|

Vocapedia >

Economy > Auction,

Bid,

eBay

New York, US

A Christie’s auctioneer claps

after ending the auction of Shot Sage Blue

Marilyn by Andy Warhol,

which sold for $170m (£140m)

during a sale of works from the collection

of Thomas and Doris Ammann

Photograph: Sarah Yenesel

EPA

Prince Charles and the Wagatha Christie

trial: Tuesday’s best photos

The Guardian’s picture editors select photo

highlights from around the world

G

Tue 10 May 2022 12.56 BST

https://www.theguardian.com/news/gallery/2022/may/10/

prince-charles-wagatha-christie-trial-tuesdays-best-photos

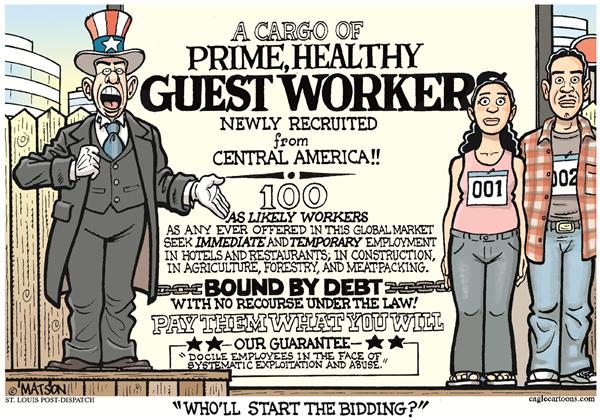

RJ Matson

The St. Louis Post Dispatch

Cagle

4 April 2007

auction

UK / USA

https://www.theguardian.com/artanddesign/2022/may/20/

the-rich-have-got-much-richer-

why-art-sale-prices-are-going-through-the-roof

https://www.theguardian.com/music/2012/apr/22/

beatles-unseen-pictures-auction

https://www.nytimes.com/2008/11/04/

arts/design/04auction.html

auction off

UK

https://www.theguardian.com/artanddesign/2012/may/07/

gunter-sachs-appeal-playboy-art-collector

go up for auction

USA

https://www.npr.org/2021/07/22/

1019391848/gun-killed-billy-the-kid-auction-2-million

up for auction

UK

https://www.theguardian.com/music/2012/apr/22/

beatles-unseen-pictures-auction

an auction at Christie's

at a sale at Christie's auction house in London

https://www.theguardian.com/politics/2011/jun/27/

lady-thatcher-handbag-charity-auction

auction house

charity auction

UK

https://www.theguardian.com/politics/2011/jun/27/

lady-thatcher-handbag-charity-auction

be auctioned by N for

N USA

https://www.npr.org/2022/05/09/

1096617152/a-warhol-marilyn-brings-a-record-auction-price-195-million

http://www.nytimes.com/2012/05/03/

arts/design/the-scream-sells-for-nearly-120-million-at-sothebys-auction.html

auctioneer

UK / USA

https://www.nytimes.com/2013/11/23/

arts/design/principal-auctioneer-of-sothebys-leaving-post.html

http://www.theguardian.com/artanddesign/2013/nov/18/what-sells-art

https://www.nytimes.com/2012/05/03/

arts/design/the-scream-sells-for-nearly-120-million-at-sothebys-auction.html

under the hammer / go

under the hammer UK

https://www.theguardian.com/artanddesign/2014/apr/24/

banksy-works-auction-london-hotel

http://www.guardian.co.uk/artanddesign/gallery/2012/may/03/most-expensive-auction-in-pictures

USA > set a new record

for art auction sales

at Sotheby's in New York

UK

https://www.theguardian.com/artanddesign/gallery/2012/may/03/

most-expensive-auction-in-pictures

bring a record auction price

USA

https://www.npr.org/2022/05/09/

1096617152/a-warhol-marilyn-brings-a-record-auction-price-195-million

art sale prices

UK

https://www.theguardian.com/artanddesign/2022/may/20/

the-rich-have-got-much-richer-why-art-sale-prices-are-going-through-the-roof

going, going, gone

Bonhams

https://www.bonhams.com/

Christie's

UK

https://www.theguardian.com/artanddesign/2021/mar/11/

christies-first-digital-only-artwork-70m-nft-beeple

Sotheby’s

USA

https://www.nytimes.com/2014/07/14/

arts/design/with-ebay-partnership-sothebys-extends-potential-reach-by-145-million.html

http://www.nytimes.com/2012/05/03/

arts/design/the-scream-sells-for-nearly-120-million-at-sothebys-auction.html

bid

bid

bidding

bidder

USA

http://www.nytimes.com/2012/05/03/arts/design/

the-scream-sells-for-nearly-120-million-at-sothebys-auction.html

winner bid

USA

http://www.nytimes.com/2012/05/03/

arts/design/the-scream-sells-for-nearly-120-million-at-sothebys-auction.html

fetch UK

http://www.guardian.co.uk/politics/2011/jun/27/lady-thatcher-handbag-charity-auction

http://www.guardian.co.uk/music/2011/jun/27/michael-jackson-thriller-jacket-auction

eBay UK / USA

https://www.nytimes.com/topic/company/ebay-inc

https://www.theguardian.com/technology/ebay

https://www.ebay.com/

https://www.theguardian.com/technology/2014/aug/18/

how-ebay-transformed-way-people-shop

https://www.nytimes.com/2014/07/14/

arts/design/with-ebay-partnership-sothebys-extends-potential-reach-by-145-million.html

https://www.nytimes.com/2012/07/28/

business/ebays-turnaround-defies-convention-for-internet-companies.html

http://www.nytimes.com/2008/10/12/business/12giants.html

https://www.theguardian.com/technology/2007/apr/08/news.newmedia

https://www.theguardian.com/technology/2006/dec/27/news.christmas2006

https://www.theguardian.com/business/2006/aug/29/digitalmedia.advertising

PayPal UK / USA

https://www.nytimes.com/2012/08/02/

technology/paypal-antifraud-measures-are-extreme-some-users-say.html

https://www.theguardian.com/media/2010/dec/04/

paypal-internet-backlash-wikileaks

bid

on...

outbid

Congratulations Anglonautes!

You're currently the highest bidder,

but you're close to getting outbid.

You're currently the highest bidder,

but you're only one bid from letting it get away.

You are close to being outbid.

If someone else places a bid,

you will no longer be the high bidder.

Increase your chances of winning

by increasing your maximum bid.

Corpus of news articles

Economy > Auction, Bid, eBay

Behind eBay’s Comeback

July 27, 2012

The New York Times

By JAMES B. STEWART

Remember Myspace, Friendster, eToys, Webvan, Urban Fetch,

Pets.com? Like meteors, they burned with dazzling brilliance before turning

shareholder dollars to ash. EBay, Yahoo and AOL, the dominant Internet

triumvirate circa 2004, seemed destined for a similar fate. The conventional

wisdom has been that once decline sets in at an Internet company, it’s

irreversible.

But that was before eBay’s latest earnings surprise, which sent its stock

soaring and had analysts scrambling to raise their projections. “Can Internet

companies ever turn around? The answer has been no,” Ken Sena, Internet analyst

at Evercore, told me this week. “But now, there’s eBay. The answer may turn out

to be yes.”

If so, eBay’s success has big implications for struggling companies like Yahoo

and AOL, not to mention more recent sensations that have already lost some

luster, like Zynga, Groupon and even Facebook, whose shares tumbled this week

after its first earnings report as a public company disappointed investors.

“EBay has demonstrated that it’s possible to turn the corner even against long

odds,” said David Spitz, president and chief operating officer of

ChannelAdvisor, an e-commerce consulting company.

EBay shares hit a peak of over $58 in 2004 and made its chief executive, Meg

Whitman, a Silicon Valley celebrity. But by November 2007, when she stepped down

to enter politics, the telltale signs of decline had set in. Its stock was

slumping. Its dominant online auction business had matured, and growth had

slowed. Sellers complained about higher fees and poor support. That year, eBay

wrote off $1.4 billion on its poorly conceived $2.5 billion acquisition of the

calling service Skype, recording its first loss as a public company. Analysts

worried that eBay had lost its quirky soul, and was abandoning the flea market

auction model that had made it distinctive and dominant in online auctions. By

early 2009, its stock was barely over $10, down over 80 percent from its peak.

Ms. Whitman was succeeded by a former Bain & Company managing director, John

Donahoe. “One of the unique things about the Internet is a company can be a

white-hot success and become a global brand and reach global scale in just a few

years — that’s the good news,” he told me this week. “But then somebody can turn

around and do it to you. There’s constant disruption. One of the first things I

had to do here was face reality. EBay was getting disrupted.”

Little more than four years after taking charge, a buoyant Mr. Donahoe sounded

like the chief executive of a surging start-up when he announced eBay’s latest

results on July 18. So thoroughly has eBay been transformed that he didn’t even

mention its traditional auction business. “Our multiyear effort is paying off,”

he said. Profit more than doubled and revenue jumped 23 percent. “EBay is

revitalized. We believe the best is yet to come.” In a stock market struggling

with recession fears and the European debt crisis, eBay stock this week hit a

six-year high.

How has eBay done it when so many others have failed?

Excitement about eBay’s prospects has little to do with its traditional auction

business, or even its core e-commerce operations, although its marketplace

division posted solid results and had its best quarter since 2006, the company

said. Most of its growth came from mobile retailing and its PayPal online

payments division, a business it acquired in 2002 for what now looks like a

bargain $1.5 billion.

As consumers embrace shopping on their smartphones, “mobile continues to be a

game-changer,” Mr. Donahoe said. He noted that 90 million users had downloaded

eBay’s mobile app and that 600,000 customers made their first mobile purchase

during the most recent quarter. “A woman’s handbag is purchased on eBay mobile

every 30 seconds,” he said. “Mobile is revolutionizing how people shop and pay.”

“It’s hard to think of many companies that benefit from mobile,” Mr. Sena said.

“Usually it means more competition. But clearly, eBay is one of them. EBay is

offering a one-click payment solution. You don’t have to type in a credit card

number or PIN. It’s just one click on your mobile phone.”

Mr. Spitz said he was recently stopped at a traffic light and the sun was

bothering his eyes. By the time the light turned green, he had used his phone to

order and pay for sunglasses. “This is what commerce anytime, anywhere means,”

he said. “It’s here.”

Mr. Donahoe deserves credit not only for recognizing that smartphones would

change the shopping experience, but for acting on it, Mr. Spitz said. “EBay

under Mr. Donahoe pivoted hard in this direction,” he said.

Mr. Donahoe confirms that, saying: “We saw the mobile revolution early and we

made a big bet across the entire company. We saw that mobile was an important

factor for our customers. It was becoming the central control device in their

lives. We didn’t worry if it cannibalized our existing business, because we knew

it was what our customers wanted.”

The smartphone “has blurred the line between e-commerce and off-line retail,”

Mr. Donahoe continued. “Four years ago, you had to be in front of a laptop or

desktop to shop online. Now you can do it seven days, 24 hours. We’re going to

have to drop the ‘e’ from e-commerce.”

Retailers have warmed to the new eBay. “They’re a great partner,” Gerald L.

Storch, chairman and chief executive of Toys “R” Us, told me this week. “In an

omni-channel retail world, mobile, social, Internet, physical stores — they’re

all linked. Customers want to interact with our brand at every level. EBay is

especially strong in mobile and payment systems, but they address all those

areas and help us compete. We do everything with them.”

Amazon was supposed to have crushed eBay by now with its bigger scale and

state-of-the-art inventory and delivery systems. That didn’t happen, but Amazon

remains eBay’s biggest competitive threat. Amazon continues to invest in its

delivery systems and it, too, has an effective mobile app and one-click payment

system.

Even so, many analysts see plenty of room for both Amazon and eBay, and perhaps

even more competitors. “When you look at e-commerce as a share of overall

consumer spending, it’s not even 10 percent worldwide,” Mr. Spitz said. “There’s

plenty of room for growth.”

Mr. Donahoe agreed. “We’ve never viewed the world as a zero-sum game with

Amazon,” he said. “There’s plenty of room for multiple winners.”

Moreover, eBay is likely to benefit from its global reach and scale as

e-commerce expands. “Consumers aren’t going to download 30 apps from individual

retailers, but they will download both eBay and Amazon,” Mr. Spitz said. EBay

and PayPal apps already rank among the top 10 mobile apps, eBay said.

And it’s obviously in retailers’ interests to prevent Amazon from becoming an

e-commerce monopoly. EBay stresses, without mentioning Amazon by name, that it

doesn’t compete with its retail customers. Some sellers have complained that

when Amazon spots a hot product, it starts promoting and selling it itself at

lower prices.

As Mr. Storch put it: “We do sell Kindle Fires and other Amazon products, but

when it comes to retail, eBay helps us succeed. Amazon is the competition.”

The dynamics of e-commerce aside, several broad themes emerge from eBay’s

turnaround:

¶ EBay had to break with its past and seize new opportunities. “It was clear the

world had innovated around eBay and eBay had stayed with the same formula,” Mr.

Donahoe said. “Saying that was considered heresy. With any company that’s been

this successful, there’s enormous momentum to keep doing what you’ve been doing

and hope the world will go back to what it used to be.”

At the same time, EBay didn’t entirely abandon its roots — it’s still an

e-commerce company. But “we had to make changes that were unpopular with subsets

of our customers and other people. You have to have the conviction to do what

you know is right,” Mr. Donahoe said. “We spent three years fixing the

fundamentals and tried not to worry about what everyone else was saying.”

¶ Technological innovation is critical. “We stepped on the gas with innovation,”

Mr. Donahoe said. “We’re more technology- and innovation-driven than we’ve ever

been. Mobile gave us the opportunity to start with a clean slate from a

technology perspective.” Less than two years ago, eBay acquired Critical Path

Software, which was helping to develop eBay’s mobile apps. “We thought they were

the best, so we bought them and got a couple hundred of the best software

developers in the world working exclusively for us,” Mr. Donahoe said.

The resulting mobile apps have been hugely successful with customers. “They’re a

nice, clean, elegant solution, a very pleasant experience,” Mr. Spitz said.

“Many people are encountering eBay on a mobile device and coming away with a

great first impression.”

New products are in the pipeline. Mr. Donahoe said PayPal Here, a new payment

system, would allow customers to “check in” in advance at a shop, be greeted by

name when they arrive, complete transactions without a mobile device or credit

card and get a text message as a receipt.

¶ Management change is necessary and inevitable. Mr. Donahoe has been chief for

just over four years, and has replaced most of eBay’s top management. “A

significant change in senior leadership was necessary to take eBay to the next

level,” he said. He built a team of managers who shared his dedication “to

building a great and enduring company, a company that will last,” as he put it.

“No one else has really done that on the Internet, and we’re excited by the

possibility.” At the same time, he said, “We can’t take anything for granted.

We’re almost paranoid. We get up every morning and we’re focused on delivering

for our customers and continuing to innovate. It’s a fast-changing world.”

Behind eBay’s Comeback,

NYT,

27.7.2012,

https://www.nytimes.com/2012/07/28/

business/ebays-turnaround-defies-convention-for-internet-companies.html

‘The Scream’ Is Auctioned

for a Record $119.9 Million

May 2, 2012

The New York Times

By CAROL VOGEL

It took 12 nail-biting minutes and five eager bidders for

Edvard Munch’s famed 1895 pastel of “The Scream” to sell for $119.9 million,

becoming the world’s most expensive work of art ever to sell at auction.

Bidders could be heard speaking Chinese and English (and, some said, Norwegian),

but the mystery winner bid over the phone, through Charles Moffett, Sotheby’s

executive vice president and vice chairman of its worldwide Impressionist,

modern and contemporary art department. Gasps could be heard as the bidding

climbed higher and higher, until there was a pause at $99 million, prompting

Tobias Meyer, the evening’s auctioneer, to smile and say, “I have all the time

in the world.” When $100 million was bid, the audience began to applaud.

The price eclipsed the previous record, made two years ago at Christie’s in New

York when Picasso’s “Nude, Green Leaves and Bust” brought $106.5 million.

Munch made four versions of “The Scream.” Three are now in Norwegian museums;

the one that sold on Wednesday, a pastel on board from 1895, was the only one

still in private hands. It was sold by Petter Olsen, a Norwegian businessman and

shipping heir whose father was a friend, neighbor and patron of the artist.

The image has been reproduced endlessly in popular culture in recent decades,

becoming a universal symbol of angst and existential dread and nearly as famous

as the Mona Lisa.

Outside of Sotheby’s, there was excitement of a different kind, as demonstrators

protesting the company’s longtime lockout of art handlers waved placards with

the image of “The Scream” along with the motto, “Sotheby’s: Bad for Art.” Many

in the group — a mix of union members and Occupy Wall Street protesters — even

screamed themselves when the Munch went on the block. (Munch’s work was an apt

focus for the group, said one protester, Yates McKee: “It exemplifies the ways

in which objects of artistic creativity become the exclusive province of the 1

percent.”)

Inside, the atmosphere generated by the Munch’s record price carried through the

rest of the auction, which saw high prices for everything from Picasso paintings

to sculptures by Giacometti and Brancusi.

Of the 76 lots on offer, 15 failed to sell. The evening’s total was $330.56

million, close to its high estimate of $323 million. (Final prices include the

buyer’s commission to Sotheby’s: 25 percent of the first $50,000; 20 percent of

the next $50,000 to $1 million and 12 percent of the rest. Estimates do not

reflect commissions.)

As is often true of auctions with star attractions, having “The Scream” for sale

helped win other business. Its inclusion was a draw, for example, for the estate

of Theodore J. Forstmann, the Manhattan financier, who died in November. The top

work in his collection was Picasso’s “Femme Assise Dans un Fauteuil,” a 1941

portrait of Dora Maar, the artist’s muse and lover, posed in a chair. The

painting went for $26 million, or $29.2 million with fees, within its estimated

$20 million to $30 million.

In 2004, Mr. Forstmann bought Soutine’s “Le Chasseur de chez Maxim’s,” a 1925

portrait of an employee at the celebrated French restaurant, for $6.7 million at

a Sotheby’s auction. It had belonged to Wendell Cherry, vice chairman of the

Louisville-based health care company Humana, who died in 1991, and his wife,

Dorothy. On Wednesday night the painting was up for sale again, this time with a

$10 million to $15 million estimate, which turned out to be optimistic. Two

bidders went for the Soutine, which ended up selling to a telephone bidder,

working through Mr. Moffett, for $8.3 million, or $9.3 million with fees.

More popular, however, was an 1892 Gauguin landscape, “Cabane Sous les Arbres,”

which Mr. Forstmann had bought at Christie’s in 2002 for $4.6 million. On

Wednesday night it was estimated to sell for $5 million to $7 million, but there

were four bidders for the canvas, and it sold for $8.4 million.

Surrealism has been the rage recently, and Sotheby’s had many examples to sell.

Among the best was Dalí’s “Printemps Nécrophilique,” a 1936 painting that once

belonged to Elsa Schiaparelli, the Paris couturier closely associated with the

Surrealist movement who collaborated on designs with Dalí. Six bidders fought

over the painting, which went for $16.3 million, well above its $12 million high

estimate.

Another popular Surrealist image was Ernst’s “Leonora in the Morning Light,” a

1940 painting that depicts his lover, Leonora Carrington, a Mexican artist of

English birth, emerging from a lush jungle. It brought $7.9 million, above its

$5 million high estimate.

A gilded bronze head that Brancusi conceived and cast in 1911 was another of the

evening’s top sellers, bringing $12.6 million, well above its $6 million to $8

million estimate.

But it was the record price for “The Scream” that captured everyone’s

imagination. As soon as the hammer fell, rumors began circulating about who the

buyer could be. Among the names floated were the financier Leonard Blavatnik,

the Microsoft tycoon Paul Allen and members of the Qatari royal family.

While some were surprised at the price, one Munch enthusiast was not: “It’s nice

to see the centrality of Norway in the mainstream of western culture,” said Ivor

Braka, a London dealer. “The scream is more than a painting, it’s a symbol of

psychology as it anticipates the 20th-century traumas of mankind.”

Colin Moynihan contributed reporting.

This article has been revised

to reflect the following correction:

Correction: May 2, 2012

A earlier version of this article misspelled the surname

of Theodore J.

Forstmann,

the Manhattan financier, as Fortsmann

It also incorrectly

described the position

Wendell Cherry, who died in 1991, had held at Humana.

He was not

chairman.

‘The Scream’ Is Auctioned for a Record

$119.9 Million,

NYT,

2.5.2012,

https://www.nytimes.com/2012/05/03/

arts/design/

the-scream-sells-for-nearly-120-million-at-sothebys-auction.html

Explore more on these topics

Anglonautes > Vocapedia

economy, money, taxes,

housing market, shopping,

jobs, unemployment,

unions, retirement,

debt,

poverty, hunger,

homelessness

industry, energy, commodities

|