|

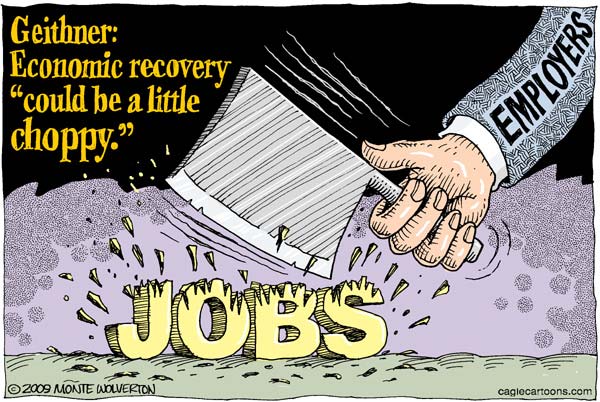

History > 2009 > USA > Economy (VIII)

Monte Wolverton

cartoon

The Wolvertoon

Cagle

2 November 2009

Op-Ed Columnist

The Jobs Imperative

November 30, 2009

The New York Times

By PAUL KRUGMAN

If you’re looking for a job right now, your prospects are terrible. There are

six times as many Americans seeking work as there are job openings, and the

average duration of unemployment — the time the average job-seeker has spent

looking for work — is more than six months, the highest level since the 1930s.

You might think, then, that doing something about the employment situation would

be a top policy priority. But now that total financial collapse has been

averted, all the urgency seems to have vanished from policy discussion, replaced

by a strange passivity. There’s a pervasive sense in Washington that nothing

more can or should be done, that we should just wait for the economic recovery

to trickle down to workers.

This is wrong and unacceptable.

Yes, the recession is probably over in a technical sense, but that doesn’t mean

that full employment is just around the corner. Historically, financial crises

have typically been followed not just by severe recessions but by anemic

recoveries; it’s usually years before unemployment declines to anything like

normal levels. And all indications are that the aftermath of the latest

financial crisis is following the usual script. The Federal Reserve, for

example, expects unemployment, currently 10.2 percent, to stay above 8 percent —

a number that would have been considered disastrous not long ago — until

sometime in 2012.

And the damage from sustained high unemployment will last much longer. The

long-term unemployed can lose their skills, and even when the economy recovers

they tend to have difficulty finding a job, because they’re regarded as poor

risks by potential employers. Meanwhile, students who graduate into a poor labor

market start their careers at a huge disadvantage — and pay a price in lower

earnings for their whole working lives. Failure to act on unemployment isn’t

just cruel, it’s short-sighted.

So it’s time for an emergency jobs program.

How is a jobs program different from a second stimulus? It’s a matter of

priorities. The 2009 Obama stimulus bill was focused on restoring economic

growth. It was, in effect, based on the belief that if you build G.D.P., the

jobs will come. That strategy might have worked if the stimulus had been big

enough — but it wasn’t. And as a matter of political reality, it’s hard to see

how the administration could pass a second stimulus big enough to make up for

the original shortfall.

So our best hope now is for a somewhat cheaper program that generates more jobs

for the buck. Such a program should shy away from measures, like general tax

cuts, that at best lead only indirectly to job creation, with many possible

disconnects along the way. Instead, it should consist of measures that more or

less directly save or add jobs.

One such measure would be another round of aid to beleaguered state and local

governments, which have seen their tax receipts plunge and which, unlike the

federal government, can’t borrow to cover a temporary shortfall. More aid would

help avoid both a drastic worsening of public services (especially education)

and the elimination of hundreds of thousands of jobs.

Meanwhile, the federal government could provide jobs by ... providing jobs. It’s

time for at least a small-scale version of the New Deal’s Works Progress

Administration, one that would offer relatively low-paying (but much better than

nothing) public-service employment. There would be accusations that the

government was creating make-work jobs, but the W.P.A. left many solid

achievements in its wake. And the key point is that direct public employment can

create a lot of jobs at relatively low cost. In a proposal to be released today,

the Economic Policy Institute, a progressive think tank, argues that spending

$40 billion a year for three years on public-service employment would create a

million jobs, which sounds about right.

Finally, we can offer businesses direct incentives for employment. It’s probably

too late for a job-conserving program, like the highly successful subsidy

Germany offered to employers who maintained their work forces. But employers

could be encouraged to add workers as the economy expands. The Economic Policy

Institute proposes a tax credit for employers who increase their payrolls, which

is certainly worth trying.

All of this would cost money, probably several hundred billion dollars, and

raise the budget deficit in the short run. But this has to be weighed against

the high cost of inaction in the face of a social and economic emergency.

Later this week, President Obama will hold a “jobs summit.” Most of the people I

talk to are cynical about the event, and expect the administration to offer no

more than symbolic gestures. But it doesn’t have to be that way. Yes, we can

create more jobs — and yes, we should.

The Jobs Imperative,

NYT, 30.11.2009,

http://www.nytimes.com/2009/11/30/opinion/30krugman.html

Weekly Jobless Claims

Drop Below 500, 000

November 25, 2009

Filed at 8:33 a.m. ET

The New York Times

By THE ASSOCIATED PRESS

WASHINGTON (AP) -- The number of newly laid-off workers filing claims for

unemployment benefits fell more than expected last week to the lowest level in

over a year.

The concern is that the big improvement will be temporary as the weak economy

continues to push unemployment higher.

The Labor Department says the number of people filing first-time claims for

jobless benefits fell by 35,000 to 466,000. That was the lowest level for

initial claims since the week of Sept. 13, 2008, and was far better than the

500,000 that economists had expected.

The number of workers receiving benefits also fell sharply, dropping 190,000, to

5.42 million, the lowest level for continuing claims since February.

Weekly Jobless Claims

Drop Below 500, 000, NYT, 25.11.2009,

http://www.nytimes.com/aponline/2009/11/25/business/AP-US-Economy.html

From the Hospital Room to Bankruptcy Court

November 25, 2009

The New York Times

By KEVIN SACK

NASHVILLE — Some of the debtors sitting forlornly in this city’s old stone

bankruptcy court have lost a job or gotten divorced. Others have been summoned

to face their creditors because they spent mindlessly beyond their means. But

all too often these days, they are there merely because they, or their children,

got sick.

Wes and Katie Covington, from Smyrna, Tenn., were already in debt from a round

of fertility treatments when complications with her pregnancy and surgery on his

knee left them with unmanageable bills. For Christine L. Phillips of Nashville,

it was a $10,000 trip to the emergency room after a car wreck, on the heels of

costly operations to remove a cyst and repair a damaged nerve.

Jodie and Charlie Mullins of Dickson, Tenn., were making ends meet on his

patrolman’s salary until she developed debilitating back pain that required

spinal surgery and forced her to quit nursing school. As with many medical

bankruptcies, they had health insurance but their policy had a $3,000 deductible

and, to their surprise, covered only 80 percent of their costs.

“I always promised myself that if I ever got in trouble, I’d work two jobs to

get out of it,” said Mr. Mullins, a 16-year veteran of the Dickson police force.

“But it gets to the point where two or three or four jobs wouldn’t take care of

it. The bills just were out of sight.”

Although statistics are elusive, there is a general sense among bankruptcy

lawyers and court officials, in Nashville as elsewhere, that the share of

personal bankruptcies caused by illness is growing.

In the campaign to broaden support for the overhaul of American health care, few

arguments have packed as much rhetorical punch as the

there-but-for-the-grace-of-God notion that average families, through no fault of

their own, are going bankrupt because of medical debt.

President Obama, in addressing a joint session of Congress in September, called

on lawmakers to protect those “who live every day just one accident or illness

away from bankruptcy.” He added: “These are not primarily people on welfare.

These are middle-class Americans.”

The Senate majority leader, Harry Reid of Nevada, made a similar case on

Saturday in a floor speech calling for passage of a measure to open debate on

his chamber’s health care bill.

The legislation moving through Congress would attack the problem in numerous

ways.

Bills in both houses would expand eligibility for Medicaid and provide health

insurance subsidies for those making up to four times the federal poverty level.

Insurers would be prohibited from denying coverage to those with pre-existing

health conditions. Out-of-pocket medical costs would be capped annually.

How many personal bankruptcies might be avoided is unpredictable, as it is not

clear how often medical debt plays a back-breaking role. There were 1.1 million

personal bankruptcy filings in 2008, including 12,500 in Nashville, and more are

expected this year.

Last summer, Harvard researchers published a headline-grabbing paper that

concluded that illness or medical bills contributed to 62 percent of

bankruptcies in 2007, up from about half in 2001. More than three-fourths of

those with medical debt had health insurance.

But the researchers’ methodology has been criticized as defining medical

bankruptcy too broadly and for the ideological leanings of its authors, some of

whom are outspoken advocates for nationalized health care.

At the bankruptcy court in Nashville, lawyers provided a spectrum of estimates

for the share of cases in Middle Tennessee where medical debt was decisive, from

15 percent to 50 percent. But many said they felt the number had been growing,

and might be higher than was obvious because medical bills are often disguised

as credit card debt.

“This has really become the insurance system for the country,” said Susan R.

Limor, a bankruptcy trustee who calculated that 13 of the 48 Chapter 7

liquidation cases on her docket one recent afternoon included medical debts of

more than $1,000.

Under Chapter 7, a debtor’s assets are liquidated and the proceeds are used to

pay creditors; any remaining debts are discharged, and filers are left with a

10-year stain on their credit ratings.

“You can’t believe how many people discharge medical debts,” Ms. Limor said.

“It’s a kind of trailing indicator of who’s suffering in this economy.”

Kyle D. Craddock, a bankruptcy lawyer here, said his medical cases were

heartbreaking because the financial devastation was so rapid and ill-timed.

“They’re sick, they’re bankrupt, and if they stay sick for too long, they end up

losing their jobs as well,” he said.

That was the case for Ms. Phillips, 45, who said she was fired in October from

her job in a shipping department because she had missed so much work while

recuperating from her car accident and operations. Her firing came only 11 days

after she filed for bankruptcy, listing about $7,000 in unpaid medical bills

among her $187,000 in liabilities.

“The medical bills put me over the edge,” said Ms. Phillips, who lost her health

insurance along with her job. “I had no money for food at this point. How was I

going to do it?”

It was the same for the Mullinses, who have two children. They had a mortgage

and owed money on credit cards and student loans. “But the medical problem is

what took us down,” said Ms. Mullins, who is packing to move from the

two-bedroom house they will soon surrender to Wells Fargo. “Everything was due,

they wanted their money now, now, now, and it just became overwhelming.”

For some, like Nathan W. Hale, 34, who had an attack of pancreatitis two months

after losing his job with a Nashville cable company, it is the absence of

insurance that pulls them under. Others, like Robin P. Herron, 35, of

Eagleville, Tenn., have insurance, but it is not enough. Her Blue Cross Blue

Shield policy covered only 80 percent of the cost when her daughter needed

surgery to remove a cyst from a fallopian tube, leaving her $6,000 in debt.

After cortisone injections failed to cure his gimpy knee, Mr. Covington, 31, had

surgery because the pain was forcing him to miss days of work as an emergency

medical technician. His recovery kept him off the job for five months.

Simultaneously, his wife, a 911 dispatcher, developed sciatica while pregnant

and had to take months off on reduced disability pay. Their insurance policy,

with an $850 monthly premium, has a $4,000 annual deductible per family.

As the bills rolled in, the Covingtons compounded their troubles by placing

medical charges on credit cards, simply to make the collection agencies stop

calling. They fell months behind on their mortgage, and by August had lost their

house and both cars.

Mr. Covington, who has taken a second job, said he found it ironic that it had

not been the recession that forced them into bankruptcy. “I tell my wife that we

beat the economy,” he said, “but health care beat us.”

From the Hospital Room

to Bankruptcy Court, NYT, 25.11.2009,

http://www.nytimes.com/2009/11/25/health/policy/25bankruptcy.html

Price War Brews

Between Amazon and Wal-Mart

November 24, 2009

The New York Times

By BRAD STONE

and STEPHANIE ROSENBLOOM

Ali had Frazier. Coke has Pepsi. The Yankees have the Red Sox.

Now Wal-Mart, the mightiest retail giant in history, may have met its own worthy

adversary: Amazon.com.

In what is emerging as one of the main story lines of the 2009 post-recession

shopping season, the two heavyweight retailers are waging an online price war

that is spreading through product areas like books, movies, toys and

electronics.

The tussle began last month as a relatively trivial but highly public

back-and-forth over which company had the lowest prices on the most anticipated

new books and DVDs this fall. By last week, it had spread to select video game

consoles, mobile phones, even to the humble Easy-Bake Oven, a 45-year-old toy

from Hasbro that usually heats up small cakes, not tensions between

billion-dollar corporations.

Last Wednesday, Wal-Mart dropped the price of the oven to $17, from $28, as part

of its “Black Friday” deals. Later the same day, Amazon cut its price, which had

also been $28, to $18.

“It’s not about the prices of books and movies anymore. There is a bigger battle

being fought,” said Fiona Dias, executive vice president at GSI Commerce, which

manages the Web sites of large retailers. “The price-sniping by Wal-Mart is part

of a greater strategic plan. They are just not going to cede their business to

Amazon.”

Retailers are already fighting for every dollar consumers spend this holiday

season. Sales are not expected to drop as much as they did last season, but the

National Retail Federation, an industry group, predicts that they will decline 1

percent, to $437.6 billion.

Of course, Wal-Mart and Amazon are fundamentally different companies, and for

now, at least, Amazon poses little immediate threat to the behemoth from

Bentonville, Ark.

Wal-Mart, with $405 billion in sales last year, dominates by offering affordable

prices to Middle America in its 4,000 stores. Amazon is a relative schooner to

Wal-Mart’s ocean liner, with $20 billion in sales, mostly from affluent

urbanites who would rather click with their mouse than push around a cart.

This fight, then, is all about the future. Rapid expansion by each company, as

well as profound shifts in the high-tech landscape, now make direct

confrontation inevitable. Though online shopping accounts for only around 4

percent of retail sales, that percentage is growing quickly. E-commerce did not

suffer as deeply as regular retailing during the economic malaise, and it is

recovering faster than in-store shopping. People are also shopping on

smartphones and from their HDTVs.

Amazon, based in Seattle, has harnessed all of these trends, and is also

behaving more like a traditional retailer. This fall it expanded its

white-labeling program, slapping the Amazon brand onto audio and video cables

and other products, and introduced same-day shipping in seven cities, trying to

replicate the instant gratification of offline shopping.

For rivals both real and putative, Amazon is expanding its slice of the retail

pie at what must be an alarming rate. In the third quarter of this year, regular

retail sales dipped by about 4 percent and e-commerce over all was flat. But

Amazon sales shot up 24 percent, sending its shares soaring.

More important for Wal-Mart, sales in Amazon’s electronics and general

merchandise business — which competes directly with much of the selection in

Wal-Mart stores — were up 44 percent. Wal-Mart does not break out Web sales, but

it has been reported that its online business produces revenue of several

billion dollars.

“If you are Wal-Mart, you want to have your proportional piece of this change in

consumer behavior,” said Scot Wingo, chief executive of ChannelAdvisor, which

helps retailers sell online. “You can even paint a scenario where e-commerce one

day is 15 percent of all shopping, and that could really start to erode

Wal-Mart’s offline business.”

That is why many analysts are unsurprised that Wal-Mart executives have placed

Amazon squarely in their sights, with public throw-downs in interviews and

pointed discounting.

It began last month with what appeared to be a public-relations-oriented

competition on book prices, with both companies (along with Target, based in

Minneapolis) dropping prices on books like “Under the Dome,” by Stephen King, to

below $9.

The companies then began jousting over the prices of DVDs. Less visibly, there

were isolated skirmishes, some of which also lowered prices in Wal-Mart’s

stores. Wal-Mart offered a $15 gift card with a purchase of the new video game

Call of Duty: Modern Warfare 2 — and Amazon matched soon after.

Wal-Mart and Amazon then both offered the Xbox 360 gaming console for $199 —

with a $100 gift card thrown in. Last week, they both began offering the new

Palm Pixi phone for around $30 — nearly $175 off the suggested retail price.

Of course, online retailers have always competed on price, monitoring rivals’

sites for changes and adjusting accordingly.

“We’ve grown up in a supercompetitive environment where customers can check

prices with one click, and we like it that way,” said Craig Berman, an Amazon

spokesman.

But rhetoric from Wal-Mart itself has stoked the flames of rivalry. In an

interview last week, Raul Vazquez, the president and chief executive of

Walmart.com, asserted that the site was growing faster than Amazon’s; suggested

that Amazon Prime, a two-day-shipping service that costs $80 a year, was too

expensive; and said that it was “only a matter of time” before Wal-Mart

dominated Web shopping.

“Our company is based on low prices,” Mr. Vazquez said, laying down a challenge.

“Even in books, we kept going until we were the low-price leader. And we will do

that in every category if we need to.”

Friction between the two companies is not entirely new. In the late 1990s,

Amazon assembled at least some of its knowledge of retail supply chains by

hiring away Wal-Mart employees. Wal-Mart sued, and the two companies settled

privately.

In a battle over prices, Wal-Mart is on more familiar turf. With its unmatched

size, Wal-Mart has more leverage than anyone to negotiate better terms with

suppliers. Offering the lowest price “is in our DNA,” Mr. Vazquez said.

Among Amazon’s advantages are a sophisticated distribution network built

specifically for Web shopping, the thousands of outside sellers who offer

products on Amazon.com, and a recognizable online brand. Amazon’s customers also

do not pay sales tax in most states, a crucial advantage that companies like

Wal-Mart, and their lobbyists, are trying to eliminate.

Jeffrey P. Bezos, Amazon’s chief executive, is fond of saying that retailing is

a big market with room for many winners. But for Ms. Dias, from GSI Commerce,

Wal-Mart’s campaign against Amazon is overdue. As an executive at the

now-defunct Circuit City chain, and as an adviser to traditional retailers

today, she says she has watched many companies overlook the long-term threat

posed by Amazon.

“We have to put our foot down and refuse to let them grow more powerful,” she

said. “I applaud Wal-Mart. It’s about time multichannel retailers stood up and

refused to let their business go away.”

Price War Brews Between

Amazon and Wal-Mart, NYT, 24.11.2009,

http://www.nytimes.com/2009/11/24/business/24shop.html

U.S. Mortgage Delinquencies

Reach a Record High

November 20, 2009

The New York Times

By DAVID STREITFELD

The economy and the stock market may be recovering from their swoon, but more

homeowners than ever are having trouble making their monthly mortgage payments,

according to figures released Thursday.

Nearly one in 10 homeowners with mortgages was at least one payment behind in

the third quarter, the Mortgage Bankers Association said in its survey. That

translates into about five million households.

The delinquency figure, and a corresponding rise in the number of those losing

their homes to foreclosure, was expected to be bad. Nevertheless, the figures

underlined the level of stress on a large segment of the country, a situation

that could snuff out the modest recovery in home prices over the last few months

and impede any economic rebound.

Unless foreclosure modification efforts begin succeeding on a permanent basis —

which many analysts say they think is unlikely — millions more foreclosed homes

will come to market.

“I’ve been pretty bearish on this big ugly pig stuck in the python and this

cements my view that home prices are going back down,” said the housing

consultant Ivy Zelman.

The overall third-quarter delinquency rate is the highest since the association

began keeping records in 1972. It is up from about one in 14 mortgage holders in

the third quarter of 2008.

The combined percentage of those in foreclosure as well as delinquent homeowners

is 14.41 percent, or about one in seven mortgage holders. Mortgages with

problems are concentrated in four states: California, Florida, Arizona and

Nevada. One in four people with mortgages in Florida is behind in payments.

Some of the delinquent homeowners are scrambling and will eventually catch up on

their payments. But many others will slide into foreclosure. The percentage of

loans in foreclosure on Sept. 30 was 4.47 percent, up from 2.97 percent last

year.

In the first stage of the housing collapse, defaults and foreclosures were

driven by subprime loans. These loans had low introductory rates that quickly

moved to a level that was beyond the borrower’s ability to pay, even if the

homeowner was still employed.

As the subprime tide recedes, high-quality prime loans with fixed rates make up

the largest share of new foreclosures. A third of the new foreclosures begun in

the third quarter were this type of loan, traditionally considered the safest.

But without jobs, borrowers usually cannot pay their mortgages.

“Clearly the results are being driven by changes in employment,” Jay Brinkmann,

the association’s chief economist, said in a conference call with reporters.

In previous recessions, homeowners who lost their jobs could sell the house and

move somewhere with better prospects, or at least a cheaper cost of living. This

time around, many of the unemployed are finding that the value of their property

is less than they owe. They are stuck.

“There will be a lot more distressed supply entering the market, and it will

move up the food chain to middle- and higher-price homes,” said Joshua Shapiro,

chief United States economist for MFR Inc.

Many analysts say they believe that foreclosures, instead of peaking with the

unemployment rate as they traditionally do, will most likely be a lagging

indicator in this recession. The mortgage bankers expect foreclosures to peak in

2011, well after unemployment is expected to have begun falling.

There was one sliver of good news in the survey: the percentage of loans in the

very first stage of default — no more than 30 days past due — was down slightly

from the second quarter. If that number continues to decline, at least the ranks

of the defaulted will have peaked.

“It’s arguably a positive, but it doesn’t undermine the fact that there are

still five or six million foreclosures in process,” Ms. Zelman said.

The number of loans insured by the Federal Housing Administration that are at

least one month past due rose to 14.4 percent in the third quarter, from 12.9

percent last year. An additional 3.3 percent of F.H.A. loans are in foreclosure.

The mortgage group’s survey noted, however, that the F.H.A. was issuing so many

loans — about a million in the last year — that it had the effect of masking the

percentage of problem loans at the agency. Most loans enter default when they

are older than a year.

When the association removed the new loans from its calculations, the percentage

of F.H.A. mortgages entering foreclosure was 30 percent higher.

The association’s survey is based on a sample of more than 44 million mortgage

loans serviced by mortgage companies, commercial and savings banks, credit

unions and others. About 52 million homes have mortgages. There are 124 million

year-round housing units in the country, according to the Census Bureau.

U.S. Mortgage

Delinquencies Reach a Record High, NYT, 20.11.2009,

http://www.nytimes.com/2009/11/20/business/20mortgage.html

Pathology of a Crisis

November 19, 2009

The New York Times

By ERIC DASH

The coroner’s report left no doubt as to the cause of death: toxic loans.

That was the conclusion of a financial autopsy that federal officials performed

on Haven Trust Bank, a small bank in Duluth, Ga., that collapsed last December.

In what sounds like an episode of “CSI: Wall Street,” dozens of government

investigators — the coroners of the financial crisis — are conducting

post-mortems on failed lenders across the nation. Their findings paint a

striking portrait of management missteps and regulatory lapses.

At bank after bank, the examiners are discovering that state and federal

regulators knew lenders were engaging in hazardous business practices but failed

to act until it was too late. At Haven Trust, for instance, regulators raised

alarms about lax lending standards, poor risk controls and a buildup of

potentially dangerous loans to the boom-and-bust building industry. Despite the

warnings — made as far back as 2002 — neither the bank’s management nor the

regulators took action. Similar stories played out at small and midsize lenders

from Maryland to California.

What went wrong? In many instances, the financial overseers failed to act

quickly and forcefully to rein in runaway banks, according to reports compiled

by the inspectors general of the four major federal banking regulators.

Together, they have completed 41 inquests and have 75 more in the works.

Current and former banking regulators acknowledge that they should have been

more vigilant.

“We all could have done a better job,” said Sheila C. Bair, the chairwoman of

the Federal Deposit Insurance Corporation.

The reports, known as material loss reviews, delve into the past, but their

significance lies in how they might shape the future. As another wave of bank

failures looms, policy makers are considering a variety of measures that would

generally strengthen banks’ finances and limit their ability to lend money

aggressively in risky areas like construction. Bankers contend that such steps

would not only hurt their businesses but also the broader economy, because they

would throttle the flow of credit just as growth is resuming.

But while the worst seems to be over for the banking industry as a whole, many

lenders are still in danger. The havoc caused by the collapse of the housing

market is now being exacerbated by the deepening problems in commercial real

estate, which many analysts see as the next flashpoint for the industry.

Given the past lapses, some wonder whether examiners will spot new troubles in

time. Of the nation’s 8,100 banks, about 2,200 — ranging from community lenders

in the Rust Belt to midsize regional players — far exceed the risk thresholds

that would ordinarily call for greater scrutiny from management and regulators,

according to Foresight Analytics, a banking research firm.

About 600 small banks are in danger of collapsing because of troubled real

estate loans if they do not shore up their finances soon, according to the firm.

About 150 lenders have failed since the crisis erupted in mid-2007.

Many bank examiners acknowledge they were lulled into believing the good times

for banks would last. They also concede that they were sometimes reluctant to

act when troubles surfaced, for fear of unsettling the housing market and the

economy.

Then as now, banking lobbyists vigorously opposed attempts to rein in the banks,

like the 2006 guidelines that discouraged banks from holding big commercial real

estate positions.

“Hindsight is a wonderful thing,” said Timothy W. Long, the chief bank examiner

for the Office of the Comptroller of the Currency. “At the height of the

economic boom, to take an aggressive supervisory approach and tell people to

stop lending is hard to do.”

Haven Trust, founded in 2000, enjoyed a light touch from its regulators,

according to its autopsy, which was completed in August.

Almost from the start, examiners with the F.D.I.C and the state of Georgia

raised red flags. In 2002, F.D.I.C. officials found problems with the bank’s

underwriting practices. Over the next few years, Haven’s portfolio of risky

commercial real estate loans grew so quickly — by an astounding 40 percent

annually — that the regulators raised questions about the dangers.

But not until August 2008 did examiners step up their scrutiny by telling Haven

to raise its capital cushion. A month later, the regulators issued a memorandum

of understanding, known as an M.O.U., ordering the bank to limit its

concentration of risky loans.

Haven’s examiners “did not always follow up on the red flags,” says the report,

which runs 29 pages. “By the time the M.O.U. was issued in September 2008,

Haven’s failure was all but inevitable,” it concluded.

But the fiasco at Haven Trust was not all that unusual. At the fast-growing

Ocala National Bank in Florida, for example, examiners from the Office of the

Comptroller of the Currency found loose lending standards and a high

concentration of construction loans.

But regulators “took no forceful action to achieve corrections,” according a

review after the failure. The bank collapsed in late January.

At County Bank in California, a potential powder keg of construction and land

loans warranted “early, direct and forceful” action from the Federal Reserve

Bank of San Francisco, according to a review of the failed lender, which

collapsed in early February.

Regulators have begun to act on some of the lessons learned. Federal officials

are discussing whether to impose hard limits, not just soft guidelines, on the

portion of bank balance sheets that can be made up of commercial real estate

loans. That would automatically prevent the buildup of risky assets and take

more discretion out of the examiners’ hands.

Other ideas include requiring all lenders to hold more capital if they report

big concentrations of risky assets or rapid loan growth — an approach that is

the centerpiece of the Obama administration’s policy for too-big-to-fail banks.

Daniel K. Tarullo, the Federal Reserve governor overseeing bank supervision,

recently proposed to impose new rules that would require banks to raise capital

in the event they breach certain financial thresholds in areas like loan

delinquencies or defaults.

At the F.D.I.C., Ms. Bair has been increasing the hiring of experienced

examiners in the last few years, and recently empowered its on-site supervisors

to impose restrictions on dividends, brokered deposits and loan growth. Every

major regulator has urged examiners to take swifter action and issue more formal

enforcement orders.

Still, banking executives and some regulators worry that after the long period

of lax oversight chronicled by the reports, regulators will crack down too hard.

The challenge, these people say, is to strike a balance between rigorous

oversight and oppressive regulation. A heavy hand might discourage banks from

lending.

“Right now, bankers don’t need to be told it is a dangerous world,” said William

M. Isaac, the former F.D.I.C. chairman and now a regulatory consultant. “Right

now, they need to be told there will be a tomorrow.”

Pathology of a Crisis,

NYT, 19.11.2009,

http://www.nytimes.com/2009/11/19/business/19risk.html

U.S. Home Building

Unexpectedly Slumps in October

November 19, 2009

The New York Times

By JAVIER C. HERNANDEZ

New home construction slowed unexpectedly in October to the lowest level in

six months, the Commerce Department said Wednesday, resurrecting fears that the

housing market may be slow to recover.

A separate report showed consumer prices inched upward in October, but not

enough to make inflation a concern even as the dollar weakened and with interest

rates at historic lows.

The data on home construction showed a decline in the rate of single- and

multiple-family homebuilding, contributing to an overall decrease of 10.6

percent in housing starts from September. In total, construction was at a

seasonally adjusted annual rate of 529,000 housing units in October, falling

short of the 590,000 predicted by analysts. Building permits, an indicator of

future construction, declined as well, to an annual rate of 552,000 from

575,000, also falling short of forecasts.

Apartment construction slowed to a historic low, dipping to a seasonally

adjusted annual rate of 53,000 in October. Analysts attributed the decrease to

the reluctance of banks to finance large construction projects and lackluster

demand for rentals as vacancies remained abundant.

Part of the overall decline in housing construction might be explained by the

uncertainty in October over whether Congress would extend a tax credit for

first-time home buyers. Earlier this month, lawmakers voted to extend the credit

through April, but builders may have been reluctant to begin construction in

October without assurance that homes would be bought.

The revival of the housing market is considered crucial to reviving the economy.

Construction adds jobs to the economy, and once a home is sold, consumers

typically go on spending sprees as they stock up on furnishings like

televisions, refrigerators and sofas.

“These figures can be pretty volatile from month to month, so it may just be a

blip,” Paul Ashworth, senior United States economist at Capital Economics, wrote

in a research note on Wednesday. “Nevertheless, taken at face value it suggests

homebuilders are still uncertain about the sustainability of the rebound in home

sales.”

Celia Chen, senior director at Moody’s Economy.com, said demand for homes would

likely remain weak into 2010.

“The housing market is still very fragile,” she said. “It seems that the market

has bottomed in terms of sales and starts, but that stability can be easily

broken, even if affordability is very high.”

The Labor Department’s report on consumer prices showed the Consumer Price Index

climbed 0.3 percent, slightly above analysts’ estimates of 0.2 percent. The

index measures the changes in the cost of a bundle of goods for consumers —

everything from cooking oil to airplane tickets to medical care.

The increases came because of rising energy and motor vehicle costs, the report

said. When the government excluded the cost of food and energy, which can be

volatile, prices rose 0.2 percent.

The prices of cars and trucks showed steep increases. Analysts said that could

be a side effect of the government’s popular cash-for-clunkers program, which

depleted the supply of both cheaper 2009 models and used vehicles, driving up

prices.

The small increase in consumer prices signaled that inflationary pressures, by

and large, appear to be in check, restrained by the nation’s high unemployment

rate and significant unused factory capacity. On Tuesday, a report on wholesale

prices showed similar results, though there were signs that higher prices might

be on the horizon.

“Effectively, this gives the Federal Reserve a checkered flag to keep rates

exceptionally low for an extended period of time,” said Brian Bethune, chief

United States financial economist for IHS Global Insight.

U.S. Home Building

Unexpectedly Slumps in October, NYT, 19.11.2009,

http://www.nytimes.com/2009/11/19/business/economy/19econ.html

Editorial

Another Round

of Regulatory Reform

November 18, 2009

The New York Times

Throughout the fall, lawmakers in the House have been drafting and reworking

legislation to reform the financial system. Senate Democrats weighed in last

week with a plan that is stronger than the House bills on aspects of derivatives

regulation and consumer protection. It also invites healthy debate on other

issues, like the role of the Federal Reserve in a reformed system.

But the proposal, created by Senator Christopher Dodd, the chairman of the

banking committee, is just a draft. Senators will have to stand up to pressure

from banking and business lobbies, which surely will try to weaken the

beneficial parts of the plan as it makes its way through the legislative

process. On that score, the experience in the House has not been encouraging.

Some major issues:

DERIVATIVES An overarching goal of reform is to ensure that derivatives are

traded on public exchanges rather than as opaque and risky private bilateral

contracts. Proposals in the House and by the Obama administration undercut that

goal by exempting derivatives from exchange trading for corporations that use

them to hedge risks, like a utility that wants to hedge against swings in energy

prices. The Dodd plan would correctly leave it up to the regulator to rule on

any such exemptions.

Still, it does not attack all loopholes. As in House and administration

proposals, it excludes from oversight a type of derivative known as a

foreign-exchange swap. That is dangerous because it could enable various types

of derivatives — say those used to hedge against interest rate spikes — to be

structured to avoid regulation.

CONSUMERS Like the House and the administration, Mr. Dodd calls for a Consumer

Financial Protection Agency to ensure that financial products sold to the public

are in a consumer’s best interest. Unlike the House version of the new agency,

Mr. Dodd would always allow states to impose tougher consumer protection

regulations, in addition to federal rules. Also in contrast to the House, the

Dodd plan does not have carve-outs for auto dealers who offer credit, or for

other special interests.

BANK REGULATION The House and administration would distribute supervisory powers

among the Federal Reserve, the Federal Deposit Insurance Corporation and the

Office of the Comptroller of the Currency. Mr. Dodd calls for the creation of

one main federal regulator, reasoning that a single regulator would end

“regulator shopping” — whereby banks choose their own overseer, invariably

opting for the weakest one.

But that still ignores the problem of “regulatory capture” — whereby regulators

come to be controlled by the entities they regulate. With only one primary

federal regulator, the risk of capture is heightened, because there would be no

parallel regulatory regimes by which to judge the relative strength or weakness

of the single regulator. A better approach may be to retain multiple regulators,

but restrict the easy ability of banks to pick and choose among them. Congress

must also do a better job of overseeing the regulators, a duty it largely

abdicated in the years before the crisis.

THE FED The House and the administration propose new bank regulatory powers for

the Fed. But they have not called for the changes needed in the clubby and

secretive Fed system for the central bank to exercise its new powers in an

unbiased and transparent way. The Dodd plan pulls in the opposite direction. It

would strip the Fed of regulatory powers, even though Fed supporters say that

such powers are central to the Fed’s ability to make informed decisions about

the economy.

None of the proposals have yet to strike a workable balance, but Mr. Dodd is

right not to blindly accept the notion that the Fed has the expertise and

willingness to regulate, when such expertise and willingness were manifestly

absent in the run-up to the crisis.

TOO BIG TO FAIL Like other reform proposals in Congress, the Dodd plan imposes

costs — like higher capital requirements — on large and interconnected firms.

The aim is to make size and complexity so costly that firms opt to be smaller.

The plan stops short, however, of creating a fail-safe mechanism to break up

too-big-to-fail firms — before they fail — if incentives to downsize don’t work.

The Dodd plan is also in line with other proposals in calling for resolution

authority — the power for regulators to seize and restructure large bank holding

companies and nonbank financial firms when imminent failure poses a systemwide

threat. But unless the final legislation is very tightly written, resolution

authority could be misconstrued as bailout authority — the ability of regulators

to use taxpayer money to keep failing firms alive. Some regulators and

administration officials may prefer that flexibility. But it is imperative that

resolution authority rule out the possibility of such bailouts. Otherwise, it

will be impossible to control risks in the system.

It is also important to grapple with the limits of resolution authority. Most

large and interconnected firms are global, and thus would require an

international resolution system to dismantle them in a crisis. Resolution

authority for American regulators is a necessary step to confront the nation’s

outsize financial sector, but it is not a sufficient fix for the too-big-to-fail

problem.

With the House moving forward and a Senate plan on the table, opportunities

exist for strong reform. The other option, which sadly also exists, is that

lawmakers will entrench the status quo under the guise of reform.

Another Round of

Regulatory Reform, NYT, 18.11.2009,

http://www.nytimes.com/2009/11/18/opinion/18wed1.html

Job Woes

Exacting a Heavy Toll

on Family Life

November 12, 2009

The New York Times

By MICHAEL LUO

THE WOODLANDS, Tex. — Paul Bachmuth’s 9-year-old daughter, Rebecca, began

pulling out strands of her hair over the summer. His older child, Hannah, 12,

has become noticeably angrier, more prone to throwing tantrums.

Initially, Mr. Bachmuth, 45, did not think his children were terribly affected

when he lost his job nearly a year ago. But now he cannot ignore the mounting

evidence.

“I’m starting to think it’s all my fault,” Mr. Bachmuth said.

As the months have worn on, his job search travails have consumed the family,

even though the Bachmuths were outwardly holding up on unemployment benefits,

their savings and the income from the part-time job held by Mr. Bachmuth’s wife,

Amanda. But beneath the surface, they have been a family on the brink. They have

watched their children struggle with behavioral issues and a stress-induced

disorder. He finally got a job offer last week, but not before the couple began

seeing a therapist to save their marriage.

For many families across the country, the greatest damage inflicted by this

recession has not necessarily been financial, but emotional and psychological.

Children, especially, have become hidden casualties, often absorbing more than

their parents are fully aware of. Several academic studies have linked parental

job loss — especially that of fathers — to adverse impacts in areas like school

performance and self-esteem.

“I’ve heard a lot of people who are out of work say it’s kind of been a

blessing, that you have more time to spend with your family,” Mr. Bachmuth said.

“I love my family and my family comes first, and my family means more than

anything to me, but it hasn’t been that way for me.”

A recent study at the University of California, Davis, found that children in

families where the head of the household had lost a job were 15 percent more

likely to repeat a grade. Ariel Kalil, a University of Chicago professor of

public policy, and Kathleen M. Ziol-Guest, of the Institute for Children and

Poverty in New York, found in an earlier study that adolescent children of

low-income single mothers who endured unemployment had an increased chance of

dropping out of school and showed declines in emotional well-being.

In the long term, children whose parents were laid off have been found to have

lower annual earnings as adults than those whose parents remained employed, a

phenomenon Peter R. Orszag, director of the White House Office of Management and

Budget, mentioned in a speech last week at New York University.

A variety of studies have tied drops in family income to negative effects on

children’s development. But Dr. Kalil, a developmental psychologist and director

of the university’s Center for Human Potential and Public Policy, said the more

important factor, especially in middle-class households, appeared to be changes

in family dynamics from job loss.

“The extent that job losers are stressed and emotionally disengaged or

withdrawn, this really matters for kids,” she said. “The other thing that

matters is parental conflict. That has been shown repeatedly in psychological

studies to be a bad family dynamic.”

Dr. Kalil said her research indicated that the repercussions were more

pronounced in children when fathers experience unemployment, rather than

mothers.

She theorized that the reasons have to do with the importance of working to the

male self-image, or the extra time that unemployed female breadwinners seem to

spend with their children, mitigating the impact on them.

Certainly, some of the more than a dozen families interviewed that were dealing

with long-term unemployment said the period had been helpful in certain ways for

their families.

Denise Stoll, 39, and her husband, Larry, 47, both lost their positions at a

bank in San Antonio in October 2008 when it changed hands. Mrs. Stoll, a vice

president who managed a technology group, earned significantly more than her

husband, who worked as a district loan origination manager.

Nevertheless, Mr. Stoll took unemployment much harder than she did and struggled

to keep his spirits up, before he landed a new job within several months in the

Kansas City area, where the family had moved to be closer to relatives. He had

to take a sizable pay cut but was grateful to be working again.

Mrs. Stoll is still looking but has also tried to make the most of the

additional time with the couple’s 5-year-old triplets, seeking to instill new

lessons on the importance of thrift.

“Being a corporate mom, you work a lot of hours, you feed them dinner — maybe,”

she said. “This morning, we baked cookies together. I have time to help them

with homework. I’m attending church. The house is managed by me. Just a lot more

homemaker-type stuff, which I think is more nurturing to them.”

Other families, however, reported unmistakable ill effects.

Robert Syck, 42, of Fishers, Ind., lost his job as a call-center manager in

March. He has been around his 11-year-old stepson, Kody, more than ever before.

Lately, however, their relationship has become increasingly strained, Mr. Syck

said, with even little incidents setting off blowups. His stepson’s grades have

slipped and the boy has been talking back to his parents more.

“It’s only been particularly in the last few months that it’s gotten really bad,

to where we’re verbally chewing each other out,” said Mr. Syck, who admitted he

had been more irritable around the house. “A lot of that is due to the pressures

of unemployment.”

When Mr. Bachmuth was first laid off in December from his $120,000 job at an

energy consulting firm, he could not even bring himself to tell his family. For

several days, he got dressed in the morning and left the house as usual at 6

a.m., but spent the day in coffee shops, the library or just walking around.

Mr. Bachmuth had started the job, working on finance and business development

for electric utilities, eight months earlier, moving his family from Austin.

They bought something of a dream home, complete with a backyard pool and spa.

Although she knew the economy was ultimately to blame, Mrs. Bachmuth could not

help feeling angry at her husband, both said later in interviews.

“She kind of had something in the back of her mind that it was partly my fault I

was laid off,” Mr. Bachmuth said. “Maybe you’re not a good enough worker.”

Counseling improved matters significantly, but Mrs. Bachmuth still occasionally

dissolved into tears at home.

Besides quarrels over money, the reversal in the couple’s roles also produced

friction. Mrs. Bachmuth took on a part-time job at a preschool to earn extra

money. But she still did most, if not all, of the cooking, cleaning and laundry.

Dr. Kalil, of the University of Chicago, said a recent study of how people spend

their time showed unemployed fathers devote significantly less time to household

chores than even mothers who are employed full-time, and do not work as hard in

caring for children.

Mr. Bachmuth’s time with his girls, however, did increase. He was the one

dropping off Rebecca at school and usually the one who picked her up. He began

helping her more with homework. He and Hannah played soccer and chatted more.

But the additional time brought more opportunities for squabbling. The rest of

the family had to get used to Mr. Bachmuth being around, sometimes focused on

his search for a job, but other times lounging around depressed, watching

television or surfing soccer sites on the Internet.

“My dad’s around a lot more, so it’s a little strange because he gets frustrated

he’s not at work, and he’s not being challenged,” Hannah said. “So I think me

and my dad are a lot closer now because we can spend a lot more time together,

but we fight a lot more maybe because he’s around 24-7.”

When Rebecca began pulling her hair out in late summer in what was diagnosed as

a stress-induced disorder, she insisted it was because she was bored. But her

parents and her therapist — the same one seeing her parents — believed it was

clearly related to the job situation.

The hair pulling has since stopped, but she continues to fidget with her brown

locks.

The other day, she suddenly asked her mother whether she thought she would be

able to find a “good job” when she grew up.

Hannah said her father’s unemployment had made it harder for her to focus on

schoolwork. She also conceded she had been more easily annoyed with her parents

and her sister.

At night, she said, she has taken to stowing her worries away in an imaginary

box.

“I take all the stress and bad things that happen over the day, and I lock them

in a box,” she said.

Then, she tries to sleep.

Job Woes Exacting a

Heavy Toll on Family Life, NYT, 12.11.2009,

http://www.nytimes.com/2009/11/12/us/12families.html

U.S. Says Mortgage Help

Is Reaching More Homeowners

November 11, 2009

The New York Times

By THE ASSOCIATED PRESS

WASHINGTON (AP) — After a slow start, the Obama administration’s mortgage

relief program has reached one in five eligible homeowners, a government report

said Tuesday.

More than 650,000 borrowers, or 20 percent of those eligible, have signed up for

trials lasting up to five months, the Treasury Department said Tuesday. The

modifications reduce monthly payments to more affordable levels.

Started with great fanfare in March, the plan got off to a weak start, but now

nearly 920,000 loan modification offers have been sent to more than 3.2 million

eligible homeowners. That works out to 29 percent, up from 15 percent at the end

of July.

In California, about 130,000 homeowners have been enrolled in the “Making Home

Affordable” loan modification plan, which President Obama introduced in

February. That works out to about 19 percent of homeowners who were either two

payments behind or in foreclosure at the end of last month, according to

Treasury Department data.

Two other hard-hit states, Arizona and Nevada, had similar rates of assistance

as California, at 22 percent and 18 percent. Florida, however, was much lower,

at 12 percent, possibly because of high numbers of investor-owned properties

that did not qualify for the program.

The $50 billion plan got off to a slow start, but government officials say they

are pressing the industry hard to improve performance. Still, many housing

advocates have been disappointed with the plan’s progress and say that getting a

loan modification is still a battle.

And economists doubt the Obama administration will reach its broad goal of

helping three million to four million borrowers within three years.

Most of the borrowers enrolled so far have been signed up for preliminary trial

modifications for up to five months. To make the change permanent, though, they

must complete a big stack of paperwork and show they can make their payments on

time. The government expects to release details in the coming weeks on permanent

modifications.

“We’re seeing some early indications that the servicers haven’t done enough to

get all the documents in,” said Michael Barr, an assistant Treasury secretary..

U.S. Says Mortgage Help

Is Reaching More Homeowners, NYT, 11.11.2009,

http://www.nytimes.com/2009/11/11/business/11mortgage.html

Retailers Report Healthy Sales Increases

November 6, 2009

The New York Times

By STEPHANIE ROSENBLOOM

The nation’s stores on Thursday posted a second consecutive month of sales

increases, the retailing industry’s best monthly performance in more than a

year.

Results at chains as varied as Costco and Saks were clearly helped by easy

comparisons to the dismal results of a year ago, but also by October’s cool

weather and Columbus Day sales. Retailing analysts said sales might also have

been driven by pent-up demand.

Over all, the industry reported a 1.8 percent increase at stores open at least a

year, according to Thomson Reuters. Retailers have not reported a sales increase

that large since June 2008, when the industry’s sales rose 2 percent. Nearly

every sector had sales gains in October, with the exception of teenage-clothing

retailers and department stores.

In a statement on Thursday, Michael P. Niemira, chief economist and director of

research for the International Council of Shopping Centers, an industry group,

called the results “further evidence of retail recovery.” Clothing chains

selling designer names at bargain-basement prices were the top performers. Sales

at TJX stores open at least a year, a measure of retail health known as

same-store sales, increased 10 percent. TJX, which owns stores including TJ

Maxx, Marshall’s and Home Goods, has been on a roll for months as consumers shop

for bargains.

Carol M. Meyrowitz, the company’s chief executive, said in a news release that

“customer traffic continued to drive sales throughout the month, boding well for

the holiday season.”

A TJX competitor, Ross Stores, also thrived, turning in a 9 percent sales

increase.

Other discounters reported healthy numbers, including Costco (up 5 percent) and

Kohl’s, the value-priced clothing chain, which had its fourth consecutive month

of positive sales. October sales increased 1.4 percent at Kohl’s, though that

was lower than what analysts were expecting.

Kohl’s also reported some signs of broader recovery, saying in a news release

that its strongest year-over-year gains were in the home goods category, a

retailing sector hit hard by the recession. The company said same-store sales

increases were notable in the Southwest, a region that was hurt more by the

recession than other parts of the country.

Sales at BJ’s Wholesale Club declined 1.1 percent, though customer traffic was

up 4 percent year-over-year. Sales at Target also decreased slightly, by 0.1

percent, yet its same-store sales of clothing were slightly stronger — a sign

that consumers are beginning to spend some discretionary dollars.

“We are entering the holiday season with very clean inventories,” Gregg W.

Steinhafel, chief executive of Target, said in a news release, “and we believe

we are positioned to perform well in what continues to be a challenging economic

environment.”

Wal-Mart Stores, the nation’s largest chain, stopped reporting monthly sales

figures in April.

Same-store sales at department stores — a group that was struggling even before

the recession — declined slightly, falling 0.9 percent, according to Thomson

Reuters. Even so, some department stores had sales growth for the first time in

months. Same-store sales increased even at the upscale chains like Nordstrom (up

6.5 percent) and Saks (up 0.7 percent). Nordstrom was one of the industry’s top

performers. And Saks said in a news release that it experienced “relative

strength” in some of its merchandise categories, like women’s designer

sportswear, its e-commerce business and its outlet stores, Saks Off 5th.

At Bon-Ton, sales rose 3.1 percent. “We are encouraged by the sustained

improvement in our sales trend, which began in August,” Tony Buccina, vice

chairman and president for merchandising at Bon-Ton, said in a news release.

Other department stores did not fare as well. Sales declined at Dillard’s (down

8 percent), Neiman Marcus (down 6 percent), Stein Mart (down 4.9 percent), JC

Penney (down 4.5 percent) and Macy’s (down 0.8 percent).

Teenage retailers posted the weakest results, with same-store sales declining

5.8 percent, according to Thomson Reuters. That was much lower than analysts’

estimates. Sales fell at Abercrombie & Fitch (down 15 percent), Zumiez (down 8.9

percent), American Apparel (down 6 percent), American Eagle Outfitters (down 5

percent), Limited Brands (down 4 percent), Hot Topic (down 2.6 percent),

Children’s Place (down 2 percent) and Wet Seal (down 1.3 percent).

Of course some teenage clothing chains bucked the trend as they have for the

last several months, including Buckle (up 4.3 percent) and Aéropostale (up 3

percent). The Gap, which is in the midst of a turnaround, posted a 4 percent

increase.

For November, the first month of the crucial holiday shopping season, the

International Council of Shopping Centers is forecasting a 5 to 8 percent

same-store sales increase.

Retailers Report Healthy

Sales Increases, NYT, 6.11.2009,

http://www.nytimes.com/2009/11/06/business/economy/06shop.html

In October,

Signs of Life at Retailers

November 4, 2009

The New York Times

By STEPHANIE ROSENBLOOM

October was far and away the best month American retailers have had since

consumers put the brakes on spending last autumn. Major categories had robust

sales growth for the first time in more than a year, new figures show.

On Thursday, when individual chains report their October sales, the industry is

expected to post its strongest sales figures yet in this recession. Contrary to

predictions made only a few weeks ago, the nation’s stores could be poised for a

merrier Christmas this year than last.

To be sure, the enthusiasm of industry professionals is tempered. A major reason

the latest numbers look so good is that they are being compared with figures

from October 2008, the first full month of a brutal nationwide spending freeze.

“Things are better than they were a year ago,” said Michael McNamara, vice

president for research and analysis at SpendingPulse, an information service by

MasterCard Advisors. “But we’re still below where we were two years ago.”

The latest sales figures come from his organization, which estimates sales for

all forms of payment, including cash, checks and credit cards. They show, for

example, that sales of women’s apparel increased 0.6 percent in October, the

first positive figure since August 2008.

However, women’s apparel sales are still 12.2 percent lower than in the heyday

of consumer spending, in October 2007. That theme — up compared with last year,

but still down compared with the height of the boom — played out across several

retailing categories, including jewelry and luxury goods.

Nonetheless, the signs of recovery were unmistakable in the sales numbers that

MasterCard Advisors released late Tuesday.

One sign was that retailers were able to drive sales in October without offering

the kinds of deep margin-eroding discounts they dangled last year. “That’s

generally a positive,” Mr. McNamara said. “Even though the number of purchases

may not be spiking, it could be an indication that inventory and demand are more

lined up.”

Another positive sign is that retailers and analysts are beginning to see some

stabilization in California, one of the places hit hard by the recession. Big

chains like Mervyn’s and Gottschalks went belly up there. Recently, though,

major retailers with a presence in California — Target, Costco, J.C. Penney and

Kohl’s — have said to varying degrees that they were seeing improved sales and

customer traffic.

Mr. McNamara said apparel sales on the West Coast increased 2.2 percent in

October. “We are showing a positive comparison for the first time in the last

year,” he said.

In a research report last week titled “Christmas in Southtown: California

Dreamin’,” Bill Dreher, a senior research analyst with Deutsche Bank Securities,

said companies like Costco and Nordstrom were “seeing solid results in

California,” and underscored that Kohl’s has had sales growth for several months

now. (Kohl’s has also gained significant market share in California, having

snapped up 36 Mervyn’s stores on the cheap.)

“With this earnings acceleration going into Christmas,” Mr. Dreher said, “it

looks like early predictions of flat-to-down Christmas sales will turn out to be

stale.”

Many analysts, economists and the National Retail Federation are forecasting

holiday sales to be the same or slightly worse than last year. But more bullish

analysts, at Deutsche Bank and Citi for instance, think sales for the industry

will rise 1 to 2 percent.

Over all for the industry in October, apparel sales increased 3.4 percent

compared with the period a year ago, luxury goods rose 6.5 percent, jewelry

increased 7.2 percent, and department store sales declined 1.5 percent,

according to SpendingPulse.

E-commerce was the most robust sector, increasing 18.7 percent — the third

consecutive month of double-digit growth — because of strong sales of small,

low-price goods.

October is typically a clearance month, though some industry professionals

consider it an early indicator of Christmas sales. It appears the month started

off strongly. Analysts think stores benefited from cool weather, Columbus Day

discounts, and last-minute back-to-school shopping. Halloween may have hurt

sales slightly, though, because this year it fell on a Saturday, typically a

shopping day, Mr. Dreher said.

Even so, analysts at Standard & Poor’s Equity Research said in a report on

Monday that “consumers appear to be shopping again for apparel and some home

fashions.”

Whether there will be enough merchandise to go around this Christmas remains to

be seen. Mike Moriarty, a partner at A.T. Kearney, a management consultancy,

said many retailers were intentionally low on inventory. “They’re going to have

an unhappy but maybe a safe holiday,” he said.

In October, Signs of

Life at Retailers, NYT, 4.11.2009,

http://www.nytimes.com/2009/11/04/business/economy/04shop.html

U.S. Consumer Spending

Slipped in September

October 31, 2009

The New York Times

By REUTERS

WASHINGTON (Reuters) — Consumer spending in the United States fell in

September for the first time in five months as the increase from the

cash-for-clunkers auto rebate program faded, data showed on Friday, adding to

fears that consumers may be pulling back as they head into the last quarter of

the year.

The Commerce Department said spending fell 0.5 percent, the largest decline

since December, after an upwardly revised 1.4 percent increase in August.

Consumer spending in August was previously reported to have advanced 1.3

percent.

September’s decline was in line with expectations. Consumer spending, which

normally accounts for over two-thirds of economic activity, in August was

bolstered by the popular “cash-for-clunkers program that gave discounts on some

new motor vehicle purchases.

The program, which ended in August, contributed to a jump in consumer spending

in the third quarter and helped to pull the economy out of its worst recession

since the 1930s.

Spending adjusted for inflation fell 0.6 percent in September, also the largest

decline since December, after rising 1 percent the prior month, the Commerce

Department said.

Personal income was flat last month after rising 0.1 percent in August. That was

also in line with market expectations.

Real disposable income fell 0.1 percent in September. Despite the fall in

income, Americans saved more money last month. Savings increased to an annual

rate of $355.6 billion, lifting the saving rate to 3.3 percent from 2.8 percent

in August.

Commerce Department data also showed the personal consumption expenditures price

index excluding food and energy, a key inflation gauge monitored by the Federal

Reserve, was up 1.3 percent from a year ago in September, matching the August

increase.

U.S. Consumer Spending

Slipped in September, NYT, 31.10.2009,

http://www.nytimes.com/2009/10/31/business/economy/31econ.html

U.S. Economy Started to Grow Again

in the Third Quarter

October 30, 2009

The New York Times

By CATHERINE RAMPELL

Ending a year of contraction, the United States economy grew in the third

quarter, the Commerce Department said on Thursday. But even if a recovery is

technically in the offing, job seekers likely will not begin to feel the

benefits for months to come.

The nation’s gross domestic product expanded at an annual rate of 3.5 percent in

the three months ending in September, a significant spike from a somewhat

shrunken base. The economy had contracted at annual rates of 0.7 percent and 6.4

percent in the second and first quarters of this year, respectively.

Much of the growth can be attributed to the billions in federal aid devoted to

economic renewal, including policies that encouraged consumer spending on cars

and housing.

“That alters the dynamic of a recession and a recovery, and what you’re left

with, to some degree, is an artificial recovery,” said Dan Greenhaus, chief

economic strategist at Miller Tabak, an investment research firm. “Over the next

several quarters, the support for the economy on the part of the government

wanes and the economy has to find its own footing.”

The cash-for-clunkers program helped boost consumer spending on durable goods,

which grew by an annual rate of 22.3 percent in the third quarter compared to a

decline of 5.6 percent in the previous quarter. Similarly, economists say the

$8,000 federal tax credit for first-time homebuyers helped revive spending on

housing, which increased 23.4 percent in the third quarter, in contrast to a

decrease of 23.3 percent in the second quarter. The economic growthcame without

a major surge in inflation. The price index for gross domestic purchases, a

broad measure of prices that Americans pay for goods and services, increased at

an annual rate of 1.6 percent in the third quarter, compared with an increase of

0.5 percent in the second, the department said. Excluding food and energy

prices, the inflation index rose 0.5 percent in the third quarter, compared with

an increase of 0.8 percent in the second.

The stock market surged in reaction to the news, with major indexes up about 1

percent in mid-morning trading.

Thursday’s report will likely provide ammunition to both advocates and opponents

of additional federal spending to stimulate certain parts of the economy, as

mutually reinforcing pessimism among consumers and employers continues to

fester.

On the one hand, the poor job market is discouraging Americans from increasing

their spending by too much. Consumer spending on nondurable goods like food and

clothing, for example, increased 2 percent in the third quarter, compared to a

decline of 1.9 percent in the second.

Likewise, stagnant consumer demand and withering consumer confidence have left

companies wary of hiring more employees — or, for that matter, taking any

expensive risks. The jobless rate reached 9.8 percent in September, its highest

rate in 26 years. According to Thursday’s report, business investment in

buildings and other structures fell at an annual rate of 9 percent in the third

quarter.

“At some point firms will have to begin to bring some of their workers back, but

it may not be anytime soon,” said Joseph Brusuelas, director of Moody’s

Economy.com. “That means 2010 may be a year of growth in the economy, but it’s

likely to be characterized as jobless growth.” Initial jobless claims fell 1,000

in the week ending Oct. 24 to 530,000, according to a Labor Department report

also released Thursday. The number has been trending downward, but is still

“well above the level of claims that is historically associated with net job

creation,” according to a report by RDQ Economics.

Such forces may pressure Washington to look for targeted interventions into the

labor market, in addition to last winter’s broader $787 billion stimulus

package, which continues to work its way through the economy. Proposals on the

table include another extension in unemployment benefits and various job

creation programs.

A slower drawdown in inventories was one bright spot in Thursday’s report, as it

indicated that businesses have largely sold out their current stock and may rev

up orders in the coming months to replenish supplies.

“Everybody had been dealing with a just-in-time status quo,” said Sandra

Westlund-Deenihan, president and design engineer for Quality Float Works, a

plant in Schaumburg, Ill., that manufactures metal float balls and valve

assemblies. “They were living off inventories they’d built up over the last

several years. Now they’ve drawn that down and reached a point where they may

have to have it ready and back on the shelf again.”

Like many American manufacturers, Ms. Westlund-Deenihan says that international

business has helped keep her company afloat. United States exports overall grew

at an annual rate of 14.7 percent in the third quarter, while imports grew 16.4

percent.

“We’re seeing a strong rebound in trade simply because global trade had

collapsed before,” said Robert Barbera, the chief economist at ITG.

Javier C. Hernandez contributed reporting.

U.S. Economy Started to

Grow Again in the Third Quarter, NYT, 30.10.2009,

http://www.nytimes.com/2009/10/30/business/economy/30econ.html

Editorial

Ongoing Agony of the Banks

October 29, 2009

The New York Times

It is hardly surprising that GMAC is circling back to the government for a

third helping of taxpayer money. GMAC is struggling under the double whammy of

bad car loans and the fallout from its misguided foray into mortgage finance at

the height of the housing bubble. After the government applied stress tests to

the banks last May, it was the only big bank that could not raise the capital it

was deemed to need.

Still, GMAC’s return to the public trough — where it expects to get up to $5.6

billion on top of the $12.5 billion it has received since December — should

serve as a reminder that much of the American banking system is nowhere near

where it needs to be despite hundreds of billions of dollars doled out by the

Treasury.

If the federal government’s strategy to save the banks was meant to get them

back into the business of lending to American consumers and businesses, it has

not worked yet.

GMAC’s sorry state is bad enough news for Main Street. It is the main source of

financing for General Motors and Chrysler dealers around the country. That means

it is virtually assured to get the additional money it needs for the same reason

that the government bailed out the automakers and then gave them the windfall

profits of the cash-for-clunkers initiative: too many auto-sector jobs are on

the line.

But GMAC is hardly the only hobbled financial institution in the country. Bank

of America reported a $1 billion loss in the last quarter and is still limping

along, dragged down by its bloated portfolio of bad loans. Citigroup relied on

accounting gymnastics and a dubious decision to stockpile few reserves against

potential loan losses in order to make a $100 million profit.

The mere fact that these banks are still going concerns is because of the

government’s willingness to ply them with cash. But neither is lending much.

The banks that do have the financial wherewithal — like Goldman Sachs and

JPMorgan Chase, which made combined profits of nearly $7 billion in the third

quarter — are not making their money through lending. They are making it from

trading complex financial products that few people understand.

Meanwhile, sectors of the economy are being starved of credit. Consumer credit

by commercial banks stood at $834 billion in August — about $45 billion less

than at the end of last year. Business financing is doing no better. Banks’