|

Vocapedia

>

Economy > Companies

> Profits

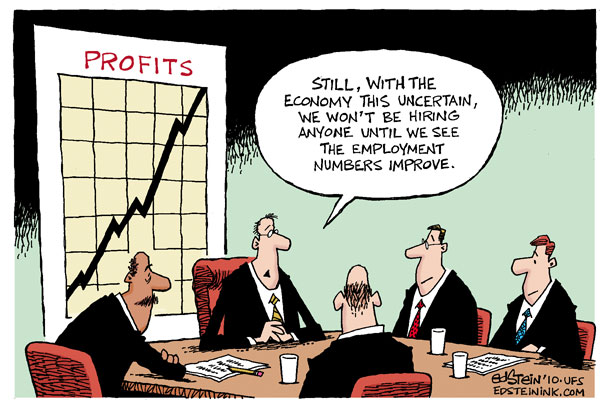

Ed Stein

cartoon

Denver, Colorado

Cagle

6 October 2010

profits UK

https://www.theguardian.com/business/2023/feb/07/

bp-profits-windfall-tax-gas-prices-ukraine-war

profit

USA

https://www.npr.org/2020/11/06/

932045805/what-blockbuster-automaker-profits-tell-us-

about-the-pandemic-economy

https://www.npr.org/sections/thetwo-way/2018/02/08/

584220408/twitter-announces-a-profit-for-the-first-time

https://www.nytimes.com/2015/07/22/

technology/apple-earnings-q3.html

https://www.nytimes.com/2014/01/31/

technology/revenue-and-profit-rise-at-google-

but-mobile-struggles-continue.html

earnings / profits

USA

https://www.npr.org/2020/11/06/

932045805/what-blockbuster-automaker-profits-tell-us-about-the-pandemic-economy

http://www.nytimes.com/roomfordebate/2014/09/14/pocketing-profits-or-reinvesting-them

report bumper third-quarter

profits

report

an 18 percent rise in quarterly revenue

and a near doubling of profit

achieve record

profits

post record

profits UK

http://www.theguardian.com/business/2006/feb/02/

oilandpetrol.news

double UK

https://www.theguardian.com/business/2023/feb/07/

bp-profits-windfall-tax-gas-prices-ukraine-war

first-quarter profit

USA

full year profits

profitable quarter

USA

http://www.nytimes.com/2010/10/27/

business/27auto.html

post a profit

post a

lower quarterly profit

post a higher

quarterly profit

http://www.nytimes.com/2010/11/17/business/17shop.html

post

a higher-than-expected profit thanks to cost cutting

post a 67 percent

increase

in first-quarter earnings / profit

report impressive earnings

USA

https://www.npr.org/2020/11/06/

932045805/what-blockbuster-automaker-profits-tell-us-about-the-pandemic-economy

first-quarter profit and revenue

USA

http://www.nytimes.com/2010/10/29/technology/29soft.html

increase in profit

USA

http://www.nytimes.com/2013/01/23/

technology/ibm-continues-its-profit-growth.html

drop in profit

USA

http://www.nytimes.com/2013/01/25/

technology/microsoft-reports-drop-in-profits.html

profit / net earnings

UK / USA

https://www.nytimes.com/2013/10/25/

technology/amazons-revenue-soars-but-no-profit-in-sight.html

https://www.nytimes.com/2012/07/27/

technology/amazon-delivers-on-revenue-but-not-on-profit.html

https://www.theguardian.com/business/2011/feb/28/

hsbc-profits-double-almost-twelve-billion-pounds

http://www.nytimes.com/2011/01/29/business/29ford.html

http://www.nytimes.com/2010/11/24/business/economy/24econ.html

http://www.nytimes.com/2010/11/17/business/17shop.html

http://www.nytimes.com/2010/10/20/technology/20yahoo.html

http://www.nytimes.com/2010/04/23/technology/23amazon.html

http://www.nytimes.com/2009/10/21/technology/companies/21yahoo.html

http://www.nytimes.com/2009/04/24/technology/companies/24microsoft.html

http://www.guardian.co.uk/business/2008/oct/28/oil-oilandgascompanies

https://www.independent.co.uk/news/business/news/

bp-announces-pound-37maday-profits-879641.html - 29 July 2008

http://www.guardian.co.uk/business/2008/jan/31/royaldutchshell.oil1

quarterly profit

underlying profits

operating profit

record profit

UK / USA

http://www.npr.org/blogs/thetwo-way/2013/04/02/

176011012/fannie-mae-posts-record-profit-paid-taxpayers-11-6-billion-in-2012

http://www.nytimes.com/2010/01/22/business/22goldman.html

http://www.guardian.co.uk/business/2009/apr/21/tesco-record-profits-supermarket

http://www.guardian.co.uk/business/2008/oct/30/oil-royaldutchshell

http://www.independent.co.uk/news/business/news/

record-profits-for-lloyds-but-tougher-times-ahead-804615.html

report its fourth

consecutive quarterly profit USA

http://www.nytimes.com/2010/04/28/business/28ford.html

report a record profit

USA

http://www.nytimes.com/2010/01/22/business/22goldman.html

monster

profits UK

https://www.theguardian.com/environment/2023/feb/09/

profits-energy-fossil-fuel-resurgence-climate-crisis-shell-exxon-bp-chevron-totalenergies

triple

USA

http://www.nytimes.com/2009/10/21/technology/companies/21yahoo.html

bounce back /

return to profit UK

http://www.theguardian.com/business/2013/aug/01/lloyds-sell-off-moves-nearer-profit

annual

profit growth forecast

raise one's profit forecast

rise in profits

windfall

USA

https://archive.nytimes.com/dealbook.nytimes.com/2011/01/18/

study-points-to-windfall-for-goldman-partners/

bumper year

pre-tax profits

capitalization

USA

https://www.npr.org/sections/thetwo-way/2017/05/10/

527715624/espn-troubles-cloud-disney-earnings-apple-surpasses-800-billion-mark

Drug Makers Reap Benefits of Tax Break

NYT

May 8, 2005

https://www.nytimes.com/2005/05/08/business/08taxes.html

profit warning

UK

https://www.theguardian.com/business/2011/apr/05/

hmv-third-profit-warning-this-year

a profit warning from

N

drop in profits

drop

USA

https://www.nytimes.com/2009/07/31/

business/global/31oil.html

warn of

profits slump

a 29 per cent slump in full-year

profits

Corpus of news articles

Economy > Companies > Profits

Amazon

Delivers on Revenue

but Not on Profit

July 26,

2012

The New York Times

By DAVID STREITFELD

SAN

FRANCISCO — Leaping revenue, little profit.

That is the long-established Amazon story, and those who expected to hear it

again Thursday were not disappointed.

The company reported sales of $12.8 billion, up 29 percent, in the second

quarter while it eked out net income of $7 million, or a penny a share.

Those results essentially matched expectations. Analysts had estimated the

Seattle-based retailer would earn 2 cents a share, down from 41 cents a share in

the second quarter of 2011.

In what is becoming a routine warning, Amazon said that profit in the current

quarter would remain elusive. Revenue might grow as much as 31 percent, the

company said, but it was expecting a loss. Losses at Amazon were routine in its

early years but in recent years it has made a profit, albeit a small one.

This would be devastating news from some Internet companies. But Amazon bulls

were unfazed, saying the retailer was investing, as always, in the future.

“If they keep this up, there’s a good possibility that you’re looking at

shopping malls going the way of the record store and the bookstore and the video

rental store,” said Jason Moser, who covers Amazon for the Motley Fool

investment site.

Amazon shares Thursday were up $3 to $220 during regular trading. The stock is

trading only about 10 percent below its record high, with a stratospheric

price-to-earnings ratio of about 170. In after-hours trading, shares continued

rising.

Since its founding in 1994, Amazon has been focused on broadening its product

and customer bases, not pumping up its profit margins. And the growth has been

tremendous — it is now one of the country’s largest retailers. Even in North

America, its most established market, it has been growing consistently more than

twice as fast as the e-commerce market as a whole, a Forrester Research report

released Thursday noted.

Amazon is building 18 new fulfillment centers around the world this year. In the

United States, many of them are close to major cities, including New York City,

San Francisco and Los Angeles. In a conference call with analysts, Thomas J.

Szkutak, Amazon’s chief financial officer, said, “We’re investing certainly for

the long term.”

In the past, Amazon declined to build warehouses in states where it had many

customers, because it would then have to collect sales taxes from them. Now the

promise of offering these areas even faster delivery seems to be more of an

imperative than continuing to fight the tax issue.

Amazon fans probably dream of ordering books or bagels and getting them the same

day. But Mr. Szkutak indicated this would remain a dream. “We don’t really see a

way to do same-day delivery on a broad scale economically,” he cautioned.

Six of the new warehouses are already open. Getting some of the others ready for

the all-important holiday season helps explain the predicted absence of profit

in the third quarter. The centers are a large factor in Amazon’s accelerating

head count, which is up 60 percent over the last year to 60,000 employees.

One word that was little mentioned during the call by either Mr. Szkutak or the

analysts: Kindle. Amazon’s tablet, the Kindle Fire, was introduced last fall in

an ocean of hype. New models are seen by some as overdue.

“We’re excited about the road map we have” for e-readers and e-books, Mr.

Szkutak said. He declined to say what that map was.

Amazon Delivers on Revenue but Not on Profit,

NYT,

26.7.2012,

https://www.nytimes.com/2012/07/27/

technology/amazon-delivers-on-revenue-but-not-on-profit.html

HSBC profits double to almost £12bn

• Unnamed highest-paid banker

earned over £8.4m in 2010

• Chief executive Stuart Gulliver earned £6.1m

Monday 28 February 2011

10.49 GMT

Guardian.co.uk

Jill Treanor

This article was published on guardian.co.uk

at 10.49 GMT

on Monday 28 February

2011.

It was last modified at 15.40 GMT

on Monday 28 February 2011.

It was first published at 09.28 GMT

on Monday 28 February 2011.

HSBC revealed that its highest-paid banker took home more than

£8.4m last year as it reported that profits more than doubled to $19bn (£11.8bn)

in 2010.

The UK's largest bank also admitted that more than 253 of its staff were paid

more than £1m last year and that some 89 of these were based in the London.

The bank said 280 of its most senior employees had shared in bonuses of $374m.

Some 186 of these were in the UK and their share of the bonuses was $172m. This

means key bankers in the UK get paid an average bonus of $920,000 verses $1.3m

group-wide, although this is partly because the UK numbers include lower-paid

staff involved in monitoring the bank's risks.

Information provided by the bank showed that if their salaries are included,

those key staff earned a total of $471m, which averages at $1.7m – just over

£1m.

Stuart Gulliver, who took over as chief executive at the start of the year, is

to take his £5.2m bonus in shares. His total pay was £6.1m, down on the £10m he

received a year ago when he was the highest-paid employee of the bank.

While the chief executive's office is Hong Kong, Gulliver joked that he lives on

Cathay Pacific and British Airways, spending a third of his time in the UK, a

third in Hong Kong and a third in the air.

For 2010, the highest-paid banker – who is not named – received between £8.4m

and £8.5m; one took £6.8m and three received between £6.3m and £6.4m.

HSBC provides more information about pay than other financial institutions

because it is listed in Hong Kong, which demands disclosure of the five

highest-paid staff. In banking, the biggest earners are often outside the

boardroom.

Under Project Merlin, the deal between major banks and the UK government, the

disclosure is different and only requires the pay of the five highest-paid

executives outside the boardroom – rather than all bankers and traders – to be

disclosed. Under this measure the highest-paid executive received £4.2m.

The information about the bonus pool for senior staff is being provided to

comply with a new Financial Services Authority rule, which requires so-called

"code staff" – those deemed to be high paid and taking big risks – to have their

pay published in aggregate.

Gulliver replaced Michael Geoghegan as chief executive after a very public

boardroom reshuffle. For 2010 Geoghegan received £5.8m after his £2m salary and

benefits were topped by a £3.8m bonus. He is also to receive £1m for 2011 and a

pension contribution of £401,250 under the terms of his contract. While he

stepped down at the end of December, he will receive £200,000 in consultancy

fees to 1 April, which he will donate to charity.

The bank cut its long-term return on equity target to 12%-15% from a previous

15%-19% target, blaming the costs caused by regulations requiring banks to hold

more capital and extra liquid instruments that can be sold quickly in a crisis.

The shares fell 4% to 682p as the market digested numbers which, Gulliver

admitted, showed income was flat, costs were up and that profits had been

bolstered by the $12.4bn fall in impairments to $14bn – the lowest level since

2006.

The new finance director, Iain Mackay, said: "We've targeted 12% to 15% through

the cycle for return on equity, principally taking into consideration what we

view as a somewhat unstable and uneven economic recovery over the coming years

as well as much higher capital requirements."

Commenting on the profits, which were below the $20bn estimated by analysts,

Gulliver said: "Underlying financial performance continued to improve in 2010

and shareholders continued to benefit from HSBC's universal banking model.

"All regions and customer groups were profitable, as personal financial services

and North America returned to profit. Commercial banking made an increased

contribution to underlying earnings and global banking and markets also remained

strongly profitable, albeit behind 2009's record performance, reflecting a

well-balanced and diversified business."

HSBC's new chairman, Douglas Flint – who was the finance director until he

replaced Stephen Green in December – said the group would not forget the

financial crisis and support from governments around the world, adding the group

entered 2011 "with humility". Green's departure to join the government as trade

minister caused the bank to reorganise its top team last year.

But Flint hit out against George Osborne's permanent levy on bank balance

sheets, saying that if the chancellor removed the levy – which will cost HSBC

about $600m – the bank would increase its payouts to shareholders. The final

dividend was announced at 12 cents, up from 10 cents at the same point last

year.

Flint was also concerned about the new rules that force banks to hold more

liquid instruments such as government bonds. "It will be a near impossibility

for the industry to expand business lending at the same time as increasing the

amount of deposits deployed in government bonds while, for many banks but not

HSBC, reducing dependency on central bank liquidity support arrangements," he

said.

"It is to be hoped that the observation period, which starts this year and

precedes the formal introduction of the new requirements, will inform a

recalibration of these minimum liquidity standards."

For 2009 the bank reported a 24% fall in pre-tax profit to $7bn (£4.63bn), which

included a total bill for salaries and bonuses of $18.5bn, down 11%.

HSBC profits double

to almost £12bn, G, 28.2.2011,

http://www.guardian.co.uk/business/2011/feb/28/

hsbc-profits-double-almost-twelve-billion-pounds

Corporate Profits

Were the Highest

on Record Last Quarter

November

23, 2010

The New York Times

By CATHERINE RAMPELL

The

nation’s workers may be struggling, but American companies just had their best

quarter ever.

American businesses earned profits at an annual rate of $1.66 trillion in the

third quarter, according to a Commerce Department report released Tuesday. That

is the highest figure recorded since the government began keeping track over 60

years ago, at least in nominal or non-inflation-adjusted terms.

Corporate profits have been going gangbusters for a while. Since their cyclical

low in the fourth quarter of 2008, profits have grown for seven consecutive

quarters, at some of the fastest rates in history.

This breakneck pace can be partly attributed to strong productivity growth —

which means companies have been able to make more with less — as well as the

fact that some of the profits of American companies come from abroad. Economic

conditions in the United States may still be sluggish, but many emerging markets

like India and China are expanding rapidly.

Tuesday’s Commerce Department report also showed that the nation’s output grew

at a slightly faster pace than originally estimated last quarter. Its growth

rate, of 2.5 percent a year in inflation-adjusted terms, is higher than the

initial estimate of 2 percent. The economy grew at 1.7 percent annual rate in

the second quarter.

Still, most economists say the current growth rate is far too slow to recover

the considerable ground lost during the recession.

“The economy is not growing fast enough to reduce significantly the unemployment

rate or to prevent a slide into deflation,” Paul Dales, a United States

economist for Capital Economics, wrote in a note to clients. “This is unlikely

to change in 2011 or 2012.”

The increase in output in the third quarter was driven primarily by stronger

consumer spending. Wages and salaries also rose in the third quarter, which

might help bolster holiday spending in the final months of 2010.

Private inventory investment, nonresidential fixed investment, exports and

federal government also contributed to higher output. These sources of growth

were partially offset by a rise in imports, which are subtracted from the total

output numbers the government calculates, and a decline in housing and other

residential fixed investments.

Corporate Profits Were the Highest on Record Last Quarter,

NYT, 23.11.2010,

http://www.nytimes.com/2010/11/24/

business/economy/24econ.html

Profit Dropped 66% in Quarter

at Exxon Mobil

July 31, 2009

The New York Times

By JAD MOUAWAD

Exxon Mobil, the world’s biggest publicly traded oil company,

said Thursday that its profit dropped 66 percent in a second quarter after a

sharp fall in oil prices in the last year.

The oil giant reported that its net income fell to $3.95 billion, or 81 cents a

share, from $11.68 billion, or $2.22 a share, in the period a year ago.

Capital spending fell 6 percent to $6.56 billion in the quarter.

“Global economic conditions continue to impact the energy industry both in the

volatility of commodity prices and reduced demand for products,” the company’s

chairman and chief executive, Rex W. Tillerson, said in a statement.

The company’s combined oil and gas production fell 3 percent in the quarter,

because of restrictions imposed by OPEC producers and lower output from mature

fields. Exxon’s oil production in the quarter averaged 2.35 million barrels a

day and gas production was about 8.01 billion cubic feet a day. The company said

it increased its output from new projects in Qatar and in the United States.

Profit at the company’s production and exploration unit fell to $3.81 billion in

the second quarter, down $6.2 billion compared with a year earlier. In its

refining business, Exxon saw its profit drop to $512 million, down $1.05 billion

from a year ago. That included a loss of $15 million at Exxon’s domestic

refining business.

Despite the lower profit, Exxon continued its program to reward shareholders by

buying back shares and paying dividends. The company spent $5.2 billion in the

second quarter to buy back 75 million shares.

Exxon’s report caps a week of lower earnings across the energy industry after

oil prices tumbled from last year’s record levels and the global economy slowed

down. Oil prices, which had reached a record closing price of $145.29 a barrel

last July, recently traded around $63 a barrel.

The global recession is expected to reduce oil consumption around the world for

a second consecutive year, the first time that’s happened since the early 1980s.

Oil companies, which are struggling to adapt to a new environment of lower

prices and slower demand, have responded by slashing costs, paring down drilling

activities and shutting some operations.

Earlier on Thursday, Royal Dutch Shell reported that its net profit fell 67

percent in the second quarter, to $3.82 billion, from $11.6 billion in the

period a year ago. Sales were $63.9 billion, down from $131.4 billion in the

quarter a year ago. The company said that it planned to reduce capital spending

by more than 10 percent next year to about $28 billion and that it would cut

jobs.

Earnings at Shell’s exploration and production unit dropped 77 percent, to $1.33

billion, from $5,9 billion a year ago, mostly on lower oil prices. Production

declined 6 percent, to 2.9 million barrels of oil and equivalents a day, while

prices were $52.62 a barrel, down from $111.92 in the period a year ago.

“Our second quarter results were affected by the weak global economy. Shell’s

chief executive, Peter R. Voser, said. “This weakness is creating a difficult

environment both in upstream and downstream.”

On Wednesday, ConocoPhillips, the third-largest American oil company after Exxon

and Chevron, said that its quarterly profits tumbled 76 percent, to $1.3

billion, after a loss in its refining business. Chevron reports its earnings on

Friday.

The British oil giant BP said earlier this week that its profit declined 53

percent, to $4.39 billion. The company said it would reduce its costs by $3

billion this year, $1 billion more than it had initially planned. The company’s

chief executive, Tony Hayward, also signaled that he expected oil prices hover

in a range of $60 to $90 a barrel.

Julia Werdigier contributed reporting.

Profit Dropped 66% in

Quarter at Exxon Mobil, NYT, 31.7.2009,

http://www.nytimes.com/2009/07/31/business/global/31oil.html

Microsoft Profit

Falls for First Time in 23 Years

April 24, 2009

The New York Times

By ASHLEE VANCE

Fresh off one of the worst quarters in company history, Microsoft offered

investors little evidence that a beleaguered personal computer market would

recover anytime soon.

On Thursday, Microsoft set the wrong kind of record, as it reported the first

year-over-year quarterly revenue decline since it first sold stock to the public

in 1986. In its third quarter, which ended March 31, Microsoft said its revenue

fell 6 percent, to $13.65 billion, from $14.45 billion. It reported net income

of $2.98 billion, or 33 cents a share — a 32 percent drop from the $4.39

billion, or 47 cents a share, reported in the period last year.

The company’s Windows franchise has come under unprecedented pressure during the

recession as consumers and businesses have shied away from buying new computers

or have purchased cheaper machines. While Intel, the chip maker, said last week

that the worst of the PC decline had passed, Microsoft displayed no such

confidence.

“I didn’t see any improvement at the end of the quarter that gives me

encouragement that we are at a bottom and coming out of it,” Christopher P.

Liddell, Microsoft’s chief financial officer, said during a conference call to

discuss the company’s results. “They stopped getting worse, but that’s different

from they started getting better.”

The recession has generated a series of firsts for Microsoft, including its

first large layoff and first decline in Windows sales.

Microsoft, based in Redmond, Wash., said its earnings included 6 cents of

charges related to the layoffs and impairments to investments.

Analysts surveyed by Thomson Reuters had expected Microsoft to earn 39 cents a

share, excluding the one-time charges, on revenue of $14.1 billion.

Intel supplies the processors for most PCs, while Microsoft supplies the key

operating system software.

Last week, Intel’s chief executive, Paul S. Otellini, declared that “the worst

is now behind us.”

Mr. Liddell of Microsoft maintained a more somber tone. “While we would all like

to think a recovery will be soon and painless, we actually believe it will be

slow and painful,” he said.

Still, shares of Microsoft rose in after-hours trading after release of the

results as investors apparently took solace from the company’s cost-cutting

efforts.

Microsoft has lowered its forecast of its operating expenses by as much as $1

billion for the year.

“Microsoft, like everyone else, has got serious about cost-cutting,” said

Brendan Barnicle, a software analyst with Pacific Crest Securities. “They never

really had to do that before, and investors had been hoping they would cut

more.”

Microsoft’s online services business, which competes with Google and Yahoo,

continued to disappoint observers as a depressed advertising market pushed sales

down to $721 million, from $843 million.

“The online business looked bad, but I still believe they have to be in that

space to fulfill the larger vision of where Microsoft is going,” said Richard

Williams, the senior software analyst at Cross Research. “It may mean that they

have to acquire rather than build.”

Microsoft has been in talks with Yahoo about some kind of partnership in online

advertising.

In the company’s core Windows business, sales declined to $3.4 billion in the

quarter, down from $4 billion in the period last year.

Netbooks, the cheap, small laptops that have surged in popularity, remained the

big story. According to Microsoft’s research, PC sales fell 7 to 9 percent

during the quarter. Excluding netbooks, traditional PC sales fell 15 to 17

percent.

Last quarter, netbooks accounted for about 10 percent of PC sales, Microsoft

said. Netbooks are a mixed blessing for Microsoft. The company’s average selling

price for Windows has declined, because it ships a discounted version of the

older Windows XP on netbooks. Microsoft’s Windows profit fell 19 percent, to

$2.5 billion.

On a positive note, many customers have bought netbooks as complements to their

existing computers, representing fresh revenue for Microsoft and Intel during

these lean times.

However, “there are some real challenges in that business behind this shift to

the low end,” said Israel Hernandez, director of software research at Barclays

Capital. “And on the horizon, you have Apple and Google who appear ready to

introduce their own takes on netbooks.”

Microsoft declined to offer specific financial guidance for the coming quarters.

Shares of Microsoft ended regular trading Thursday at $18.92, up 14 cents. The

company released third-quarter figures after the market closed, and in

after-hours trading the shares rose more than 3 percent, to $19.50.

Microsoft Profit Falls

for First Time in 23 Years, NYT, 24.4.2009,

https://www.nytimes.com/2009/04/24/

technology/companies/24microsoft.html

Exxon Mobil Posts

Biggest US Quarterly Profit Ever

October 30, 2008

Filed at 9:01 a.m. ET

The New York Times

By THE ASSOCIATED PRESS

HOUSTON (AP) -- Exxon Mobil Corp., the world's largest

publicly traded oil company, reported income Thursday that shattered its own

record for the biggest profit from operations by a U.S. corporation, earning

$14.83 billion in the third quarter.

Bolstered by this summer's record crude prices, the Irving, Texas-based company

said net income jumped nearly 58 percent to $2.86 a share in the July-September

period. That compares with $9.41 billion, or $1.70 a share, a year ago.

The previous record for U.S. corporate profit was set in the last quarter, when

Exxon Mobil earned $11.68 billion.

Revenue rose 35 percent to $137.7 billion.

On average, analysts expected the company to earn $2.39 per share in the latest

quarter on revenue of $131.4 billion.

Exxon Mobil's results got a boost of $1.62 billion in the most-recent quarter

from the sale of a natural gas transportation business in Germany. It also took

a special, after-tax charge of $170 million related to a punitive damages award

related to the 1989 Exxon Valdez oil spill.

Excluding those items, third-quarter earnings amounted to $13.38 billion --

nearly 15 percent above its previous profit record from the second quarter.

As expected, Exxon Mobil posted massive earnings at its exploration and

production, or upstream, arm, where net income rose 48 percent to $9.35 billion.

Higher oil and natural gas prices propelled results, even though production was

down from the third quarter a year ago.

Oil producers are coming off a quarter during which crude prices reached an

all-time high of $147.27 -- and their profits have reflected it. Crude prices,

however, have quickly fallen 50 percent from the summer's highs, and the global

economic malaise has raised questions about energy demand at least into 2009.

Some companies, especially smaller producers, are scaling back spending on new

exploration and production projects because of the uncertainty, though analysts

say that its less likely to happen at the well-heeled giants like Exxon Mobil.

Company shares rose 96 cents to $75.61 in premarket trading.

Exxon Mobil Posts

Biggest US Quarterly Profit Ever,

NYT, 30.10.2008,

http://www.nytimes.com/aponline/business/

AP-Earns-Exxon-Mobil.html

Profit

Data May Explain U.S. Gloom

August 1,

2008

The New York Times

By FLOYD NORRIS

Corporate

profits earned in the United States rose much more rapidly from 2005 through

2007 than had been earlier reported, making the subsequent fall seem even more

precipitous, government figures showed Thursday.

The revised figures may help to explain the sense of pessimism that has been

reported in surveys of consumers and business executives, said Robert Barbera,

the chief economist of ITG, an economic research company. Pointing to the

previous profit figures, some commentators had suggested there was more gloom

than the economic data seemed to justify.

First-quarter profits earned in the United States by American companies have

fallen 18 percent from their peak, the revised figures show, rather than the 11

percent previously reported.

That decline has been partly offset by soaring overseas profits for American

companies. On Thursday, the government raised its estimate of those profits in

the first quarter, even as it reduced its estimate of profits earned in this

country.

By the latest measure, first-quarter overseas profits were the highest they have

ever been for American companies — up 25 percent from the third quarter of 2006,

when domestic profits peaked.

Overseas profits, while important to shareholders, do not reflect the

performance of the American economy or the prospects for employment in this

country. Surveys show that both business executives and consumers expect

declines in jobs in America in coming months.

The figures show that more than a third of profits earned by American companies

are now made overseas. In the first three months of this year, the proportion

was 35 percent, nearly twice what it was a decade ago.

The revised data shows that profits of American companies are down 7 percent

over all, rather than the 2 percent previously reported.

The revised figures were contained in the revisions of the gross domestic

product numbers issued Thursday by the Bureau of Economic Analysis, a part of

the Commerce Department.

Brent R. Moulton, the bureau’s associate director for national economic

accounts, said the new figures reflected preliminary data from the Internal

Revenue Service for 2006, and revised figures for 2005. For 2007 and 2008, the

changes reflect assorted revisions in estimates of the performance of various

industries.

Because the figures are largely based on tax returns, the eventual totals are

used as clear indicators of overall economic performance of American businesses,

both privately owned companies and those owned by shareholders.

The revised figures indicate that in the third quarter of 2006, when domestic

profits of American companies peaked, the annual rate of profits was $1.27

trillion, $100 billion more than had previously been estimated. That figure fell

to $1.04 trillion in the first quarter of this year, the lowest rate since the

third quarter of 2005.

By contrast, the overseas profits of American companies came in at an annual

rate of $557 billion in the first quarter of 2008, an increase of more than $100

billion from the 2006 quarter.

The profit figures in the government report represent operating profits, not

changes in the value of assets. That policy means that the profit figures for

financial industries estimated by the government are now far higher than the

ones being reported to shareholders. Mr. Moulton said that write-downs of the

value of securities, or write-offs of bad loans — which have cost banks tens of

billions of dollars — are not included.

Were they included, it seems certain that the decline in profits earned in the

United States by American companies would be even larger than was indicated by

the figures released Thursday.

Profit Data May Explain U.S. Gloom,

NYT, 1.8.2008,

http://www.nytimes.com/2008/08/01/

business/economy/01profit.html

BP

profits soar on record oil price

Published:

July 29 2008 08:33

Last updated: July 29 2008 08:33

The Financial Times

By Sylvia Pfeifer

Record

crude prices and soaring natural gas prices helped BP on Tuesday to report a 28

per cent rise in second-quarter profits to $9.46bn (£4.74bn), from $7.37bn a

year ago.

Replacement cost profit, which excludes gains from the value of the company’s

crude oil inventories, was up 6 per cent to $6.85bn for the quarter. It rose 23

per cent to $13.44bn for the second half.

The strong results helped lift BP’s shares nearly 2 per cent to 528½p in early

morning trading in London.

The company has been locked in a bitter battle for control of its Russian joint

venture, TNK-BP, which accounts for almost a quarter of BP’s worldwide

production.

BP’s Russian partners have demanded the dismissal of Robert Dudley, who heads up

TNK-BP, who they say is treating the venture as a subsidiary of BP. Mr Dudley

fled Russia last week to run the business from a secret location abroad.

In its results statement, BP warned that while it continued to work to resolve

these matters, “currently it is not possible to predict the ultimate outcome if

these matters remain unresolved”.

Meanwhile, the company said production for the second quarter was broadly flat

compared with the same period in 2007, at 3.83m barrels of oil equivalent per

day. BP is counting on the start-up of the long-delayed Thunder Horse field in

the Gulf of Mexico to boost output in the coming months.

Profits at the company’s refining division collapsed from $2.7bn to $539m. The

company said higher energy costs continued to hit the division’s profits,

especially in the US.

BP said it would pay a dividend of 14 cents a share for the quarter, up from

10.825 cents.

BP profits soar on record oil price,

FT,

29.7.2008,

https://www.ft.com/content/

ae695a68-5d3e-11dd-8129-000077b07658

Explore more on these topics

Anglonautes > Vocapedia

economy, money,

shopping, bills, taxes,

housing market,

jobs, unemployment,

unions, retirement,

debt,

poverty, hunger,

homelessness

industry, energy, commodities

figures, numbers, statistics, data,

toll, ratings, trends

|