venture together was

running a delicatessen. They soon realised that along with salami and rye bread,

newcomers from Europe needed a wider array of goods. They borrowed from a local

bank manager and used profits from the deli to buy farmland out of town. The

pair read about the popularity of American shopping malls, and in 1959 built

their first shopping centre on that land. Westfield Investments was listed on

the Australian stock exchange in 1960. Over the next two decades, the pair built

up their company to become one of the best-known shopping centre providers in

Australia, where Lowy now owns 44 malls.

In 1977, the company bought its first US shopping centre, in Connecticut, but it

was not until 2000 that the company gained its first foothold in the UK market.

In March of that year it bought the Broadmarsh centre in Nottingham, in

partnership with the investment house Hermes. The same year it also acquired

shopping centres in Tunbridge Wells, Guildford, Derby and Northern Ireland.

Now, Lowy runs his worldwide empire – across Australia, New Zealand, the United

States and Britain – with his two sons, group managing directors Steven and

Peter. Frank Lowy is based on the top floor of the 24-storey Westfield Towers in

Sydney, which his company built in 1974. The company founder's own floor has

uninterrupted views of Sydney's Opera House and Harbour Bridge, near to which

Lowy's 74-metre yacht, named Ilona IV after his mother, is berthed. It was here

that the Australian executive worked on his plan to enter the UK market – a plan

that took his three decades to perfect.

The company developed its first UK shopping centre, after demolishing an

existing mall in Derby. The £340m Westfield Derby project opened in October of

last year. It was the biggest shopping centre to open in Britain that year. Now,

Westfield hopes its west London development – located in an area known as White

City – will move shopping centre development in the UK to the "next level".

"All our projects are about evolution," says Westfield UK and Europe managing

director Michael Gutman. "In the White City project we are trying to bring

together all the knowledge we have gathered from our 118 centres in four

countries around the world. This will be our 119th. It is a unique trading area

and demographic in terms of the power and disposable income of the people who

live nearby. It is unparalleled in terms of connectivity. It contains some

phenomenal public spaces both inside and out."

The story of how Westfield created Westfield London goes back four years. It

involves a complicated series of acquisitions and joint ventures, but

essentially involved Westfield taking control of an existing scheme being

developed by fellow property firm Chelsfield in 2004.

Westfield bought out its partners in that acquisition, the Reuben brothers,

billionaire private investors, and Multiplex, the Australian construction firm.

In 2006 Westfield also took control of the project's construction from the

Australian construction firm Multiplex, which at the time was dealing with

negative press surrounding the late delivery of Wembley Stadium, which it was

also contracted to build. Westfield currently owns a half stake in Westfield

London, with the other half being owned by the property arm of the German

financier Commerzbank.

Before Westfield's acquisition of the development, the acclaimed British

architect Ian Ritchie had designed a concept for the shopping centre. He had

suggested a number of features, which included the interior of the centre being

covered by a fabric roof. When Westfield took control, it decided not to

continue its relationship with Ritchie and brought its own in-house designers on

board, who collaborated with out-of-house architects on specific elements of the

scheme. These external designers included a young firm of London architects,

Softroom, who designed a futuristic-looking café court called "The Balcony".

Acclaimed New York designer Michael Gabellini took charge of blueprints for "The

Village" – the separate area of the centre where the luxury brands such as

Tiffany & Co are housed.

Westfield's own architects scrapped the fabric roof in favour of a glass version

that would allow more light to enter the centre's interior. They also introduced

a street of bars and restaurants that will be open around the clock – the

"Southern Terrace" – at the centre's south-east corner, at the suggestion of

superstar architect Richard Rogers, who at that point was acting as an adviser

to former London mayor Ken Livingstone. Rogers felt the street would improve the

area's public space.

"Normally we design all of our own buildings. But when we acquired the property,

its design had already won planning permission from the council and it was under

construction," says Gutman. "On a major retail development, the planning and

circulation requires knowledge and experience. So we needed to bring on board

some specialists, which we got through Softroom and Michael Gabellini."

On a private tour with the developer late last week, two weeks before the

completion of construction, things appeared to be in impressive shape.

Approaching Westfield London from the south-east, where a new bus terminal and

specially designed, sleek-looking Shepherd's Bush Tube station sit, shoppers

ascend the shallow granite ramp or "shopping street" of "Southern Terrace". This

street is already lined with finished restaurants, outside which diners will sit

on terraces overlooking the thoroughfare. The façades of the restaurant are of

various sizes and designs to give each its own character. Overhead, various

canopies, each again of unique size and material, offer protection from the

elements. The red Westfield logo is affixed at key points to the street's

façade.

Entering through a huge glass entrance, customers encounter a massive central

space. Above this, one gets a look at the distinctive, undulating glass roof,

through which daylight streams to cast triangular patterns on perfectly white

walls.

This central space contains a large central "well" surrounded by the centre's

three floors. On the uppermost of these, a 14-screen cinema, due to open next

autumn, will allow film-goers to take a beer, wine or cocktail to the newest

film releases as well as to reserve special "VIP" areas.

On the floor beneath this, the clothing store Timberland has turned the front of

its shop into what appears to be a large wooden box, in line with the company's

"rugged and outdoor" branding. A short distance away, Apple has finished its

unit with typical white minimalism. To one side, Softroom's "Balcony" stretches

for some 50 metres. Its futuristic, capsule-like appearance is contained within

a façade that appears to be divided into a series of wooden slats. Here, an

array of dedicated restaurants such Crocque Gascon – who will serve modern

French cuisine like "duck burger classique" – and Vietnamese street food

restaurant Pho, will serve to customers who will then sit at a shared seating

area.

On the lowest floor, DKNY and Russell & Bromley have leased units. Gabellini's

"Village" lies to the north-east of this central space. Here, the ceiling is

shaped into soft ovals of plastic from which chandeliers hang.

Such features seem to have gone down well with retailers. At the time of

opening, Westfield says the centre will be more than 96 per cent leased. Around

90 per cent of the tenants locked into 10 to 15-year contracts before the full

extent of the current economic crisis was known. Unless the shops go out of

business, Westfield will get their money.

It may sound worrying for the retailers concerned, but signing on Lowy's dotted

line may well prove to suit them as much as Westfield. It's impossible to know

the details of each deal, but industry experts believe that they may not have to

part with any cash for the first year or two. So they can take their places in

this glittering cathedral to the future of shopping, and pay for it when (they

hope) the economy, and consumer confidence, is in an altogether better place.

And many believe that Lowy will prosper despite the current economic gloom.

"Rather than being troubled by the financial crisis, Westfield has almost landed

on its feet," says Retail Week editor Tim Danaher. "In fact, far from being

unenthusiastic about the development, retailers don't want to be left out. While

the details of the deals they have struck are mired in secrecy, Westfield, like

all developers of new shopping centres, will have made concessions – such as

rent-free periods and contributions to the shops' fit-outs, which have helped to

persuade people to come on board. While some of the smaller retailers might go

bust, the big guys won't come unstuck. Westfield has got the stomach to cope."

It has not all been plain sailing for Lowy and his empire, however. The business

news agency Bloomberg reports that the billionaire is embroiled in a bout with

tax authorities. The Australian Taxation Office is investigating claims that he

hid £42m from tax officials. A US Senate panel had alleged in July that the Lowy

family and LGT Group, a bank owned by Liechtenstein's royal family, had used a

foundation and companies registered in Delaware and the British Virgin Islands

to conceal the fact that the Lowys owned the money in question. This is

something Frank Lowy has vehemently denied.

On a more local level, the White City scheme has encountered a degree of

opposition. Nigel Kersey, director of the London branch of the Campaign to

Protect Rural England, tried unsuccessfully to take the local council to court

in 2000 for failing to ask for an environmental damage assessment over the

initial Chelsfield scheme. "Had the planning authority played by the rules, it

would have shown that the impact would be substantial," he said at the time.

Since then, Westfield says it has conducted broad consultations and that local

groups now welcome the project. Indeed, the company is so confident that it is

pressing on with plans to build a £1.45bn, 175,000sq m centre in Stratford, east

London, to be completed in time for the 2012 Olympics. "The current slowdown is

only likely to be relatively short-term compared with the planning process and

the active life of a shopping centre," says Richard Dodd, a spokesperson for the

British Retail Consortium, which represents British shopping centres. "Now, when

retailers are competing more fiercely for customers' every pound, investing in

your premises can be a good thing to do. Shopping centres offer great access and

investment in retail."

Certainly, Michael Gutman feels the company has done enough to make sure that it

is not hit by any forthcoming economic crash. "Most definitely we are in this

for the long haul," he concludes. "We have a history of being long-term owners.

We are beginning our relationship with Londoners and we hope to be embraced as a

new icon on the landscape, like Covent Garden or the O2.

"We have opened projects in recessions before and in booms before. These

buildings are built for long-term and they take several years to settle. The

retailers who have taken stores are our customers and we are in a partnership

with them to maximise their performance. The ability to effectively come in the

morning to do grocery shopping and have a coffee and maybe go to the gym and go

back home as well as doing fashion shopping surpasses anything you currently see

in the high street."

In an interview last month, Frank Lowy, Gutman's ultimate boss, divulged that a

few times a month, he plays poker. The billionaire says he gambles for stakes

high enough to be painful if he doesn't win. "It has to hurt you a little bit

when you lose," he said, declining to say how much someone with his finances

might actually bet. "And I don't like to lose, period."

This time, with the ante at £1.7bn, you can bet that losing would cause Lowy

considerable pain.

Mega-mall: Is this

the future of shopping?, I, 23.10.2008,

http://www.independent.co.uk/news/uk/this-britain/

megamall-is-this-the-future-of-shopping-969624.html

Cost of

a shopping basket soars

in the 'phoney' supermarket price war

Saturday,

12 July 2008

The Independent

By James Thompson

and Sam Kriss

British supermarkets have introduced massive price hikes over the past year,

shattering the myth of a so-called price war in which grocers are bending over

backwards to help hard-pressed consumers.

Tesco, Asda and Sainsbury's have ramped up the price of many products by between

22 and 32 per cent over the past 13 months, hitting customers at a time when the

cost of living is soaring, The Independent can reveal.

The soaring figures illustrate the level of food inflation heaped on consumers,

as they face spiralling petrol prices, rising utility bills and stagnating house

prices. The revelation comes at a time when grocers are as active as ever in

claiming that they are delivering millions of pounds of price cuts to consumers.

On a sample of 17 products, Sainsbury's has hiked prices by 31.6 per cent, Tesco

by 27.5 per cent and Asda by 21.6 per cent between 11 June 2007 and 11 July

2008, according to grocery price comparison site, mysupermarket.co.uk.

The Independent tracked 17 products including thick-sliced white bread (800g),

six pints of semi-skimmed milk, English butter (250g) and garden peas (1kg).

Tesco has raised the price of white bread from 54p to 72p; Sainsbury's has hiked

the price of Basmati rice (1kg) from 90p to £1.89p; and Asda has increased

English butter from 58p to 94p, as have its other two rivals.

These figures dwarf the estimates of the British Retail Consortium, which this

week said that food cost 7 per cent more in British supermarkets in June than it

did in the same month last year.

Before the last weekend in June, Tesco said it would reduce the price of 3,000

items by up to 50 per cent, while Asda promised to sell 10 staple items,

including bread, eggs and butter for only 50p until end of trading on 29 June.

However, industry experts say the current activity on price does not compare to

previous battles, and is more about PR than helping consumers.

Greg Lawless, an analyst at Blue Oar, says: "I don't think there is a price war.

This is a price skirmish. The last proper price war we had was in the early